In 2012, The Boston Consulting Group conducted a consumer survey across five European countries. (See The European Automotive Aftermarket Landscape: Customer Perspective, Market Dynamics, and the Outlook to 2020, BCG report, July 2012.) The authors concluded that brisk competition and the resulting price pressures had benefited European consumers—a primary aim of European Commission policy for more than a decade. Both the survey and the market analyses proved that the European aftermarket had been transformed to yield lower prices as well as increased customer satisfaction.

BCG, in collaboration with the European Automobile Manufacturers’ Association (ACEA), has again investigated the dynamics of the automotive aftermarket. We surveyed executives of European automotive manufacturers and conducted extensive interviews with industry experts across the aftermarket spectrum. With the help of their input, we updated our comprehensive automotive-aftermarket model to reflect the developments in the market since we performed our 2012 study. Our analyses covered the aftermarket overall, while maintaining a particular focus on France, Germany, Poland, Spain, and the UK. In this report, we identify the trends that will shape competition in the European aftermarket in the coming years. In addition, we discuss the challenges and opportunities that face the various market players.

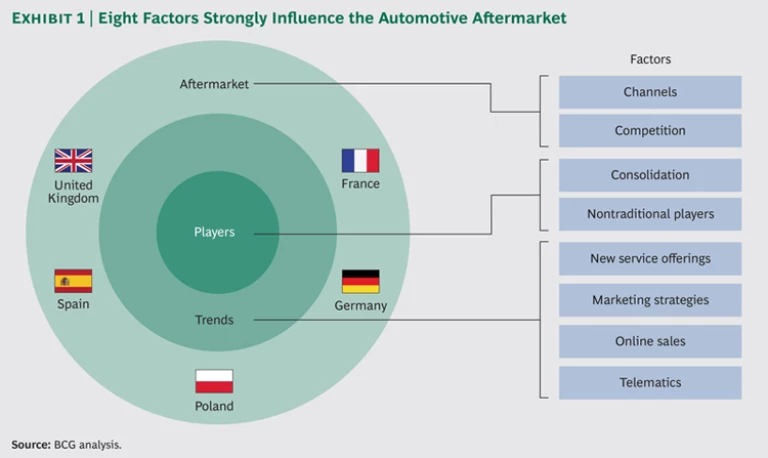

Our analyses considered in detail eight factors that strongly influence the aftermarket. (See Exhibit 1.)

- The aftermarket has two main channels.

- Competition remains intense.

- Some players are consolidating.

- Nontraditional players are transforming the repair business.

- Manufacturers are crafting new service offerings.

- Repair shops are marketing more aggressively.

- Part and tire sales are moving online.

- Telematics is an emerging trend.

The Aftermarket Has Two Main Channels

Although the automotive aftermarket is highly fragmented, the competition for repair business is between two main channels—the authorized and the independent. The authorized channel is composed of vehicle manufacturers (VMs) and their country organizations, dealer networks, and repair shops. Some of the latter are authorized to service a single brand; others service multiple brands.

The independent channel consists of service providers that do not have contractual ties to any VM. They often join forces with other independent providers to form purchasing networks, which buy in volume to secure better prices on wholesale parts sold by independent distributors. The independent channel also includes companies that collect, process, and sell data. Independent service providers can be subdivided into the following three retail categories:

- Franchises that offer a full range of services

- Automotive centers and “fast fitters”—repair shops that have standardized and often limited service offerings and that frequently sell over-the-counter parts

