The past few years have been relatively good ones for the world’s leading automotive suppliers. Thanks to an industry recovery from the global financial crisis of 2008 and 2009 and successful cost-cutting initiatives, earnings and return on capital for the ten largest automotive suppliers are approaching their highs of about a decade ago. Global auto sales remain strong, powered by robust growth in emerging markets.

A new financial squeeze is on the way, however. Suppliers’ key customers—the world’s biggest automakers—are preparing to demand some of the deepest cost reductions in years. At the same time, automakers are increasingly pressuring their suppliers to locate more production facilities and R&D in fast-growing emerging markets so that they will be closer to their assembly plants. For most suppliers, expanding their manufacturing footprints in emerging markets—where wages are rising fast and skilled talent is becoming scarce—will add both cost and complexity to global operations.

We call the dilemma over how to balance these conflicting demands—for both cost reduction and manufacturing close to the customer—the proximity paradox. It is one of the most serious management challenges that the global automotive-supply industry will face over the next few years. Pressure to cut prices is unlikely to relent, and avoiding emerging markets is not an option because they are critical to growth. Indeed, China surpassed the U.S. in 2009 as the world’s biggest automotive market and is emerging as the engine of global growth for the industry.

To understand the challenges that companies are facing and to assess how well they are prepared to confront them, The Boston Consulting Group in partnership with the Fraunhofer Institute for Manufacturing Engineering and Automation surveyed 42 automotive suppliers from around the world. This sample comprised one-quarter of the world’s 100 biggest players and a selection of midsize companies. We also interviewed dozens of auto supply executives and industry experts.

Our research confirmed that suppliers are struggling with the twin burdens of lowering costs and locating production closer to their customers and are taking action to find an optimal balance between these two demands. But we also found evidence that most companies can better prepare to succeed in the increasingly difficult environment. Some of the key findings of this research are as follows:

- The cost pressures are real. An overwhelming majority of respondents—86 percent—said that they are under increased cost pressure from their automotive customers. Industry experts told us that major automakers are rolling out multibillion-dollar programs.

- The pressures to localize production are real as well. The second most important factor driving manufacturing-location decisions is proximity to the customer’s manufacturing plants. Suppliers surveyed expect to increase the number of their global manufacturing sites by an average of 9 percent over the next five years.

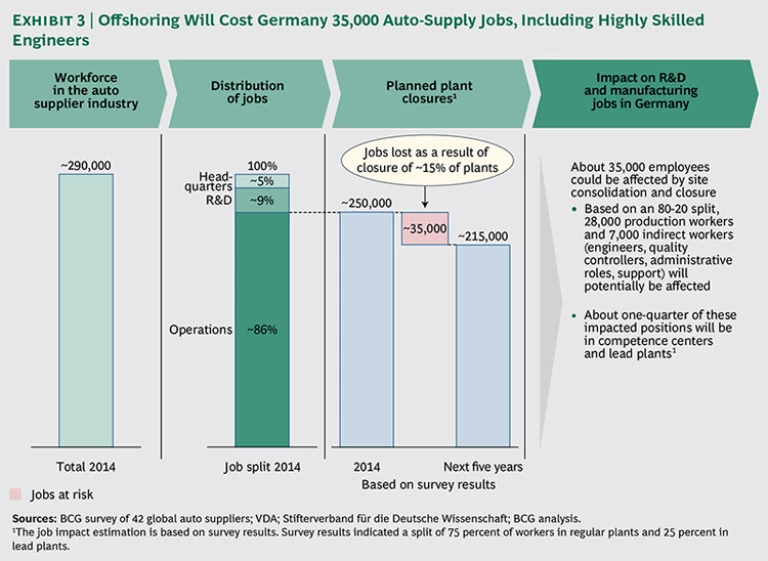

- The balance in manufacturing capacity is shifting. Nearly 60 percent of surveyed auto suppliers’ total production sites—including many core manufacturing operations for certain products—is expected to be located in emerging markets some five years from now, compared with only 45 percent five years ago. The automotive-supply industry in Germany alone is projected to lose 35,000 jobs, including highly skilled blue- and white-collar workers.

