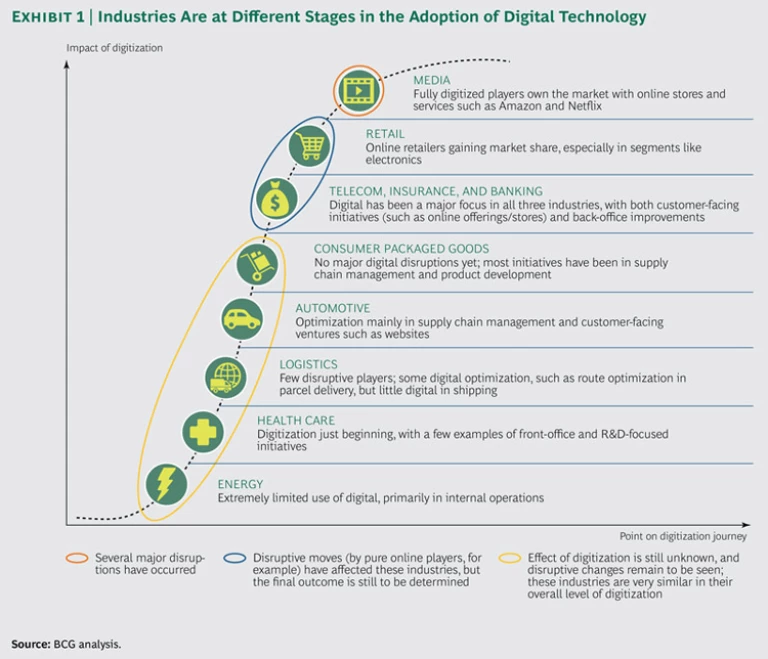

In contrast to industries like media and retail, where digital technology has been a significant disruptive force, process-oriented industries such as energy, transportation, industrial goods, and health care have not yet seen its full effects. (See Exhibit 1.) For management teams in these industries, it can be difficult to know how to start implementing digital technology—or even to see the need.

As a result, many companies have yet to take action to capitalize on digital. Some of these late adopters say they are hindered by legacy IT systems or don’t have the necessary capabilities in place. Others spend months studying the market and getting bogged down in large-scale strategic and conceptual considerations, believing—incorrectly—that they need to understand how and where the journey will end before they can take the first step. The development cycles of digital technology are extremely rapid—far faster than for most traditional products and services—and this deliberate (and outdated) approach means that these companies are essentially fighting yesterday’s battles.

Given the pervasiveness, low cost of entry, and potential impact of digital technology, it’s imperative that late adopters act today to launch new digital products and services and digitize internal processes. This means they must implement far more nimble development processes and become far more comfortable making decisions amid uncertainty. Rather than using a top-down, strategy-driven approach (which worked in the past), these companies need to innovate using build-assess-learn cycles, even when not entirely sure of the outcome. They need to focus on pilot tests and prototypes that can be developed and rolled out quickly, assessed for performance, and scaled up (or shut down) accordingly. They need to embrace the concept of “fail fast and fail cheap” and build up their digital capabilities through direct experience. And rather than making a single big, strategic bet, they need to manage multiple initiatives, trying out new business models with low sunken costs, killing off the losers, and scaling up the winners.

Our experience with companies in virtually all industries shows that success with this kind of trial-and-error approach requires a structured transformation methodology built around three steps: securing quick wins at the outset, scaling up successful initiatives, and leading and sustaining change. (See “Three Stages of a Digital Transformation.”)

Three Stages of a Digital Transformation

BCG has helped clients in all industries launch transformations across a range of functions and disciplines. Based on that work, we have developed a three-part methodology:

- Launch quick wins that generate financial results in 3 to 12 months, free up capital for the overall effort, and establish momentum.

- Win in the medium term by developing the business model and operating model to increase the company’s competitive advantage and fend off new entrants.