- Small, fully independent repair shops that offer a full range of services

Competition Remains Intense

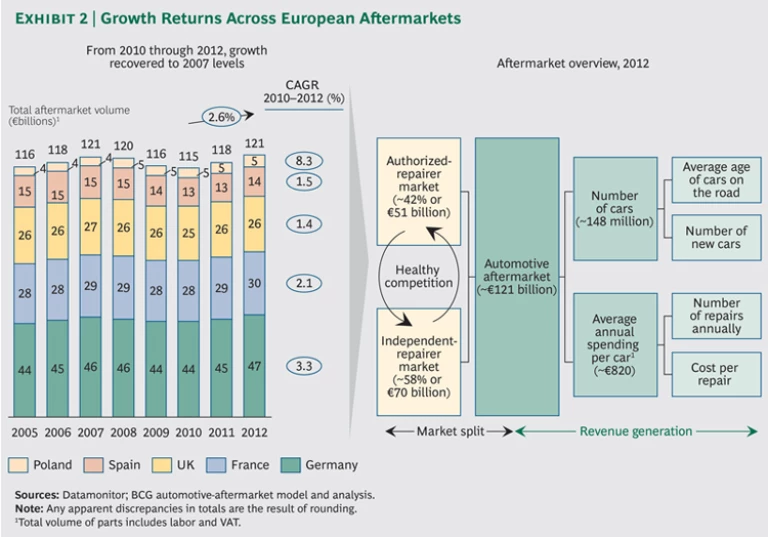

The size of the five national aftermarkets on which we focused grew from €115 billion in 2010 to approximately €121 billion in 2012, a compound annual growth rate (CAGR) of 2.6 percent. Four of the five markets had growth rates in the low single digits. Poland was the outlier, growing by about 8 percent per year. (See Exhibit 2.)

The growth reflects the modest increase in the number of cars on the road in the study’s five aftermarkets, to 148 million units. At the same time, the average annual spending per car—including accident repairs, wear-and-tear repairs, mechanical and electronics repairs, tires, and consumables—increased to roughly €820, while the frequency of maintenance and repairs decreased. The latter change resulted primarily from an increase in the longevity of parts and from longer intervals between scheduled service appointments.

In the five countries we analyzed, independent repair shops continued to dominate the retail sector in 2012. In Poland, for example, they had 70 percent of market share; in Spain, 63 percent; and in the UK, 66 percent. In these countries, no single national VM has the clout to shape the respective aftermarkets. In France and Germany, independents owned roughly 50 percent of the market. Their smaller share reflects the influence of national automotive-manufacturing champions, dense networks of authorized repairers, and a younger average car age. Nevertheless, the respective market shares of authorized repair shops and independent service providers changed only slightly since 2010—a sign of a highly competitive market with no clear winner.

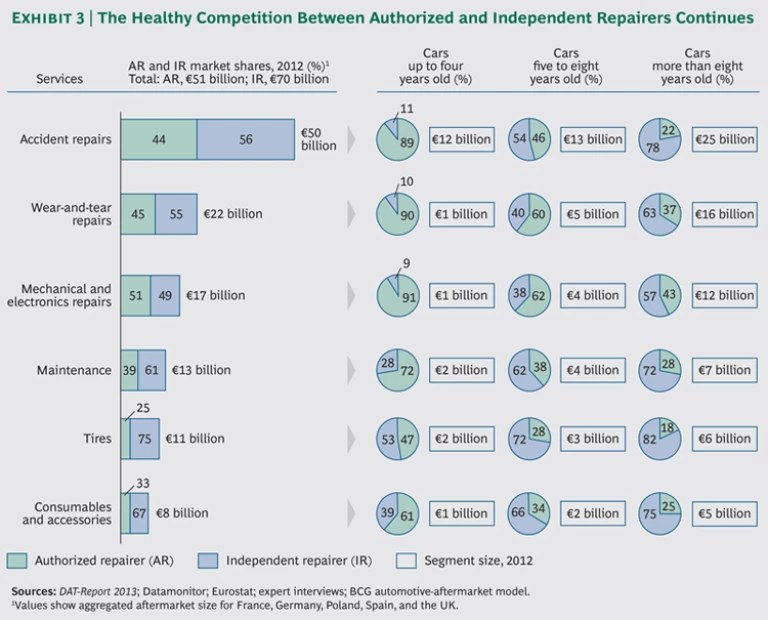

In addition to the overall market situation, we analyzed the market shares of authorized repair shops and independent service providers in terms of several critical services, including accident repairs, mechanical and electronics repairs, and maintenance.

