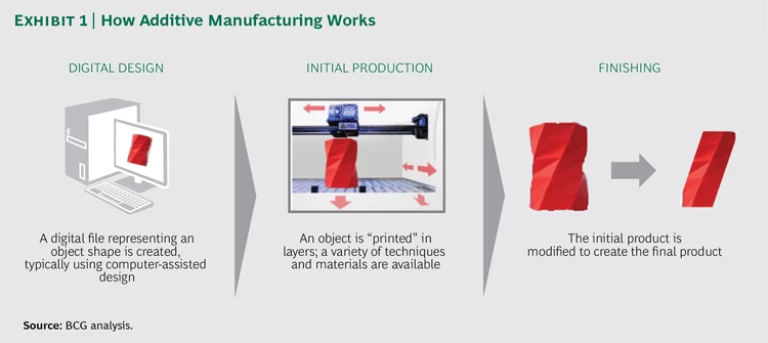

For more than two decades, companies have been excited about a revolutionary industrial process that has the potential to reinvent manufacturing. Additive manufacturing—also known as 3-D printing—certainly represents a significant change in the way items can be produced. As opposed to traditional injection molding, casting, or other “subtractive” manufacturing processes, additive manufacturing takes a digital file and creates three-dimensional objects by printing successive layers of materials that are then modified slightly to create the desired end product. (See Exhibit 1.) Many predict that this technology will eventually displace myriad traditional manufacturing processes.

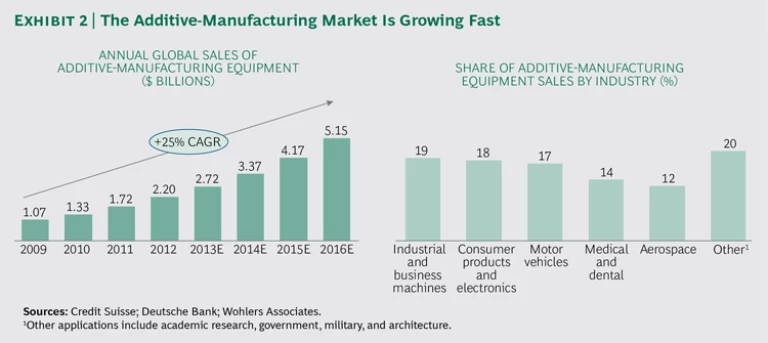

The enthusiasm about additive manufacturing does have merit. In recent years, rapid technological advances have driven down the costs of equipment and materials, making 3-D printing increasingly accessible. The fast-growing market for additive manufacturing is projected to exceed $5 billion by 2016, according to Credit Suisse. (See Exhibit 2.) Other experimental processes are being developed that extrude objects out of liquid material.

Additive manufacturing is being adopted in many industries, particularly machinery, consumer products, motor vehicles, medical devices, and aerospace. General Electric is one of the companies that are already additively manufacturing complex parts for aircraft engines in significant quantities. At the other end of the spectrum, consumers can have novelty items additively manufactured at The UPS Store locations around the country or buy their own 3-D printer for $1,000 or less.

But is additive manufacturing really ready to take off and be widely adopted for large-scale manufacturing? We believe that significant challenges must first be overcome. The chief constraints are economics, speed, and material science. Certainly, additive manufacturing offers benefits for some applications, but companies should understand how, specifically, the technology can create value for their business before they invest.

We also believe that while additive manufacturing is economically viable for only a limited number of specific applications today, it is likely to play an important role in most manufacturing operations over time. Companies that begin experimenting with the technology now will be positioned to utilize it successfully in the future. However, they should view additive manufacturing as part of a suite of advanced manufacturing tools that can improve performance, operational efficiency, quality, and the customer experience.

The Challenges of Additive Manufacturing

Considerable constraints prohibit large-scale additive-manufacturing adoption, both now and in the foreseeable future. The most notable challenges include the following.

Economics. Additive-manufacturing materials are prohibitively expensive for most high-volume manufacturing applications, often more than offsetting any benefits that may be derived from any reduced labor that additive manufacturing confers. For example, thermoplastic materials used for traditional injection molding cost $2 to $3 per kilogram, whereas the corresponding photopolymers used in additive manufacturing cost anywhere from $100 to $300 per kilogram, according to a 2014 report by Wohlers Associates.

Industrial printers, which can cost hundreds of thousands of dollars each, add to the economic challenge and make the up-front investment for industrial applications substantial.

