An old adage is ringing true for developing-market mobility carriers (DMMCs): all good things must come to an end. What seemed like boundless growth just a few years ago has turned out to have limits after all—and some rather unforgiving ones at that. Mobile penetration has reached saturation levels in most countries. Average revenue per user is deteriorating. And competition, having turned from fierce to brutal, now includes free alternatives to mature voice and messaging services through companies such as Facebook and WhatsApp.

In Malaysia, for example, the SIM-card penetration rate for DMMCs rose from 37 percent in 2007 to 86 percent in 2012. During the same period, the average revenue per user for Malaysian carriers dropped by 20 percent, while Indonesian carriers suffered a decline of nearly 50 percent. Carriers in other developing markets are faring similarly. Whatever action a provider takes to get ahead is quickly replicated by others. To put it simply, and soberingly, DMMCs have lost their competitive differentiation.

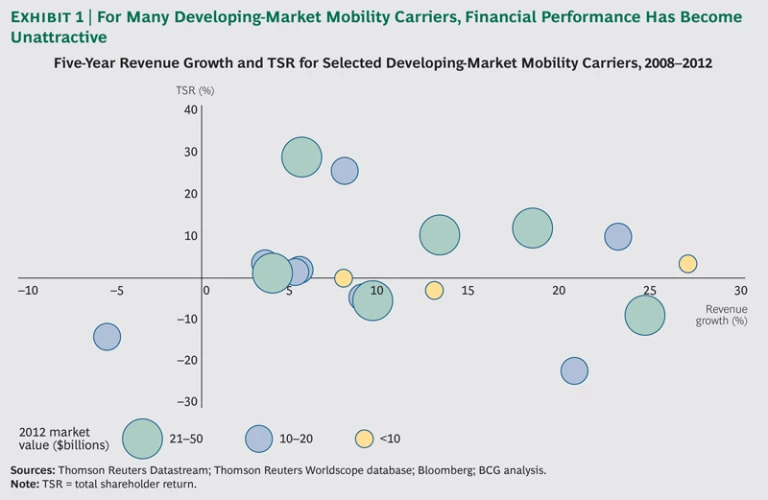

The carriers are well aware of this problem. Many are experiencing all-too-clear drops in total shareholder return. (See Exhibit 1.) CEOs have developed plans for corrective actions, and most are pursuing an array of initiatives to stimulate revenue, share networks, develop app stores, offer shared-data plans, and develop digital services, such as mobile advertising. These are all sensible moves, but they will provide more of a nudge than an edge. Everyone is working with the same list of initiatives, which are both easy to emulate and unlikely to re-create sustainable competitive advantage.

What’s more, the challenge goes beyond the new ideas that DMMCs are embracing; it also includes the old ideas that they haven’t yet relinquished. When upgrading their networks, most carriers follow the traditional approach for capital allocation: they look at the aggregated demand forecast for all customers and roll out technology based on the overall demand for capacity and coverage. The model worked when the subscriber base was expanding and the added capacity enabled more customers to come on board. But now that the subscriber base is no longer expanding, the aggregated approach has become a recipe for decreasing returns on invested capital.

Carriers are just beginning to understand that value creation is concentrated within a small percentage of subscribers. In Southeast Asian markets, for example, 20 to 22 percent of subscribers contribute 64 to 68 percent of revenue. And that’s no anomaly. BCG has found such concentrations to be virtually an industry constant—true in almost all environments. These high-value customers are where DMMCs should be focusing and what their business models should be centered on.

Applying lessons from our work, we’ve developed a targeted model—a playbook—for DMMCs. It consists of two core elements that target high-value customers:

- Accelerating the deployment of a least-cost network

- Providing a differentiated customer experience focused on localization, personalization, and collaboration

This new model is surprisingly straightforward, and carriers already possess everything they need to make it work. The results may be surprising, too: DMMCs that implement the playbook can reverse declines in shareholder returns, restore returns on invested capital to market-leading levels, and increase their enterprise values by 30 percent or more within 18 to 24 months.