Authorized repair shops captured a higher percentage of complex repair jobs than independents did. For mechanical repairs, for example, authorized repairers had a market share of 51 percent across the five national markets. For more straightforward services such as tire changes, authorized repair shops captured only a quarter of the market volume. (See Exhibit 3.)

Vehicle age clearly influences consumers’ choice of repair shop. Independent repairers dominated the large aftermarket for cars older than eight years, capturing 57 percent of mechanical and electronics repairs and 82 percent of tire replacements. In contrast, authorized repair shops dominated the market for new-vehicle repairs covered by warranty protection or comprehensive service plans. In every service category except the tire segment, clear majorities of owners of cars up to four years old preferred the authorized channel.

Authorized repairers made slight market-share gains in the segment of cars up to four years old, thanks to the increased complexity of cars and the rising number of new cars sold with service plans. In the category of cars five to eight years old, large independent chains gained market share in mechanical and electronics repairs, reflecting the increased competency of these providers to fix complex, high-tech components, such as ignition systems and turbochargers. VMs counterattacked in this segment with upgraded service offerings, such as extended warranties and service packages for used cars.

The size of the aftermarket for cars more than eight years old grew the most since 2010, to roughly €71 billion, as drivers held on to their old cars longer. At the same time, the aftermarket for new cars and those up to four years old shrank slightly, to about €19 billion. These two factors combined to shift a few points of market share from authorized repair shops to independent service providers since 2010.

Some Players Are Consolidating

The intense competition that characterizes the European aftermarket overall continues to transform the situation within individual channels.

The number of authorized outlets in our study’s five national markets has decreased by about 2 percent, or approximately 1,500 shops, since 2010, as revenue per outlet has increased by about 3 percent per year. This consolidation may continue as authorized repairers come under even greater competitive pressure from independents.

In contrast, much of the independent channel has shown little sign of consolidation since 2010. In Germany, for example, the number of independent outlets has held steady at about 20,000, while the average revenue per outlet has increased approx- imately 6 percent per year. No major consolidation in the independent channel has occurred since 2011, with the exception of Stahlgruber’s acquisition of PV Automotive and Centerbridge Partners’ purchase of A.T.U Auto-Teile-Unger; the formation of the TecAlliance network may affect the purchasing power and effi-ciency of the independent channel.

The biggest change in the aftermarket has occurred in the segment of small, fully independent shops—those standalone repairers unaffiliated with any large franchise system. Because these repairers have generally lacked the scale to compete on price against the big franchises or automotive centers, the pressure to win and keep customers has been unrelenting. This development will be driving some consolidation of the independent sector, and the following three factors will further fuel the trend:

- The Need for Diagnostic Tools. With every passing year, the complexity of new cars increases. Electronic components become more prevalent, and diagnosing problems requires more tools—and expensive ones—to access the necessary data. Smaller repair shops often choose not to invest in equipment, because they lack the scale needed to generate a positive return on the investment.

- The Pressure to Professionalize. In addition to hardware, repairing electronic components requires technical knowledge—and for independents, knowledge about multiple car types. Many small shops choose not to pay for the costs of training existing staff and recruiting more skilled repair professionals.

- Broad Changes in Maintenance Patterns. Today’s cars require less frequent but more complex maintenance and repairs—a result of the increase in technical complexity and the longevity of parts.

These three factors create an increasingly challenging environment for small, fully independent repair shops. To survive, they will have to professionalize and grow, specialize in basic services, or focus on specific consumer segments.

