For decades, companies have built supply chains focused on cost optimization, using inventory as a buffer to meet customer service objectives. And since forecasting customer demand can be challenging, companies often add inventory to protect against inaccurate forecasts. From a profit-and-loss perspective, they think of this inventory as “free,” creating little incentive for efficiency. If carrying extra inventory in the form of finished goods avoids a call from an unhappy customer about a missed shipment, most sales executives would gladly make the trade-off.

As sources of growth become more difficult to find, companies are attempting to drive incremental sales increases through innovation, faster speed to market, and customization. In this world, an efficient, high-performing supply chain is critical to success. Yet often companies are challenged by their inability to meet customer service expectations despite having high levels of slow-turning inventory. Such problems are the result of an underperforming supply chain, often resulting from poor forecasting accuracy, ineffective planning processes, and production capabilities that are slow to respond to changing market demand. These inefficiencies become a barrier to growth, leading to dissatisfied customers and lost sales, bloated inventories and stale product, and clogged distribution networks. Ultimately, they consume resources and capital that could be better used to fuel growth through product development and marketing activities.

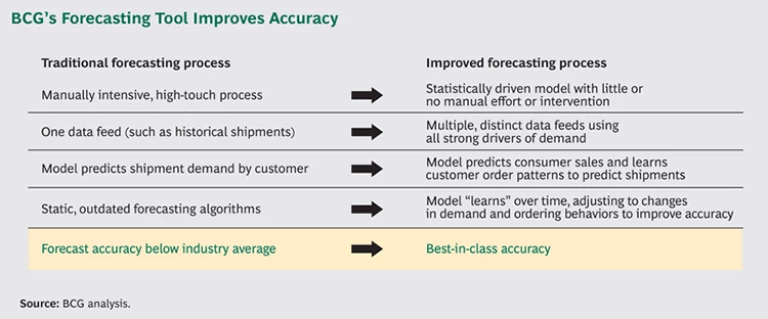

Many levers are available to address these issues. In BCG’s experience, one of the most effective is a more accurate understanding of future demand. In our work with several large consumer product companies, we have developed a forecasting methodology that is more accurate in predicting demand and can help companies reduce inventory, improve on-shelf availability, and minimize waste. What’s more, BCG’s demand-planning approach and forecasting tools reduce the time employees spend inputting data and developing a consensus forecast, freeing them to focus on using the supply chain to increase productivity, improve speed, and boost innovation. (See the exhibit, “BCG’s Forecasting Tool Improves Accuracy.”)

The Problems with Forecasting

Companies have tried for years to optimize production and inventory deployment decisions through more effective forecasting of customer (retailer) and consumer (end user) demand. Too often, though, the forecasting models they use have contributed to, rather than reduced, uncertainty. Most available forecasting tools use generic algorithms based on the assumption that demand can be predicted uniformly for all companies and across all industries, product lines, and geographies. This one-size-fits-all approach yields a forecast that fails to reflect the relative impact of different demand drivers and to adapt as market conditions and consumer behaviors evolve. To compensate, companies often attempt to layer on manual “consensus” processes in hopes of generating more accurate results. This process is time-consuming, distracts from higher-value activities, and still generates poor results.

What’s more, this consensus-building process often leaves companies vulnerable to competing interests within the organization. Business managers and sales teams provide optimistic forecasts to meet aggressive financial targets and ensure more than adequate inventory. And they often change demand requirements at the last minute in order to drive incremental sales, destabilizing manufacturing and the downstream network. Manufacturing and supply chain operators, meanwhile, want stability, lower inventory, and less waste. These competing interests create an inherent conflict that can skew the outcome of a demand-planning process.

In contrast, a more analytical view based on hard data allows for fact-based trade-offs and decision making. It enables managers to justify demand levels with an impartial analysis that reduces the inherent conflict between overly optimistic sales predictions and the desire for longer production lead times. Furthermore, a better, more analytical forecast helps highlight gaps between financial performance targets and sales and operating plans early in the planning cycle, when actions can be taken to address them. Sales executives can leverage bottom-up forecasting to evaluate the impact of specific planned activities—such as promotions and merchandising events—compared with the top-down targets established in their overall plans. This approach highlights potential missed targets and can provide an early warning of where additional actions are required.

Building a Better Forecast

Most companies use some type of enterprise resource planning (ERP) software to develop their forecasts. Unfortunately, these programs can be rigid in their methodology and difficult to modify after they are installed. They typically strive to forecast customer orders without first understanding the underlying drivers of consumer demand. This approach fails to recognize the “noise” caused by retailer behaviors—such as order policies and advance buying for large promotions—that degrade the quality of the forecast. Furthermore, employees who design and implement ERP programs typically move to other roles over time, taking with them the rationale for the design and an understanding of its inner workings. These systems become static black boxes without the ability to adapt to changing conditions.

