Travel is on the move—again. Travel companies can’t afford to stand still.

The travel industry has been upended more than most by digital technology. More than 95 percent of travelers today use digital resources in the course of their travel journeys: dreaming about, planning, booking, experiencing, and reflecting on their trip. The average customer visits or uses a combination of 19 websites and mobile applications during the course of one trip, and many travelers use digital tools to share their experiences and reactions throughout the process.

Until recently, the travel revolution played out primarily on personal computers (PCs). Online travel agencies (OTAs) grabbed about a third of U.S. online bookings while search engines and metamediaries, companies that act as single points of contact between suppliers and intermediaries on the one hand and online customers on the other, inserted themselves as major influencers in the travel journey. Now the landscape is shifting again, this time to mobile platforms. IDC expects the number of U.S. mobile users to grow at an annual rate of 9 percent for the next several years. The number of Internet-connected mobile devices worldwide will increase by 16 percent per year, led by strong growth in developing countries, according to Ovum. Meanwhile, PC sales are in steep decline. PhoCusWright expects mobile’s share of U.S. travel bookings to grow from 4 percent in 2013 to 12 percent by 2015, while eMarketer projects the value of U.S. travel purchases made on smartphones and tablets to soar from $26 billion in 2014 to $65 billion in 2018.

This shift presents multiple challenges. For one thing, travel companies need to address a fast-growing sales-and-marketing channel. For another, mobile usage adds complexity to the relationship between travel companies and their customers as travelers use multiple devices—starting on a PC, moving to a smartphone, then to a tablet, and back to the PC, for example—to dream about, plan, and book their trips. In 2013, almost half of all travelers using digital resources began the dream phase of their travel journey on one device and completed it on another. This makes it increasingly difficult for travel companies to follow individual travelers’ identities throughout their journeys.

We believe that the impact of mobile technology on the travel industry will be at least as far-reaching as that of the PC and the Internet. Suppliers and intermediaries—including OTAs, metamediaries, and search engines—need to come to grips with mobile’s transformative potential in all of its present and future manifestations: smartphones, tablets, “wearables,” “drivables,” and innovations still in development, such as virtualization. For many travel suppliers, this shift means an opportunity to strengthen or reestablish customer relationships that have been eroded by online intermediaries. For intermediaries, it means rethinking their offerings to protect the positions they have established on the PC. In both cases, companies will need to understand their customers’ mobile-usage trends, tailor their marketing, and even adapt their operating models accordingly to win. They will also find themselves working with a shifting universe of “gatekeepers,” whose influence over how consumers use their mobile devices, including where they spend their time and the apps they access, can be compared (albeit imperfectly) to the role of search engines on PCs.

This report examines the changes under way and offers some suggestions on how travel companies can make the most of the opportunities they present.

Mobile Changes the Digital Game

Mobile is still just getting moving. According to TripAdvisor’s most recent Trip-Barometer survey, 4 percent of travelers worldwide now book their trips using mobile devices. The percentage is higher in many emerging markets where, as we have observed before, mobile technology is leapfrogging PC-based access. In China, for example, research by The Boston Consulting Group shows that 28 percent of consumers are using apps to plan their trips, compared with only 33 percent who use travel websites accessed from PCs. From 2013 to 2017, mobile hotel-bookings worldwide will triple, from $20 billion to $60 billion, while nonmobile online reservations will rise only 4 percent annually, from $142 billion to $167 billion, according to Deutsche Bank Securities. BCG’s research shows that Millennial consumers (ages 18 to 34) are more likely to use a mobile device for making travel arrangements. Far more Millennials than non-Millennials report having travel apps on their smartphones: 75 percent versus 47 percent.