The big service chains—franchise operations, automotive centers, and fast fitters—are emerging as the clear winners in the independent channel. They have two major advantages:

- Volume purchasing, which translates into cost savings that they can pass on to consumers

- Stronger finances, which provide the necessary funding to train repair staff and acquire the diagnostic tools for standardized services

Nontraditional Players Are Transforming the Repair Business

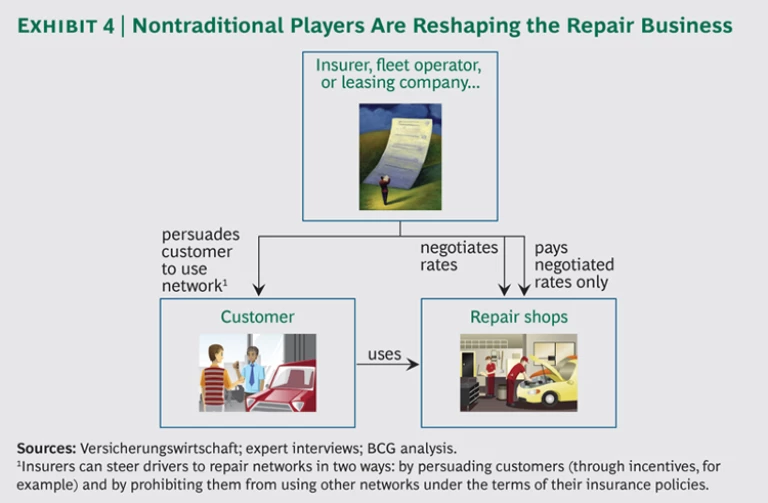

Nontraditional players in the automotive-services market are altering the competitive landscape. (See Exhibit 4.) Insurers, fleet operators, and leasing companies are all experiencing price pressures in their own markets and straining to capture every possible cost advantage. Because vehicle repair and maintenance are among the highest expenses of these nontraditional players, they are moving more and more toward special-condition contracts or partnerships with networks of selected repair shops. Special-condition contracts are not only controlling costs for nontraditional players but also increasing the business volume of their repair-shop partners.

In recent years, such partnerships have signed up a significant number of new customers. In Germany, for instance, partner networks established by nontraditional players captured 28 percent of accident repairs in 2012—an increase of 18 percentage points since 2003. The trend among nontraditional players to form partner networks will continue to reshape the competitive landscape in the European aftermarket in the coming years.

Among nontraditional players, insurers and fleet owners have different priorities. Insurers, for example, try to guide cars of all ages to their selected repair networks with consumer incentives, such as discounts for parts. Fleet managers, by contrast, focus mostly on routing the younger cars in their fleets to the repair network of their choice. Fleet managers generally arrange with one repair network to service the entire fleet, which usually consists of vehicles of several brands and models.

Manufacturers Are Crafting New Service Offerings

VMs, for their part, are responding to the competition from nontraditional players with service packages aimed at drivers of cars up to eight years old. These packages often provide a broad menu of services for new cars and a more limited selection for used vehicles. However, to be covered by these packages, the services must be performed by VM-authorized repair facilities.

These new service packages represent a significant change from past practices. Traditionally, VMs offered after-sales service packages for new cars only. But in recent years, VMs have begun offering after-sales packages for used cars to counter the inroads that independent repairers have made by joining the networks of nontraditional players. Service packages typically combine financing or leasing services, warranty extensions or used-car warranties, and service and maintenance coverage, as well as replacement cars for drivers whose vehicles are being repaired. Offering service packages is a growing trend in the used-car market, but it is not yet as pervasive as it is in the new-car market.

