Top-performing corporate banking divisions are profit engines for the banks that own them. The Boston Consulting Group’s benchmarking database includes examples of corporate banking divisions with positive and growing economic profit, operating in every region and serving every client segment from small businesses to large corporations. Performing well in this domain is critical, given that corporate banking accounts for roughly half of the banking industry’s global revenue pool and will grow by an estimated 7 to 8 percent annually through 2020.

Global Corporate Banking 2015

Banks that miss out on this growth, or that underperform in such a large part of the banking business, will find it difficult to achieve their objectives in terms of market share and profitability. Yet the fact remains that more than half of the corporate banking divisions in BCG’s most recent benchmarking study are suffering from declining economic profit—and the gap between the top and bottom players has grown by 50 percent.

Can underachieving corporate banks right their ships? In our view, they can, but changing their performance trajectory is an increasingly tall order. Long a relatively stable business, corporate banking is currently being transformed by a wave of disruptive megatrends. Although the 2007–2008 financial crisis was a major fault line that put many players on the precipice, crisis-era market gyrations camouflaged other, more far-reaching trends that have undermined traditional business models in corporate banking. Dynamics such as the impact of new regulation, shifting client needs, digitization, disintermediation, and globalization will continue to disrupt even as the crisis recedes into history.

It is also possible that we will witness the demise of the traditional multiproduct corporate banking model. Some regulators and politicians seem to be pushing for a simple “utility” model for basic lending, cash-management, and risk-management services. This model would presumably be supplemented by less-regulated shadow-banking entities that provide more complex services.

While it would be premature to write the obituary for corporate banking as we know it, today’s players must markedly change how they do business if they hope to thrive in the future. The increasing divergence between the top and bottom performers shows that players adapting to the new environment can create significant value. Those that fail to adapt their business models run the risk of suffering prolonged, painful periods of underperformance.

On the basis of our work with leading players in every region and client segment, we see a number of critical moves in corporate banking. The first starts with a clear-eyed review of the current portfolio of client segments, products, and regions served. Banks no longer have the luxury of being all things to all clients in all places. Then there is a set of initiatives to undertake. These include identifying new value propositions for clients, improving specialization and differentiation, building new credit capabilities that are better suited to the postcrisis environment, and investing in value-based pricing initiatives. Finally, there is a set of enablers that banks should focus on from front to back. These include digital prowess, operating excellence, and a high-performance organization.

To be sure, most corporate banks have already spent significant time and resources trying to improve their performance along such lines. But results have often been disappointing. Relatively few top players are driving focused and well-resourced programs that steadily build competitive advantage.

Ultimately, the winning corporate banking divisions in 2020 will internalize elements such as the above and will be even bigger economic-profit engines for the banks that own them. But the time to act is now.

The Recent Performance of Corporate Banks

Since the start of the 2007–2008 financial crisis, it has been a struggle to create value in corporate banking in many markets around the world. The 2014 edition of BCG’s Corporate Banking Performance benchmarking effort, with more than 250 participating corporate banking divisions serving small businesses, midmarket companies, and large corporations, showed that two-thirds of corporate banking divisions had returns on capital below the hurdle rate. (BCG’s methodology uses a 16 percent pretax hurdle rate, and assumes that regulatory capital is 10.5 percent of risk-weighted assets.)

The challenge was particularly severe in Western Europe as well as in Central and Eastern Europe, with median pretax returns below 10 percent in both regions. But even in relatively fast-growing markets such as Latin America and Asia-Pacific, a significant number of players are battling against increasingly competitive margins, too much reliance on lending products, and rising loan losses.

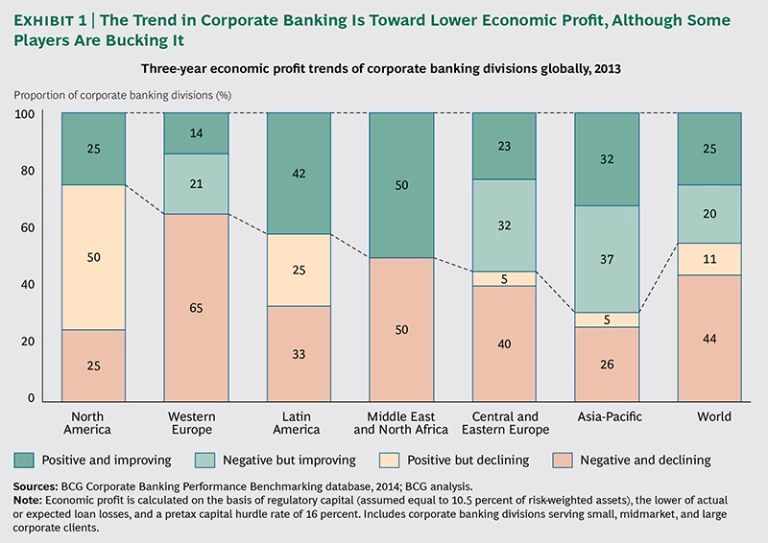

Our 2014 benchmarking also found that more than half of corporate banking divisions worldwide showed declining economic profit over the previous three years. (See Exhibit 1.) North American banks stand out for above-average performance in terms of return on capital, but even their returns are trending downward as postcrisis competition intensifies. Western Europe, despite turnaround initiatives at many banks, has a large number of players—some 65 percent—with negative and declining economic profit. More than half of Latin American players show declining economic profit.

The situation appears to be the reverse in Central and Eastern Europe, where more than half of corporate banking divisions show rising economic profit. Yet many started the period with severe profitability crises because of local macroeconomic factors and severe loan losses. In Asia-Pacific, about 70 percent of local players are on upward economic-profit trajectories.

