Wholesale transaction banking—which includes payments, cash management, and trade finance—is an increasingly important business for banks, one critical to building strong client relationships and cross-selling. It also has several structural advantages: moderate cyclicality, relatively low risk, and (with the exception of trade finance) low capital requirements. Further, it is a fairly stable source of low-cost liquidity and funding.

Global Payments 2015

- Listening to the Customer's Voice

- Unlocking the Potential of Consumer Digital Payments

- Bolstering Treasury and Trade Services in Wholesale Transaction Banking

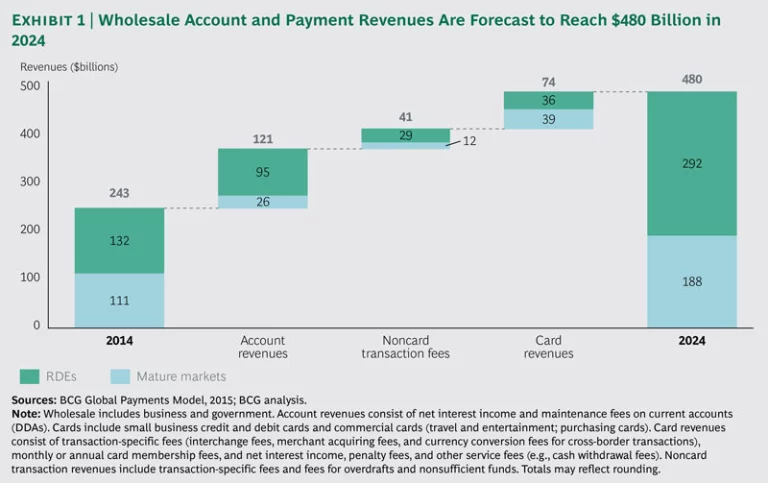

Wholesale transaction banking generated about $330 billion in revenues globally in 2014. Account and payment revenues (covered in this report) generated $243 billion and are expected to nearly double to about $480 billion by 2024, a CAGR of 7 percent. (See Exhibit 1.) Trade finance added $45 billion, and value-added services (such as information reporting) contributed another $40 billion. Trade finance revenues should reach nearly $100 billion by 2024, a CAGR of 8 percent. (See the sidebar “Being a Champion in Trade Finance.”) In general, growth will be driven by increasing volumes and deposit balances, as well as by improving spreads. The importance of all these drivers, however, will vary by region. In RDEs, account revenues stand out as a dominant growth driver.

BEING A CHAMPION IN TRADE FINANCE

Despite the recent slowdown in trade flows, trade finance remains one of the most dynamic businesses in the wholesale transaction-banking arena. Shifts in corporate needs and the rise in demand from small and midsize enterprises (SMEs) are opening numerous opportunities. In addition, trade flows are shifting, with the north-to-south, RDE-to-RDE corridors growing at an above-average pace. These opportunities, however, will be hard won. Increasing regulation and its attendant compliance requirements are hindering banks’ ability to respond to new client demands and deliver new services efficiently.

In response, many banks are reviewing and pruning their geographic footprint and client relationships, resulting in service gaps. Rising competition from nonbank providers, which tend to be more nimble and proactive, is threatening banks’ market share. Nonetheless, banks can succeed if they deliver a differentiated value proposition and forge smart partnerships.

A differentiated value proposition requires an organizational structure that listens to the voice of the customer and enables coordinated, integrated delivery of trade finance—as well as payment and cash management—services. Two trends have led many corporations to integrate their cash and trade-finance operations more closely: first, the rise of open-account trading, and second, working capital constraints. As we have seen, banking clients are seeking holistic solutions, not just individual products. The Bank Payment Obligation (BPO) is an example of this. Collaboratively developed by the International Chamber of Commerce and SWIFT, the BPO aims to bring together the security of documentary trade with the convenience and efficiency of open-account trade, opening doors to FX and hedge revenue and to direct supply-chain financing. For example, banks can offer lucrative receivables-finance solutions to exporters using BPO-facilitated trade. Developing such solutions will require close coordination across product and sales teams, including FX. Overall, banks are finding that if they can deliver a streamlined, transparent, data-rich FX and payment service, they can compete against the multibank FX platforms.

Within the organization, a differentiated value proposition requires several layers of capabilities. At the foundation, a flexible technological platform that enables integrated services and the easy addition of new functionality is needed. In the middle and at the front end, delivery models must be tailored to target segments, avoiding the “everything to everyone” syndrome. Large corporations need a robust client-service team consisting of product and country specialists as well as industry experts. The middle market can be served by a relationship manager who has strong industry expertise and coordinates well with product and country specialists. At the front end, channels tailored to the needs of specific segments are critical.

