In a business environment characterized by greater volatility and more frequent disruptions, companies face a clear imperative: they must transform or fall behind. Yet most transformation efforts are highly complex initiatives that take years to implement. As a result, most fall short of their intended targets—in value, timing, or both. Based on client experience, The Boston Consulting Group has developed an approach to transformation that flips the odds in a company’s favor. What does that look like in the real world? Here are five company examples that show successful transformations, across a range of industries and locations.

VF’s Growth Transformation Creates Strong Value for Investors

Value creation is a powerful lens for identifying the initiatives that will have the greatest impact on a company’s transformation agenda and for understanding the potential value of the overall program for shareholders.

VF offers a compelling example of a company using a sharp focus on value creation to chart its transformation course. In the early 2000s, VF was a good company with strong management but limited organic growth. Its “jeanswear” and intimate-apparel businesses, although responsible for 80 percent of the company’s revenues, were mature, low-gross-margin segments. And the company’s cost-cutting initiatives were delivering diminishing returns. VF’s top line was essentially flat, at about $5 billion in annual revenues, with an unclear path to future growth. VF’s value creation had been driven by cost discipline and manufacturing efficiency, yet, to the frustration of management, VF had a lower valuation multiple than most of its peers.

With BCG’s help, VF assessed its options and identified key levers to drive stronger and more-sustainable value creation. The result was a multiyear transformation comprising four components:

- A Strong Commitment to Value Creation as the Company’s Focus. Initially, VF cut back its growth guidance to signal to investors that it would not pursue growth opportunities at the expense of profitability. And as a sign of management’s commitment to balanced value creation, the company increased its dividend by 90 percent.

- Relentless Cost Management. VF built on its long-known operational excellence to develop an operating model focused on leveraging scale and synergies across its businesses through initiatives in sourcing, supply chain processes, and offshoring.

- A Major Transformation of the Portfolio. To help fund its journey, VF divested product lines worth about $1 billion in revenues, including its namesake intimate-apparel business. It used those resources to acquire nearly $2 billion worth of higher-growth, higher-margin brands, such as Vans, Nautica, and Reef. Overall, this shifted the balance of its portfolio from 70 percent low-growth heritage brands to 65 percent higher-growth lifestyle brands.

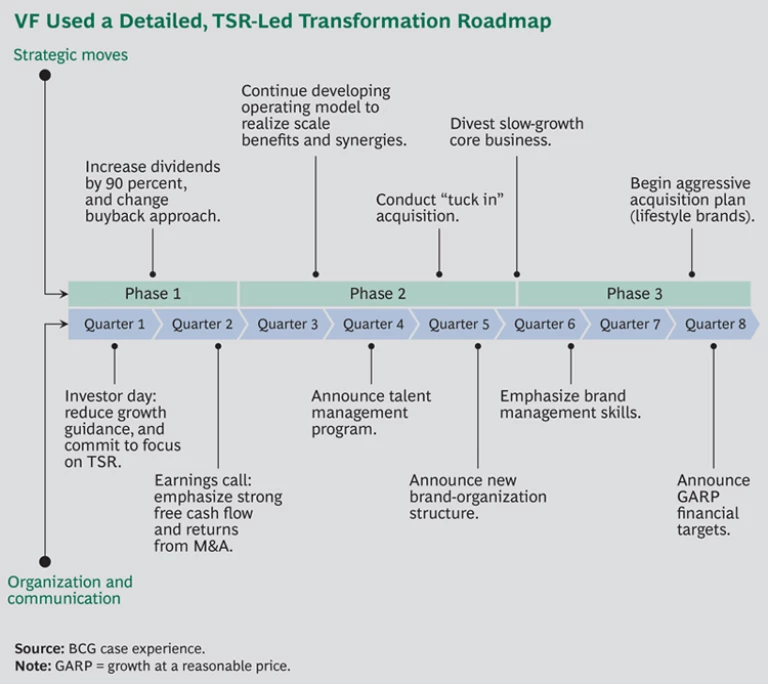

- The Creation of a High-Performance Culture. VF has created an ownership mind-set in its management ranks. More than 200 managers across all key businesses and regions received training in the underlying principles of value creation, and the performance of every brand and business is assessed in terms of its value contribution. In addition, VF strengthened its management bench through a dedicated talent-management program and selective high-profile hires. (For an illustration of VF’s transformation roadmap, see the exhibit.)

The results of VF’s TSR-led transformation are apparent.

A Consumer-Packaged-Goods Company Uses Several Levers to Fund Its Transformation Journey

A leading consumer-packaged-goods (CPG) player was struggling to respond to challenging market dynamics, particularly in the value-based segments and at the price points where it was strongest. The near- and medium-term forecasts looked even worse, with likely contractions in sales volume and potentially even in revenues. A comprehensive transformation effort was needed.

