The $112 billion global lighting market is undergoing a rapid transformation driven by technological change—and the rules of the game continue to change for players across the industry.

The upheaval stems from two powerful shifts: the move toward light-emitting-diode (LED) lighting and the growing adoption of connected lighting systems. These trends, which reinforce one another, are fundamentally altering the underlying economics and dynamics of the market. The result: companies across the complex lighting ecosystem must evaluate where they can compete effectively amid the changes and adopt new strategies to win in the future.

Steady Growth Belies Major Change

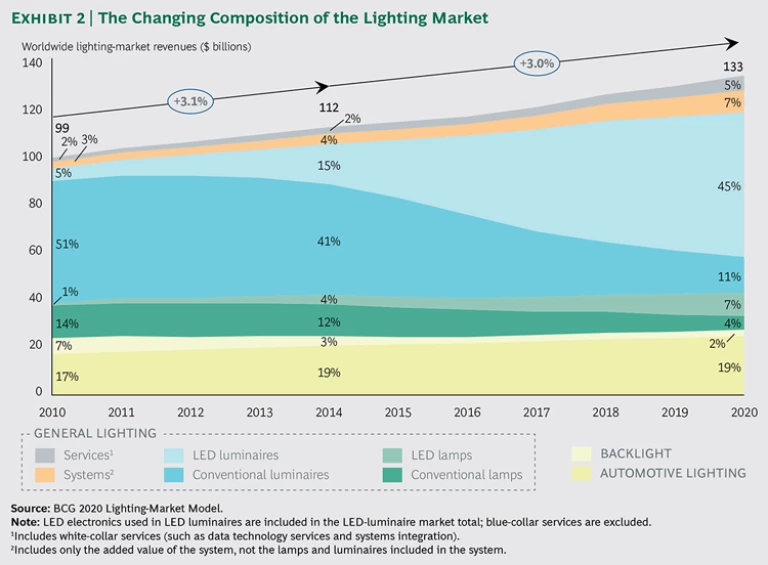

Historically, growth in the lighting market has tracked global GDP growth, running at about 3 percent on a compound annual basis from 2010 through 2014. In the developed world, growth is driven by economic expansion and the annual increase in the number of households; in developing markets, growth stems not only from both those factors but also from increasing access to electricity. In fact, rapidly developing economies such as China and countries in Latin America accounted for about 70 percent of lighting-industry growth over the last five years.

In the years ahead, growth will continue at the 3 percent annual pace, with lighting revenues topping $130 billion in 2020. But although overall growth will hold steady, the dynamics within the lighting market are changing dramatically.

The Rapid Rise of LED. LED technology boasts major advantages over conventional technologies such as incandescent, halogen, and compact fluorescent lamp (CFL) lighting:

- LED is currently four to five times more energy-efficient than conventional technologies and is expected to become even more efficient—a critical edge considering that more than 50 percent of the total cost of lighting stems from energy consumption.

- LED is more versatile than other technologies. LED lights come in a wider variety of colors, for example, and are smaller than those of other technologies, so LED can be used in creative new ways.

- LED lamps last about 15 years, roughly four times the life span of CFL lighting and more than ten times that of incandescent lights.

In the next few years, the shift toward LED technology is likely to accelerate, for two key reasons.

First, although LED technology is still more expensive than conventional lights, the price is falling precipitously. That decline is due to technological advances in manufacturing and increasing LED efficiency (fewer LEDs are required for a similar amount of light output).

Second, there is an increasing focus on the total cost of ownership (TCO) of lighting—TCO includes not only the initial cost of lamps and luminaires but also the expense of replacing lamps and costs for energy. As buyers pay greater attention to this measure, LED technology will gain additional traction.

The Shift to Connected Lighting. The increasing popularity of LED gives momentum to another significant shift: the adoption of connecting lighting systems (also called smart systems). Given the versatility of LED in terms of factors such as brightness and color variation, connected systems make more sense for use with LED than when conventional lighting technology is used.

Other factors are driving the growing popularity of connected lighting as well:

- Smartphone apps can be used to easily manage connected lighting systems, which makes those systems increasingly accessible to a broader group of customers.

- Connected lighting systems save money—in some cases another 40 percent in energy savings on top of the already hefty savings offered by LED alone.

