Over the last decade, the medical-technology market in China has grown at a rapid clip, fueled by increased government funding for health care. And while the pace of growth will continue to be healthy, at about 14 percent annually between 2013 and 2020, ongoing health-care reform will reshape the market in fundamental ways. There will be three significant changes: the increasing importance of the midmarket, the rise of local companies, and a revamping of the way in which products are sold in the marketplace.

These changes will create great opportunities—and major challenges—for multinational corporations (MNCs) and local companies alike. As a result, both will need to adapt their business models. MNCs must defend their leadership position at the premium end of the market against stronger local rivals, while at the same time expanding their reach in the fast-growing midmarket. Local companies, meanwhile, must up their game, developing the products, skills, and talent required to succeed at the upper end of the midmarket—and even in some premium segments.

Growth and Change in the Health Care System

China’s medtech market is expected to emerge as the second largest in the world by 2020. That growth is being fueled by two powerful forces. The first is rising demand for health care products and services. As the Chinese population ages, and as a sedentary lifestyle becomes more prevalent, chronic and serious diseases are increasingly common. Along with an expanding middle class that can afford to pay more for care, this is stoking demand.

In addition, the Chinese government is increasing its spending on health care, including significant investments in public hospitals in order to increase the capacity of the overall system. And thanks to health care reform, all citizens now have access to basic health care through public insurance. As a result, the percentage of total spending on health care covered by the government will expand from 30 percent in 2012 to 40 percent in 2020.

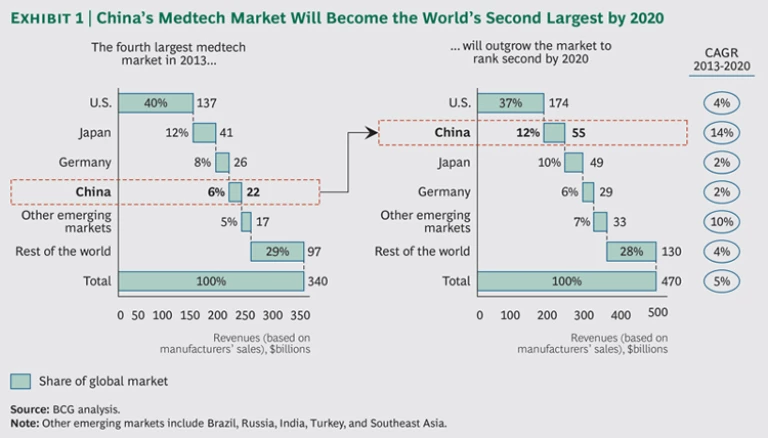

We project that the Chinese medtech market, buoyed by the strength of the overall health-care sector, will post a compound annual growth rate of 14 percent between 2013 and 2020, expanding from $22 billion in annual revenues to $55 billion. (See Exhibit 1.) Almost all product categories will experience double-digit growth, with some—such as orthopedics and minimally invasive surgical devices—growing even faster.

Amidst this robust expansion, the medtech landscape is being transformed, largely as a result of ongoing reforms in China’s health-care system.

Changing regulatory policies are encouraging innovation and leveling the playing field. The China Food and Drug Administration (CFDA) wants to encourage innovation across the health care industry. While it will likely be several years before policies in this area have any real impact, the aim within medtech is to create a prioritized review process for innovative products. As part of this effort, an Innovative Medical Device Assessment office will be established within the CFDA to assess new products. To be considered innovative, a product’s key mechanism must be new to the Chinese market or one of its features must constitute a major enhancement over previous versions, among other criteria. The assessment will allow companies to correct any technical problems during the review, avoiding a rejection that would require them to restart the approval process. In addition, CFDA will push to improve communication between manufacturers and regulatory bodies in order to streamline the approval of all products.

At the same time, changes are in the works to simplify re-registration applications, which are required when a product’s original registration expires or when alterations have been made in the manufacturing process or in the product itself. The CFDA will allow companies to file the simplified application in some cases, including those involving a standard registration expiration or a change in manufacturing location.

In other areas, the CFDA is raising the bar, imposing stricter clinical-trial requirements for new

Pricing pressure is intensifying. Government policies are aimed at reducing costs at hospitals and at other points in the health care system.

