Asset managers face a future in which growth isn’t a given but cost and pricing pressures are constant. Although assets under management (AuM) are rising, revenue margins continue to erode. Superior investment performance and historical distribution strength are not assured paths to greater market share.

Global Asset Management 2015

- Sparking Growth with Go-to-Market Excellence

- The Asset Manager’s Go-to-Market Survival Guide

- Catching Asset Management’s Tilt Toward Asia

In short, the basis for competitive advantage has changed. Managers need to execute better—and with sharper differentiation—to gain a disproportionate share of net new flows, which seem likely to remain well below precrisis levels in the low single digits.

Generating value through go-to-market excellence is more crucial than ever before. The Boston Consulting Group’s go-to-market excellence framework comprises six sets of fundamental capabilities or functions. They include market intelligence and strategic priority setting, product development and portfolio management, marketing and customer communications, sales platform management, performance monitoring, and, finally, underlying organizational enablers. Each component has its own array of metrics and KPIs. (See Exhibit 1.)

Although this framework includes many traditional elements to maximize performance, the crucial competencies for achieving success in each dimension of the framework are shifting, and managers are responding by adopting best practices—such as marketing analytics—from other industries and porting them into the asset management space.

The new environment is forcing many managers to be more selective and rigorous in their approach to becoming best in class. For example, many are focusing more sharply on where they place investments for the data and digital capabilities they need to remain competitive. Others are successfully launching new lines of differentiated funds by developing focused capabilities in coordinating customer insights, sales, marketing, and product activities.

As a result, in an era of diverse global markets, areas of focus now vary widely among managers—influenced by such factors as client base, market competition, and regulatory environment.

The most successful managers now prioritize two or three components of the capability framework to achieve truly best-in-class performance. These managers, by very selectively pushing the envelope in go-to-market performance, capture a disproportionate share of net flows. Their highly focused efficiency and effectiveness improvements unlock money and free up management attention for product innovation, entry into new asset classes, enhanced client relationships, and new marketing initiatives. They are taking market share at a time when superior investment performance—although more difficult to sustain—is just a minimum requirement, not a sufficient differentiator.

In many cases, the winning managers gain advantage by developing and deploying advanced capabilities in data-driven decision making. In the U.S., such decision making is enabled by an enhanced use of big data, as well as digitally driven advanced analytics, such as use of transaction data to customize physical interactions.

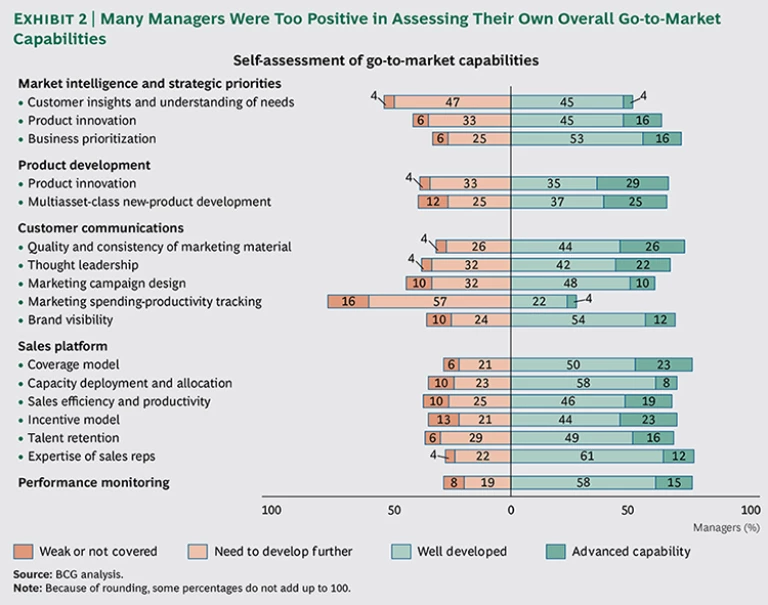

These successful players stand in contrast to a broader set of managers polled in our latest benchmarking survey, which measured participants’ perceptions of their own go-to-market capabilities. The collective responses reflected a lack of insight or critical judgment by many asset managers, who tended to over-rate their own overall capabilities across the framework. At the same time, they reported critical gaps and lack of progress in specific capabilities and components that they also ranked as being crucial for commercial success. These included customer insights, marketing spending-productivity tracking, and product development and innovation. (See Exhibit 2.)

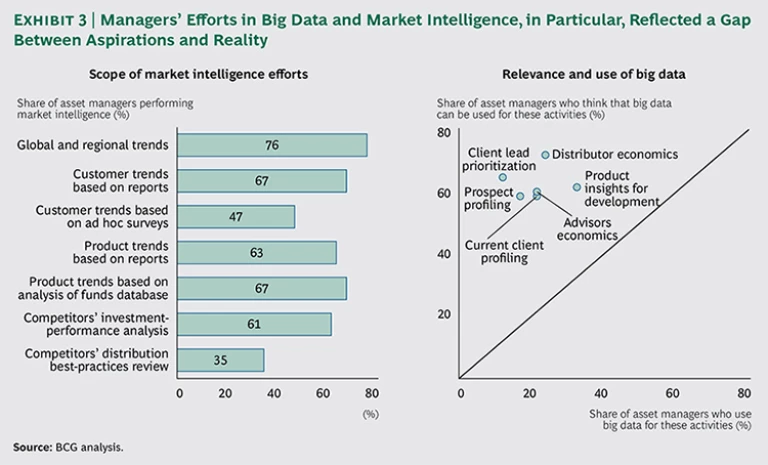

The gap between managers’ aspirations and reality was particularly wide in managers’ use of big data and market intelligence. Although most rated market intelligence and big data capabilities as relevant and important, their use and ability levels were generally low. Only a third of managers looked at competitor activity using specific research. Relatively few applied big data to harvest retail investor or institutional client insights. (See Exhibit 3.)