The shift to connecting lighting will be most swift in the professional segment in developed countries. Given that these professional systems typically control a large network of lights, the savings based on TCO are usually significant. Growth in the use of connected lighting systems in the consumer segment will be slower, however. Those systems generally deliver less dramatic cost savings for the end-user relative to professional systems owing to the smaller number of lights in a household and the lower frequency with which lights are used.

New Strategies Across the Value Chain

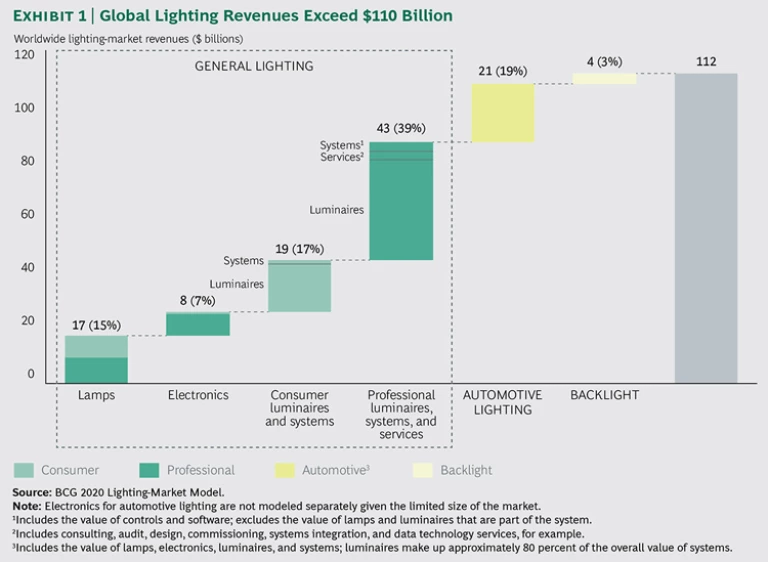

We have studied the lighting industry by breaking it down into three main categories comprising a total of six segments (see Exhibit 1):

- General Lighting. This segment includes four categories: lamps, which include both points (one type of LED light source, or LED lamp) and the linear lamps typically used in ceiling fixtures; electronics (the units that regulate the electric current in lighting equipment and the LED light sources known as modules); consumer, which includes household luminaires (the piece of equipment that combines the fixture and the electronics to create a singular usable end product) and systems; and professional, which includes professional luminaires, systems, and services.

- Automotive Lighting. This segment comprises all elements of lighting systems in cars including electronics and lamps.

- Backlight. This segment is made up of the lighting used in devices such as TVs, smartphones, and tablets.

The increasing adoption of LED and connected lighting systems will fundamentally alter the composition of the global lighting market by 2020. (See Exhibit 2.) In the face of such a transformation, it is critical that companies rethink their strategies.

General Lighting: Adopt New Strategies. In the general lighting market, we see various changes, including the decline in the market for conventional lighting and the development of lighting-related services. Here, we dive into the four segments within general lighting—lamps, electronics, professional, and consumer—to understand how shifting industry dynamics will alter strategies.

Strategies in lamps must be tailored to meet customer needs. Within the total lamp market, two separate segments—conventional and LED—will emerge, each with distinct economics. Manufacturing scale will remain an advantage in the conventional-lamp business. But in the LED-lamp market—which is essentially an assembly operation involving semiconductors and other components—manufacturing scale is no longer critical.

Volumes will grow in the LED segment—by about 30 percent on a compound annual basis during the period from the end of 2014 through 2020. After 2023, however, volumes will decline as a consequence of LED luminaires’ cannibalization of the LED-lamp market. (In LED luminaires, the LED light source—known as a module—is built in, so no separate lamp is required.) The upshot: we expect LED-lamp revenues to rise to nearly $10 billion in 2020 and decline thereafter. And margins, currently almost zero or even negative for most players given the intense competition for shelf space, will remain weak in the near term.

The conventional-lamp segment, meanwhile, will shrink quickly. Revenues are expected to decrease from roughly $13 billion in 2014 to about $5.5 billion in 2020, as sales throughout the segment (particularly for incandescent, halogen, and high-intensity discharge, or HID) decline. Overall margins, however, are expected to hold steady.

At some point after 2023, LED-lamp prices will bottom out and lamp volumes will stabilize. That’s because two trends that depress lamp volume—the increased use of longer-life LEDs and the market share gains of LED luminaires—will have run their course. The result: after 2030 the total demand for light sources—including both lamps and the modules that provide the light in LED luminaires—will return to the historical 3 percent compound annual sales growth rate. To succeed, lamp manufacturers will need to match their strategy to the needs of the end user.