- The Prices Charged by Hospitals. Under the policy known as packaged pricing, the government allows hospitals to charge patients a fixed amount for a medical procedure, rather than a variable amount based on such factors as the number and type of supplies used. The 2012 National Medical Service List, published recently by the government’s National Development and Reform Commission (NDRC), has expanded the list of procedures covered under packaged pricing. As a result, the number of medtech products included among the procedures that are subject to the policy has grown from about 4,000 to more than 9,000. These are mainly lower-priced consumable products used only on a single patient or during a single procedure. If a newer, more expensive product is substituted for a lower-priced item, or if a large number of products are used, the patient cannot be charged for the additional cost. The result: hospitals will use fewer—and lower-cost—products than they did in the past.

- The Prices Hospitals Pay. Tendering—the process by which a product provider is selected from among a number of bidders every three to five years—is gradually expanding across China. That means more tenders will be executed in China’s provinces for consumable products, especially for high-value, relatively standard devices like coronary stents and pacemakers. In fact, the price of drug-eluting coronary stents has been found to decline by 10 to 15 percent, on average, after each tender, though the extent to which the process reduces prices varies by province. This trend could have a greater impact on MNCs, whose products tend to come with higher price tags, than on local companies.

- The Markup Passed on by Distributors. A draft policy issued by the NDRC in 2012 aims to limit the “channel markup,” the difference between what distributors charge hospitals for a product and what they pay the manufacturer. Certainly it will take some time for this policy to be implemented, given the complexity of determining the appropriate markup for different products, the difficulty of tracking markups as products move from manufacturer to distributor to end user, and the lack of support from key stakeholders, notably distributors, physicians, and some manufacturers. But channel markups will undoubtedly fall, which means that manufacturers must make sure that their distribution partners can survive the declining margins.

Reimbursement coverage is broadening—but hospital budgets are getting tighter. The benefits offered under basic public health-insurance coverage will continue to expand. Moreover, the government is pushing local governments to offer major- disease insurance, which pays health care expenses related to serious, life-threatening diseases, and it is also adopting policies that will drive the development of a healthy market for private insurance. As a result, more medtech products will be covered by public insurance, and the reimbursement ratio will continue to improve.

But other factors will continue to create obstacles for medtech players. Reimbursement decisions will still be set at the city or county level in most cases, leading to fragmented policies that create challenges for manufacturers and patients. And those decisions are likely to favor relatively lower-priced midmarket products. (See “Different Dynamics Within Different Product Segments.”) Furthermore, the government is piloting policies intended to keep a lid on overall health-care costs. One of these is global budgets that will reimburse hospitals a fixed amount from local public-insurance funds (city, county, or province, depending on the region) every year. Global budgets are set with an eye toward controlling costs, so hospitals will have an even greater incentive to use lower-priced midmarket products.

Different Dynamics Within Different Product Segments

Understanding the dynamics of China’s premium, middle, and low-end medtech market is critical to success. But the medtech market is complex, and there are no simple rules. In fact, the characteristics that distinguish premium products frequently differ from one category to the next.

Premium Products. In some categories, such as imaging, these high-quality, high-priced products are characterized by the use of a new technology. But in other categories, such as orthopedics, premium products are those that have a new design or use new materials. Meanwhile, premium operating-room equipment may be distinguished by neither a new technology nor new materials, but rather by the seamless integration of components such as tables and lights into a single system. In still other categories, premium products are those that come with clinical support—such as surgeon training—provided by the manufacturer.

Midmarket Products. These products have a lower price tag than premium products but still offer good quality. In some categories, midmarket products have fewer features than higher-priced offerings or may be made of less durable materials, resulting in a shorter life span. In other categories, they may be of very high quality but based on an older technology. Typically, the sales and marketing strategy for midmarket products involves less training and education or less after-sales customer service than that of premium products.

Low-End Products. These products are lower priced and sometimes of lower quality than their premium and midmarket counterparts. In many cases, companies break into the market with low-end offerings and, over time, raise the quality of these products and move into the midmarket.

The provider landscape is changing, with smaller hospitals taking on a larger role. Major changes are coming to China’s hospital system—from large urban hospitals to smaller county hospitals to the still nascent network of private hospitals. And these changes have major implications for medtech players.