- Efforts to address the challenge are insufficient. Every supplier surveyed agreed that it is important that it adjust its manufacturing network, but our research found that most suppliers lack the organizational capabilities, business processes, and tools to achieve an optimal manufacturing footprint.

To keep—and increase—their market share, automotive suppliers must be able to skillfully balance cost and proximity considerations throughout their entire value chains when deciding where to locate manufacturing. More than ever, suppliers need to have a process in place to reconcile conflicting customer demands—and to decide where to make trade-offs—as they seek to define the ideal configuration of their manufacturing networks.

Network optimization requires a comprehensive and holistic approach, one that encompasses a clear understanding of performance and the right capabilities, methods, and implementation process to achieve results. To be really successful, these programs must be ongoing so that suppliers have the flexibility to adjust their manufacturing footprints in response to shifts in global cost, market demand, and technology trends. For many suppliers, this will require at least some transformation of their organization.

The Auto Supplier’s Dilemma

Meeting perennial demands by automakers to cut costs has long been an uncomfortable fact of life for the world’s roughly $750 billion global automotive-parts-and-components industry. In a typical year, suppliers are asked to shave 2 to 3 percent off their prices. But after several years of relative price stability, the coming round of cost reductions is likely to cut much deeper. Some of the largest automakers have adopted programs to cut $2 billion to $6 billion in annual costs, constituting about 4 to 6 percent of total spending, according to press reports. Suppliers will bear some 55 to 65 percent of these cutbacks.

Meeting these cost targets will be especially difficult because they come at a time when auto suppliers’ production networks have been growing more globally dispersed and more complex. Complexity costs are more difficult to manage than ever.

Shifts in the global economy further complicate the tasks of managing the costs and efficiency of production networks. Direct manufacturing cost structures around the world are changing fast, owing to rapidly rising wages in countries such as China and Brazil, volatile energy markets, and swings in currency values. (See The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide , BCG report, August 2014.) A worsening talent shortage in many emerging markets, meanwhile, can undermine productivity and add unanticipated costs. The percentage of human resources representatives declaring that they are having a difficult time filling jobs in China, for example, rose from 15 percent in 2009 to 24 percent in 2014, and in India it rose from 20 percent to 64 percent, according to research by ManpowerGroup.

On top of this, most suppliers are not fully prepared for a raft of technological changes that could fundamentally alter their businesses and production. Electric vehicles, for example, require some entirely different components with dramatically different cost drivers and new supplier relationships. Digital dashboards—which will be loaded with screens and software—will require high degrees of customization based on software, rather than hardware, changes. Such software changes can be made easily without requiring local production. Components such as plug-in displays can be made in low-cost countries and inexpensively shipped.

Other technology trends are expected to transform manufacturing itself. Highly computerized, next-generation smart factories—connected through the Internet by what is known as Industry 4.0—will link the production processes of all plants and offer instant, transparent access to real-time data on costs, capacity use, and productivity. This will enable suppliers to adjust their manufacturing networks more quickly. Most suppliers have not yet factored these technological trends into their long-range manufacturing-network plans.

Regardless of the practical difficulties of lowering costs and expanding locations, suppliers are being pulled in both directions by their customers. Asked to rate the most important reasons for adjusting their global production networks on a scale of one to six, respondents assigned increasing cost pressure a five, the highest mark given. The second-most-important driver was proximity to end customers. Typically, that means having manufacturing sites close to the assembly plants of automakers, wherever those assembly plants are located. Other considerations, such as the desire to shorten product lead times or reduce the risk of disrupting extended supply chains, ranked relatively low.

The essential problem is that production decisions that are intended to cut costs and those made to be close to the customer are based on fundamentally different business rationales.

If cost is the primary consideration, most production decisions rest mainly on the basis of total landed cost, which takes into account such factors as labor, logistics, and energy. Economies of scale and the expertise and process capabilities needed to build a plant are also important considerations. Labor-intensive components such as wire harnesses, for example, are typically made where labor costs are lowest, whereas fuel injection systems are built at the site with the best skill base. Commodity sealing products, by contrast, are usually made most economically where the supplier has the largest production capacity and can therefore achieve economies of scale.