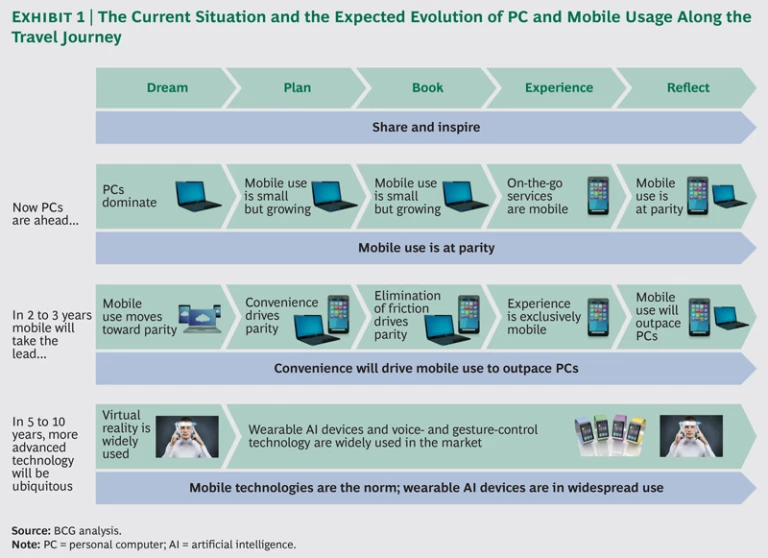

All that said, our research indicates that while most travel companies recognize the rapid ascent of mobile, they have yet to develop a full understanding of its reach and impact. Mobile rearranges the relationship between a travel company and its customers, much the way the original wave of digital disruption did, scrambling established patterns of behavior in different phases of the travel journey. (See Exhibit 1.) The mobile experience is a whole new universe of connectivity that’s local (it’s always where you are), personal (tailored to your needs and preferences), and social (all your friends are there as well). And it’s always on. For companies, the opportunity to build brand and relationships, drive incremental purchase opportunities, and add to the overall service offering is enormous. But the dynamics of interaction on a mobile device are very different from those on a desktop. Companies cannot approach mobile users as if they were simply carrying a PC in their pocket.

Controlling the Journey

On a PC, search is king: 58 percent of travelers working on PCs use search engines to plan their trips, according to a recent study by Google. As aggregators of information on choice and price, OTAs and metamediaries occupy privileged positions in the king’s court. In a PC environment, search has the unparalleled ability to steer demand, boost awareness, and influence consumer consideration.

On mobile platforms, however, the king must yield his throne. According to mobile-analytics firm Flurry, the average U.S. consumer spends two hours and 42 minutes per day on his or her mobile devices, using apps for 86 percent of that time. Data from comScore shows that the amount of time spent on the apps of the top five travel companies (as opposed to visiting their websites) jumped to 48 percent in February 2014 from 38 percent in February 2013—an increase of 26 percent. TripAdvisor’s mobile app has been downloaded 100 million times; Expedia’s app, more than 25 million times in more than 220 countries and territories. Mobile usage accounted for almost two-thirds of searches and almost half of local ad revenues at Yelp in the third quarter of 2013.

Apps are closed environments, a fact that works to a company’s advantage as long as the company maintains the user’s interest. It pays to remember that apps are also easy to leave—and easier still to avoid altogether—if the user’s experience is slow, difficult, or frustrating. Good apps are fun and simple to navigate, especially when the time comes to transact business. Very good apps make the user want to return.

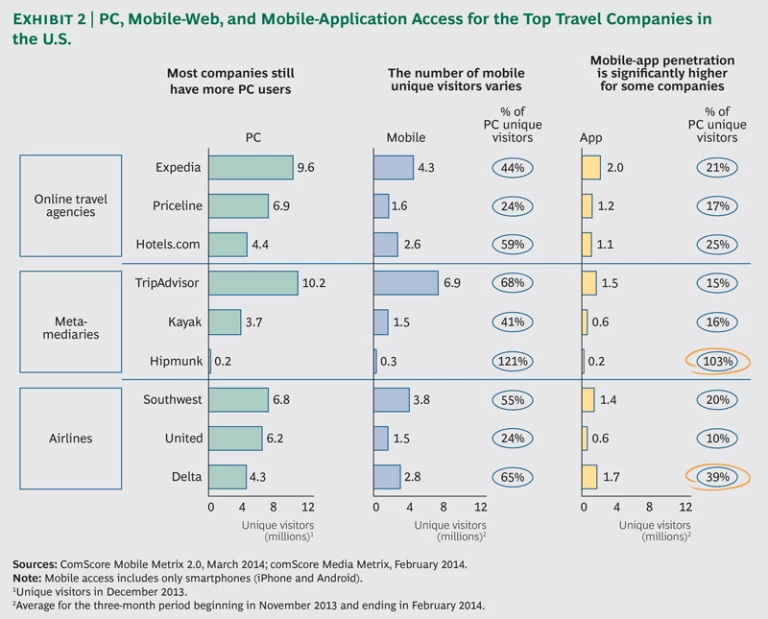

This dynamic creates a completely new battleground for the travel industry. Travel companies vary widely in how well they have replicated their success on the Web in the mobile environment. (See Exhibit 2.) For example, Delta Air Lines has fewer unique visitors on the Web than its major competitors, but almost 40 percent of them use its mobile app, which puts it in the lead in terms of mobile success—at least for the moment.

