Every successful business understands the critical importance of effective selling. Too often, however, sales force effectiveness decreases over time. The reasons are varied. Bad habits take hold, paperwork gets in the way of face time with customers, incentives become misaligned with objectives, managers don’t spend enough time coaching in the field, or sales reps focus more on products than on customer needs. In other cases, the sales force loses sight of which accounts are actually generating a profit once sales costs and support are factored in. As a result, most companies are leaving money on the table and growing more slowly than they could. Some are even losing money on high-touch customer accounts.

By rethinking the most important aspects of the sales process and pulling the right levers, managers can make even high-performing sales forces more productive—and increase the revenue and profits of the business by 10 to 15 percent.

We measure sales-force effectiveness (SFE) by looking at the gross profit per sale, after subtracting all selling costs. In our opinion, a customer-centric approach and a Activating the Sales Force for Rapid Growth are critical to success. While we recognize that direct B2B selling is occurring more and more in a multichannel environment, the traditional sales force is still a very effective way to generate demand.

Every company will have a different starting point and a different end goal when it comes to increasing sales force effectiveness. Some businesses will seek to continually refresh their sales capabilities; others will aim for a longer-term transformation. The key is to understand where the critical areas for improvement are by diagnosing all aspects of selling and support—and targeting those with the biggest upside potential.

Five Areas of Attack

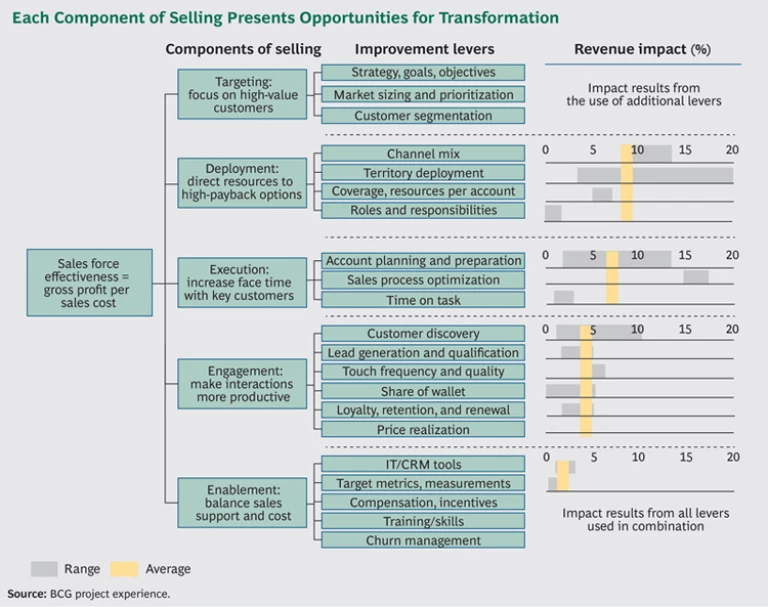

Opportunities for improvement and transformation lie in each of the five key components of selling: targeting, deploying, executing, engaging, and enabling. As shown in the exhibit, each of these areas has specific improvement levers, all of which are interconnected. Some companies choose to tackle many levers at once for a broad-based transformation of the sales force, while others achieve meaningful results by first focusing on a subset of levers and then addressing others over time. An initial analysis and diagnostic can identify the areas with the greatest improvement potential. Moreover, we’ve quantified the results that each lever delivers, on the basis of our experience with a wide range of companies.

Let’s examine each component of sales and its improvement levers more closely.

- Targeting: focus on markets and customers with the highest value. Defining a clear sales strategy and goals, understanding the market, and prioritizing the customer accounts to go after should be table stakes for an effective sales organization. But too often, sales teams approach these levers with insufficient rigor or use incomplete or outdated information. A quick review of customer segments, for example, often reveals a lack of meaningful detail that sales reps can act on. Without greater insight into the needs, buying patterns, and overall value of different customers, the sales force has no way of knowing where to focus its activities. But too much data can be overwhelming. The key is to clarify where the highest-value opportunities lie, so that sales reps can prioritize accordingly.