The logic behind localization is entirely different. The primary factor is the customer’s requirement that parts and components arrive at the automotive assembly line at the precise time and in the precise sequence needed—a practice known as just in sequence. Seating modules and dashboards are examples. If a component is bulky and expensive to ship—a front-end module, for example—the assembly is typically located close to the customer’s auto plant for logistical reasons.

Unfortunately, suppliers do not always have the leeway to locate production where it makes the most economic sense. They often feel that to keep their customers’ business, they must manufacture where their customers want them to. In most cases, that means opening more plants in more countries, especially in emerging markets.

The Auto Supply Industry’s Shifting Center of Gravity

The world’s leading auto suppliers are no strangers to globalization. Bosch Auto Parts, Denso, Continental, and Magna International have had plants in China, Mexico, and Poland for years. The original primary reasons were to take advantage of low-cost labor and to meet local-content requirements at customers’ automotive assembly plants.

These days, the main driver of localization programs is a dramatic shift in global demand for cars and light vehicles. In 2009, 53 percent of global auto sales and 56 percent of global production were in the group of developed nations that are known as the triad economies and include Western Europe, the U.S., and Japan. By 2014, the share of sales in the triad countries had dropped to 46 percent. The triad economies are projected to account for only 40 percent of sales by 2019.

China has emerged as the world’s biggest market. By 2019, IHS projects, China will account for 29 percent of worldwide sales of cars and light vehicles, far surpassing Europe (16 percent) and the U.S. and Canada (18 percent combined). Other rapidly developing economies are also gaining ground in the global industry. For example, India is projected to account for 5 percent of sales in 2019, compared with only 3 percent in 2009. Although those percentages may seem small, they reflect a two-thirds increase in India’s global share.

So far, shifts in production have not kept pace with shifts in demand: the triad economies still produced 51 percent of the world’s cars and light vehicles as of 2014. But this will change. By 2019, China is projected to account for 29 percent of automotive output, nearly as much as Europe, the U.S., and Canada combined that year. The contribution of production by all triad economies is expected to drop to 44 percent.

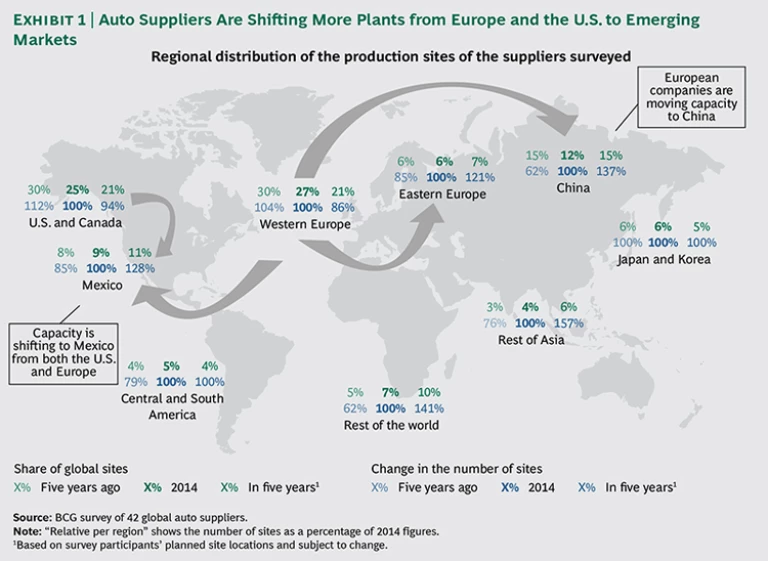

In 2009, the suppliers in our study had 66 percent of their manufacturing sites in triad economies. That share is now down to 58 percent—and is expected to decline to 47 percent in 2019. The share of manufacturing sites in Canada and the U.S. is expected to drop to 21 percent in 2019, from 30 percent in 2009. The share of sites in Western Europe will also drop to 21 percent. China, not surprisingly, will see significant gains in share, as will Mexico. (See Exhibit 1.)

One challenge posed by this additional offshore production is that suppliers’ manufacturing networks are becoming more spread out and difficult to coordinate. Over the past five years, the average respondent to our survey added two plants—many of them through acquisition—and entered one new region. That translates into a 9 percent overall increase in manufacturing sites for the 42 suppliers surveyed. The number of nations in which respondents have plants also rose by 9 percent. In five years, the number of worldwide production sites is expected to grow by another 9 percent. The rapid growth through acquisition “dramatically increases the complexity of network management for us,” explained the chief operating officer of one auto supplier based in Europe.