- Lead and sustain performance by building capabilities and designing the organization to build on performance gains over time.

In a digital transformation, these steps are slightly modified. The process still starts with quick wins, but they are aimed at rapidly developing new digital products and services and improving the customer experience (rather than freeing up capital to fund a longer journey). The second step in a digital transformation is to scale up the most successful digital initiatives and fit them into the organization in the right way. And the third step is similar: leading and sustaining improved performance over time. (See Transformation: The Imperative to Change, BCG report, November 2014, and The New CEO’s Guide to Transformation: Turning Ambition into Sustainable Results, BCG Focus, May 2015.)

Together, these steps can help management teams determine where to start, how to manage the process, and how to generate sustainable progress with their digital transformations . (See Exhibit 2.)

Securing Quick Wins at the Outset

Companies seeking to pursue digital often proceed from very different starting points, with different capabilities, circumstances, and degrees of ambition. Some will require a full transformation of their operations, processes, and business model in order to fully leverage digital technology and drive revenue. Others may only need to increase efficiency by reengineering their existing business and operating models.

Regardless of how ambitious their digital effort, companies should start with quick wins in at least one of several areas: improving the customer experience, offering new digital products and services, and digitizing internal processes.

To improve the customer experience, some energy companies are starting to offer mobile apps that allow customers to check bills and obtain meter data. More advanced offerings from retail chains allow customers to keep track of shopping lists and order out-of-stock items through an e-commerce portal on their smartphone. (See “ A Retail Player Quickly Rolls Out a Mobile App .”) Similarly, some travel sites send flight status updates, departure gates, seat assignments, rental car confirmations, hotel directions, and other trip-related information to customers’ phones—all sequenced to arrive at precisely the right time. And automakers are improving sales by using digital channels to send vehicle information and specs to potential customers at critical junctures in the purchasing process.

The second source of quick wins is new data-driven offerings and services that complement the company’s existing assets and business model. These offerings don’t merely improve the value proposition for customers; they transcend it and help the company expand into new areas of the value chain. For example, many banks are moving beyond the processing of payment transactions into services such as shopping, product comparisons, discounts, and post-transaction ratings. Similarly, telecom companies are starting to provide streaming-video and e-commerce services for their customers, in addition to basic voice and data. (See “ A Telecom Company Evolves from Network Operator to Digital Service Provider .”) In the industrial goods industry, many companies are now using embedded sensors in capital equipment to warn users of maintenance issues, allowing them to make less expensive repairs early on and prevent larger problems.

The third option is to use digital to improve internal processes and functions, such as finance or HR. This approach is particularly relevant for B2B companies, which place less emphasis on the customer experience. The use of digital can improve the efficiency and accuracy of internal processes, reduce costs, and allow the company to use data-driven analytics to improve performance over time.

Whether a company begins its digital transformation by improving the customer experience, developing new products and services, or improving internal processes (or a combination of all three), speed is critical. Instead of taking the traditional, linear approach to rolling out new initiatives, companies should quickly bring new ideas to market, gather customer feedback, and refine the concept iteratively. Many accomplish this by means of the minimum viable product (MVP) process of prototyping.

The MVP process is based on the idea of the “good enough” product. Rather than trying to perfect new products or services internally during the development stage, the company instead aims to get them to market quickly, with just enough features included to make them functional. That allows the company to minimize its investment, test the new products and services in the real world (instead of in artificial settings such as focus groups), and refine them using customer feedback. For example, the initial versions of apps and online stores are often quite basic, with new features and functions added over time, depending on how the products are used by customers.

Scaling Up Successful Initiatives

Once the company has identified its most important digital priorities and launched some quick wins, it faces the challenge of scaling up the most promising ventures. Several levers are available to accomplish this. The right one depends on the company’s level of ambition, the strength of its existing digital capabilities, and external market factors (primarily, the degree of disruption posed by new digital competitors).