Repair Shops Are Marketing More Aggressively

Given the intense competition for market share, authorized repair shops and independent service providers are actively poaching one another’s customers. Authorized repair shops, which are strongest in the new-vehicle segment, are trying to push further into the used-car market and retain customer loyalty over the vehicle’s entire life cycle. To capture share, authorized outlets are taking the following steps:

- Offering incentives, such as discounts on parts, to used-car drivers

- Building on traditional competitive advantages, such as high service quality, extensive employee training, and tight links with VMs and dealers

Meanwhile, independent service providers are seeking to expand their market share in the new-vehicle segment by providing the same broad range of services as authorized repair shops. Their strategic initiatives include the following:

- Attractive prices, improved service quality, and speedy repairs

- Standardized service contracts for fleet operators and business customers

- Partnerships with nontraditional players—diagnostics specialists, insurers, fleet operators, and leasing firms—to secure maintenance work for a wide variety of vehicle

Part and Tire Sales Are Moving Online

Since 2010, online sales of parts and tires have continued to grow rapidly, though their absolute levels remain low. Online sales of parts and tires in the European Union grew from about 4 percent of total aftermarket sales in 2010 to approximately 6 percent in 2012. We expect that percentage to continue to grow at a CAGR of 15 percent over the next several years.

The increased price transparency that is typical of the online marketplace is making consumers more conscious of price and quality, putting pressure on the profit margins of traditional players and intensifying competition. And the emergence of direct B2C online sales of parts could have a long-term impact on the structure of sales channels in some corners of the industry. It’s possible that an increasing number of consumers will buy parts online and either install them themselves or take the parts to a repair shop for installation.

Online tire purchases in the B2C and B2B channels are also increasing, accounting for a larger share of total aftermarket sales. In Germany, for instance, online B2C tire sales increased from 6 percent of aftermarket sales in 2010 to 8 percent in 2012. According to market experts, online tire sales account for 15 to 20 percent of aftermarket sales in urban areas of Germany, compared with a much lower percentage in rural areas.

Telematics Is an Emerging Trend

Recognizing the emergence of connected cars as a major development in the automotive industry in the years ahead, our research focused on the following two dimensions of this phenomenon:

- The expected penetration of after-sales, service-oriented telematics

- Likely uses of telematics in the aftermarket

The Expected Penetration of After-Sales, Service-Oriented Telematics. Our comprehensive survey of European automotive executives shows there is a clear consensus that connected vehicles are penetrating the market at an increasing rate. However, opinions vary widely on how quickly telematics solutions for after-sales service will grow.

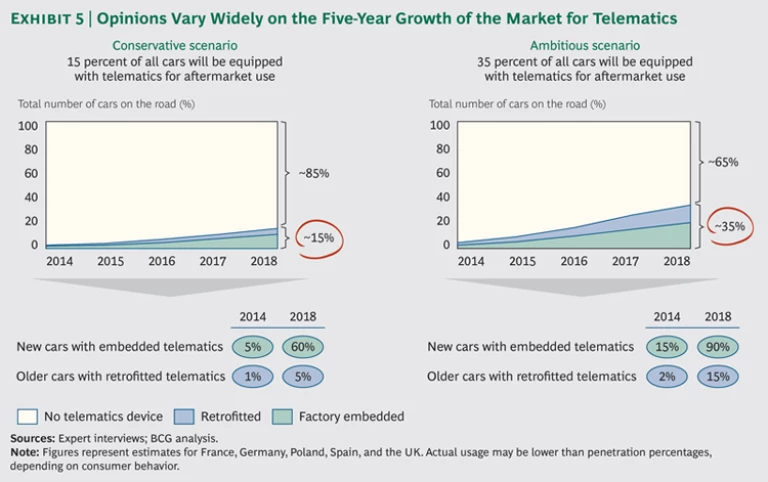

The anticipated increase in the percentage of new cars with embedded connectivity, combined with the expected growth in retrofitting, lead some executives to think that telematics penetration will likely climb to 15 percent of all cars on the road by 2018, while others expect the share to grow to 35 percent. (See Exhibit 5.) When asked about the new-car segment in particular, respondents said that by 2018, they expect 60 to 90 percent of new cars to have an embedded telematics solution that can support after-sales service.

For older cars, executives predict that 1 to 2 percent will be retrofitted with a telematics solution able to support after-sales service by 2014 year end, starting with corporate fleets. (The survey was conducted at the end of 2013.) By 2018, 5 to 15 percent of older cars are expected to be retrofitted with such devices.