To get a sense of how these shifts will translate into numbers of facilities, we asked several major suppliers about their plans. Respondents expect to increase the total number of plants from 605 in 2014 to 644 in 2019. Networks are slowly reaching a size that makes tasks such as increasing productivity, coordinating product development, and simply managing supply chains very challenging, requiring the highest process standards.

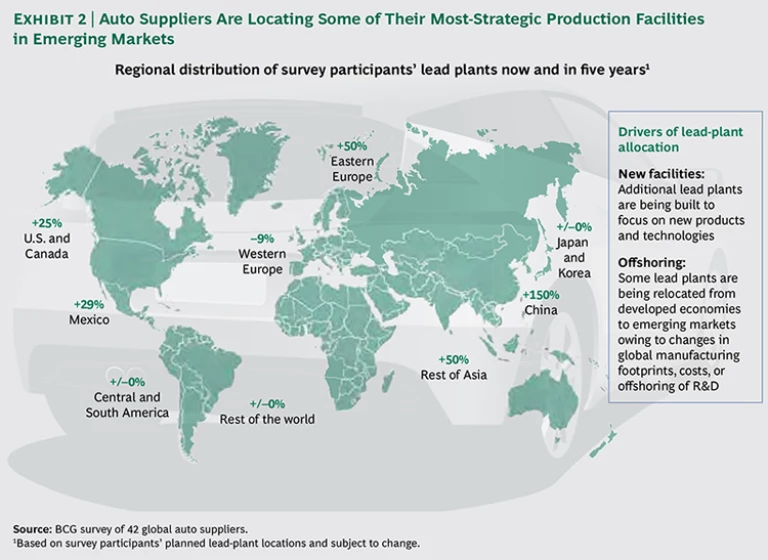

More triad-country-based suppliers are becoming truly global players. One telling sign is that they are locating more lead plants in more markets around the world. Lead plants are the core manufacturing operations of every supplier. They pioneer the most-advanced production processes and are staffed with the company’s top design and engineering talent.

The number of companies in our study with lead plants in China is expected to double to 16 in five to ten years, and the overall number of lead plants located there is projected to jump by 150 percent over that period. The number of lead plants is expected to rise by 29 percent in Mexico, by 50 percent in Eastern Europe, and by 50 percent in the rest of developing Asia, a region that includes India and the Southeast Asian nations. Emerging markets will not be the only ones to gain. Our survey respondents also expect to increase their number of lead plants in the U.S. and Canada by 25 percent over the next five to ten years. (See Exhibit 2.)

Most of these lead plants will assume global responsibility for manufacturing new products and developing new manufacturing technologies and processes. But several will replace current lead plants in Western Europe. To get a sense of how many facilities may be involved, we asked ten leading suppliers about their plans for lead plants. Companies in this small sample plan to increase the number of lead plants in China from 10 to 25 in five years. The U.S. will gain 4 plants. Lead plants in Germany will drop from 46 to 39.

One German supplier that is planning to shift a lead plant to Eastern Europe indicated that the goals are to reduce cost and improve efficiency. The new plant, according to the supplier, will be more productive than the current German one because work rules are more flexible and new processes and a new organization structure will be introduced. The supplier plans to transfer only production at the outset but to gradually transfer all core functions and skilled positions. The new plant will have few expatriates.

The transfer of lead plants and R&D will have a particularly significant impact on the European automotive-supply industry. In Germany, we estimate, 35,000 of the current auto-supplier workforce of approximately 290,000 could be affected by plant closures—including some 7,000 engineers, administrators, and support positions. About one-quarter of those jobs will be in competence centers and lead plants. (See Exhibit 3.)

For each supplier, transferring such core operations offshore presents both opportunities and risks. It can put suppliers in a stronger position to capitalize on growth in emerging markets and strengthen their relationships with both international automakers and rising local players. The downside is that once the home R&D and skill base has been dismantled, there is little turning back if the offshore operations underperform. Such transfers also typically require significant changes in organization structure and the ways in which an organization operates, given that lead plants typically focus on one region as a “home market.” If not well managed, localization can add cost at a time when customers are demanding major cost reductions.