Because businesses vary, companies need forecasting tools that take these dynamics into account and are customized to the unique traits of each product category and geography. Better forecasts, in turn, can improve organizational and business performance, resulting in these benefits:

- Fewer Missed Sales. Knowing where demand will occur ensures that the right inventory is in the right place at the right time.

- Higher Customer-Service Levels. With a deeper understanding of both consumer demand and subsequent retailer ordering behaviors, companies can more effectively deploy inventory to provide higher fill rates, improved on-time availability, and fewer stock-outs.

- Lower Working Capital. Companies can operate with less inventory because they’re more confident about demand.

- More Efficient Manufacturing. Production schedules can be optimized through a better understanding of demand and the prevention of last-minute changes.

- Less Waste and Spoilage. With less inventory, companies are more likely to sell stock before it reaches its expiration date and has to be discarded.

- Reduced Effort. Automating the forecasting function gives the sales force more time to focus on selling, and it reduces the time management must devote to overseeing the forecasting process.

Building a Better Forecasting Tool

To illustrate the effectiveness of BCG’s forecasting and demand-planning approach, consider the example of a major consumer products company in North America. A household name with a well-established supply chain, the company suffered from too much inventory and a planning process that required substantial employee input and time to complete. It relied on generic forecasting tools that failed to account for the company’s specific products and markets. In some cases, employees didn’t fully understand how to properly deploy these tools.

We first worked to build a better forecasting tool based on a customized set of demand drivers. The tool started with the basics of consumer demand—sales during the same week of the previous year and planned pricing for the current year—and then added data points such as the timing and type of advertising employed, promotional activities, and competitors’ pricing moves. Through rigorous back-testing, we developed an accurate and dynamic consumer-demand forecasting model that assessed how these drivers changed over time and that updated the algorithm automatically.

With this highly accurate model, we then evaluated customer order patterns and behaviors in order to understand—and compensate for—the additional volatility that these factors inject into the forecast. When layered into the modeling algorithms, this two-stage approach resulted in a highly accurate and robust forecasting tool that could be used to inform production and inventory deployment decisions. It also enabled the company to highlight the inefficiencies that customer behaviors bring to supply chain performance and begin to eliminate this noise through better communication with retailers.

In parallel, we streamlined the sales, operations, and planning processes and made the timing and responsibility for decisions more explicit. We updated this process with critical inputs collected in a timely manner and eliminated all unnecessary or detrimental “consensus building” activities—saving time and improving forecasting accuracy.

These tools and processes together enabled the company to better anticipate and respond to changes in customer demand and identify future opportunities. The accuracy of forecasted demand rose dramatically. For one product line, for example, accuracy jumped to 58 percent from 28 percent. Across all categories, we observed a 1,000 to 1,500 basis-point improvement. At the same time, inventory levels fell by more than 10 percent while service levels improved. The entire process required less effort than the company’s previous system. The number of employees involved in the inputting process was cut in half, from more than 100 to fewer than 50.

This company’s results are typical of those of other BCG clients that have implemented the program. Using BCG’s forecasting tool, companies can establish processes that do the following:

- Create objective data points for all parties, whether it’s sales, manufacturing, or business planning.

- Balance the long- and short-term views of demand, since everyone in the organization uses the same forecast numbers.

- Identify supply chain shortcomings early, allowing time to make adjustments without disrupting supply chain functions or efficiency.

- Establish a clear hierarchy for decision making so that employees know what is expected of them. This creates more cross-functional dialogue and encourages the incorporation of perspectives from across the organization, instead of relying on the sales force to react to shortcomings.

- Hold people accountable for the accuracy of the data inputs and rely on analytical tools to generate the outputs.

- Reduce or eliminate unnecessary contacts between employees and inventory, allowing employees across the organization to focus on higher-value activities.

The enhanced forecasting tools and demand-planning processes described above can serve as the linchpin for a more responsive and flexible supply chain, while also driving a much broader set of benefits. With greater confidence in demand forecasts, manufacturers and retailers can coordinate promotional and merchandising events and improve the effectiveness of their trade spending. Plants can avoid overproduction caused by uncertainty, improve their production schedules, and unlock trapped capacity. This enables more frequent production runs tied to customer demand and shortens lead times. By eliminating the waste associated with last-minute expediting to meet unpredicted demand, plants can further reduce the inventory levels required by both manufacturers and retailers—and provide fresher products to the end consumer.