Deciding to divest is one decision. Determining how to unlock the full value of the asset being shed is another, often more complicated, step. Maximizing value depends substantially on choosing the right exit route. This is more involved than it might first appear. Multiple factors come into play, and the straightforward option—such as the instinct to grab the cash—is not always the best approach.

The 2014 M&A Report

Consider Your Options Carefully

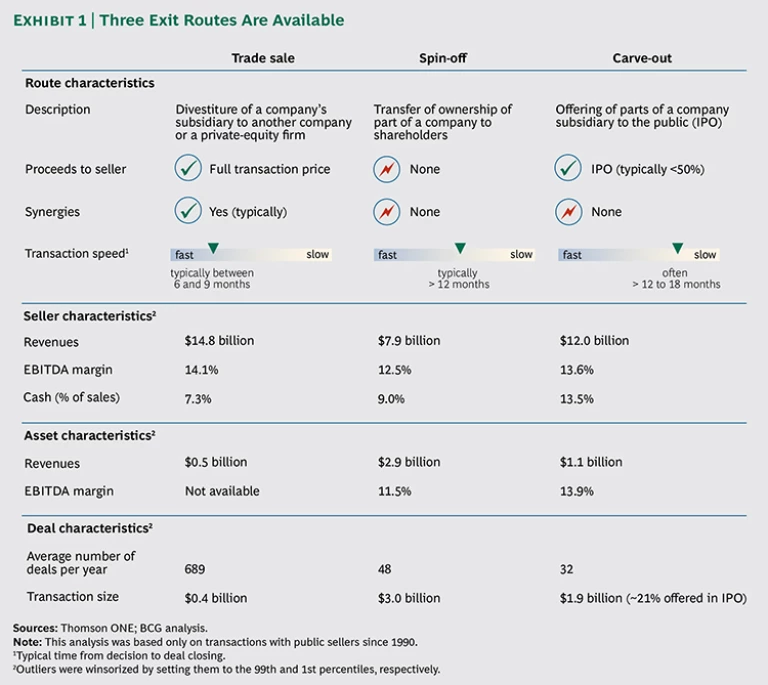

Companies have three basic ways to divest unwanted businesses or assets: a straight trade sale to another buyer; a spin-off to the company’s shareholders; and a carve-out, in which the parent company sells a partial interest to the public while retaining ownership—often a controlling interest. (See Exhibit 1.) Each option offers its advantages, and choosing the right route depends, as we shall see, on a combination of factors particular to the parent, the business being sold, and the market at the time of the transaction. (See “Three Routes to Value.”)

THREE ROUTES TO VALUE

Trade sale, spin-off, or carve-out? The decision to divest is only the first step in a complex process. Deciding how (and when) to shed a noncore asset is a multifaceted challenge with billions of dollars of value often hanging in the balance. The route a company chooses to take depends on its own situation and strategic and financial goals, the attributes of the asset to be divested, and prevailing market conditions—which of course are subject to change at a moment’s notice.

In 2012, for example, Procter & Gamble abandoned the transfer of its Pringles snack-food business to Diamond Foods, in a complex stock-swap transaction that combined elements of a trade sale and a carve-out, in favor of a straight $2.7 billion cash sale to Kellogg. The divestiture of Pringles completed P&G’s exit from the food business so that the company could focus on its core cosmetics and health care operations. At the same time, the acquisition of Pringles transformed Kellogg into the second-largest savory-snacks producer. The market appreciated the strategies of both companies, and they exhibited returns well above that of the S&P 500 around the announcement date of the deal.