Balancing Cost and Proximity

There is little doubt that finding the right balance in their global manufacturing networks is an urgent priority for automotive suppliers. A full 97 percent of executives we interviewed agreed with the statement, “The relevance of manufacturing-network design will increase in the next five to ten years.” Ninety-six percent reported that their companies review their manufacturing networks either once or twice a year.

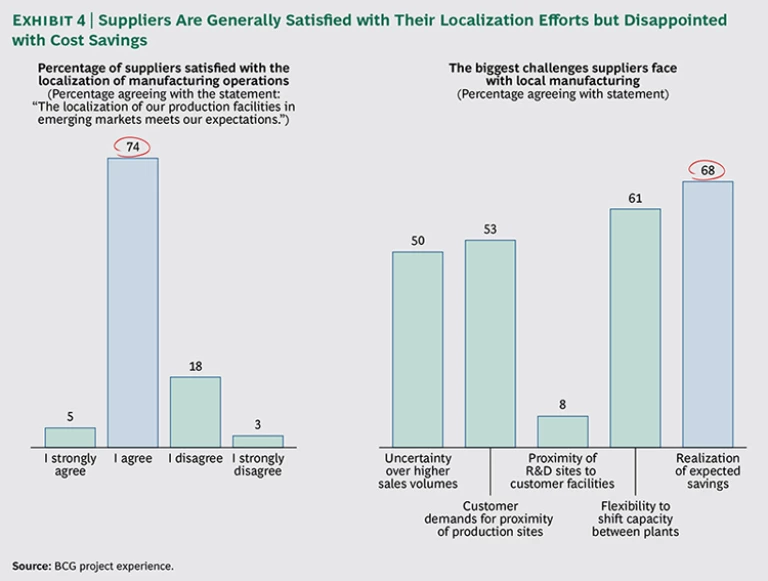

It is also clear, however, that automotive-supply executives have not been satisfied with the cost savings they have attained through previous manufacturing-optimization projects in emerging markets. Although 79 percent of respondents stated that they are satisfied overall with the performance of their localized production facilities in emerging markets, 68 percent reported that the cost savings were lower than expected. (See Exhibit 4.)

In part, this is because cost-efficiency was not the top priority when automotive suppliers opened their first factories in emerging markets. Many entered because their customers needed to meet local-content requirements. The chief concern was meeting quality standards. In the early years, cars assembled in countries such as China sold for high prices, and the added costs of producing locally could more easily be passed on to customers. Many suppliers transplanted the same processes and equipment used at home, staffed their plant management with expatriates, and imported key components and materials. Today, these markets are dramatically more competitive.

Optimization programs can improve these manufacturing networks. A well-executed program lowers costs in most industries by 15 percent—and in some cases by up to 25 percent—over a three- to eight-year period. Optimization programs also make networks significantly more manageable, enable organizations to develop new capabilities, and allow suppliers to spread best practices and production standards throughout the network more easily.

But in our experience, we have found that auto suppliers have generally struggled more than manufacturers in other industries with efforts to optimize their global production networks.

One major reason for the disappointing savings is the difficulty in gauging total costs. Huge fluctuations in labor, energy, and other direct costs are rapidly changing the economics of auto parts manufacturing in emerging markets. A host of other factors can also decrease an emerging market’s cost advantage. In Eastern Europe, for example, corporate taxes, investment incentives, the ease of doing business, labor regulations, and personal-security expenses all vary widely among countries. The availability and quality of skilled labor, local suppliers, and distribution infrastructure also vary and can significantly influence costs.

Another huge challenge facing auto suppliers is that they have limited flexibility to manufacture where costs are lowest, owing to commitments to locate plants close to customers. Because their customers’ assembly plants are scattered across the globe, moreover, it is harder for auto suppliers to consolidate their production in a few locations and thereby fully achieve economies of scale. Some plants, especially those in mature, triad country markets, operate well below their capacity.