Data-Driven Decisions and the Role of Big Data

The advantages won by today’s strongest managers, as noted above, are often rooted in their advanced capabilities in data-driven decision making. Innovation, increasingly enabled by digital technologies and data, has become a critical driver of that advantage. For many top-performing managers, the competition to achieve data sophistication now affects their approach to every element of the traditional go-to-market framework.

In pursuit of this goal, managers are refining their data, digital, and analytic capabilities, whether or not they use or even have access to big data.

Big-data capabilities are mostly relevant in the U.S., where the larger and more uniform market and greater data availability allow leading managers to develop this approach. But outside the U.S., data-driven decision making, not limited to big data, is still highly relevant. For example, leaders elsewhere do the following:

- Use client-relationship-management systems to track and understand preferences of distributors and advisors

- Continuously crunch data from mutual fund and institutional mandates for product insights

- Use data-driven insights, such as transaction data and interaction history, to prioritize products and create messaging for distribution campaigns to specific advisors and companies

The role of data needs to be adjusted to the scale of each market and the costs and benefits at stake. Focus and prioritization are crucial. Since U.S. data practices are currently the most advanced, leading managers in the U.S. will achieve a more sophisticated level of data-driven decision making before most others elsewhere.

In the future, current U.S. practices will influence practices in other markets—for example, by expanding data availability. U.S. managers have already achieved a sustained leadership position in European markets and will be quick to export their U.S. capabilities there. Non-U.S. players would be wise to begin investing in analytic capabilities in preparation for this evolution, staying alert to data-driven developments in the U.S.

Data tools and capabilities are relevant to all six components of the traditional go-to-market framework. The most effective players today often focus their priorities on three capabilities, which we will examine individually. They are marketing effectiveness, enhanced sales-force productivity, and enhanced customer experience.

The Future State of Marketing Effectiveness

Current models of marketing effectiveness allow teams to create a message and position it within the marketplace. But in today’s environment, those models generally fail to distinguish an asset manager from its peers and competitors. Furthermore, current practice provides little tracking of return on marketing investment (ROMI), limited understanding of its implications, and little nuanced segmentation by distribution channel.

The future state of marketing effectiveness being developed by the most successful players offers a strong, distinct brand and value proposition. ROMI is measured and tracked more accurately, employing synchronized metrics and analytics that are aligned across the organization to meet common decision-making targets. And there is a keener understanding of customer segmentation and needs, allowing marketing that is tailored to those needs. This is achieved more systematically and brought to the next level with additional, timely information.

The future state of marketing effectiveness, in short, improves ROMI, drives increased sales, and employs advanced data and analytics to help create a virtuous circle.

Another hallmark of future marketing is global consistency in an increasingly globalized world, with nuanced messaging by distribution channel, customer segment, and market. The rising focus on the needs of retail customers has increased the complexity of that task.

Marketing and branding have always focused mostly on B2B efforts even within retail channels. Today, direct marketing is increasingly relevant, especially in more open markets such as the U.S., the UK, and Australia, where many retail investors are becoming self-directed. Defined contribution plans have shifted from single-source to best-in-breed models, which allow retail investors to decide where to invest a large portion of their retirement income. Large companies increasingly use a provider to host defined contribution programs, such as 401(k) programs in the U.S., offering the investor a selection of multiple fund families.

However, even in this more retail-driven environment, B2B marketing to advisors also needs to be strengthened and nuanced. Many of the most sophisticated retail investors use advisors and increasingly value a strong brand. Finding effective ways to reach these high-potential clients as well as their advisors is therefore critical.

Enhanced Sales-Force Productivity: Data-Driven ROI

Current models of sales force productivity generally support business as usual using a rearview mirror approach based on data from past sales. Most productivity efforts offer little return on investment (ROI) insight regarding time or money invested in clients or sales activities.

The strongest managers have begun to develop data on sales potential to inform their decision making. To achieve best-practice productivity levels, data-driven coverage and support models must employ multiple information sources. Incorporating both past performance and future potential can be done more deeply and tracked more easily over time. Increasingly, dedicated sales teams are fully equipped with tools to provide customer insights. Boundaries between territories and client segments are defined and enforced through periodic review. Sales managers prioritize time spent on clients and activities in order to generate the highest ROI.

Sales models that track ROI for time and money spent can also test returns on the basis of specific scenarios and can provide narratives and recommendations for sales teams. Digital data and analytic programs incorporating Web traffic can track client activity and interests, in turn identifying more productive client-outreach opportunities for sales teams.

Better Customer Experience: Serving by Segmenting

Current approaches that employ customization are limited. They provide little institutional knowledge of the customer beyond what is remembered by sales managers. Customization of client investment proposals is often limited to a few generic offerings, such as account size. Customer feedback is generally just qualitative, and little quantitative data is captured.

Best-in-class capabilities in customer subsegmentation lead to better value propositions and enhanced client experience. Advanced analysis of client portfolios and purchase histories can help customize sales communications and refine product offerings. These results are possible because analytics teams increasingly are equipped with more accurately integrated data sources.

Finer segmentation is also possible today because clients—institutions, advisors, and end investors—now have access to more data through online and other digital means. Sales managers are no longer the single source of information. That means that they waste less time responding to random, nontransactional, and generally lower-value generic queries that can be channeled to digital and other direct communication channels.

The outcome is a client better served by a more tailored offering, and an asset manager with an enhanced brand perception.