Another deal involving a major snack producer—the spin-off of Mondelēz International from Kraft Foods—took a very different path. In 2011, Kraft announced plans to split itself into two businesses, each with very different characteristics, strategies, and outlooks: its North American grocery business, which retained the Kraft name; and Mondelēz, the larger global snack company. When combined under one roof, both businesses were difficult to decipher, their performance was challenging to predict, and they were hard to value. As a stand-alone entity, each company became much more tightly focused and easier to assess on its individual merits and performance. The deal was complex—it took more than a year to execute; but the spin-off was praised by analysts and rewarded by capital markets. The deal yielded a 2 percent CAR for Kraft following its announcement, and shares of both companies have outperformed the S&P 500.

In 2012, Pfizer announced its intention to offer about 17 percent of Zoetis, the company’s animal-health-product unit, to the public and thus create a new stand-alone company that would be the world’s largest animal-medicine and vaccine company, with some 300 products and about $4.3 billion in annual sales. As part of its strategy to focus on its core pharmaceutical business, Pfizer had already sold its infant-nutrition unit to Nestlé for $11.9 billion.

Owing to high demand and attractive conditions (a total of 12 IPOs had already raised more than $5 billion in January 2013), Zoetis shares were offered at a price of $26—above the initially planned range of $22 to $25—and rose by 20 percent to close at $31 on their first day of trading on the New York Stock Exchange. The new company’s market value was $15.5 billion—the largest U.S. IPO since Facebook went public in May 2012. The IPO brought Pfizer about $2.2 billion in cash.

In June 2013, Pfizer successfully offered its remaining stake to its own shareholders, in an exchange offer of 0.9898 Zoetis shares for each Pfizer share, thus completing its exit from the animal-health-product business and enhancing value for its shareholders by both giving them the opportunity to own the new company and reducing the number of its own shares outstanding, which increased earnings, EBITDA, and enterprise value per share.

Trade Sales: Quick, Easy, and Low Risk. In its simplest form, a trade sale is a straightforward cash sale to another company or a private-equity buyer. Trade sales generate cash, which the seller can use to invest in its remaining businesses, make acquisitions, pay down debt, or return to shareholders. The market’s reaction to a trade sale often depends, at least in part, on the seller’s intentions for the proceeds. Trade sales are the only exit vehicle in which the seller has the potential to indirectly participate in the new owner’s synergies with the acquired business. Our research indicates that sellers collect approximately 30 percent of the average capitalized value of expected synergies, although the actual share in any single transaction can vary widely. (See Divide and Conquer: How Successful M&A Deals Split the Synergies , BCG Focus, March 2013.)

Since they generate the most cash for the asset being sold, trade sales are the preferred exit strategy for companies looking to deleverage—a fact that the markets appreciate. They are the preferred choice in times of high volatility, when IPOs are tricky to execute. Many sellers also choose trade sales in times of high capital-market valuations, seizing the opportunity to monetize the value that others see in the asset, especially when it is higher than the current owner’s view. Because they are the simplest and quickest form of transaction to complete (and often less risky as well), trade sales are, not surprisingly, also the most common type of deal, far outnumbering the other options.

Spin-offs: Direct Distribution to Shareholders. Spin-offs generally result from a purely strategic decision to refocus the portfolio and exit a line of businesses. They do not generate cash, but they do produce value—often considerable value—for shareholders, who become the direct owners of the divested business through a distribution of shares. Spin-offs are also usually tax advantaged, and they have high completion security because they do not depend on market conditions.

Investors reward spin-offs because they receive value in the form of new shares and they expect the value of their shares in the parent company to increase as management heightens its focus on its remaining operations. There are exceptions, however. In the case of a highly leveraged parent, for instance, the wisdom of a spin-off that generates no cash proceeds will almost certainly raise concerns.

Spin-offs and carve-outs result in newly public companies with their own administrative overhead requirements—one reason they are pursued more often for bigger businesses. As shown in Exhibit 2, average revenues for businesses in our study that were spun off were roughly $2.9 billion—six times higher than the average size of the trade sale sample.