Perhaps the most significant shift will be the expanded role of county hospitals. The government has undertaken a broad effort to discourage people from seeking treatment for serious illnesses at large urban hospitals; the ultimate aim is for 90 percent of critical-illness cases to be treated at county hospitals. As part of this drive, the government will spend roughly $17 billion from 2012 through 2020 to upgrade county hospitals, making them better equipped to diagnose and treat major diseases. The result: county hospitals will become the fastest-growing group, albeit starting from a smaller base than large urban hospitals, which will continue to account for more than half of all health-care spending though 2020. This trend is still in its early days, but medtech companies will eventually need more efficient sales and distribution coverage in order to reach these dispersed county hospitals.

Meanwhile, the management of urban public hospitals will change. Right now, a single central-government body establishes regulations for hospitals and oversees their management. But pilots in some cities are testing a new approach involving separate regulatory and management bodies. If that structure is widely adopted, medtech companies will need to develop relationships with these two different oversight bodies. This shift will take place over the course of a number of years, with purchasing decisions increasingly made by centralized management bodies with more bargaining power than individual hospitals. And that is likely to put additional downward pressure on pricing. Moreover, the government is piloting the creation of hospital alliances—for example, between some large and small institutions—with the aim of coordinating patient care more effectively and efficiently. Ultimately, that could alter usage patterns across the hospital system for some devices.

Finally, the government has set a goal for private hospitals to provide 20 percent of health care services by 2015. However, there are significant obstacles to making that happen, not least of which is the lack of a clear plan from the government. In addition, obtaining the required licenses to open new hospitals and recruiting sufficient numbers of trained physicians and other medical personnel will be a tall order. Still, even a modest amount of construction will be good news for equipment providers, which will need to outfit the new facilities.

Sales and marketing practices remain under a microscope. Headlines about government investigations into sales and marketing practices in China make clear that a tougher compliance environment is here to stay. Consequently, as the government focuses on the problem of physician corruption, all manufacturers need to ensure that their sales and marketing approaches are compliant. At the same time, traditional marketing and sales activities, which do not adequately prevent noncompliant practices, will change. Companies will need to develop alternative approaches to reaching customers, such as more digital marketing, less one-on-one selling, and increased bundling of products—shifts that will not only eliminate noncompliant practices but also help reduce marketing costs amid declining margins.

The Medtech Industry in Transformation

In light of these trends, the medtech industry in China will look quite different ten years from now than it does today. The biggest changes: a larger and more important midmarket, an increase in the competitiveness and reach of local companies, and a major shift in the way medtech products are sold and distributed.

Midmarket products will become increasingly attractive. As county hospitals—which use a large proportion of midmarket products—grow in importance, overall industry revenues from this segment will surge. Amplifying that trend will be share gains for midmarket products in class 3 hospitals—typically, large urban facilities. While these hospitals often use premium products, mounting pricing pressure and tightening budgets will prompt them to shift to midmarket products where possible.

The upshot is that the middle market will be the fastest-growing segment in key product categories and the major battleground for MNCs and local companies. For example, the projected compound annual growth rate for the premium and low ends of the

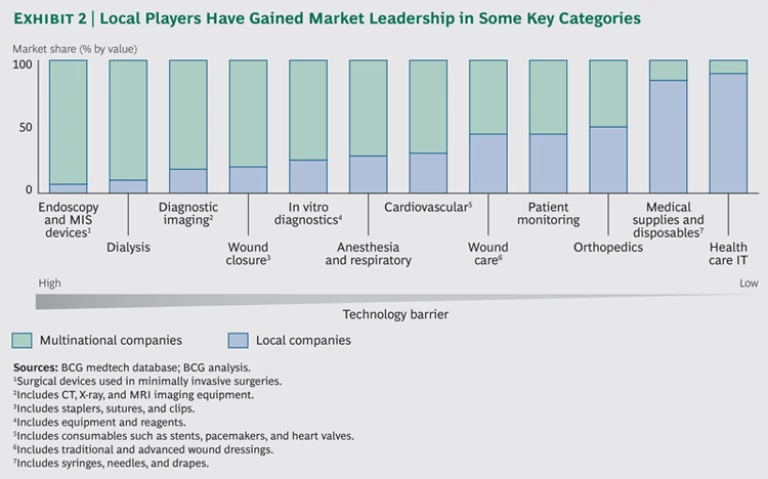

Local companies will expand their reach. Local companies are already leaders in many medtech categories, including health care information technology and medical supplies and disposables (such as needles and syringes). (See Exhibit 2 and “Locals Conquer the Stent Market.”) But these companies will increasingly make gains in other markets as well, including the premium-product segment.