Indeed, our research found that auto suppliers that focus most on proximity to their customers’ assembly plants realize lower cost savings than those that do not. Eighty percent of suppliers with less than €1 billion ($1.13 billion) in annual revenues that focus on customer proximity when locating plants reported that their cost savings from related production-network-optimization efforts amounted to less than 5 percent. By contrast, more than 60 percent of these small companies that do not focus on proximity achieve cost savings of 5 to 25 percent.

Several factors undermine efficiency. Auto suppliers still struggle to find good local suppliers of components and materials at competitive prices in particularly remote regions. Some have built production facilities that are clones of those in their home countries and that are equipped with expensive automation, rely on high-cost suppliers, and are excessively staffed with expatriates. The relatively high employee head count in emerging markets bloats overhead costs.

All of the challenges of emerging markets and complex supply chains, however, are not diminishing the imperative to manufacture close to customers’ assembly plants. Even as costs rise in China and other emerging markets, the automotive-supply industry is not witnessing as much reshoring activity as other industries.

What options do auto suppliers have if they must both manufacture close to customers and slash costs? One approach to resolving the proximity paradox is to gently push back against customer demands that are uneconomic. Suppliers can be firmer, essentially asking customers, “What is more important—low cost or proximity? If cost is paramount, then let us do our job.”

There is reason to believe that, in some cases, the localization requirements of customers are not as rigid as they are perceived to be. Only a small percentage of parts and assemblies really need to be delivered on a just-in-time or just-in-sequence basis. Manufacturing next door to a car assembly plant is especially advantageous for products such as interiors, body and structural parts, transmissions, drive shafts, and heating, ventilation, and air-conditioning systems. Proximity is less important for electronics, engine control systems, and audio and telematic systems, which are relatively inexpensive to ship.

Suppliers can also make better use of “around the corner” locations by manufacturing labor-intensive components in lower-cost countries that border assembly plants in higher-cost countries. Suppliers manufacturing components requiring close proximity for cars built in China, Western Europe, or the U.S. can locate their facilities in neighboring countries such as Vietnam, the Czech Republic, or Mexico and still remain responsive to customer needs. An executive at a leading automotive supplier in Mexico explained that its engineers need to be at a customer’s assembly plant “the next day” in case of problems. “To be really flexible, this requires a proximity of not more than 1,000 kilometers.” This range allows flexibility that is not often utilized.

The biggest opportunities for cutting costs come from improving the efficiency of current production networks. We estimate that savings from optimization programs can be doubled if the programs address organizational inefficiencies, supply chain issues such as local sourcing and logistics, and production processes through such measures as lean initiatives or improved utilization of capital equipment.

Many suppliers are focusing on the right general areas. But they often lack the full set of tools and a coherent and holistic approach to achieve the best results. Suppliers need a comprehensive understanding of the economic factors influencing costs in their far-flung global production networks—including indirect costs such as taxes, logistics, and the expense of bringing a plant up to full operation—so that they can accurately compare one site with another and allocate production efficiently. Although most suppliers devote resources to optimizing their networks, few have dedicated departments that focus on implementing best practices across all businesses and regions.

Most suppliers are also using planning and investment time horizons that are too short to achieve the desired results: investments in manufacturing-network optimization may take up to a decade to yield the full cost benefits, but more than 80 percent of suppliers in our survey use planning periods of five years or less. And while some of the largest automotive suppliers use standard business-case guidelines to plan their global capacity needs, midsize and small suppliers may lack the capabilities and resources to do so.

Suppliers could significantly improve profitability by adopting a more comprehensive approach to adjusting their manufacturing networks, one that balances the necessity to have certain production close to customers with a cost analysis that goes beyond direct factors such as labor rates, materials, and shipping. A manufacturing-network optimization program should encompass improvements to the global supply chain, organization structure, and manufacturing processes.

Developing an Optimal Production Network

In today’s swiftly changing global economy, maintaining an optimal global manufacturing footprint calls for far more than periodic tactical adjustments. It requires an ongoing commitment with a time horizon of at least a decade and a high level of management focus so that the organization can continually adapt its manufacturing network with speed and vigor.