Carve-outs: Playing It Both Ways. Under the right circumstances, companies may be able to have their cake and eat it too by using a carve-out strategy to divest, at least partially, a noncore business or an asset that management believes is undervalued. Carve-outs generally involve an IPO of some portion of the business, often about 20 percent. The company retains the balance, which it can keep for the long term or dispose of in a secondary offering at a future date.

Carve-outs generate cash for deleveraging or reinvestment. They shine the spotlight of public-company independence and market valuation on the divested asset. They also allow the parent to participate in the future growth of the divested asset—an ability the market appreciates in cases of innovative assets or assets in sectors bound for a cyclical upswing.

Carve-outs are the most complex of the three exit strategies and they require a certain capital-market window of opportunity. They can take the most time to complete and they are the most rarely used. They are nonetheless often highly worthy of consideration and can be approached as part of a two- or even three-option strategy along the other exit routes.

Investors Prefer Spin-offs…

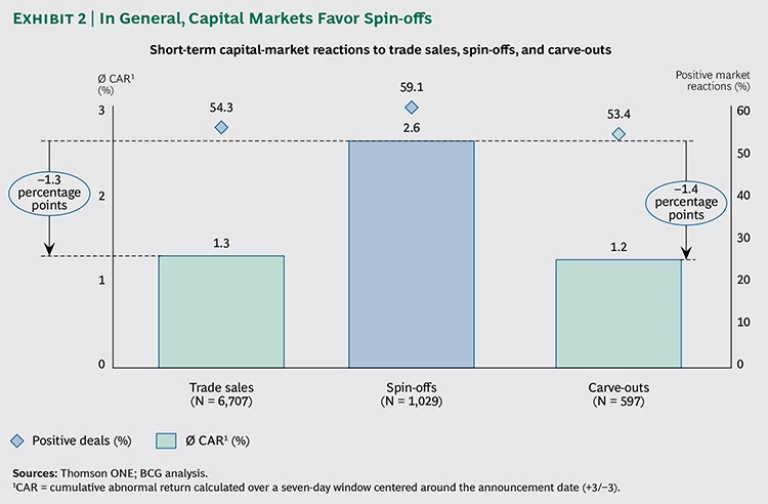

Investors react positively toward all three types of divestitures—they reward companies that actively reshape their business portfolios. More than half of the divestitures in our study resulted in positive CARs for the parent company.

In a somewhat surprising finding, investors reward spin-offs most highly of the three divestiture options, even though they generate no cash for the seller and usually take more time than trade sales to execute. Almost 60 percent of spin-offs since 1990 generated positive CARs for the parent company, compared with approximately 54 percent of trade sales and carve-outs. Moreover, the average CAR for spin-offs was 2.6 percent—double the 1.3 percent and 1.2 percent generated by trade sales and carve-outs, respectively. (See Exhibit 2.)

Our analysis indicates that there are four primary reasons for this spread. First, spin-offs are a purely strategic decision: they have no financing requirements or other capital constraints. They tend to reduce any conglomerate discount assigned to the parent, since shareholders can decide for themselves what to do with the spun-off asset.

Second, there is a tax advantage to spin-offs. While the proceeds from trade sales and carve-outs are subject to corporate taxes, spin-offs usually generate no tax liability for the company, and shareholders are not taxed until they sell the new shares they receive.

Third, spin-offs tend to be larger transactions in terms of both value and share of the parent’s revenue; this type of transaction often has a larger impact on the company’s remaining portfolio of businesses.

Last, the spun-off subsidiary enjoys a higher degree of freedom and thus avoids potential conflicts of interest with the parent company. This allows more independence when the new company is deciding future strategy, and it opens new options, such as merging with other companies.

