As entire industries are disrupted by bold digital entrants and business models, more and more companies are at risk of extinction. Music, retailing, media, and travel are far along on this path, but we are also seeing similar patterns in more traditional industries, such as banking, agriculture, energy, health care, industrial goods, and manufacturing.

Digital strategy and transformation must therefore be a top priority of the CEO and the senior management team. Companies can’t just dabble at the edges by appointing a charismatic chief digital officer or CIO, adopting the latest shiny technologies, or “letting a thousand flowers bloom.” The digital imperative calls for more fundamental action in five areas.

Prototype Your Strategy

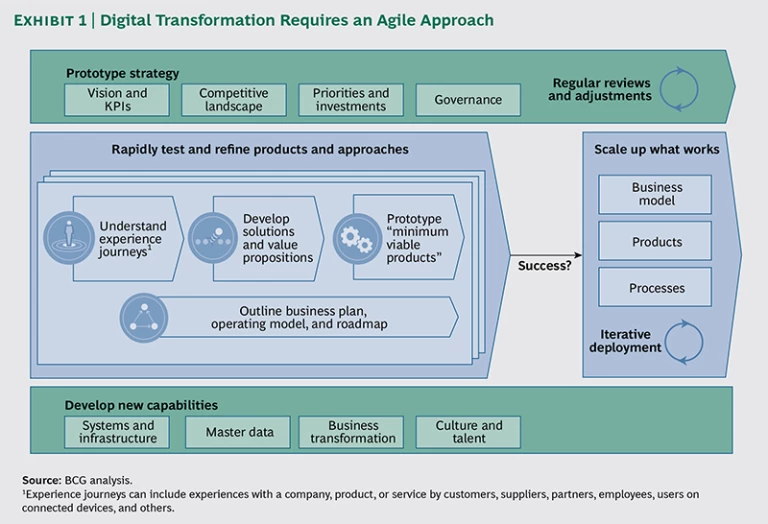

When consumer needs and competitive landscapes are rapidly evolving, it’s no longer possible to craft a long-term strategy, assign responsibility and performance targets, and execute a three- to five-year plan. “Agile” methods successfully pioneered in software development at companies such as Google, Amazon, Facebook, and Twitter have shown real advantages through learning by doing, rapidly and frequently delivering working products inspired by real consumer needs, developing innovative delivery methods and value propositions, and adapting to changing requirements.

Leading digital companies test and refine, or prototype, products and strategies in close cooperation with customers and at a dizzying pace. For example, Amazon has introduced e-readers, tablets, smartphones, cloud services, delivery services, and online marketplaces—all within the past ten years. We have found that this test-and-refine approach can greatly inform the world of strategy. (See Exhibit 1.)

A company’s organization and culture must also support digital transformation, with structures, governance, and incentives that promote speed, risk taking, and experimentation—rather than kill disruptive projects before they bear fruit. (See “ A Breakthrough Innovation Culture and Organization ,” BCG article, October 2014.)

Consider how European automaker Renault is prototyping a multichannel strategy. The company’s goal is to digitize and strengthen customer relationships across channels to develop a simpler and more personal relationship with the brand. In order to achieve that goal, Renault is simultaneously piloting several strategic approaches: developing digital services to connect cars to Internet-based offerings in areas such as navigation, entertainment, and insurance; testing new business and operating models such as the optimization of the total cost of ownership across a vehicle fleet; and adapting its marketing and sales processes in Renault Stores and company call centers.

In just seven months, Renault also built the foundation of a 360-degree view of customer data from models of the customer journey that spotlight “moments of truth” in which the company has an opportunity to influence a decision, convert customers to a sale, or build loyalty. The company can then integrate that foundation with a tool to manage customer leads that unites disparate data from internal and external sources. Renault is now implementing these IT approaches as a pilot project in France for 32 million customer accounts, with a plan to deploy them across 25 countries after learning what works.

Disrupt Your Business (Before Others Do)

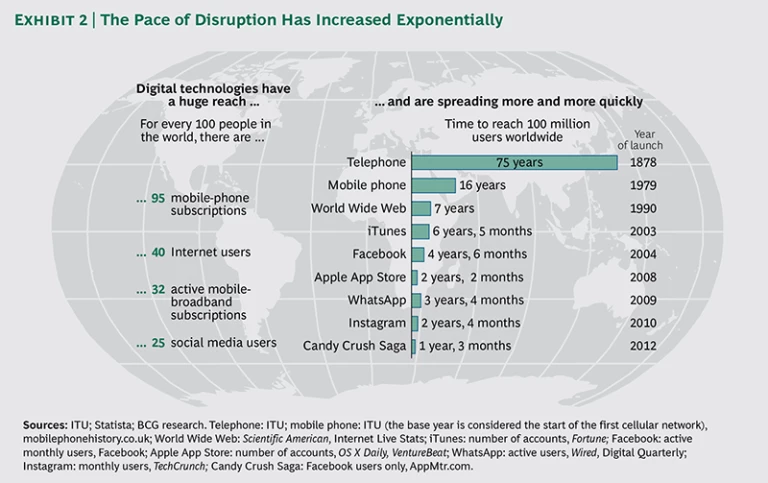

Executives need to create their own “digital attacker” businesses. Long-dominant companies are increasingly under attack from a host of digital start-ups that are out to reinvent businesses and industries by addressing consumer needs in completely new ways. Examples are emerging in every industry: just look at Uber in the taxi business and Airbnb in travel. And the pace of disruption is rapidly increasing. Digital disrupters are themselves constantly under attack, as witnessed by the start-ups targeting established companies such as Facebook, itself once a disrupter. (See Exhibit 2.)