As for partnerships, banks are increasingly finding that working with the right collaborator is the most effective means of delivering their value propositions across key regions. Global banks and strong local and regional banks in emerging markets are benefiting from partnerships that combine international infrastructure and sophisticated product suites with local expertise and savoir faire.

Furthermore, while much of banks’ energy has been focused on serving large corporate clients, significant opportunity lies in serving the small and midsize market. BCG estimates that SMEs accounted for more than one-third of export trade in 2012 and that their share will likely hit 40 percent by 2020. The increasing digitization of processes has significantly lowered banks’ cost-to-serve for this segment.

Although revenue-pool growth projections are strong, excelling in wholesale transaction banking is becoming increasingly difficult. For example, the attractiveness of the business has heightened competition among banks, while deficiencies in bank services and the rise of multibank platforms have opened the door to nonbank competitors. In addition, the regulatory compliance burden has grown dramatically, adversely affecting client relationships, bank operations, product development, and international expansion. (See the sidebar “Compliance: A Key Element of Success.”)

COMPLIANCE: A KEY ELEMENT OF SUCCESS

Amid the tsunami of regulations that has flooded the financial-services industry since the financial crisis, compliance has become a key element of success in all sectors, including transaction banking. Yet many payments providers have invested extensively in compliance without seeing the desired results. This disconnect is often the result of two issues:

- Deficiencies in “Big C” (the formal compliance organization): typical problems include a lack of top talent, difficulty in implementing regulatory change, and problems with IT systems

- A payments business that does not prioritize compliance or understand how regulations should affect its business model

In order to achieve sustainable compliance, the payments business needs to take the lead. Senior leadership must set and enforce compliance objectives and make them a cornerstone of the company’s culture. The focus on compliance must extend to the front line, which needs to understand how daily interactions with clients must be tailored. The right incentives for both management and the front line can help embed a strong culture of compliance.

Moreover, effective compliance must go beyond personnel to include the way products are designed. Operating controls must be robust, and the results of compliance must be continuously measured. Organizations that can identify compliance issues, discuss them candidly, and move to address them effectively will find themselves well positioned to thrive in the ever-evolving regulatory climate. (For more on this topic, see “Enabling Sustainable Compliance at Banks,” BCG article, September 2015.)

In our view, there are four critical steps to overcoming current challenges and becoming what we call a transaction-banking champion:

- Focusing on the true needs of treasurers and CFOs

- Excelling in the basics

- Differentiating along key dimensions (such as superior data and analytics; risk management and regulatory advisory services; and flexible platforms and open architecture)

- Outperforming in go-to-market strategies

Focusing on the True Needs of Treasurers and CFOs

The roles of treasurer and CFO at large corporations and multinationals have evolved considerably since the financial crisis of 2007–2008. Responsibilities have expanded and the stature of these positions has grown. Mandates now encompass a complete balance-sheet mission that includes optimizing working capital and tightening risk management in a time of rising security and fraud threats.

BCG, leveraging a proprietary survey conducted in cooperation with BNP Paribas—a study involving some 500 corporate treasurers and CFOs—has identified critical client needs that offer banks clear opportunities to differentiate themselves. For example, treasurers and CFOs cite service quality and process execution as top criteria for selecting a bank. In addition, we see an overarching theme: companies increasingly want banks to act as advisors and partners in solving their problems and improving their operations. Allowing for some variation by region and client segment, corporate clients ranked having creative ideas and clear solutions either first or second in importance for their relationship managers (RMs). Clients also expect their banks to liaise with other business units (such as retail banking) to help solve difficulties such as inefficient client-to-business or business-to-client payments. (See also “ Corporate Treasury Insights 2015: As the Dust Settles ,” a Focus report by BCG and BNP Paribas, May 2015.)

Further, in financing, treasury needs have gone far beyond traditional credit products. They now require solutions in areas such as integrated working-capital financing, off-balance-sheet financing, and cash optimization.

In terms of service quality, treasurers and CFOs are critical of banks’ performance in several areas. They cite inefficiencies and ambiguity in service delivery and an unwillingness to explore nontraditional solutions. They would like to see increases in process efficiency and a reduction in complexity—more straight-through processing (STP), less paperwork, and more automation of administrative tasks. Treasurers and CFOs also expect transaction-banking partners to help them tackle inefficiencies in their own operations. For example, many financial executives are seeking support both in implementing payment factories and in improving electronification of their financial supply chains (such as through e-invoicing).