Implementing the playbook, however, will require DMMCs to think and operate in unfamiliar ways. They will have to work more closely with equipment vendors and with companies that are bringing new technologies to life. And they must make sure that the initiative is led from the top. But carriers willing to set aside their embedded mindsets will find the effort well worth making because the playbook can bring about outsize performance—or, more accurately, bring it back.

Accelerating the Deployment of a Least-Cost Network

DMMCs are already migrating to least-cost networks—the fastest, most capable, most cost-effective networks enabled by available technology. Like the other initiatives on the companies’ agenda, this too makes sense. Operators moving from 3G single-carrier technology to 4G, for example, experience a 17-fold increase in speed while reducing the cost per megabyte by a factor of 12.

In time, all DMMCs will have least-cost networks. But those deployments will take years, and many carriers are not allocating their capital as efficiently as they could—thus creating an opportunity for those that do. Carriers that base upgrades on aggregated demand often wind up deploying too much new infrastructure to customers who won’t use it and too little to customers who would readily pay to use it. Carriers that base deployments on the revenue potential of coverage areas, meanwhile, risk ranking a large cluster of low-value customers above a smaller cluster of high-value customers.

But a carrier that uses our playbook to quickly deploy its best technology to its best subscribers can realize far better results. Margins from high-value customers, already higher than average, will increase because the cost of delivering service is reduced. Carriers are likely to attract more of these prized customers, too, since they’re providing higher-quality network service in the areas that are most receptive to it—and beating their competitors to the punch as well.

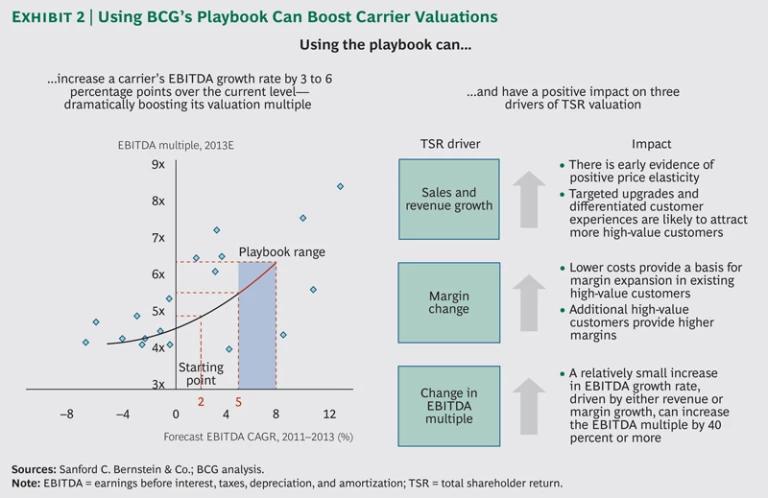

The result can be a dramatic rise in enterprise value. BCG estimates that an aggressive deployment of a least-cost network targeted to high-value customers can realize a three-year growth rate of earnings before interest, taxes, depreciation, and amortization (EBITDA) that is at least 3 to 6 percentage points higher than current levels. While the lower end of this range would come simply from reduced costs, additional achievement will depend on how successfully the carrier is expanding its high-value customer segment and even capturing additional revenue from it. These are eye-opening figures, since even a relatively small rise in EBITDA growth will increase a company’s valuation significantly. Indeed, a carrier with a preplaybook EBITDA compound annual growth rate of 2 percent, which is typical for many carriers today, should see a postplaybook rate of 5 to 8 percent. A jump to 8 percent would translate to a 40 percent increase in the company’s valuation multiple. (See Exhibit 2.)

The key is to identify where, exactly, high-value customers are located on the network—where they live and work—and to prioritize those areas for upgrades. This, it turns out, is an easier task than one might think. DMMCs already possess the necessary information, though it has rarely been incorporated within the capital allocation process. The first step is to identify each high-value customer’s mobile-subscriber ISDN number, which is a unique identifier. Once those numbers have been collected, carriers can map them to individual base-transceiver stations and pinpoint the locations where traffic from high-value customers is concentrated.