To fund the journey, the company looked at several cost-reduction initiatives, including logistics. Previously, the company had worked with a large number of logistics providers, causing it to miss out on scale efficiencies.

To improve, it bundled all transportation spending, across the entire network (both inbound to production facilities and out-bound to its various distribution channels), and opened it to bidding through a request-for-proposal process. As a result, the company was able to save 10 percent on logistics in the first 12 months—a very fast gain for what is essentially a commodity service.

Similarly, the company addressed its marketing-agency spending. A benchmark analysis revealed that the company had been paying rates well above the market average and getting fewer hours per full-time equivalent each year than the market standard. By getting both rates and hours in line, the company managed to save more than 10 percent on its agency spending—and those savings were immediately reinvested to enable the launch of what became a highly successful brand.

Next, the company pivoted to growth mode in order to win in the medium term. The measure with the biggest impact was pricing. The company operates in a category that is highly segmented across product lines and highly localized. Products that sell well in one region often do poorly in a neighboring state. Accordingly, it sought to de-average its pricing approach across locations, brands, and pack sizes, driving a 2 percent increase in EBIT.

Similarly, it analyzed trade promotion effectiveness by gathering and compiling data on the roughly 150,000 promotions that the company had run across channels, locations, brands, and pack sizes. The result was a 2 terabyte database tracking the historical performance of all promotions.

Using that information, the company could make smarter decisions about which promotions should be scrapped, which should be tweaked, and which should merit a greater push. The result was another 2 percent increase in EBIT. Critically, this was a clear capability that the company built up internally, with the objective of continually strengthening its trade-promotion performance over time, and that has continued to pay annual dividends.

Finally, the company launched a significant initiative in targeted distribution. Before the transformation, the company’s distributors made decisions regarding product stocking in independent retail locations that were largely intuitive. To improve its distribution, the company leveraged big data to analyze historical sales performance for segments, brands, and individual SKUs within a roughly ten-mile radius of that retail location. On the basis of that analysis, the company was able to identify the five SKUs likely to sell best that were currently not in a particular store. The company put this tool on a mobile platform and is in the process of rolling it out to the distributor base. (Currently, approximately 60 percent of distributors, representing about 80 percent of sales volume, are rolling it out.) Without any changes to the product lineup, that measure has driven a 4 percent jump in gross sales.

Throughout the process, management had a strong change-management effort in place. For example, senior leaders communicated the goals of the transformation to employees through town hall meetings. Cognizant of how stressful transformations can be for employees—particularly during the early efforts to fund the journey, which often emphasize cost reductions—the company aggressively talked about how those savings were being reinvested into the business to drive growth (for example, investments into the most effective trade promotions and the brands that showed the greatest sales-growth potential).

In the aggregate, the transformation led to a much stronger EBIT performance, with increases of nearly $100 million in fiscal 2013 and far more anticipated in 2014 and 2015. The company’s premium products now make up a much bigger part of the portfolio. And the company is better positioned to compete in its market.

A Leading Bank Uses a Lean Approach to Transform Its Target Operating Model

A leading bank in Europe is in the process of a multiyear transformation of its operating model. Prior to this effort, a benchmarking analysis found that the bank was lagging behind its peers in several aspects. Branch employees handled fewer customers and sold fewer new products, and back-office processing times for new products were slow. Customer feedback was poor, and rework rates were high, especially at the interface between the front and back offices. Activities that could have been managed centrally were handled at local levels, increasing complexity and cost. Harmonization across borders—albeit a challenge given that the bank operates in many countries—was limited. However, the benchmark also highlighted many strengths that provided a basis for further improvement, such as common platforms and efficient product-administration processes.

To address the gaps, the company set the design principles for a target operating model for its operations and launched a lean program to get there. Using an end-to-end process approach, all the bank’s activities were broken down into roughly 250 processes, covering everything that a customer could potentially experience. Each process was then optimized from end to end using lean tools. This approach breaks down silos and increases collaboration and transparency across both functions and organization layers.

Employees from different functions took an active role in the process improvements, participating in employee workshops in which they analyzed processes from the perspective of the customer. For a mortgage, the process was broken down into discrete steps, from the moment the customer walks into a branch or goes to the company website, until the house has changed owners. In the front office, the system was improved to strengthen management, including clear performance targets, preparation of branch managers for coaching roles, and training in root-cause problem solving. This new way of working and approaching problems has directly boosted both productivity and morale.

The bank is making sizable gains in performance as the program rolls through the organization. For example, front-office processing time for a mortgage has decreased by 33 percent and the bank can get a final answer to customers 36 percent faster. The call centers had a significant increase in first-call resolution. Even more important, customer satisfaction scores are increasing, and rework rates have been halved. For each process the bank revamps, it achieves a consistent 15 to 25 percent increase in productivity.