- Deployment: direct sales resources to opportunities with the biggest payback. As businesses become more complex, clarity about where to deploy resources is increasingly elusive. Multiple factors, such as products, customers, competition, geographies, channels, and industries, come into play and must be matched against numbers and types of resources. Since needs inevitably overlap, decision making about how best to deploy resources given numerous market opportunities becomes that much more complicated. Typically, these decisions involve tradeoffs and require a deep understanding of customers in order to identify, for instance, accounts in which direct selling is either inefficient or ineffective. Even the best companies can benefit from a systematic, data-driven review of how they deploy their salespeople. This type of analysis can reveal critical gaps and significant improvement opportunities that—if addressed—can boost revenue by 20 percent.

- Execution: increase face time with key customers. Sales reps who spend less time on low-value administrative tasks can spend more time selling or deepening their relationships with customers—which ultimately will increase their productivity. To this end, we recommend three levers. First, make sure that sales reps are thorough in their account planning so they know where and how to spend their time most effectively. Second, make the sales process, tools, and handoffs as streamlined and simple as possible—perhaps by using digital tools to reduce costs and increase efficiency. And finally, identify and try to minimize the tasks and activities that take the sales force away from customers. Each of these levers involves a fairly significant effort but can have a major impact on productivity, so companies should zero in on the ones with the most upside potential. The payback will be worth it: the typical revenue impact is between 5 and 10 percent and can exceed 15 percent in some cases.

- Engagement: make customer interactions more productive. Sometimes just improving how leads are generated and vetted can lead to better outcomes. But as a rule, greater upfront research and planning can help reps get far more out of both initial sales calls and visits with existing customers. By exploring the full range of customer needs, taking advantage of every cross-selling opportunity, and finding out if and where price sensitivities exist, sales reps can optimize their share of wallet. Often, simply understanding how frequently sales reps interact with customers, the quality of those interactions, and how well reps perform on renewals relative to the competition can lead to important insights. Again, the key is to quickly identify the things that will make the biggest difference. Improvements in this area typically increase revenues by 5 percent.

- Enablement: find the right balance between sales support and cost. Supporting the sales force is critical, but some tools and benefits may cost more than the actual value they deliver. By evaluating sales coaching and management, software tools, training programs, support manuals and brochures, incentives, and compensation packages, companies can weigh the cost-value tradeoffs and make informed decisions about which ones are the most effective.

Because every situation is different, the right solution—and the bottom-line impact delivered—will depend on your company’s starting point, industry, and competitive position.

SFE in Action

Many companies, even those with world-class sales forces, realize that they have a problem when revenue growth slows—despite significant increases in sales resources. The telltale signs may include lower sales levels, complaints from top customers that they rarely hear from their account managers, new entrants gaining market share, or the departure of top sales reps.

An end-to-end analysis of the five areas outlined above typically reveals a range of problems with targeting, deployment, engagement, and execution. For example, sales reps may be focusing more on large but slow-growing customers than on accounts with low penetration and high potential. Or there may be little correlation between the size of an account and the number of sales reps assigned to it full time. Often, sales territories are too large, unwieldy, and unfocused to cover in a meaningful way. As a result, potential customers are underserved, and sales reps—because they don’t contact accounts more often—lose out on opportunities to explore customer needs and provide information on products that could meet those needs.

The solution could be to move from a product-centric to a customer-centric organization and improve global teamwork. By shifting resources to the highest-value areas and bringing in teams of functional and industry experts, companies can better address customers’ specific needs. Smaller territories and greater focus can help, too. Sales reps with more manageable territories—whether because they have fewer accounts or have been assigned to a targeted geographic area—can invest more time in building customer relationships. In our experience, this approach delivers sharp improvements in sales performance metrics. Typically, revenue and quota attainment increase by 20 percent or more, and sales productivity improves by double-digit percentage points.