Material Availability and Performance. Today, 3-D objects can be printed from a wide range of polymers, paper, ceramics, composites, and alloys that include aluminum, nickel, chromium, and stainless steel. However, many specific alloys and compounds required for industrial applications are not yet available for additive manufacturing.

The durability and consistency of additively manufactured materials pose further concerns. Additively manufactured parts may not perform as well as those made with traditional methods. Titanium alloys used in additive manufacturing, for example, result in lower yields and tensile strengths than titanium alloys used in traditional methods. And the dimensions of parts built from digital designs may deviate from the norm because of inconsistent finishing, jeopardizing a manufacturer’s ability to meet performance specifications. Yet another downside is that it currently is not feasible to evaluate the strength of a product while it is in the process of being additively manufactured. As a result, manufacturers can inspect such parts only by using less precise methods, such as X-ray or computed-tomography (CT) scans.

Speed. Industrial 3-D printers are much slower than the traditional high-volume manufacturing machinery. One example is plastic injection molding. According to our analysis, a traditional plastic-injection-molding system can produce nearly 26,000 parts per workday. By contrast, an additive-manufacturing laser-sintering machine can produce only 111 comparable parts per workday. In some cases, such as with aerospace engine parts, it can take two days to print a single object.

Printer manufacturers are making progress in addressing such technical barriers. Additive manufacturing will be used more widely as costs continue to drop, production speeds accelerate, and materials become better, less expensive, and more available. In the meantime, however, it is important that companies evaluate their additive-manufacturing strategies and have a clear view of the trade-offs and best options for specific applications.

How Additive Manufacturing Can Help Companies Create Value

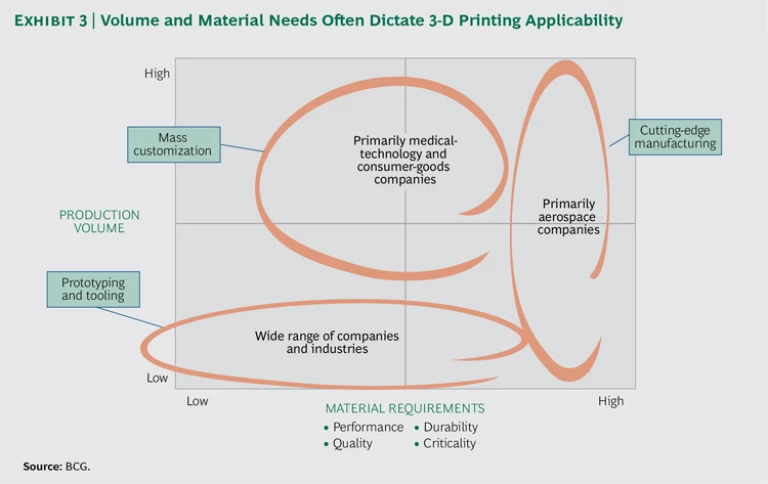

Additive manufacturing is unlikely to replace factory assembly lines anytime soon, but additive technologies can create tangible value for companies today in three main application clusters. (See Exhibit 3.)

Prototyping and Tooling. Additive manufacturing is most established in the area of prototype development and specialized tooling. These applications are uniquely suited to additive manufacturing: they require a high degree of customization, their production volumes are low, the performance and durability requirements of the materials they use are relatively modest, and their lead-time requirements tend not to be stringent.

Additively manufacturing prototypes improves the product development process by enabling engineers to design, test, redesign, and retest products more simply and more quickly. Prototypes can be manufactured in-house in a matter of days with an additive-manufacturing printer; outsourcing to suppliers requires longer lead times when traditional methods are used. Product performance is much less critical because prototype parts are often used only a few times; in contrast, a part meant for ongoing use would have to last for months or years. A wide variety of companies, including Black+Decker, adidas, Medtronic, Ford, and Xerox, currently use additive manufacturing for prototyping and tooling in some of their applications.

Mass Customization. For custom-made products that can command premium prices from buyers, additive manufacturing offers advantages over traditional manufacturing. Production processes need not be retooled or altered to additively manufacture a custom product. Rather, companies can simply modify the digital instructions for the printer. Parts can be altered at the SKU level for individual consumers. For these custom applications, the higher material costs of additive manufacturing are typically offset by the decreased need for labor and tooling; making unique items can also result in less material waste, offering further savings. Time is also less of a constraint because longer lead times are often acceptable for custom parts.