To help determine the pace for deployment, DMMCs will need to gauge the future usage patterns and bandwidth demands of their high-value customers. We recommend looking five years out and forecasting factors that include device portfolios, such as users moving from one phone to multiple mobile devices; activity types, such as more Web browsing, transactions, and entertainment; and usage intensity—increasing, say, from 5 megabytes per day to 1 gigabyte per day. In this way, carriers can see how demand from their high-value customers will shift over the coming years and can time their current investments accordingly.

Providing a Differentiated Customer Experience

Deployed wisely, a least-cost network can help a DMMC get ahead of the competition. But it’s the second element in the playbook that will help the company stay ahead. By creating a differentiated customer experience, carriers will be able to attract customers while repelling slow-coming emulators. The innovations that fuel these unique experiences exist today. Most are ready to be commercialized, and the potential is enormous. The venture capital community has already realized this. In 2012, $8 billion—or 46 percent of all global technology venture-capital funding—went into mobility. That’s up from $2 billion, or 17 percent of the total, in 2009.

About a fifth of total 2012 funding was directed at three main areas of technologies and services of particular relevance to carriers:

- Localization. These innovations add context to one’s current physical location. Perhaps the best-known example of localization is augmented reality, which integrates geo-information, visualization, and location-inference technologies to show users, often quite vividly, what is around them. For example, by pointing a smartphone camera at a street, a user can see boxes overlaying nearby restaurants, displaying each establishment’s name, distance from the user, and reviews. Innovators such as Wikitude, an Austrian company, have already brought these types of capabilities to market.

- Personalization. Personalizing one’s digital experience according to one’s interests, behaviors, and social connections can make the experience more relevant, more enjoyable, and more helpful. Dynamically generated recommendations, for example, analyze a user’s preferences and history to suggest content, goods, or services that he or she may like. Some companies, including Amazon and Netflix, have already incorporated this into the core of their businesses.

- Collaboration. These innovations—driven in large part by crowdsourcing technologies—facilitate problem solving by matching users and tasks. Companies like San Francisco–based Sparked are building platforms that don’t simply connect people looking for answers to a problem with people who can offer the most appropriate solutions. Rather, they continuously refine their matchmaking on the basis of users’ previous behaviors and capabilities.

DMMCs need not sit on the sidelines as other companies—including global players, such as Facebook and Google—develop these technologies and start making money with them. In developed markets, much of the opportunity for participation is already gone, as innovations have become accessible to users through apps and the Web, bypassing carriers entirely.

In developing markets, however, things are—for now—a bit different. Innovators are only just beginning to commercialize their technologies in these regions, and DMMCs have a lot to offer them. They can deliver unique new services to a wide audience through preinstalled apps, white-label services, integration into the back end, and app stores. They have the GPS and network-positioning data to fuel localization applications and the customer data to drive personalization. Their large user populations, meanwhile, are ideal for crowdsourcing.

But most DMMCs have little experience working with outside innovators, and few have the processes, the people, or the investment framework necessary for integrating the new technologies into their own businesses. These capabilities have to be built—and built quickly, before the window of opportunity closes in developing markets, too.

For an example of how to integrate outside innovation, DMMCs can look to one of the few developed-market telecom companies to have done it successfully: Comcast, a leading provider of cable TV and broadband services. Comcast built a lean team, separated from the core business, to rapidly test and deploy new services. It also built flexibility into its network architecture, using modular hardware and a Java-based environment to support plug-and-play innovation. As a result, Comcast was able to develop and quickly deploy an array of novel services, such as personalized recommendations and the ability to see what friends are watching on TV and to chat with them.

Comcast is not a DMMC—far from it—and it operates in a very different competitive environment. Nevertheless, three years after the company combined its new offerings with a least-cost network, Comcast’s average revenue per user for video had increased by 12 percent, and its market capitalization had risen by more than 50 percent.