…But They Ultimately Reward the Right Choice for the Circumstances

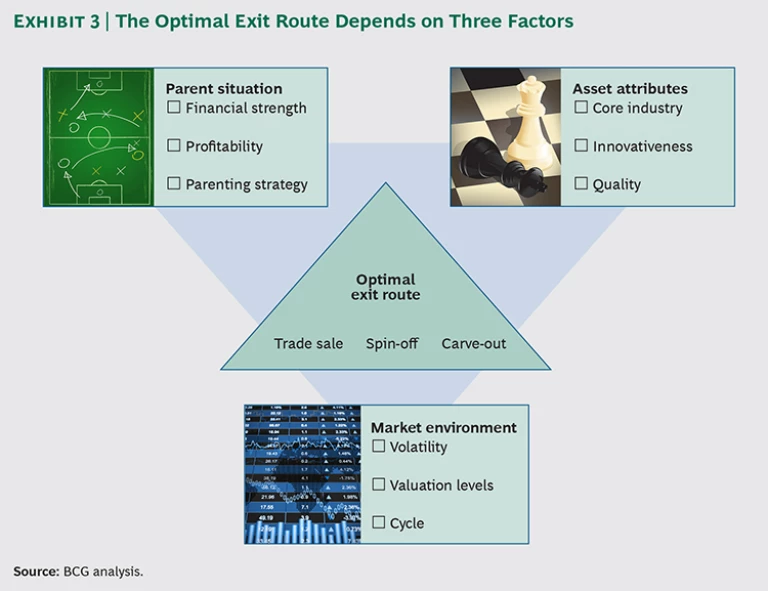

Spin-offs are not an automatic answer, however—far from it. Three factors play critical roles in the divestiture decision-making process and combine to determine the optimal divestiture path. Capital markets may not be omniscient, but they are comprehensive in their ability to take multiple factors into consideration when they assess a major corporate action such as a divestiture. They will aggressively examine the situation of the parent company (including financial strength, profitability, and strategy); the asset’s attributes (its core industry, quality, and innovativeness); and the market environment at the time (volatility, valuation levels, and point in the cycle), which means the parent company should engage in a similar exercise before deciding the optimal exit route. (See Exhibit 3.)

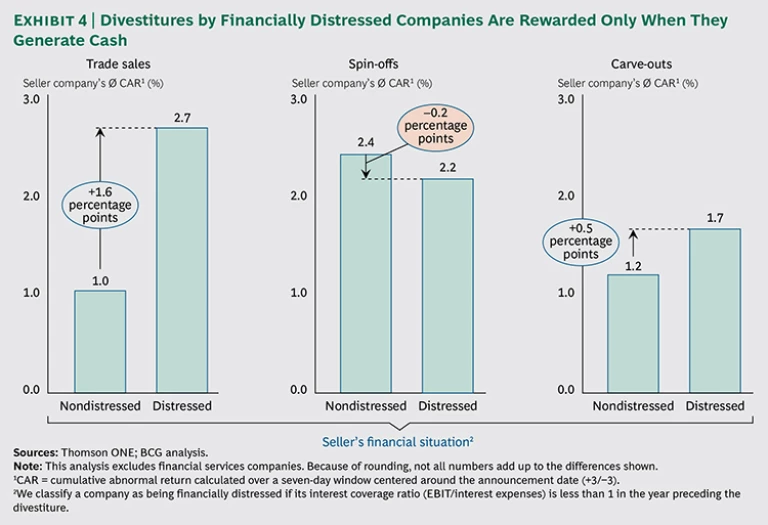

Parent Situation. The most significant consideration for companies thinking about divesting a business is their own financial condition. Companies that are highly leveraged will likely be attracted to a trade sale or a carve-out because they both provide cash for the seller. Our research shows that the market bestows big rewards on trade sales and carve-outs when the seller is financially stretched. Spin-offs by companies in financial distress result in lower CARs as investors punish the parent for choosing the “wrong” course. (See Exhibit 4.)

All three exit routes lead to improved operating performance for the parent—an indication that tighter management focus has a constructive impact once noncore assets are put on the market. The improvement is highest for trade sales. One reason for this could be the availability of new funds to invest in core operations. Another possibility is companies selling lower-quality assets that dragged down earnings.