App design is getting better almost daily. The earliest incarnations, which are only about five years old, seem increasingly clumsy as more recent advances simplify use and reduce transaction time. There’s still room for improvement, however, and functionality and usability vary widely. It can take several minutes to download and use an app for transacting business, especially if the user needs to upload payment information. The single log-in functionality offered by social networks and others addresses this issue by enabling seamless movement among apps, eliminating the need to log in for each visit. Innovations such as app install ads (ads that link to and directly install a company’s app on the user’s device), as well as conversion ads and deep links (which take the user directly from a Google search or Facebook feed to the room-booking page of a hotel app), simplify moving among multiple apps. Streamlined payment functionality will cut usage time still further.

Many experts project that major technological advances to come in such areas as wearable devices, virtual reality, and semantic search (which employs technology that seeks to understand and act on user intent and context as well as actual words) will change the mobile experience in ways that can only be imagined today. But the experience will still be mobile, always on, and with the user 24/7, and will continue to improve at a rapid rate, attracting more users and more of each user’s time, even in the near term. We are still in the early days of this transformation. Early movers, therefore, will gain a big advantage, while those that miss the shift will find catching up increasingly difficult once consumers’ patterns of behavior and relationships with mobile apps and their companies solidify.

The Travel Journey Gets Personal

This evolving playing field presents opportunities and threats to both travel suppliers and intermediaries. The biggest opportunity is to cement relationships with customers—especially a company’s best, high-value customers—by offering them truly personalized service and experiences. The biggest threat is that one or more companies will cement their relationships with your best customers before you do. In this context, travel companies of all kinds need to recognize that the universe of potential competitors is broadening, a process that started on the PC. Suppliers are competing directly with OTAs, metamediaries, search engines, and social networks—and each of those players with all the others—to “own” customer relationships. New entrants that offer predominantly mobile-based functionality, meanwhile, are moving into the travel market more easily than ever.

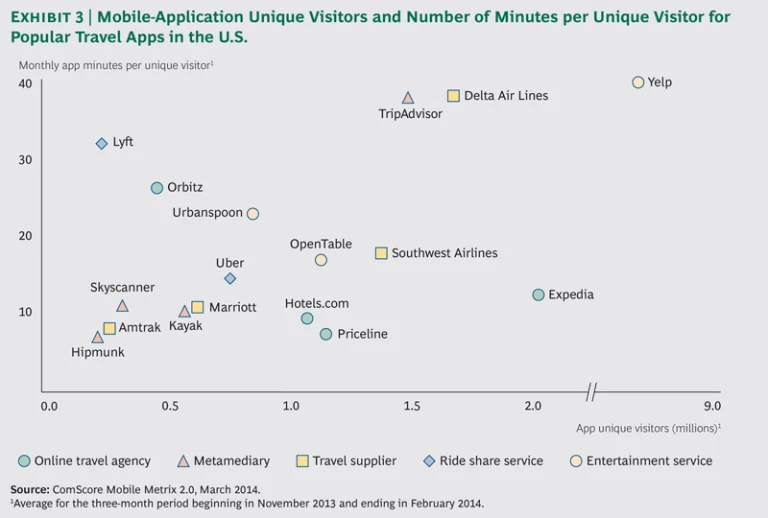

The sharp edge of this wedge is a good mobile app. Screen real estate is a prime commodity on most mobile devices, at least at this stage in their development. While the number of apps installed on the average smartphone varies, depending on who is doing the counting, it ranges from about 25 to about 40—in other words, not a lot, especially given the panoply of uses that people find for their devices. There are plenty of travel apps in the market: TripAdvisor estimates that three-quarters of hotel operators worldwide have some kind of mobile capability, and of those that don’t, half plan to introduce a mobile offering in 2014. Thus far, however, only a few are used regularly by a significant share of consumers. (See Exhibit 3.) This may be partly because design, functionality, and ease of use are huge factors for consumers, and app design is still a work in progress for most travel companies.

A successful app, meaning one that the consumer finds value in using regularly, provides a direct link to the travel company, one that is in the consumer’s pocket or handbag 24/7. This connection can empower all phases of the travel journey, from dreaming about and planning (through personalized offerings or featured routes and properties) to booking and travel customization (hotel room choice or flight seat selection, for example). Apps can also play a role in the sharing phase, allowing consumers to capture and communicate their travel experience as it unfolds. Apps help suppliers stay relevant in a competitive mobile environment. According to a recent EyeforTravel report, almost two-thirds of U.S. smartphone users agree that making apps easier to use would influence them to complete more travel purchases on mobile devices.