Medical-device manufacturers use additive manufacturing to create products that are customized from start to finish. For example, ConforMIS, founded in 2004, additively manufactures individualized knee-replacement parts—along with unique accompanying surgical kits—for approximately 1,000 procedures each year. The process begins with a 3-D CT scan of the knee; the data harvested from these images is used to print the orthopedic device. Studies show that while additively manufactured orthopedic devices cost significantly more, they fit better and provide superior patient satisfaction.

In other examples, Siemens uses additive processes to create specialized products like hearing aids. Align Technology uses such processes to fabricate orthodontic devices. Consumer goods companies are using additive manufacturing for mass-customization applications. Nike, for example, offers an additive-manufacturing service that lets buyers paying a premium customize the size, fit, and color of athletic shoes.

Companies can also use additive manufacturing to fabricate specialty spare parts. In addition to reducing inventory space, printing parts on-site can enable companies to get critical machinery back up and running more quickly, a particularly important consideration for equipment that operates at remote locations, such as mines.

Cutting-Edge Manufacturing. A third cluster of applications in which additive manufacturing is being adopted is high-value, complex end-use parts. Such cutting-edge manufacturing operations are primarily found in the aerospace and defense sectors. In many ways, cutting-edge manufacturing is the “sweet spot” of additive-manufacturing technology.

One key reason is that production volume requirements in this sector are manageable, even with the speed constraints of additive manufacturing. For certain components of aircraft and defense-related products, fewer than 3,000 parts are required per year. Even if a 3-D printer can produce only one part every 24 hours, many manufacturers can make a one-year supply of parts with fewer than ten printers.

Additive manufacturing also enables companies in the aerospace and defense sectors to print complex parts and unique designs that cannot be manufactured using traditional processes. Benefits to manufacturers include printing single parts that previously required subassembly and more effectively reducing the weight of parts.

A further consideration in cutting-edge manufacturing is that additive manufacturing sometimes gives OEMs an alternative source of supply. OEMs can disrupt the supply chain by bringing outsourced production in-house. This can be especially effective and economical for high-value parts that have previously been sourced from specialized, high-margin suppliers.

GE Aviation offers the most prominent example of the use of additive manufacturing for high-value, complex parts; this General Electric company additively manufactures fuel nozzles for its next-generation Leading Edge Aviation Propulsion, or LEAP, turbofan engines. Traditionally, fuel nozzles have been cast in ceramic molds. Using an additive-manufacturing direct metal-laser melting process, GE Aviation has been able to produce nozzles in-house and reduce the weight of each unit by 25 percent. The additive process prints nozzles as a single part; in contrast, nozzles built with the traditional manufacturing process contained 18 parts. GE Aviation plans to produce more than 100,000 parts via additive manufacturing by 2020.

Other aerospace and defense companies are using additive manufacturing as well. Space Exploration Technologies, also known as SpaceX, relies on additive manufacturing to print oxidizer valves that are used in the Falcon 9 rocket and an engine chamber for the SuperDraco rocket. Lockheed Martin is experimenting with additively manufacturing titanium components for satellites, and Boeing additively manufactures such parts as air ducts and hinges for the 787 Dreamliner.

Is 3-D the Right Option for Your Business?

Additive manufacturing is an exciting technology, but one whose widespread adoption is challenged by a number of constraints, as we have described. When used in the right applications, however, additive manufacturing can be a one-of-a-kind, disruptive technology.

To identify opportunities to use additive manufacturing to create and capture value, companies should first assess which aspects of their operation fall within the current clusters of adoption. Doing so will identify the highest-impact opportunities over the near term.

A next step is to determine whether additive manufacturing, in instances where it makes sense, is consistent with an organization’s future manufacturing strategy. Additive processes are among several advanced technological tools that have the potential to influence the manufacturing landscape and improve productivity in the years ahead. Some of the other tools are autonomous robots, integrated computational-material engineering, digital manufacturing, the Industrial Internet, and flexible automation. (See “ Why Advanced Manufacturing Will Boost Productivity ,” BCG article, January 2015.)

As 3-D printers and material science evolve, additive manufacturing will become applicable—and economically feasible—in more areas. We believe every large manufacturing organization should consider how additive manufacturing fits into its overall manufacturing strategy. We also encourage organizations to experiment with additive processes and search for opportunities to use the technology to create value for the business.