Information is multiplying inside businesses at an exponential rate, generated by sensors, social media, transactions, smartphones, and other sources. Companies increasingly want to tap into the potential of these vast, fast-moving, complex streams of data to achieve step-change improvements in performance. But executives would be wise to consider whether the information they collect could do even more than boost performance. In fact, big data can generate billions of dollars in additional revenues that can go toward fueling growth.

We call these new revenue opportunities “big data as a business.” Companies in a variety of information-rich industries are already generating entirely new revenue streams, business units, and standalone businesses out of the data they hold. Over the long term, we see strong potential for such data businesses to spread to even the most traditional industries. Our on-the-ground analysis of this nascent field reveals the many ways that companies are getting in the game, as well as the important building blocks of a profitable big-data-as-a-business strategy.

How Companies Are Seizing the Opportunity

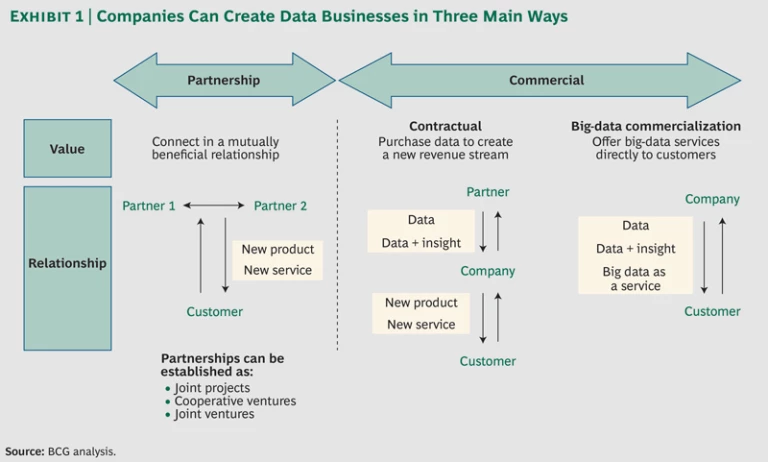

Companies can create big-data businesses by forming partnerships, developing contractual relationships, or going it alone. (See Exhibit 1.) The majority of organizations we surveyed prefer to have control over the development of new products and services. They frequently contract with third parties to help speed development, but full-fledged partnerships or alliances are still a relatively uncommon arrangement.

Companies that commercialize big data on their own have the advantage of economies of scale, control over strategy, and much greater revenue potential. Partnerships, on the other hand, allow them to share risk and take advantage of the partner’s skills, assets, or data to create new opportunities and get to market quickly. Whichever approach they use, companies must understand the profoundly disrupting digital ecosystems—the intersecting networks of companies, individual contributors, institutions, and customers—in which they will be collaborating and competing. (See “ The Age of Digital Ecosystems: Thriving in a World of Big Data ,” BCG article, July 2013.)

In our work with leading companies looking to develop big data as a business, we have observed two basic starting positions: companies with a great deal of existing transactional data that they can capitalize on, and companies with valuable data but not enough of it to make the business viable. Financial and telecommunications companies have the largest amounts of existing data and are typically the most advanced in commercializing it. In our survey, 80 percent of the efforts we identified were in these industries. Often, such companies sell data to those that lack enough high-quality data of their own for analytical purposes. For example, National Australia Bank records the details of millions of electronic transactions, strips the data of information that could identify individual customers, and passes it to a joint venture that the bank set up in 2008 with the data analytics company Quantium, which sells insights from the data to third parties.

Outside of finance and telecom, companies with rich stores of data are concentrated in IT-intensive insurance and retailing. Grocery retailer Tesco has worked with its Dunnhumby business unit to build a big-data business that analyzes millions of customer transactions and sells the resulting insights about shopping behavior (but not customer-level data) to major manufacturers, including Unilever, Nestlé, and Heinz. The anonymous data can pinpoint spending habits down to the level of postal area, identifying which groups of residents buy, for example, the most wine, chocolate, or organic food. Tesco uses the insights to offer its Clubcard holders rewards worth £500 million each year. Dunnhumby generated £53 million in profits for Tesco in 2012.