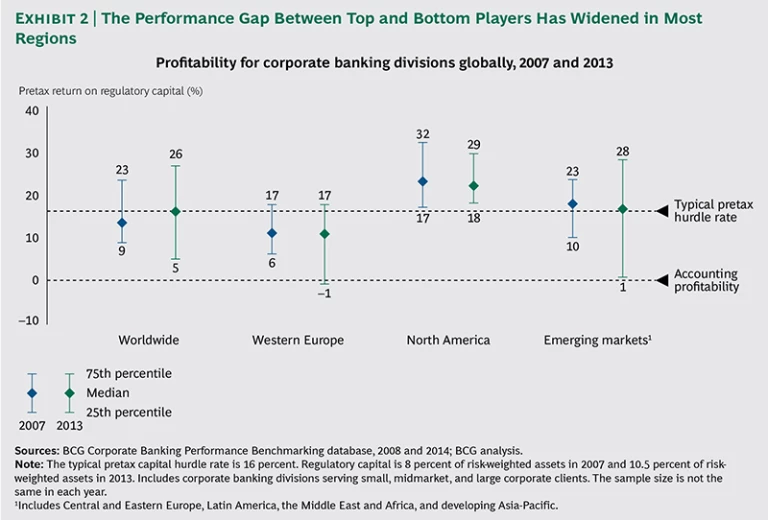

It is also worth noting that, in most regions, the gap between the top and bottom players has widened in recent years. (See Exhibit 2.) In our 2007 study, for example, there was a 14-percentage-point gap in return on regulatory capital between the top-quartile and bottom-quartile players. In our 2014 study, this gap had increased to 21 percentage points and had widened in all regions except North America. Such divergence underlines a key point: corporate banks with the right business model can create value in all segments and regions, despite local or segment-specific challenges. Even in Western Europe, which is one of the most difficult environments, top-quartile players consistently exceed typical hurdle rates.

While corporate banking has experienced some challenges in many places, it remains more attractive than many other lines of business for the typical universal bank. But a critical question remains: where are the greatest prospects for growth?

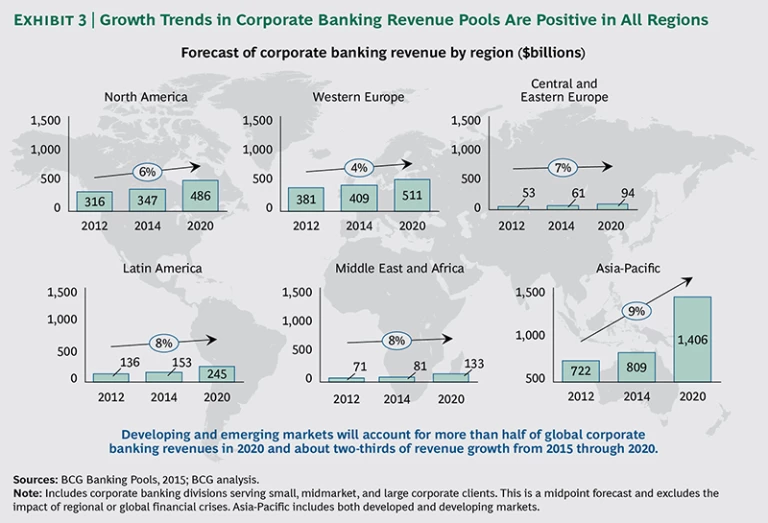

The first point to be made—and a crucial one for senior executives wondering where to invest their resources—is that corporate banking represents one of the largest available revenue pools. BCG’s global financial institutions revenue-pool model projects that roughly half of the global banking market consists of financial services purchased by small, midmarket, and large businesses. In many developing and emerging markets, where retail banking (including mortgages) and capital markets businesses are still relatively young, corporate banking is a particularly strong sector. Indeed, more than 40 percent of total global corporate banking revenues currently originate in developing and emerging markets. Moreover, BCG projects positive growth trends in corporate banking revenue pools in all regions through 2020. (See Exhibit 3.) While this forecast could be derailed by unexpected economic or geopolitical events, the growth outlook appears generally strong even in mature markets.

Given the higher growth rates projected for Asia-Pacific, Latin America, and the Middle East and Africa region, about two-thirds of total corporate banking revenue growth through 2020 will stem from developing and emerging nations.

While these global forecasts will be of interest to multinational banks and emerging challengers from developing economies, many corporate banks have refocused their regional footprints. This refocusing has been a good thing for most, allowing them to escape the value destruction caused by multiple layers of regulation, subscale operating costs, and undifferentiated value propositions in foreign countries. To find growth pockets in their core markets, these players will have to drill deeper into their revenue pools.

We have found that leading corporate banks are increasing their focus on revenue-pool and customer-wallet analytics. This exercise can be illuminating, as our project experience shows—especially with the use of industry, segment, and product lenses:

- Industry Lens. In the United States, for example, the corporate banking wallet of the health care sector is four times larger than that of the media and film sector, and is growing twice as fast.

- Segment Lens. Exports by small and midmarket enterprises as a share of total exports are expected to increase by more than 10 percentage points in both India and China through 2020, according to a BCG study on international trade flows.

- Product Lens. Specialized lending products (including asset-based lending and equipment finance) have grown faster than traditional corporate lending in many markets over the last decade, and we expect this trend to continue through 2020.

Capturing these growth opportunities will not be easy, however, given both tough competition and some fundamental disruptions hitting the industry.

Acknowledgments

The authors would particularly like to thank the following BCG colleagues for their valuable contributions to the conception and development of this report: Adesh Agarwal, Dmitri Angarov, Petra Demski, Alenka Grealish, Ankit Gupta, Anubhav Jain, Liliya Maliauka, Jens Muendler, François Orain, Stefano Valvano, and Stephanie Zisk.