Incumbents should be more disruptive in their approach and not leave the playing field open. Large companies hold a lot of cards—including resources, assets, relationships, and data—that smaller competitors frequently do not have enough of. But they often do not fundamentally rethink their business model. Only rarely do they launch anything that might attack the current business.

CEOs must think broadly and holistically about how to innovate around the unmet needs and pain points of their customers. Digital transformation is not only about a website and a sexy marketing campaign; more important, it’s about entirely new business opportunities.

For example, BBVA is beginning to act like a venture capital firm that seeds start-ups and enables innovation. BBVA’s venture-capital arm, BBVA Ventures, invests in start-ups and incubators working on disruptive technologies for the financial industry. BBVA is also launching digital bank initiatives with a focus on creating an innovative customer experience, including a promise of no minimum balances and none of the usual fees. Its peer-to-peer money app, Wizzo, allows users to transfer money to others as easily as sending a text message, without requiring an account. The product joins BBVA Wallet, which is already the biggest mobile-payment app in Spain, and BBVA Link, the first money-transfer app on Facebook in Latin America.

Digitize the Core Business

Top management must take advantage of digital capabilities to transform the current business. This isn’t just about rolling out new IT projects but also about fundamentally transforming the company’s business to ensure leanness, agility, and lower cost. Best-in-class companies think “end to end” about where digital efforts can produce a step change in performance and value for their customers—not only in marketing but also in operations and the back office. And they tackle many efforts in parallel, using standardized processes and agile techniques to accelerate execution and inject more flexibility into strategy.

To deliver an integrated, lean customer experience, global energy-management specialist Schneider Electric fundamentally transformed several core processes. One transformation covered marketing, sales efficiency, and customer care through a

dedicated effort led by the executive team. Redesigning processes to focus on the customer experience, standardizing front-office processes, and moving processes to the cloud delivered a strong foundation for a more integrated customer experience, consolidated more than 300 legacy customer-relationship-management systems, and integrated numerous enterprise-resource-planning systems.

A test-and-learn approach across 90 countries, four lines of business, and 30,000 employees delivered results every quarter. Performance significantly improved. For example, Schneider increased revenues by cross-selling energy solutions, improved customer satisfaction by routing customer service online, and increased call center efficiency by consolidating call centers from 145 to 45.

Create Value from Data

Agile leaders try to find ways to better use internal and external data. BCG research shows that leaders in the use of big data generate 12 percent higher revenues than companies that don’t experiment with big data. They are three times more likely than weak innovators to mine big data for new-project ideas and to actively target innovation toward digital design, mobile products and capabilities, speed of adopting new technologies, and big-data analytics. (See “ A Digital Disconnect in Innovation? ” BCG article, October 2014.)

Digital transformation offers companies new opportunities to gain sustainable competitive advantage from data and to generate entirely new revenue streams, business units, and stand-alone businesses by capitalizing on the data they hold. (See “ Seven Ways to Profit from Big Data as a Business ,” BCG article, March 2014.) For example, Verizon’s Precision Market Insights service offers access to anonymized data about shopping habits, interests, travel, and mobile browsing derived from a sample of the company’s more than 86 million wireless customers. A leading European cruise line developed pricing in a highly segmented and targeted way on the basis of a customer’s profile, the timing of the price being offered, and the product offering, thanks to the use of advanced analytical tools and technologies.

Position Your Business in the Broader Ecosystem

Companies must secure their place in the broader ecosystem—the network of companies, individual contributors, institutions, and customers that interact to create mutual value. Digital ecosystems are disrupting businesses in nearly every consumer-centric industry through close collaboration among partners, institutions, and customers. Ecosystem players join forces with external companies working toward a common goal and achieve complete alignment of the value chain.

Collaboration across a broader ecosystem creates new opportunities to address consumer needs. Technical foundations, or platforms, that allow devices, applications, data, products, and services to work together in new ways become core to strategy. Current owners of the customer relationship risk potential disruption from platform owners and marketplaces that allow the components of the ecosystem to easily collaborate and interconnect. (See “ The Age of Digital Ecosystems: Thriving in a World of Big Data ,” BCG article, July 2013.)

Philips, founded in 1891, is innovating as an ecosystem player in health care by collaborating with telecommunications, health-services, and logistics providers to create a new “service ecosystem” to support seniors at home. The Lifeline service consists of a pendant with a button that, when pressed, sends a radio signal to a hub device in the person’s home, which places a call to an emergency response center by means of a landline or AT&T’s cellular network.

Ecosystems also play a role in sourcing key talent. Digital talent thrives best in open, collaborative, experimental cultures where team members can learn and grow and be around a critical mass of similar talent, rather than in top-down, micromanaging bureaucracies that spread digital talent thin and stifle innovation. Leading players collaborate with incubators, universities, and other institutions to gain access to critical talent. We also see leaders experimenting with “digital factories”—functions that are set up differently from the core business, providing an ecosystem of talent to support internal digital initiatives.

Leaders in the digital age are different from leaders in the past. They prototype an agile strategy and learn from their experiences. They attack their own businesses before disrupters do. At the same time, they digitize their core business and get the most value from both their existing and external data, all the while mastering the digital ecosystems they operate in.

To be sure, companies that embrace the digital imperative take on a fundamental transformation of their business, including some strategic and execution risk and disruption. But to do otherwise risks a fate worse than disruption: extinction.

Further Reading:

BCG Technology Advantage, April 2015