Most important, apps generate data related to usage, search, time, location, spending, preferences, friends and followers, and countless other criteria. The more travel companies can encourage consumers to interact with them directly via mobile devices, the more information they will be able to collect on users’ preferences, inclinations, spending habits, and decision-making processes. They will be able to segment and target their best customers on the basis of frequency of use and expenditure, among other criteria, including customers’ current location, status, and the time of day.

As BCG has observed about loyalty programs, which got their start in the travel industry, consumers continue to actively seek out ways to interact with their favorite brands, and companies with successful brands are fanatical about providing the best end-to-end loyalty-program experience for their customers. (See Leveraging the Loyalty Margin: Rewards Programs That Work , BCG Focus, April 2014.) Today, this increasingly means interacting with loyal members on their mobile devices, using such innovations as digital loyalty cards, mobile wallets, and real-time location-based offers.

Ultimately, the ability to collect, aggregate, mine, and analyze data enables personalization of the travel experience—from making suggestions based on known patterns and preferences to reducing transaction times to a matter of seconds. Consider a hotel’s ability to greet a returning high-value guest with a vase of her favorite flowers or a glass of his favorite beverage. Or an airline that lets passengers choose their in-flight entertainment from a selection of top movies and TV shows when they book their flights. Or a rental car company that preloads directions to the driver’s destination on the car’s navigation system. Or an OTA or a metamediary that can recommend hotels, restaurants, car services, and sites to see in Boston, Brussels, or Buenos Aires on the basis of a customer’s calendar of upcoming flights. For providers and intermediaries alike, this personalization of the travel experience can lock in customers more tightly, giving them more to lose if they consider switching to a competitor.

OTAs and metamediaries, whose business models depend on online interactions, will need to be especially creative in the way they approach mobile to defend the turf they have staked out on PCs. Mobile apps will increasingly form the core of the value proposition for these companies; if they don’t offer the current app of choice, they could risk losing relevance in a short period of time. Some of these companies already have added to their apps innovative features and capabilities, which users value. Thanks to aggressive marketing, large budgets, and the speed with which they have adapted to market shifts, 7 of the 10 most used travel apps (when measured by both unique visitors and minutes of usage) belong to metamediaries and OTAs. Kayak, for example, has added the ability to check and change flights and reservations on the go to its popular aggregation capability for flights, hotels, and car rentals.

The battle for mobile supremacy is only just being joined, however, and the marketplace is wide open. Most travel companies, across all categories, have converted less than 20 percent of their PC customers to mobile app usage. In Asia, where mobile usage is high, TripAdvisor reports that only 10 percent of travelers in China, 9 percent of travelers in Thailand, and 7 percent of travelers in Indonesia and Malaysia book using mobile devices. No travel app anywhere has yet established itself as the go-to resource on more than 2 percent of smartphones.

Gaining Access Through Gatekeepers

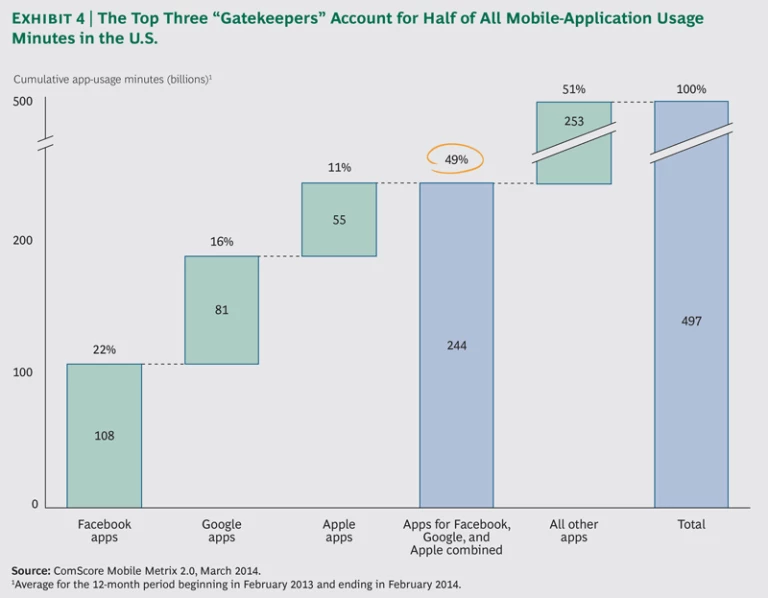

Some travel companies may choose to walk this mobile road alone. Others may benefit from joining forces with one or more mobile gatekeepers, whose positions in the mobile ecosystem, including the ability to offer users single log-in functionality, enable them to collect enormous breadth and depth of user data much the way that major search-engine owners have done on the Web. These companies know better than any other where and how users spend their mobile time, and they have unmatched ability to influence these decisions. Small wonder that they are playing an important role early in the travel journey.