In terms of engagement and integration, treasurers and CFOs identify numerous pain points. For example, increased regulatory requirements—particularly around know-your-customer and anti-money-laundering initiatives—have adversely affected relationships between banks and financial executives, with many treasurers and CFOs believing that banks’ compliance processes do not adequately consider the impact on clients. They also find difficulties in the account-opening process and in systems integration and would like to see simpler and faster integration (with fewer tests and iterations) as well as more flexible integration processes. On a continuing basis, they would like to have access to more self-administration tools and a simpler way of managing accounts.

Finally, with both treasurers and CFOs increasingly open to considering third-party, nonbank providers to address their needs, there is real urgency for banks to raise their games. Our survey showed that 20 percent of treasurers and CFOs are already using nonbank providers for at least some transaction-banking services. Moreover, these providers are targeting the most profitable products, such as supply-chain finance, foreign exchange, and cross-border payments. Although banks still possess a competitive edge—higher levels of trust, strong track records in compliance, expertise in running reliable payment systems, and deep relationships built over time (reinforced by high switching costs for clients)—they must still face the probability of losing direct interactions with their clients to nonbank players. Those that successfully address the unmet as well as shifting needs of treasurers and CFOs are likely to establish long-term advisory-based relationships and a greater share of wallet. More cross-selling can translate into more revenue to invest in differentiation and innovation, which in turn can lead to a virtuous circle of more business and still more investment. This potentially virtuous circle is worth an estimated $240 billion in account and payment revenue growth from year-end 2014 through 2024.

Excelling in the Basics

The basics begin with a superior customer experience, an advisory-driven relationship model, and, for those serving international businesses, robust global-coordination capabilities. In addition, transaction-banking champions tend to have advanced pricing strategies and tactics.

A Superior Customer Experience. Customers need to be satisfied across the entire value chain, from on-boarding and systems integration to ongoing interactions across channels. Key goals should include steady improvements in both STP rates and response times—one aim being faster resolution of exceptional items—as well as lower enterprise-resource-planning (ERP) integration time, greater automation of administrative tasks, and clearer service-level agreements. Improving STP rates involves implementing new standards, in particular ISO 20022, the universal financial-industry message scheme. In addition, our survey respondents consistently mentioned that they do not want any single bank to have full visibility into their transaction flows.

The implications of the growing reliance on third-party players are especially profound for banks’ technology road maps and their impact on the customer experience. Indeed, the IT and operations side of the business must understand client needs just as much (if not more) as RMs do. Among the questions that banks should address are the following:

- To what degree are clients relying on the bank’s online channel?

- Are there certain features and functions of the online portal that no longer serve the needs of large corporate customers?

- To what extent are clients willing to pay for integration services, and should the bank invest more to enhance integration tools?

An Advisory-Driven Relationship Model. Such a model embodies a problem-solving culture. While a “can-do” attitude starts at the top, hiring RMs with certain qualities solidifies the foundation. RMs need to look at problems from each client’s standpoint, understanding their particular working-capital and process-inefficiency challenges. Transaction-banking champions tend to recruit more from industry, finding it easier to train people in payments and cash-management products than in industry-specific domain knowledge. Like their capital-markets colleagues, champions bring industry expertise to commercial pitches.

Robust Global-Coordination Capabilities. As treasury decision-making has become more centralized (both at regional and worldwide levels), global-coordination capabilities have become more important than product depth or credit capacity. Transaction-banking champions focus on improving coordination for core customers, avoiding the temptation to try to be everything to everyone. They also strengthen client loyalty through an enhanced service model that features the RM as a single entry point who owns the relationship and leverages the bank’s full capabilities. Meanwhile, there is still a role for local banks to serve global companies, much as global banks continue to need specialists in specific countries and regions.

Advanced Pricing Strategies and Tactics. Most banks have room for improvement in their pricing structures. RMs often assume that they must discount in order to win business, so actual pricing is often much lower than the bank’s guidelines. On average, we see 30 to 40 percent discounting across products, with wide disparities in price realization per client. Such discounts can rarely be explained by rational criteria. Indeed, expected drivers such as client volumes, the size of the relationship, the number of products bought, or new-versus-renewal business combined typically explain less than 7 percent of price variation. Rather, pricing is often driven by bank cultures that place a higher value on closing the deal than on optimized pricing.

In light of this situation, repricing can yield an immediate and much-needed performance lift, often 10 percent or more of total fee revenue, with two-thirds of the increase obtainable within 12 months. Superior pricing capabilities can also help steer both the bank and its clients toward an optimal product mix that better reflects risk, capital, and liquidity factors.