The fastest way to scale up digital initiatives is to acquire digital talent on a temporary basis and then bring it in-house over time. As the company embeds talent, it can create digital units that serve as a center of excellence and an internal repository of its current thinking on technology. This is an iterative and incremental model that allows the company to develop digital capabilities organically. Redesigning business processes in this fashion takes time, but it allows the company to develop its own expertise. Critically, success often requires new leadership positions, such as a chief digital officer.

A second, and bolder, approach is to create an internal incubator to leverage capabilities already developed by another company—preferably, an entrepreneurial one. This can be done through early-stage funding of start-ups (the corporate venture-capital model), a joint venture, or an outright acquisition. (See “ An Insurer Creates a Joint Venture to Enter a Challenging Market .”) Regardless of the ownership structure, the company takes an active role by investing in and developing the new entity, with the goal of cultivating digital capabilities that it can harness—and potentially bring in-house. This approach allows the company to move quickly into digital and build a start-up mentality while limiting the risk of failure and the impact on existing operations. However, it requires capital, the willingness to act like an investor, and the right degree of oversight.

Leading and Sustaining Change

The third step in our digital transformation methodology requires the right set of internal resources. Even successful pilot projects and prototypes will not achieve their potential without organizational support. Companies need to nurture these projects to make sure they become sustainable at scale.

Most important is leadership. The company’s digital agenda needs to be driven by executive management, with visible support and accountability. (Bottom-up approaches usually do not last.) Talent and culture are critical as well. The company must hire high-potential employees with skills in such areas as agile development and analytics. And it must build a “venture” culture within both the business units and IT—including a trial-and-error mind-set that not only tolerates failure but understands that failure is a critical part of the process. In this effort, HR should work closely with the business units.

The company also needs to determine how IT can best support its digital initiatives and whether to house its digital capabilities within the business units or in a corporate center of excellence (either within or outside the company). Many companies opt to deploy dedicated new-technology platforms—particularly for customer- and analytics-focused initiatives—which function separately from the core IT department and have their own databases and other infrastructure. Digital initiatives require different capabilities and entail much faster development cycles, and they often benefit from having a clear place in the organization, along with dedicated resources. (See “ An Auto Manufacturer Uses a Two-Speed IT Structure to Support a Digital Initiative .”)

Many companies also need to break down institutional barriers and silos in order to foster a more collaborative approach between IT and the business units. Cross-functional teams put more eyes on each initiative, allowing problems to be rooted out early and promising ideas to be pushed out to market faster. (See “ A Global Bank Revamps Its Organizational Model .”)

Finally, companies should adopt strong change-management processes. A key challenge is meshing digital initiatives with the company’s established operations and ensuring that employees and managers on both sides continue to collaborate so that digital successes can spread throughout the organization. At the same time, even failures present an opportunity to learn.

How to Move Forward

Before a company can begin its digital journey, it needs to assess its readiness by looking at the availability and quality of data, its IT architecture (including the degree to which it is digital-ready), its capabilities in innovation, and its overall culture and readiness for change.

Talent is a critical element—management teams should work with HR to evaluate the company’s pool of digitally skilled employees, including those in areas such as programming, mobile, IT implementation, digital marketing, social media, and data analytics.

In addition, the company should understand its competitive environment, meaning current trends in digital that are affecting its industry (or are likely to have an effect in the next several years), along with the digital capabilities of competitors. This need not be a comprehensive, exhaustive process. Rather, the entire assessment should take four weeks at most. As with all digital endeavors, speed and initiative are critical. Launching quick-win initiatives based on partial information is far better than trying to complete a precise assessment before taking a first step.

Acknowledgments

The authors thank Martin Danoesastro, Walter Delph, Maya Gavrilova, Asger Johansen, Alexandra Kampmann, Sebastian Klauke, Louise Herrup Nielsen, Tuukka Seppä, and Fredrik Vogel for their contributions to this report.