Within the consumer category, the LED-lamp market will become segmented, with premium brands at one end of the market and private labels at the other. In both price segments, the key to success will be winning shelf space by ensuring that retailers earn a healthy margin. But the way in which lamp manufacturers deliver that retailer margin will differ on the basis of their price level:

- For premium-lamp manufacturers, it will be critical to offer a range of differentiated products with strong brands. These products will carry a relatively high retail price, giving the retailer room to earn a decent margin. Innovative R&D will be central to building out that broad, differentiated portfolio—and will protect against commoditization of the product line.

- Meanwhile, manufacturers that supply private-label lamps for the consumer market can offer retailers that margin by keeping their costs—and therefore the price they charge to retailers—as low as possible. They need to put an emphasis on a few products that will sell quickly rather than a comprehensive portfolio of products. And they need to hone an R&D process than can quickly copy popular new offerings in the market.

Within the professional segment, lamp manufacturers need strategies that offer buyers a compelling offering in terms of the TCO of LED lights. Success will stem in part from continued R&D investments to drive down manufacturing costs (thus allowing lamp manufacturers to cut prices) and to improve the efficiency and lifetime of the lamp.

Rapid innovation and customer insight will drive success in electronics. Lighting electronics comprise two key elements: drivers and modules.

Drivers regulate the current going through the light source. Some conventional-lighting technologies, which are used most commonly in the consumer segment, do not need a driver at all. But all LED-lighting products—whether a lamp or an LED luminaire—use a driver. So, as LED grabs a greater share, the market for drivers—particularly in the consumer segment—will expand.

Modules, on the other hand, exist only in LED lighting. And with the growing popularity of LED luminaires, the module market will also grow rapidly.

Overall, the electronics market—both professional and consumer—will double in size, from roughly $8.2 billion in 2014 to about $16 billion in 2020. Module revenues will jump from $2.9 billion to $5.7 billion and driver revenues will increase from $5.3 billion to $10.3 billion. Electronics profits, meanwhile, will increase from about $550 million to $950 million as margins hold relatively stable.

While the rapidly expanding electronics market in lighting is increasingly attractive, successful strategies will differ based on which end of the market a company focuses on:

- For those with the technical know-how to compete in the high-end, largely professional, segment, developing a broad portfolio is crucial. The large number of luminaire types in the professional market creates a need for a variety of drivers and modules. Electronics makers that can manage a large, complex portfolio and rapid R&D innovation will win.

- At the low end, there is little room for differentiation. As a result, the key to success will be keeping costs low. Electronics players in this end of the market should focus on building a narrow product portfolio of fast-selling items.

Managing customer relationships will be critical in the professional segment. LED luminaires are rapidly replacing conventional luminaires across just about every professional customer segment and geography. As a result, in 2020, 80 percent of professional luminaires sold (measured by volume) will be LED luminaires. At the same time, the percentage of all luminaires (measured in revenues) that are sold as part of a connected lighting system is expected to be 25 percent, up from 5 percent in 2014. Much of that shift will occur in the professional market.

The capabilities of these smart systems create new opportunities to sell professional services. The greater functionality of LED---including the ability of a single LED point (or lamp) to project light in a variety of changing colors—sparks demand for consulting and design services, for example. In some cases, professional customers will opt to hand off management of these systems to a third party, much as companies do with software today through software-as-a-service offerings.

Overall, the professional market is expected to show accelerated compound annual growth of about 4 to 5 percent through 2020, up from the 3 to 4 percent rate seen from 2010 through 2014. Total revenues should top $65 billion in 2020, with margins holding steady. Luminaire sales will grow by about 3 percent annually. Systems and services will grow more dramatically but will remain a small portion of the total professional market, only about 20 percent in 2020.

Companies competing in the professional segment will need to adjust their approach in a number of ways. Among the most significant changes:

- It will become more important for lighting players to take a direct role in sales, helping to shape project specifications when possible. Strong customer-relationship management and a more direct sales effort can help providers make the benefits of sophisticated lighting systems clear.

- At the same time, the increasing sophistication of lighting solutions will allow lighting players to develop specialized offerings for particular customer segments—thus requiring companies in the professional systems and services markets to gain a deep understanding of those customer segments.