Gatekeepers have the power and sophistication to vastly augment travel companies’ own data collection and analysis efforts, and given their capabilities and the amount of consumer information they manage, they have the potential to target likely travel customers better than anyone else. They can redirect consumers to specific travel apps through deep links and conversion ads as well as help increase awareness and penetration among the right customers. In the UK, for example, entertainment and lifestyle app YPlan uses mobile-app install ads for geographic segmentation, targeting a London-only audience.

This universe is still evolving, but the biggest gatekeepers today are the device manufacturers and the companies behind the main mobile-operating systems and app stores, app-to-app marketers, and social networks and messaging app operators. The top three players currently account for half of total app usage. (See Exhibit 4.) Gatekeepers of the future may include gaming companies (people use gaming apps for 32 percent of the time they spend on mobile devices, according to Flurry) and entertainment apps, such as YouTube. Since this segment is in flux—and, with a few exceptions, it is impossible to know who the ultimate winners will be (much like the rest of the mobile ecosystem)—travel companies will want to experiment and place multiple bets.

A client-supplier model, in which travel companies (suppliers and intermediaries) pay for ad placement in top apps such as Facebook and Yelp, will likely emerge as the standard model in the market. Strategic partnerships—between a device manufacturer and a travel company, for example—could also be formed with significant potential to change dynamics in the industry. Google Maps recently added a feature to its mobile apps that allows users to connect directly with transportation provider Uber.

Because they have strong customer bases and well-known brands, and already offer apps of choice for many consumers, leading travel intermediaries such as Kayak, Expedia, TripAdvisor, and Booking.com will not be as dependent on mobile gatekeepers as smaller companies or start-ups. Even these leaders, however, need to understand the effect of the mobile channel on customer behavior and adapt their marketing if they want to maintain their advantaged positions.

Making the Move to Mobile

The mobile travel environment creates opportunities for all types of players. App penetration rates remain low, and, with a few exceptions, no individual players have broken from the pack to establish leadership positions. New winners will emerge among both travel suppliers and intermediaries. These companies will be successful because they differentiate themselves, they develop a deep and practical understanding of the dynamics of the mobile environment, and they create “sticky” relationships with their customers, most importantly by personalizing the user experience. They will also experiment; early movers with successful apps have the opportunity to establish lasting advantage. For travel suppliers, differentiation will continue to be grounded in the travel experience that they provide, but their mobile presence needs to reflect this positioning. For intermediaries, differentiation will depend substantially on how well they transfer their competitive advantages from PCs to apps.

Travel companies want their customers to do three things with respect to their apps: discover and download them; engage with them at multiple stages of the travel journey; and find the experience so simple, satisfying, and useful that they want to come back and use the apps again—to the exclusion of the other travel apps out there. This is a tall order, to be sure, but as we have emphasized, the market is wide open, and the success factors are clear. At a practical level, travel companies also need to do three things:

- Design apps with functionality that customers—especially high-value customers—prize and others cannot match, including personalizing the experience as much as possible for users.

- Market the app effectively—for both installation and engagement.

- Experiment and bring out new functionalities quickly, offering them exclusively to a company’s own users, to keep the app fresh and make it more useful, as well as to make the experience more personal over time.

Design apps with value. Competing in the mobile game requires designing a competitive app that is easy to use, intuitive, fast, and reliable. Apps also need to work across multiple devices and operating systems. Personal information should be available in whatever way travelers choose to access it, including as they move back and forth between their PCs and mobile devices, as many inevitably do. Winning the game—meaning that consumers tap your app first when they start to dream about, plan, or book their travel—will be a function of how much a company can personalize the app experience for each user.

Suppliers may have an advantage here if they meet two conditions:

- They are good at collecting and analyzing data on what travelers—especially high-value travelers—like and do when they are visiting their hotels, flying in their planes, or driving their rental cars.

- They use this information to approach each traveler truly as an individual all the way through the journey, beginning with the moment he or she powers up the app.