There are times when a company faces the conundrum of needing to divest a business that under other circumstances it would elect to keep. One example is a high-growth subsidiary that needs more capital than the parent can provide. Or a business that is undervalued by the market because it is overshadowed by the parent’s other, larger operations. Carve-outs provide an attractive exit alternative. The parent puts the subsidiary on its own independent footing, where the market can assess it on its own merits, but the parent also participates in the future growth and earnings of the business.

Carve-outs have a few downsides, however. They are the most complex divestiture option as well as the most difficult for the market to value, precisely because the parent company retains an ownership interest in, and usually control of, the business.

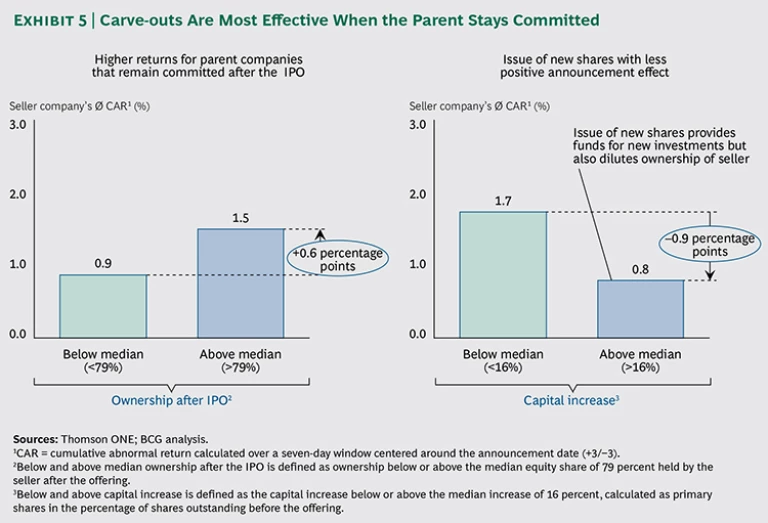

Carve-outs are most effective when the parent is committed long-term to the future of the subsidiary. Markets take a signal from the size of the stake the parent company retains in the carved-out company. Parents retaining a larger ownership (above the median of 79 percent) are seen as demonstrating a strong commitment to the future of the carved-out business, which investors appreciate. These companies received an average CAR of 1.5 percent, compared with a CAR of only 0.9 percent for those parents retaining a stake below the median. (See Exhibit 5.) Some companies use the IPO to raise fresh capital for the carved-out business, but this strategy can backfire. Investors are quick to realize that since the parent now has only a partial interest in the new company, its shareholders receive only a portion of the IPO proceeds. Our research shows that the parent’s CAR is lower for carve-outs in which significant amounts of capital are raised for the new company, compared with parents that pursue partial IPOs purely to generate cash for themselves.

