Convergence and integrated telcos go way back, but the relationship has often been a rocky one. In theory, convergence offers—packages that leverage an operator’s fixed and mobile assets—have long been tempting propositions. If all of a subscriber’s needs could be met with one basket of services, customers could be steered away from other providers. Market share and revenues would rise, churn would decrease—what could go wrong? In practice, plenty.

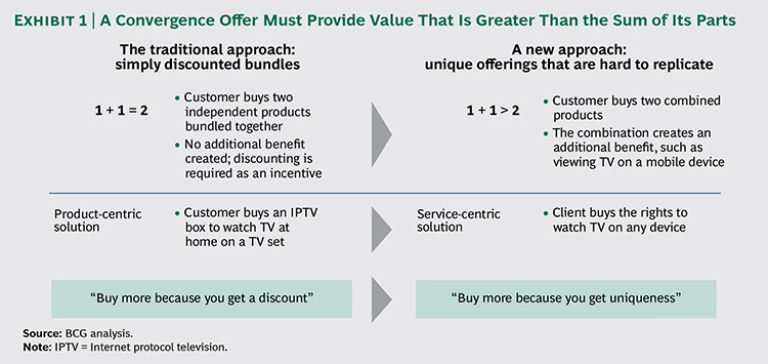

Traditionally, most convergence offers were built around very simply discounted bundles that prompted customers to buy more and save. Telcos would slap together their existing fixed and mobile plans and shave some dollars off the price. But competitors could easily replicate such bundles, shaving still more off the cost. The resulting price war eroded margins, and even the telcos that picked up market share saw little net gain.

Little wonder, then, that many telcos now look at convergence and think, “Been there, done that—it doesn’t work.” Yet increasingly, we are seeing evidence that convergence offers can work. Or, rather, that a new take on convergence offers works. At the heart of this approach is the idea that simple discounts need not be—and shouldn’t be—the sole differentiator between a convergence offer and standalone fixed and mobile plans. Instead, an operator’s assets can be combined in ways that offer unique, compelling services that can’t be easily replicated, such as the ability to watch TV from any device.

For customers, these bundles are attractive because they have a clear “better together” value proposition: subscribers end up with more overall than they would have if they had purchased separate mobile and fixed plans. In other words, one plus one now equals more than two. (See Exhibit 1.)

So how, exactly, do telcos design this new wave of convergence offers? In our work with leading providers, we have identified three core steps for them to take:

- Choose your path. Two new models for convergence offers, both centered on so-called positive discounts, provide greater opportunities for creating value than the traditional approach of adding mobile to fixed plans and taking something off the price. Telcos will need to determine which strategy fits them better.

- Design the offer. Moving beyond simple discounts will add complexity to plan design. But several key practices can help operators create offers that are very attractive to subscribers—particularly high-value customers, such as families.

- Structure for success. To reap the optimal benefits of convergence, telcos must foster collaboration among departments that traditionally have had little interaction. They’ll have to keep an eye on the competition, too, and tweak offers to account for potential responses.

This is a propitious time to get convergence right. In a 2013 consumer survey conducted by BCG, 71 percent of respondents said that they obtained their Internet and mobile services from different providers. That’s a huge pool of subscribers for telcos to attract with smartly designed offers. More promising still is the increasing number of multidevice households. With the right convergence offer, a telco could capture more SIM cards, and more traffic, while creating tighter bonds that reduce churn. There’s also the potential for mitigating the impact of over the top (OTT) players, which are gaining greater numbers of video and television viewers, not to mention traditional voice and messaging traffic.

While telcos are only beginning to embrace this new wave of convergence offers, early results have been encouraging. Orange France’s Open, Telefónica’s Movistar Fusión in Spain, and Portugal Telecom’s M4O plans have experienced fast mass-market penetration, with offers being taken up by as much as 40 percent of their broadband subscribers.

Implemented wisely, convergence offers can help telcos reduce the price pressure that has battered average revenue per user, decrease subscriber acquisition and retention costs, and increase usage, customers, and revenues. The long-awaited rewards can finally be realized.