The great variance in expert opinions on telematics penetration shows that the industry is still uncertain about the speed of change, especially in the older-car segment.

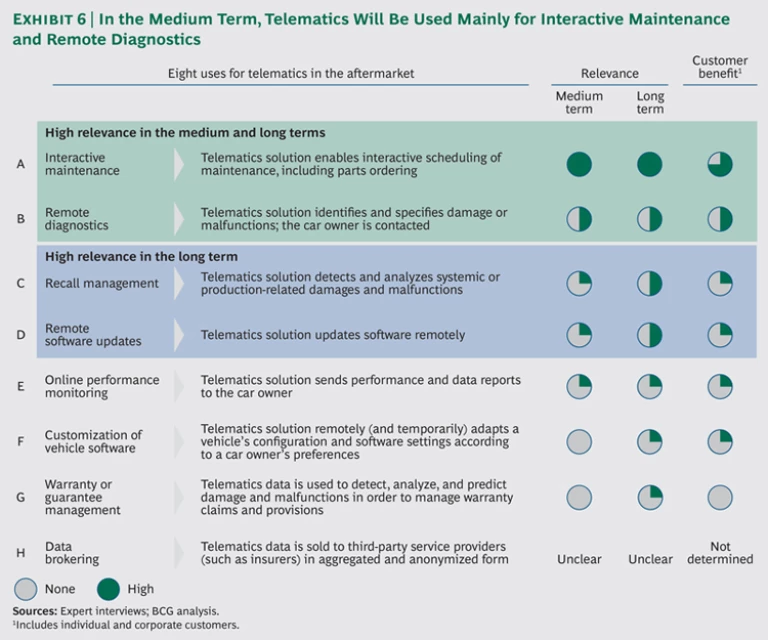

Likely Uses of Telematics in the Aftermarket. On the basis of responses to our survey, we see eight possible uses for telematics. (See Exhibit 6.)

By far the most common and likely uses of the technology will be to perform interactive maintenance and remotely diagnose malfunctions. In the case of interactive maintenance, a telematics solution will allow continuous onboard and remote diagnostics of a car’s operation. On the basis of driving performance and the car’s technical state, the telematics solution will be able to determine an optimal window for maintenance, connect the vehicle owner and the maintenance provider, set up a maintenance appointment, and, if necessary, order the required parts. In this fashion, the telematics solution can optimize the service process, reduce costs, and enhance the customer experience.

When remotely diagnosing malfunctions, the telematics solution will identify damaged parts and failures. In some cases, the telematics solution may resolve the problem remotely—for example, by downloading a software update. If more extensive repairs require human intervention, the telematics solution can perform the same services as it would for interactive maintenance. These interactions could prevent major damage and breakdowns, as well as make the diagnostic and repair process more efficient and more convenient for the customer.

In addition to interactive maintenance and remote diagnostics, survey respondents also cited recall management and remote software updates as likely applications of telematics technology. Few respondents believed it likely that telematics solutions would be used to customize vehicle software to suit driver preferences or to sell the data collected, the latter being highly controversial.

On the one hand, relatively little has changed in the European automotive aftermarket since we performed the original 2012 study. The market size has only recently returned to 2007 levels, and the competitive positions of the major players have remained fairly stable.

On the other hand, the rising complexity of cars, the growing role of nontraditional players, and the increase in online sales are transforming the aftermarket. In addition, telematics constitutes an emerging trend. How quickly telematics will penetrate the market is uncertain, given the great variance in experts’ estimates: as few as 15 percent and as many as 35 percent of all vehicles on the road are predicted to have telematics by 2018. Nevertheless, most signs point to an aftermarket that is returning to growth with fairly stable competitive positions.

Acknowledgments

The authors would like to thank Pascal Bruckner and Tobias Glas for their research assistance.