Over the longer term, companies in many other industries will get into big data as a business, including those in energy, manufacturing, health care, and consumer goods. Some leading companies in these industries are already making inroads, earning an estimated tens of millions of dollars per year from the data they generate. Often these companies partner with others to get to market quickly.

Seven Profit Patterns

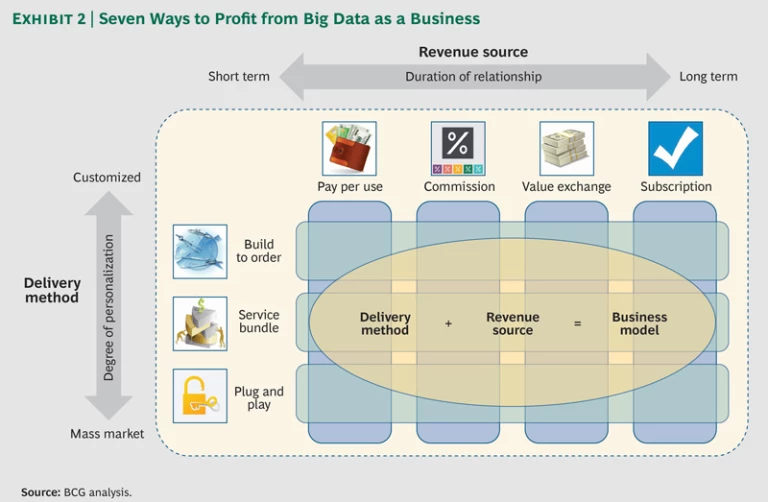

In our work in the field, we have seen seven primary profit patterns, or business models, for big data as a business. (See Exhibit 2.) They include a mix of business-to-business and business-to-consumer offerings. Three of the options differ in terms of how the product or service is delivered, from customized to mass market.

- Build to Order. Tailored products and services configured to the customer’s specifications—a customized traffic-pattern analysis for a city planning department, for instance, based on location data from multiple GPS devices—may increase customer satisfaction and perceived value, while a high degree of specialization can create barriers to new entrants. On the downside, customers may have to wait longer to obtain customized products or services, which are also often difficult to resell.

- Service Bundle. In this model, several offerings are combined into a single offering. For example, a retail energy company might combine gas and electricity delivery with a monitoring service to help customers save energy. Bundling can be profitable, drive rivals from the market, and open up opportunities to cross-sell or up-sell existing products. However, once products and services have been bundled, it can be difficult to separate them and hard for customers to assess the value of each component of the offering. (See “ Better Bundling in Technology, Media, and Telecom Markets ,” BCG article, March 2013.)

- Plug and Play. Here the same product is sold to every buyer. An example might be a bank that sells high-level reports based on aggregated and anonymized data about customers’ spending patterns. Such offerings can be easy to deliver, lend themselves to discounting strategies, and increase margins through economies of scale. But customers may consider them to be of lower value than build-to-order products because of the lack of personalization, and their transactional nature can increase the risk that customers will switch to a competitor.

The remaining four business models differ in terms of the duration of the relationship with the customer, from short term to long term.

- Pay per Use. This option gives customers easy access to a wide selection of offerings, but they only pay for what they actually use—for example, on-the-spot ski insurance based on the user’s location. While it offers improved product margins compared with subscriptions (discussed below), this business model does not create a stable source of revenues, and the sometimes high cost of customer acquisition must be factored into the profit equation.

- Commission. A bank that analyzes credit card transactions and offers discounts to stores and restaurants that agree to pay a fee, usually based on the revenue generated, exemplifies this business model. The relationship is generally stronger and more long lasting than the one associated with the pay-per-use model, because of the ongoing nature of the revenue-sharing arrangement. However, a high degree of variation can creep into the offering. Companies must also consistently add value in order to increase the fees that customers pay.

- Value Exchange. In this model, a partner standing between the company and the customer offers some kind of rebate, discount, or additional service, depending on the business. For example, a bank could offer a merchant discount brokered by an intermediary, crediting cash back to the customer upon completion of the transaction. Value is generated in the form of a commission paid to the partner by the company and the monetary benefit delivered by the company to the customer. By targeting only customers of interest, the company improves the return on its marketing investment, but the presence of an intermediary that captures value from the customer may be a long-term disadvantage.