Locals Conquer the Stent Market

MNCs that want to understand just how grave a threat locals pose need only look at the market for drug-eluting stents (DESs). These devices, used to open narrowed arteries in patients with coronary artery disease, have a drug coating that helps prevent the artery from becoming reclogged. The stents were developed by MNCs, which in 2003 dominated the Chinese market with 100 percent share (measured by volume).

But then local companies developed their own competitive, high-quality DES products. MicroPort launched a DES in 2004, followed by Lepu and JW Medical Systems. Priced about 40 percent lower than the stents of MNCs, these products were embraced by hospitals looking to contain costs.

The result: locals quickly gained dominance in lower-tier cities and with accounts where MNCs had little presence. And from there they pushed upward. Lepu, for example, started in lower-tier hospitals before entering class 3 hospitals—those with more than 500 beds—in some cities. By 2012, overall market share had virtually flipped, with locals holding 81 percent of the market and MNCs just 19 percent.

Some of this progress will be driven by government support. For example, the government has outlined plans to invest about RMB 10 billion—including grants and loans to local companies—from the end of 2012 through the end of 2020 to support medtech research and development. In addition, the twelfth five-year plan from the Ministry of Science and Technology includes the goal of promoting the development of local players in subsectors such as diagnostic imaging.

These government efforts come as local companies, largely concentrated in the middle to low end of the market, are investing to upgrade their product portfolios in terms of both technology innovation and quality. Case in point: in the digital X-ray market, local machines are increasingly being substituted for imported products, with local market share (measured in terms of volume) hitting 50 percent in 2011, up from nearly zero before 2005. Moreover, some leading locals, such as MicroPort and Mindray, are using mergers and acquisitions outside of China to enhance the quality of their product lines and access more cutting-edge technology.

The sales and distribution machine will be revamped. With the growth of the basic health-care system (county hospitals along with urban and rural health-care centers), as well as private hospitals, customers are becoming more physically dispersed. This will call for diversified sales and marketing coverage by manufacturers.

In response, makers of consumable products are increasingly looking to logistics providers to perform functions like inventory management and accounts receivable operations. In the past, these services were provided by distributors, growing numbers of which are now mostly focusing on sales. For example, many orthopedics manufacturers are using distributors to sell their products, with logistics providers dealing with shipping and warehousing (services previously provided by distributors). This shift can give manufacturers increased flexibility in managing the sales effort.

Multinational and Local Companies Must Respond

Both MNCs and locals need to adopt new business models in order to tap the opportunities created by the changes sweeping the market. For both groups, this will require a willingness to rethink approaches and processes that have been successful in the past—but will prove less so in the future.

Multinational Medtech Companies Must Move Beyond the Premium Segment

MNCs have done well to date by concentrating on the premium market. But in the future that will not be enough.

Increase focus on the midmarket. Capturing share in the midmarket will put MNCs in more intense head-to-head competition with local companies. Success here will depend on adapting the business model in three key areas.

First, MNCs need to rapidly develop a midmarket portfolio that meets the needs of health care providers and patients in China. This typically involves one of three approaches: organic new-product development, joint ventures, and acquisitions. General Electric, for example, has developed its own extensive midmarket-product portfolio in China, while Stryker, Zimmer, and Medtronic have built their midmarket offerings through acquisitions.

MNCs should also build a go-to-market model that has sufficient reach but is highly efficient; often this will involve a mix of distributors, logistics providers, and internal sales reps. Some leading players, for example, are segmenting hospitals and developing distinct sales and marketing approaches for each group. For certain private hospitals or for key accounts (such as very large urban hospitals), the company may take control of almost all activities, using logistics providers only for inventory management and accounts receivable collection. For other hospitals, especially those in large cities, it may partner with distributors for all activities, including marketing, sales, and services. And for hospitals in small cities or rural markets, the company may be only minimally involved in marketing and sales, relying on logistics providers and distributors to direct most of that effort.