More than anything, this increasingly complex global environment requires that automotive suppliers make production decisions on the basis of a good, holistic view of their own global networks, their key markets, and their competitive challenges. Our empirical analysis suggests that many suppliers still lack such a holistic view. In their local manufacturing operations, suppliers often do not have a firm understanding of the total costs of manufacturing, are not forming the best partnerships, are not taking into account disruptive technological trends, and have organizations that are not adequately adapted for that environment. We believe that this largely explains why most executives we interviewed are not satisfied with the cost savings their companies are realizing from their network-optimization efforts.

Suppliers have significant opportunities to improve their performance, starting with a full understanding of the strengths and weaknesses of their current manufacturing network and their ability to make adjustments. Suppliers should conduct a thorough “health check” of their optimization programs that assesses the past performance of the network and whether current capacity in a region can meet projected demand. The health check should also evaluate capabilities and managerial responsibilities across the network, examine the tools and methods used to identify and quantify improvement opportunities, and determine whether the capabilities and processes are in place to implement the strategy and adjust the network.

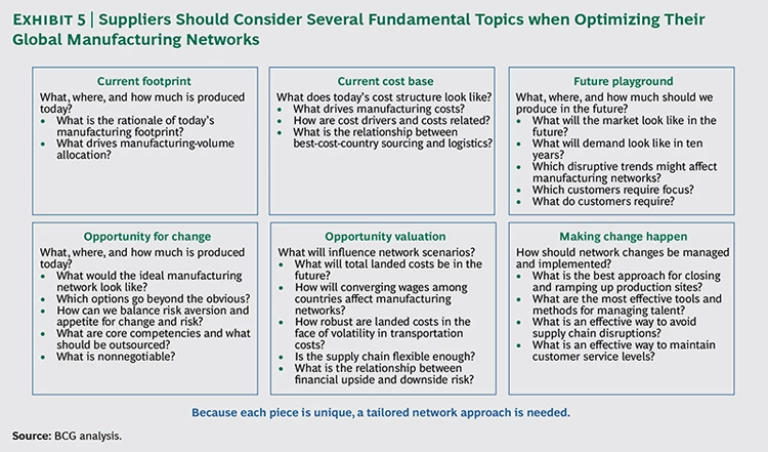

With this preparation, suppliers will be in a stronger position to optimize their global manufacturing networks in a holistic way. The process should be driven by several fundamental considerations. (See Exhibit 5.)

First, suppliers should reassess their current manufacturing footprint and the rationale that drives the allocation of production work. Next, suppliers should analyze the current manufacturing-cost structure at each location and the factors driving changes in the costs. These manufacturing costs should be weighed relative to the logistical demands of key customers. To next determine what, where, and how much to manufacture in different locations, suppliers also need a good sense of the future competitive environment.

Suppliers should then identify the opportunity for change. They should have a vision of an ideal manufacturing network. They must determine which manufacturing operations will remain core competencies and which can be outsourced. Suppliers should also strive to make sure that their global networks are flexible enough to adapt to various scenarios that could influence the economics of manufacturing, such as shifts in relative cost structures among different countries and events that could influence transportation costs. They should determine the best approaches to closing sites and ramping up others, for managing talent, and for adjusting production while at the same time maintaining high levels of customer service. Finally, suppliers should establish a strategy to make change happen and ensure that they have the organizational capabilities and talent required to do that. Suppliers that go through major change programs will have these capabilities. But they also need to standardize their processes and maintain them for the challenges ahead.

The answers to resolving the proximity paradox by striking the best balance between localization and cost reduction will vary from one auto supplier to the next and should be tailored to each competitor’s needs. But getting those answers right will be critical. The ability to optimally balance conflicting customer demands is likely to spell the difference between suppliers that seize the advantage in the rapidly evolving automotive industry—and those that are overwhelmed by its complexity.

Acknowledgments

This report would not have been possible without the efforts of our BCG colleagues Jonathan Brown, Oliver Kroll, Ines Noack, Thomas Dauner, Andreas Dinger, Daniel Küpper, Brian Collie, Kazutoshi Tominaga, Marco Gerrits, Stefan Reiter, and Susanne Frick. Valuable contributions were also made by our colleagues from the Fraunhofer Institute for Manufacturing Engineering and Automation: Andrea Prinz, Benjamin Kuch, and Anja Schatz.