Two Routes to Value

While traditional convergence offers emphasize simple discounts, the two new models are centered on positive discounts. These are features or plan attributes that consumers perceive as valuable but that telcos can provide for limited cost—or even no cost at all. Most important, positive discounts allow operators to provide unique offerings in their fixed-mobile packages without cannibalizing existing revenues. They’re also harder to replicate than mere price discounting. Positive discounts can be offered in two ways:

- Through Multiplay Access Line Bundles. These offers combine fixed and mobile products but limit discounts to only the additional products that the customer is buying. Existing revenues are thereby protected, because customers won’t be paying less for services they already use. These plans also provide attractive incentives for adding SIM cards and other revenue-generating units. The idea is to make it easy and affordable for users to bring more devices, and more usage, onto the provider’s network.

- Through Value-Added Services. With this approach, the operator provides additional services to customers for free that they would otherwise need to pay for—or even, perhaps, not be able to obtain at all outside of the convergence offer. Typically, these services—such as calls between members of the same household and collective access to video- and music-streaming services—incur very limited costs, if any, for the provider. By offering such capabilities, telcos make their convergence offers more attractive to subscribers, with little downside for themselves.

While some telcos may find a good fit with one or the other of the models right away, others will need to experiment and try a little of each. But for both approaches, the guiding principal should be to put less emphasis on straight price discounts and more focus on differentiation and value. The goal is to offer a convergence plan that subscribers find compelling and can’t easily obtain elsewhere.

Designing a Better Convergence Offer

A newer, better type of convergence offer can be developed more readily than telcos might expect. The key is to understand and leverage the way today’s subscribers use devices and services and to learn which new capabilities could win their attention and loyalty. Telcos should keep in mind, too, some general principles for effective bundling, such as ensuring better-together value for the consumer and emphasizing the services and features that give them a competitive advantage. (See “ Better Bundling in Technology, Media, and Telecom Markets ,” BCG article, March 2013). The following practices can help guide the way.

Focus on families. In most markets, families are particularly high-value customers because they have multiple users and devices within a single household. In Germany, for example, families account for 39 percent of total telco spending. Families are likely to be attracted to many positive discounts, such as free calls between members of the same household and simplified billing and support. They’re also likely to find value in being able to add new SIM cards easily. What’s more, families usually represent lower churn: the more users and devices on a plan, the harder it is to switch to another.

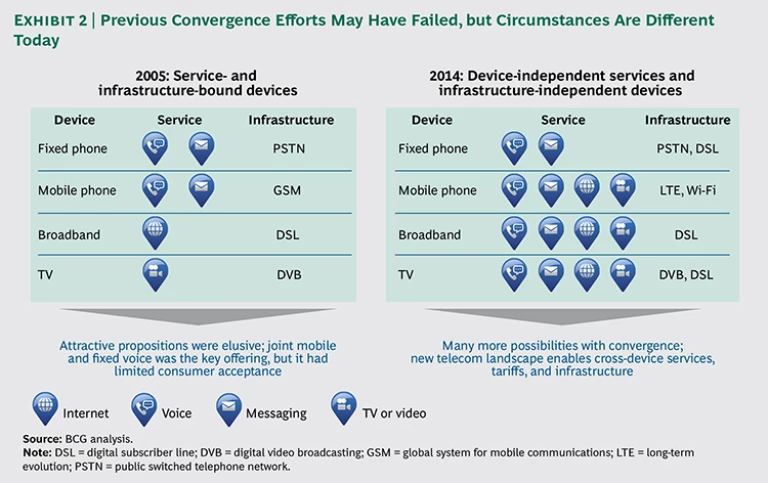

Expand the reach of traditional features to create compelling new capabilities. OTT players have capitalized on the fact that many services are no longer bound to specific types of access. Netflix and Apple, for example, can stream video content to users no matter how they connect to the Internet. Telcos can turn the tables by capitalizing on independence from specific devices. Content on TV channels, for instance, need not be restricted to traditional television sets. Instead, it can be viewed on any device, even those running on cellular networks. (See Exhibit 2.) And that’s just for starters. In the Swiss market, subscribers can store TV recordings in the cloud and access them on any device, and they can program their set-top box with their smartphones or tablets.