Roles for the C-Suite

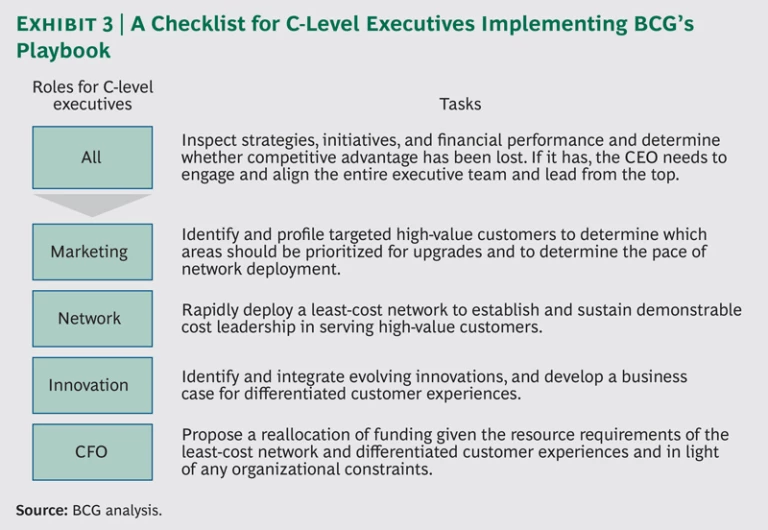

For leaders at DMMCs, using the playbook will be a hands-on endeavor, and every core department will play a crucial role in bringing the plan to life. Carriers need to be very clear on who does what, and who is accountable for getting it done. They should set concrete milestones and agree on targets to accelerate execution.

The process starts with the CEO or COO engaging and aligning C-level executives, each of whom will oversee a critical task. The chief marketing officer, for example, will manage the process for identifying high-value customers and finding where they are concentrated on the network; he or she will also determine the pace of network deployment. The head of the networking department, meanwhile, will need to come up with the actual deployment plan for the least-cost network.

The chief innovation officer—perhaps a new addition to the carrier’s organization chart—will be tasked with identifying and integrating innovations. This will include developing the business case for new services and partnerships and defining the benefits that customers will receive. Finally, the chief financial officer (CFO) will need to reallocate funding so that both prongs of the upgrade strategy—the network and the differentiated customer experience—have the necessary resources, including head count. The CFO will also take on an overall monitoring and evaluating role, ensuring that all parts of the plan stay on track. (See Exhibit 3.)

Some additional observations and recommendations are warranted as well:

- Leverage the insights gained. Identifying and profiling high-value customers often yield insights that can prove useful when creating offers and go-to-market plans. For example, in one country in Southeast Asia, we found that 40 percent of high-value customers owned phones that did not have data capabilities, so usage was high but focused on voice. An offer designed to move these users to current generation smartphones would thus be a logical complement to any network upgrade. Our analysis also found that in developing markets, prepaid plans, bundled services, and shared-data plans were all popular with high-value customers—information that a marketing chief could, and should, put to good use.

- Revisit existing capital-development plans accordingly. Any new network-deployment strategy should be compared with existing plans. Investments should be resequenced as necessary and conflicts with current initiatives addressed.

- Encourage experimentation. Innovation is most successfully integrated when experimentation, collaboration with third-party innovators, and rapid development cycles are encouraged and supported. DMMCs will need to not only create novel offerings but also get them to customers as quickly as possible.

- Hold senior executives accountable. DMMCs should leave no doubt about their commitment to a new, unorthodox approach to spurring growth. Holding C-level executives accountable for implementing the playbook is a way to set the right tone and the right pace. This is vital, because the business going forward isn’t going to be business as usual.

Mobile technology is rapidly evolving. To tackle the challenges that the evolution has created—and to exploit the opportunities—developing-market carriers will need to evolve, too. With the playbook, DMMCs have a new, practical way to increase revenues, expand margins, and boost EBITDA multiples. They can reverse declines and expand total shareholder return. And they can implement this model quickly, using data and resources already at hand. Carriers that move fast will find that the playbook gives them a chance to break the stalemate—and move ahead.

Acknowledgments

The authors would like to thank Alan Cohen for his help in writing this report.