And the bank isn’t done yet. It is focusing on permanently embedding a change mind-set into the organization so that continuous improvement becomes the norm. This change capability will be essential as the bank continues on its transformation journey.

A German Health Insurer Transforms Itself to Better Serve Customers

Barmer GEK, Germany’s largest public health insurer, has a successful history spanning 130 years and has been named one of the top 100 brands in Germany. When its new CEO, Dr. Christoph Straub, took office in 2011, he quickly realized the need for action despite the company’s relatively good financial health. The company was still dealing with the postmerger integration of Barmer and GEK in 2010 and needed to adapt to a fast-changing and increasingly competitive market. It was losing ground to competitors in both market share and key financial benchmarks. Barmer GEK was suffering from overhead structures that kept it from delivering market-leading customer service and being cost efficient, even as competitors were improving their service offerings in a market where prices are fixed. Facing this fundamental challenge, Barmer GEK decided to launch a major transformation effort.

The goal of the transformation was to fundamentally improve the customer experience, with customer satisfaction as a benchmark of success. At the same time, Barmer GEK needed to improve its cost position and make tough choices to align its operations to better meet customer needs. As part of the first step in the transformation, the company launched a delayering program that streamlined management layers, leading to significant savings and notable side benefits including enhanced accountability, better decision making, and an increased customer focus. Delayering laid the path to win in the medium term through fundamental changes to the company’s business and operating model in order to set up the company for long-term success.

The company launched ambitious efforts to change the way things were traditionally done:

- A Better Client-Service Model. Barmer GEK is reducing the number of its branches by 50 percent, while transitioning to larger and more attractive service centers throughout Germany. More than 90 percent of customers will still be able to reach a service center within 20 minutes. To reach rural areas, mobile branches that can visit homes were created.

- Improved Customer Access. Because Barmer GEK wanted to make it easier for customers to access the company, it invested significantly in online services and full-service call centers. This led to a direct reduction in the number of customers who need to visit branches while maintaining high levels of customer satisfaction.

- Organization Simplification. A pillar of Barmer GEK’s transformation is the centralization and specialization of claim processing. By moving from 80 regional hubs to 40 specialized processing centers, the company is now using specialized administrators—who are more effective and efficient than under the old staffing model—and increased sharing of best practices.

Although Barmer GEK has strategically reduced its workforce in some areas—through proven concepts such as specialization and centralization of core processes—it has invested heavily in areas that are aligned with delivering value to the customer, increasing the number of customer-facing employees across the board. These changes have made Barmer GEK competitive on cost, with expected annual savings exceeding €300 million, as the company continues on its journey to deliver exceptional value to customers. Beyond being described in the German press as a “bold move,” the transformation has laid the groundwork for the successful future of the company.

Nokia’s Leader-Driven Transformation Reinvents the Company (Again)

We all remember Nokia as the company that once dominated the mobile-phone industry but subsequently had to exit that business. What is easily forgotten is that Nokia has radically and successfully reinvented itself several times in its 150-year history. This makes Nokia a prime example of a “serial transformer.”

In 2014, Nokia embarked on perhaps the most radical transformation in its history. During that year, Nokia had to make a radical choice: continue massively investing in its mobile-device business (its largest) or reinvent itself. The device business had been moving toward a difficult stalemate, generating dissatisfactory results and requiring increasing amounts of capital, which Nokia no longer had. At the same time, the company was in a 50-50 joint venture with Siemens—called Nokia Siemens Networks (NSN)—that sold networking equipment. NSN had been undergoing a massive turnaround and cost-reduction program, steadily improving its results.

When Microsoft expressed interest in taking over Nokia’s device business, Nokia chairman Risto Siilasmaa took the initiative. Over the course of six months, he and the executive team evaluated several alternatives and shaped a deal that would radically change Nokia’s trajectory: selling the mobile business to Microsoft. In parallel, Nokia CFO Timo Ihamuotila orchestrated another deal to buy out Siemens from the NSN joint venture, giving Nokia 100 percent control over the unit and forming the cash-generating core of the new Nokia. These deals have proved essential for Nokia to fund the journey. They were well-timed, well-executed moves at the right terms.

Right after these radical announcements, Nokia embarked on a strategy-led design period to win in the medium term with new people and a new organization, with Risto Siilasmaa as chairman and interim CEO. Nokia set up a new portfolio strategy, corporate structure, capital structure, robust business plans, and management team with president and CEO Rajeev Suri in charge. Nokia focused on delivering excellent operational results across its portfolio of three businesses while planning its next move: a leading position in technologies for a world in which everyone and everything will be connected.

Nokia’s share price has steadily climbed. Its enterprise value has grown 12-fold since bottoming out in July 2012. The company has returned billions of dollars of cash to its shareholders and is once again the most valuable company in Finland. The next few years will demonstrate how this chapter in Nokia’s 150-year history of serial transformation will again reinvent the company.