Undervalued features can make for positive discounts. Some services, though not particularly novel, are nevertheless valued by subscribers and can be offered free of charge without eating into existing revenues. Examples include shared allowances for minutes and data and the ability to configure multiple devices with a single online interface.

Look to bandwidth-intensive services. Features such as multidevice video streaming and online gaming don’t just make for positive discounts, they can drive usage. With the right business model in place—that is, no flat rates—telcos could see a significant uptake in revenues as users trade up to greater data allowances, particularly on shared multi-SIM-card plans.

Partner with OTT players on value-added services. OTT companies have been viewed as the scourge of traditional telecom operators, but there’s something to be said for the approach of “if you can’t beat ’em, join ’em.” By striking exclusive (or even semiexclusive) deals with OTT providers—such as the partnerships that some European and Scandinavian operators have created with video- and music-streaming services—telcos can further differentiate their convergence offers.

Structuring for Success

Telcos, as they do with any offering, will need to consider the challenges and risks associated with convergence. And since these bundles will typically be more complex than traditional offers, and cover new ground in terms of service and delivery, the complications can be particularly vexing. But here, too, we’ve identified several practices that can help smooth the way.

Take a staged approach to implementation. The new wave of convergence offers shouldn’t be launched fully and broadly right off the bat. First it’s important to help consumers move away from expecting straight price discounts. This can be done by introducing features that convey the idea of positive discounts, such as shared data allowances or the ability to use a mobile handset as a fixed-line phone. Then the first “light” convergence premium products, such as the ability to watch TV on mobile devices, could be added. Only after these steps have been taken should a telco move toward a full convergence portfolio. (Of course, the value and price for each offering within the portfolio should be clearly stated.)

Factor in competitive responses and regulatory hurdles. Today’s offers can avoid the price war problem by differentiating with regard to features instead of cost. But since competitors can still develop their own unique fixed-mobile offers, telcos should evaluate their rivals’ capabilities and potential responses and adjust their own offers accordingly. Regulatory constraints need to be understood, too, because they may limit the leeway in combining and pricing services, particularly on the mobile side.

Organize for convergence. Introducing convergence offerings will be a strategic, multiyear effort involving essentially all departments. Though many integrated telcos have already merged their fixed and mobile businesses, they often still maintain separate product and marketing departments. Such a setup may be fine for cross-selling, but offers of true convergence require seamless collaboration between the fixed and mobile sides. We recommend creating a dedicated organization that includes all the functions involved—from product development to marketing to IT—and is overseen by a high-level executive directly accountable to the C-suite.

Measure success. Telcos will need to prove that their convergence strategy is working. Early successes, after all, are prerequisites for more complex offerings. But choosing the appropriate metrics can be difficult because there is no one-size-fits-all approach, and all of the potential key performance indicators (KPIs) have their trade-offs. The household penetration rate for convergence offers, for example, doesn’t reflect how many mobile SIM cards have successfully been added to an existing household. Measuring SIM cards, on the other hand, indicates little about the successes—or disappointments—on the fixed side, such as the extent to which customers are embracing access bundles or TV packages.

To home in on the right KPI, telcos need to consider these trade-offs in light of their customer bases and their own strengths; for example, is the mobile side much stronger than the fixed? They need to consider, too, whether they wish to achieve some particular objective, such as improved loyalty, lower subscriber-acquisition costs, or more revenue-generating units per household. Only then can they identify the metrics that will give the most accurate picture of how well their offers are doing.

Potential Waiting to Be Tapped

With well-designed convergence offers, integrated telcos can gain something that’s all too rare these days: an upper hand. For subscribers, these offers will be more valuable than the sum of their parts, making them attractive propositions. For telcos, differentiating with regard to features rather than pricing means competitive advantage—and growth.

This new chapter of convergence has only just started, but already evidence of its potential—and of the payoff—is mounting. In the Portuguese market, one operator was able to increase its market share (as measured by active SIM cards on a network) by more than 3 percent in little more than a year. In Western Europe, several telcos have increased their mobile market shares or reduced churn rates—or both.

Telcos face formidable challenges these days: price pressure, crowded markets, customers that can easily jump ship when a better deal comes along. The next wave of convergence offers, if done right, can help providers tackle all these issues and put the bad memories of convergence—as well as their competitors—behind them.