A supplier with an app of choice may benefit from greater pricing flexibility because it is interacting with customers in an environment that it controls rather than in an OTA or a metasearch bazaar, where price is the first level of competition many customers look for.

Intermediaries are not totally sidelined in the personalization game. Many can draw on the substantial databases of traveler information that they have already compiled over the past several years. Those that do not move quickly to establish strong mobile positions, however, may find themselves squeezed out by aggressive suppliers on one side and gatekeepers on the other, both of which will be armed with more and better customer data. Suppliers and intermediaries that build an early lead in collecting and using customer data are likely to find themselves with a self-sustaining advantage as their ability to personalize will become increasingly difficult to challenge over time.

Market the app effectively. A successful app needs to be top of mind. Companies should start by targeting their best customers, usually loyalty program members, to defend these relationships, and then expand from this base. Multiple travel companies are already targeting loyalty program members with features that offer rewards for recognition and program points when members share their travel experiences on social networks or use social media sites for check-in. Some offer extra loyalty points for booking via a mobile device.

Pushing app installation will likely require working with the mobile gatekeepers; they have the greatest access to users today, they provide single log-in functionality, and they will likely maintain this position, at least in the near term. Gatekeepers are rapidly advancing expertise with such installation techniques as app install ads, conversion ads, and deep links. They will be important resources over time for travel companies with poor or inadequate reservoirs of digital data or those looking to experiment with new functionality or features and to expand their own user bases.

Mobile marketing currently costs less than other forms of online advertising. This may argue for rethinking resource allocation and shifting marketing dollars to mobile while a supplier or intermediary establishes a strong mobile link with its most valuable customers and experiments with features and functionalities that can provide mobile advantage. Effective targeting is key. A scattershot approach, especially for companies with small budgets, will almost certainly fail.

Experiment and bring out new functionality quickly and exclusively. The ability to offer exclusive functionality through an app, including differentiated products, services, and loyalty program benefits, can help establish direct relationships with users, which is a prerequisite to competing effectively for most companies. Being a first mover with new functionality and innovation is a source of advantage.

Delta, for example, has fewer visitors to its website than Southwest Airlines, but it has twice the percentage of app users. What’s more, these users spend twice as many minutes with Delta’s app each month as with Southwest’s. Delta’s app covers the basics well, offering the ability to search, book, and pay for flights, as well as receive boarding passes, all via mobile device. Even more significantly, it is far ahead of its competitors in the exclusive features it offers. It provides checked-bag tracking, which many other airline apps do not, and it was the first to offer standby and upgrade lists, in-app service recovery, and seat selection and upgrade capabilities.

Marriott International is rolling out a check-in, check-out feature on its mobile app that allows loyalty program members to skip the front desk entirely. It has also added a feature to its meeting-services app that enables meeting organizers to make real-time requests for hotel services without leaving their seats. IHG and Hilton Worldwide, among others, use their mobile apps to remind users of reward levels and to offer opportunities for additional reward points for sharing experiences via mobile devices. Starwood Hotels and Resorts Worldwide is experimenting with room entry via smartphone and a Google Glass app for its preferred-guest program members. Lufthansa’s Facebook app, SceneSpotter, provides real-time information and advice on places to see and visit in 20 of its destination cities on the basis of recommendations from Facebook users as well as SceneSpotter editors. OTA Expedia is tiering pricing and promotions that vary by platform, offering the best deals on its mobile app.

This will be a hard-fought battle among travel suppliers and between travel suppliers and intermediaries. In some cases, suppliers are already coming under pressure from intermediaries to make their new functionality table stakes for all channels. Resisting such entreaties will be more difficult in some segments (highly franchised lodging, for example) than others (such as airlines, where assets are mostly owned).

The mobile environment today is young, dynamic, volatile, and still in formation. It is evolving at a rapid pace, and regardless of where mobile apps are installed—on a phone, in a car, on a pair of glasses, or somewhere else no one has even considered yet—as consumers get comfortable with the technology, they will begin to make choices that determine winners and losers. Gatekeepers are already playing a crucial role and will likely continue to do so. Travel companies that move quickly to design and market their apps, including experimenting with new functionality, will put themselves in the forefront of delivering the capabilities that enhance the various stages of the travel journey. In the process, they will build a big advantage in all aspects of their business over those that do not or are slow to take up the challenge.

Acknowledgments

The authors are grateful to Ben Stevenson and Kim Plough of BCG, and to Julie Ruggiero and Marc Kelechava of Facebook, for their assistance in the preparation of this report.