Finally, winning in the midmarket will require a focus on lowering costs through changes in manufacturing and sourcing, as well as in the go-to-market model. Leading medical-equipment players, such as GE, Siemens, and Philips, have developed local manufacturing bases that help improve their cost structure through reduced labor costs, shipping costs, and import taxes.

Defend the premium market. An offensive in the midmarket, however, cannot come at the expense of maintaining leadership at the premium end of the market. MNCs must continue to invest aggressively in both new-product development and marketing in order to defend their hold on this segment—typically concentrated in larger city hospitals. They must also preserve their brand image, using patient education and outreach to key opinion leaders to drive adoption of their products. And as competition increases in the premium segment—in part from local companies—MNCs need to strengthen relationships with large hospital accounts. This may mean reducing their reliance on distributors by handling clinical selling internally and using logistics providers to transport and deliver products.

Proactively manage government affairs. While some MNCs have established good relationships with central- and local-government agencies, this is not true across the board. Stronger skills and strategies in government affairs will be required to help shape regulatory policies on product registration, pricing and tendering, and compliance.

Local Medtech Players Must Up Their Game

The changing medtech industry in China creates great opportunity for local companies. But they will need to improve key capabilities—from new-product development to sales and marketing—in order to capitalize on those openings.

Make strategic investments to boost competitiveness. Local companies looking to grab share at the middle and premium ends of the market will need to upgrade the quality of their existing products and develop new, innovative offerings. Some major local players are already taking this approach. MicroPort, Mindray, and Lepu, for example, now boast R&D budgets (as a percentage of sales) that are on par with those of MNCs. And they are partnering with research institutions to create external R&D centers or setting up joint ventures with MNCs to gain access to advanced technologies.

In addition, locals will need to invest in marketing, branding, and clinical studies to ensure that their products can compete successfully against those of MNCs. Right now, local companies generally have relatively weak brands, making it difficult for them to sell to top hospitals or charge a premium. That is changing, however. For example, local companies are investing in clinical studies to prove that their drug-eluting cardiac stents are comparable to those of MNCs.

Local companies should also consider mergers and acquisitions or partnerships with companies outside the Chinese market. Mindray and MicroPort have already been active in such outbound deals. Although it is challenging for local companies to manage overseas acquisitions, such transactions can help them access new technology as well as increase their scale and reach beyond China.

Enhance critical skills and processes. Expanding into premium-product markets will require a more sophisticated sales and marketing operation than what many local companies have today. Locals will need to reduce their reliance on distributors in many cases, instead developing direct relationships with key accounts through their own sales force. These sales forces should harness modern tools to maximize their effectiveness, including the segmentation of customers (physicians and hospitals) to allow for tailored sales and marketing messages. Moreover, for customer groups that continue to be served by distributors, local players should build stringent distributor-management systems that allow them to gauge productivity and improve overall sales efficiency.

All these measures require a highly trained and effective team, which, for many local companies, will call for an upgrade in management talent, skills, and processes. Specifically, locals will need to boost the sophistication of their corporate governance—from designing a formal management structure to establishing better decision-making processes regarding investments and (potentially) mergers and acquisitions. Just as critically, these companies need to improve their human-resource management, establishing processes not just for hiring and training, but also for effective career development, including explicit policies to retain top performers.

The Chinese medtech market will continue to grow at a solid rate in the years ahead, making it a vital region for manufacturers of these products. Equally important is the changing structure of the market, especially the rapid growth of the midmarket—the result of government policies as well as a rising middle class and changing lifestyles. The transformation of the medtech market will require all companies competing in China to adapt.

The challenge will perhaps be greatest for MNCs, which will have to figure out how to succeed in the midmarket, adjusting both their product portfolios and their sales and marketing efforts. Many local companies, in contrast, have been focused on the midmarket for years and are already well acquainted with the requirements of this segment. But they, too, will need to adapt, as quality requirements ratchet up and MNCs try increasingly to grab share. This will compel locals to raise their capabilities across the board—from investing in the development of more innovative products to upgrading their talent base.

Our client work indicates that both MNCs and local companies appreciate the need to change. What may not be apparent to all of them, however, is the urgency and speed of the change required. The rules in China are evolving rapidly—necessitating a dramatic and forceful response.