To support better pricing decisions, banks should move from “pricing as an art,” driven by RM perceptions of required discounts, toward “pricing as a science,” where the RM is equipped with analytical tools that provide client-specific guidance. One North American bank, for example, built a detailed pricing algorithm into an RM tool to give guidelines based on specific client situations. If the RM wanted to deviate from the norms, the approval process was automated into the workflow, and specific tools made the impact of different price points on the RM’s incentives fully transparent.

Differentiating Along Key Dimensions

There are several areas in which banks can truly stand out and differentiate themselves from competitors: superior data and analytics, risk management and regulatory advisory services, and flexible platforms and open architecture.

Superior Data and Analytics. In the short term, banks should invest in providing more basic data to all client segments. They should then explore demand from key client segments for advanced analytical tools, which they can potentially choose to develop over the medium term. According to our survey, clients need better data to track payments and accounts payable and receivable, as well as to simplify reconciliation. They value analytical tools that help improve working capital and operating efficiency. Such tools can include peer-group metrics as well as customized recommendations for cash velocity, gearing ratios, and bad debts.

Risk Management and Regulatory Advisory Services. There are many opportunities for banks to develop new compliance and risk-management services, with the goal of making compliance an asset rather than a liability. Banks should structure a commercial product that would help treasurers and CFOs with know-your-customer metrics, transaction monitoring, and alert management. Banks with expertise in local regulations, sophisticated systems for assessing counterparty risk, and advanced tools for detecting fraud should evaluate opportunities to commercialize these capabilities as well.

Flexible Platforms and Open Architecture. While treasurers and CFOs of large corporations typically want a consolidated view of their balances across all bank accounts, investments, and open-account trades, they do not necessarily want their bank to provide this view. Instead, they want the bank to readily push the data they need to the system of their choice, which requires easier integration between their systems and those of their banks, as well as the flexibility to make changes to data formats. To meet these demands, banks need to continue their migration to standard formats and open architecture.

By contrast, for small and midsize enterprises (SMEs), the value of a bank’s commercial portal and a consolidated view within that portal is relatively high. Hence, banks that can deliver on these needs will deepen their relationships and face less risk of disintermediation by third-party providers with their SME clients. In addition to functionality, banks can make their portals more attractive by improving user-friendliness and providing greater ability to customize.

Outperforming in Go-to-Market Strategies

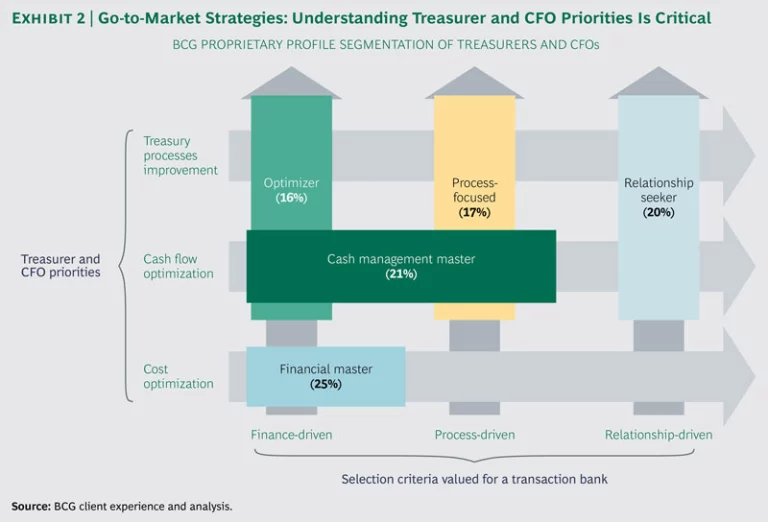

The final step in becoming a transaction-banking champion is to outperform competitors in go-to-market strategies. BCG has found that the winning combination involves fully understanding both overall client needs and the specific priorities of treasurers and CFOs. Client needs should be examined along four key dimensions: size, industry, region, and financial leverage. Treasurer and CFO needs can be categorized according to whether the priority is process improvement, cash flow optimization, or cost optimization; and within each of these categories, whether the motivation is finance-driven, process-driven, or relationship-driven. (See Exhibit 2.)

In “

Corporate Treasury Insights 2015: As the Dust Settles

” (a Focus report by BCG and BNP Paribas, May 2015), we observed that transaction banks need to respond to treasurers’ expanded roles by elevating the quality and reach of their service offerings. To remain competitive and sustain growth, they must provide smart pricing schemes, become more client centric, and create a richer and more convenient experience. Indeed, the new landscape creates high expectations from treasurers and CFOs and a sense of urgency for banks to close service gaps and differentiate their offerings, providing a combination of service excellence, cybersecurity leadership, and innovative use of digital technologies.