Different strategies will be required for the high and low ends of the consumer segment. By 2020, LED luminaires will account for about 60 percent of volume in the consumer luminaire market. On the connected-lighting front, the move to LED opens the door to wider adoption of home systems. However, we expect the home system market to remain relatively small through 2020, with buyers limited largely to affluent, technology- oriented early adopters. That projection, however, could prove to be conservative if home system prices—which are currently much higher than those of standard LED lights—fall more quickly than expected or if consumer perception of the value of such systems improves significantly.

Overall, we expect the consumer market to grow in line with the historical 3 percent compound annual rate and to reach $24 billion in 2020. Profitability within the consumer luminaire business will get a boost over the next few years from the shift toward higher-margin LED luminaires. But that improvement will be temporary thanks to the anticipated rapid decline in LED-luminaire prices that is expected to accompany manufacturing improvements. As a result, consumer luminaire margins will improve, but only temporarily; they are expected to fall back to 2015 levels by 2020.

Successful strategies in the consumer segment depend in large part on understanding customer priorities:

- Luminaire players in the value segment (where customers focus heavily on price) and the mass-market, functional segment (where customers focus more on function than aesthetics) need to develop standardized designs to minimize complexity and costs.

- Luminaire players in the premium segment (where prices are higher) and the mass-market, decorative segment (where customers put more emphasis on visual style and appeal than on function) can create some level of differentiation through unique designs with winning aesthetics, through superior technical specifications, and through strong branding.

- In the emerging home-systems market, meanwhile, lighting players must offer compelling pricing and functionality and ensure compatibility with smart-home controls and software.

Automotive Lighting: Rapid Innovation Is Critical. Right now, LED is gaining market share in automotive lighting, beating out halogen and HID. And that is enabling a shift toward sophisticated, dynamic lighting systems that can, among other things, automatically adjust to weather conditions.

Although the move to LED systems gives a boost to total segment revenues, tempering forces are at work as well. Light sources—LED as well as other technologies—are becoming more and more bright, which means that fewer lights per car are needed. Also, LED lights have a longer life than conventional lights. So, as LEDs gain favor for use in automotive lighting, the market for replacement lights will slowly erode.

Amid these shifts, the automotive-lighting market is expected to grow by about 3 percent compounded annually through 2020 to reach $25 billion, thanks in part to underlying demand for cars (which is particularly robust in emerging markets).

Automotive lighting players need to build strategies with two realities in mind:

- As dynamic lighting systems gain ground and lighting increasingly becomes a “signature” feature, the already-close collaboration between vehicle and lighting manufacturers will become more important. The winners in this segment will be those that foster strong partnerships with automakers as well as with their tier-one component suppliers.

- Robust warranty and after-service capabilities will be critical in the automotive-lighting market because vehicle owners may be dissatisfied—or worse—when they are hit with a higher-than-expected bill to replace lamps in complex auto-lighting systems. If managed correctly, these services can be a solid source of profits for lighting suppliers.

Backlight Market: Making the Shift to OLED. The $3.8 billion backlight market—which is already largely dominated by LED—will decline in the years ahead as LED prices plummet and the per-screen need for LEDs falls (owing to the increased brightness provided by the technology). We expect total sales for the backlight segment to slip to about $2.6 billion in 2020.

Amid declining revenues, backlight companies must also navigate the transition to a new technology: organic light-emitting diode (OLED). OLED is a light source in which a thin film of organic material emits light when an electric current is sent through it. The technology has already nabbed about 5 percent of the backlight market for mobile phones and is increasingly being used in large-screen televisions.

As this shift to OLED gains traction, backlight players will need to build scale. That will allow them to fund the large R&D investments required to improve the functionality of OLED (especially enhancing its brightness) and to lower manufacturing costs. Those lower manufacturing costs, in turn, will create room to lower OLED prices.

A look at all six segments together reveals a lighting market that will produce relatively stable financial results through 2020. Return on invested capital (ROIC)—which reflects the asset level required to produce profits—is healthy across all segments of the industry, even within the low-margin LED-lamp segment. In lamps and electronics, for example, ROIC is approximately 15 to 40 percent; for luminaires, systems, and services, it is about 15 to 20 percent.

That solid financial foundation will be a critical asset as lighting players adapt to an industry being rapidly transformed by technology.

For the full data generated by our study, see " Total Lighting Market ."