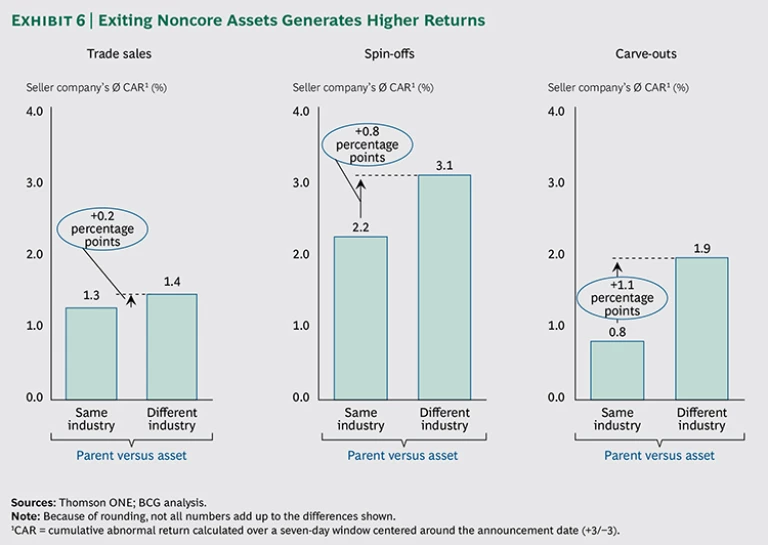

Asset Attributes. Since capital markets value simplicity of focus, they give the biggest rewards to companies that reduce the complexity of their portfolios by, for example, shedding a business that is in an industry different from the parent’s core business. The more diversified a company is to start with, the bigger the conglomerate discount the market is likely to have applied. Such companies can generally anticipate a bigger market reward. As we have seen, investors place a higher value on companies that unload unwanted businesses through spin-offs and carve-outs than through straight trade sales. (See Exhibit 6.)

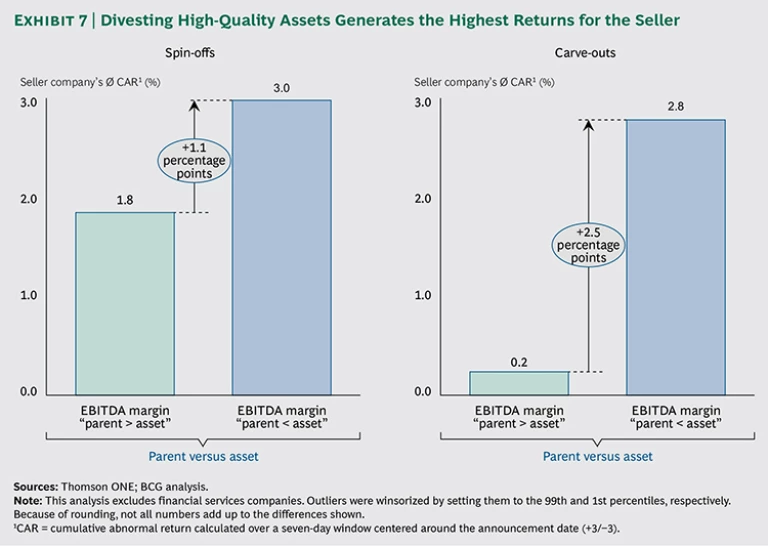

Quite often, high-quality assets get lost in a diversified mix of businesses, especially when they are overshadowed by size. A spin-off or carve-out of a high-profit subsidiary puts the focus on the business as a stand-alone operation and causes the market to value it on its own merits. CARs are considerably higher for divested businesses that have higher EBITDA margins than their sellers. (See Exhibit 7.) This is especially true for carve-outs, most likely because the carved-out business needs to attract buyers for its shares in a public offering, and healthy margins help to create a convincing equity story.

Investors also distinguish between innovative businesses that require high levels of investment in R&D and those that do not. They value innovation and punish companies that divest innovative businesses through trade sales or spin-offs while rewarding companies that maintain an interest in innovative subsidiaries through carve-outs.

If a parent is unable to provide sufficient funding to a business requiring a high level of investment in R&D, it stands to reason that the business would be better off as a stand-alone company or under a different owner. To test this hypothesis, we divided the divested companies in our sample into two groups—those with high and low R&D intensity as measured by their percentage of R&D to sales. As expected, we found that capital markets reward only carve-outs of high-R&D subsidiaries. Carve-outs are the only exit vehicles that provide new capital to finance further innovation. The average CAR is actually lower for companies divesting high-R&D assets through trade sales or spin-offs than it is for companies divesting assets with lower R&D expenditures. The message is clear: capital markets do not appreciate the sale of assets with innovation potential; they recognize that the parent is divesting a growing earnings stream.

