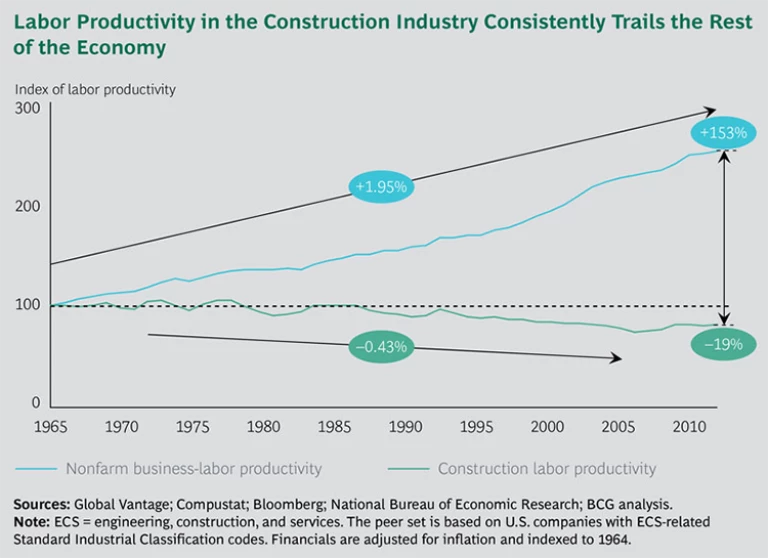

One of the most perplexing characteristics of the engineering, construction, and services (ECS) industry is its low productivity, which persistently trails far behind that of the overall economy. For example, the productivity of the U.S. economy has increased by 153 percent since 1964.

Related Article

2015 ECS Value Creators Report: Opportunities amid Uncertainty

What’s next for engineering, construction, and services companies as oil prices head south? The industry is in for a long, tough slog—just like the past few years.

During the same period, construction industry productivity has decreased by 19 percent. (See the exhibit below.) The industry is leaving big money on the table: a percentage point increase in productivity is worth $7 billion to the industry as a whole.

Although some industries—music distribution and automobile manufacturing, to name just two—have completely transformed themselves since the 1960s, today’s construction sites look very similar to those of 50 years ago. Music distribution has moved from brick-and-mortar stores to online sales and more recently to subscription-based streaming models. Automotive production has transitioned from a labor-intensive to a robot-intensive industry. Meanwhile, despite the introduction of some technological improvements, construction has remained a labor-intensive business.

The ECS industry’s chronic failure to improve productivity can be traced to a combination of factors, some of which are common to most industries and others that are unique to ECS. Those that are common to most industries include more complex project requirements, more aggressive completion schedules, and an aging workforce. More than one industry expert interviewed for this report told us that “schedule is king.” This means that in a business in which most contracts include stiff penalties for late completion, finishing the job on time is a higher priority than improving productivity. Other experts pointed out that foremen who were thirtysomething dynamos in the 1980s are slowing down as they enter middle age and that attracting young talent grows more challenging by the day.

But while ECS companies contend with those familiar constraints, they must also operate in conditions unique to the industry, including ever more congested work sites, a fragmented subcontractor scene, and limited adoption of disruptive technology. In today’s increasingly crowded world, ECS players must work in tighter, smaller spaces located within more closely settled environments, which leads to exceedingly congested construction sites and adjacent areas. Most subcontractors are still regional or local players without the scale to invest in productivity initiatives for their crews. Furthermore, the little disruptive technology that has been introduced into the marketplace has not been widely adopted. Modular construction, for example, was widely hailed as a game changer when it emerged on the scene, but success stories have been few and far between and adoption low.

Improvements to construction productivity won’t happen overnight, but players can take specific actions both individually and collectively. At the company level, players can intensify their use of digital modeling, adopt lean principles in construction, leverage crowd sourcing in the design phase, and experiment with robotics at the construction site.

At the industry level, players should continue to consolidate to build scale, transform their bidding processes, and focus on winning a few large projects rather than numerous small projects. They should also encourage value-engineering design throughout the process, keep moving toward design-build assignments, and promote outcome-based frameworks for public-private partnerships.