- Subscription. With subscriptions, the customer pays a periodic fee for unlimited access to a service over a set period. For example, a health care company could analyze electronic medical records and provide an anonymized-information service on patient outcomes. The subscription model ensures a predictable revenue stream with good potential for up-selling and cross-selling of additional products or services. The downside is lower margins than those typically generated by the pay-per-use model.

Of these models, those that involve the delivery of products and services to a mass market predominate. This is not surprising, given the need to quickly get to market with nascent services in the early days of an industry. In the future, we expect that even greater value will be generated by bundling and build-to-order offerings, particularly those that secure a longer-term relationship with the customer and create greater engagement.

Mixing and Matching Models

Three examples show some of the ways that established companies in a range of industries are mixing and matching elements of these business models to create dynamic new offerings.

- Plug and Play + Subscription. General Motors uses telematics data from its OnStar navigation system to offer “pay as you go” auto insurance through a partnership with National General Insurance. With the customer’s permission, the service uses mileage data captured from OnStar to offer discounts of up to 54 percent to those who drive less than 15,000 miles per year. The system does not gather other sensitive data, such as speed and driving behavior, and there is no penalty for driving additional miles.

- Service Bundle + Commission. Several banks offer services to retailers bundled with their existing point-of-sales products. The services analyze terabytes of credit card transactions to provide mom-and-pop retailers and others with detailed insights about customer demographics, geographic spending patterns, and individual spending behavior—information that many organizations have lacked. In Madrid, BBVA worked with the local city government to develop real-time insights from this store-level data about when and where tourists and locals were spending money across the city.

- Build to Order + Subscription/Pay per Use. Several large telecom companies are rolling out services based on the data they hold about customers’ locations and behaviors. For instance, Verizon’s Precision Market Insights service, launched in 2012, offers access to anonymized data derived from a sample of its more than 86 million wireless customers. The analytics engine generates insights and predictions about shopping habits, interests, travel, and mobile browsing. The service would allow an advertising services company, for example, to determine whether someone passing one of its billboards subsequently goes into the advertised store.

How to Put the Models into Practice

As companies explore these businesses built out of data, they must ask themselves a few key questions.

Do we have the data, capabilities, and infrastructure we need? The first step in evaluating a company’s readiness to build a big-data business is to identify the data available and the data that needs to be acquired. In our work with a variety of businesses, we have found that companies are sitting on more, and more valuable, data in-house than they realize. (See “Data to Die For,” BCG article, October 2007.) But many companies contract with third parties, such as data, knowledge, systems integration, and cloud services providers, to provide additional data, improve their capabilities, and manage infrastructure.

How could big data deliver value in new ways? The next step is to map potential uses of data to the needs of a valuable customer segment. The nature of that value will be different depending on whether the business focuses on consumers or businesses. The options described in the preceding section can help in identifying the right business model, as can the lessons learned by leaders in business model innovation. (See Business Model Innovation: When the Game Gets Tough, Change the Game, BCG White Paper, December 2009.)

With whom should we partner? Partners can come from many industries, including ones unrelated to the main business. Partner selection depends on the objectives that the business wants to achieve, the gaps it faces in achieving those goals, the ecosystem in which it operates, and the relationships that could help in executing a strategy over the short and long term. Consider how everything from company cultures to product portfolios fits together, as well as where partners will collaborate and where they will compete.

How can we foster trust? Companies must consider issues of data privacy and the risks associated with using sensitive customer information. We estimate that companies with effective trust measures in place can unlock up to five times more consumer data than other companies. (See The Trust Advantage: How to Win with Big Data , BCG Focus, November 2013.) To be trusted, companies must ask such questions as: How can we incorporate data privacy into our day-to-day work? How do we create transparency regarding the use of personal data? How can we encourage active customer participation in setting privacy levels for personal-data storage and usage?

Enormous value from big data lies hidden just beneath the surface at many companies. To pinpoint the most significant potential revenues from big data as a business, organizations must take a hard look at the data they already hold. Many companies could be sitting on the digital equivalent of gold.