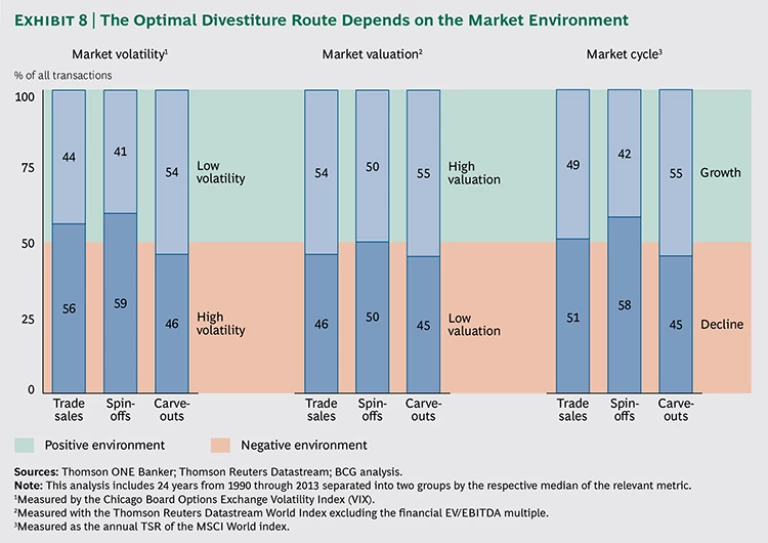

Market Environment. Timing is critical, of course. Divesting companies need to factor market volatility, valuation, and point in the cycle into their strategic considerations. Different exit routes perform very differently depending on the market environment.

To analyze the impact that market conditions can have, we divided our 24 years of data into two groups of 12 years each, assessing market volatility, valuation, and point in the cycle for each. We measured volatility by the level of the Chicago Board Options Exchange volatility index (VIX) and overall market-valuation levels by the EV/EBITDA multiple of the Thomson Reuters Datastream World Index (excluding financials). We assessed the point in the market cycle by the total shareholder return (TSR) achieved by the MSCI World Index within a year. (See Exhibit 8.)

Sellers control the process during trade sales and spin-offs, so these are the preferred routes during turbulent times, when investors shy away from IPOs. Carve-outs require a window of low volatility. Companies can keep their options open by pursuing carve-outs and also by preparing spin-off or trade-sale fallback options in the event that market sentiment shifts.

Opportunistic companies might seek to maximize cash proceeds during periods of high valuations for a subsidiary that is not part of the company’s long-term future, and indeed our results show that both carve-outs and trade sales are more often done while overall market-valuation levels are high. Spin-offs, on the other hand, can be executed in any market environment, because these transactions are cash neutral for the sellers.

Companies also need to factor in market cycles. Carve-outs are an attractive option in upswings or periods of high valuation because positive market sentiment is helpful for the parent company placing the IPO. On the other hand, spin-offs can be easily executed during downswings. Our research shows that in fact companies try to create value by this type of divestiture when market performance is poor. As for trade sales, because they are cash transactions, they can be pursued under any market conditions.

Preparing for Multiple Scenarios

Because market conditions can change quickly, it often makes sense for companies to keep their options open by pursuing multiple tracks simultaneously. In our experience, more and more companies are doing just that and delaying the final decision on which option to pursue until late in the divestiture process.

There are several benefits to a multitrack approach, including heightening the chances of competition, driving up the sales price or deal value, and allowing for maximum flexibility until a very late stage. Competition can also revitalize stalled trade sales. Moreover, the preparation processes and requirements for a trade sale, a spin-off, or an IPO, in terms of data, presentations, due diligence, and materials, are actually quite similar; a multitrack approach does not require significant additional effort.

Divestitures are a high-impact strategy with both near- and long-term benefits. Divestitures demand careful planning, however: deciding the best course for the asset, the parent company, and shareholders requires balancing multiple factors.

Companies that choose a course wisely and execute effectively can create substantial value and position themselves to perform at a higher level. When reviewing their strategic options and business portfolios, senior executives have no reason not to ask themselves, could others do better?