When Transformation Is the Objective

The same principles can be tailored to larger, more transformational efforts. For instance, we worked with a major pharmaceutical company that was about to launch three new products but had a costly selling model and a limited budget with which to increase the sales force. Because of these constraints, the company had to sharply improve the efficiency and productivity of its existing sales reps. The solution was a multiyear transformation that addressed many SFE levers, with a special focus on the enablement area and providing better support to the sales reps.

An initial diagnosis revealed that the first-line sales managers and the length of time they’d been on the job were the biggest factors driving sales performance—not the sales reps themselves. These experienced managers knew their regions and territories, their customers, and the strengths of their reps far better than their less experienced peers, and they were able to coach and manage more effectively. The less experienced managers spent less time in the field with the sales force, less time on calls, and less time coaching sales reps.

Given this insight, a key part of the SFE program was to develop a training program for these front-line supervisors. After testing and refining the program around the world, the company set up a global academy with international training centers to increase the overall discipline, standardization, and professionalism of the sales process and sales force. Account management and performance management are now important parts of selling. All members of the sales force have tools to monitor how accounts are doing, view market share, and manage their territories. Reps and their sales managers are given clear KPIs that measure the quantitative aspects of performance, such as activity levels and results, as well as qualitative factors such as call quality for reps and coaching effectiveness for line managers.

The impact of the transformation was significant. Sales activity grew by more than 30 percent with no additional hiring, while revenue and market share for three important brands increased substantially—by 10 percent on average in one key country. Driving these results were significant improvements in sales force activity. Calls per sales rep jumped by more than 25 percent, compliance with plan grew by 30 percent, and sales managers increased their coaching time by 55 percent.

Getting Started

Choosing which levers to focus on is just the beginning. A good next step is to review the key lessons we’ve distilled from our work and experience. As noted below, it’s a good idea to start with focused, visible efforts. Be sure to carefully sequence the initiatives and create an improvement agenda with a manageable number of levers to start with. A few quick wins can build enthusiasm and momentum—and won’t overwhelm the sales function.

LESSONS FROM THE FRONT LINE

Based on our work with leading companies in a wide range of industries, we’ve distilled a number of key insights for improving SFE:

- Look beyond the sales force. Think globally and across channels to achieve greater impact.

- The initial diagnostic builds the case for change, drives buy-in, and is the basis of a roadmap forward, so make sure it sets up the larger opportunity.

- Customer input brings credibility to the diagnostic and helps the improvement program get early commitment from sales managers and reps.

- A flexible, collaborative approach wins over sales teams and makes it easier to get their buy-in.

- Start by fixing the basics, and use the savings and revenue increases to fund a broader transformation.

The key is to think big but start with focused, visible efforts. Look at the global picture while systematically reviewing the end-to-end sales process. An analysis and rapid diagnostic will reveal the biggest improvement opportunities—and the levers that will have the greatest impact.

As with any major improvement effort, an SFE program is an exercise in Changing Change Management: A Blueprint That Takes Hold and behavioral adaptation that must be driven by business executives and line management—not just sales leaders. Major change starts with a clear understanding of why an improvement in the sales force is necessary and what lies at the end of the road. This clarity must come from top executives and be communicated to all levels of the organization. It is also critical to have agreement among business and sales executives on the goals of the SFE program and how to achieve them.

Even with a clear vision and executive alignment, SFE success will be elusive without rigorous program management that includes clear milestones and accountabilities, effective project teams, and strong stakeholder engagement. Without a high degree of executive commitment and oversight, high-potential initiatives often become watered down or programs lose momentum.

Sales force effectiveness is a key driver of revenue growth, which in turn drives a company’s shareholder value. In fact, BCG research shows that revenue growth is the single most important driver of long-term value creation. By following our SFE approach, even world-class sales organizations can grow revenue, cut costs, increase margins, and boost their overall effectiveness.