The Boston Consulting Group has identified eight actions that winning corporate banks will need to embrace in the coming years in order to adapt to disruptive trends. (See Exhibit 1.) These actions include rethinking the corporate bank’s portfolio strategy, igniting a set of “business engines” to drive growth through 2020, and developing some key enablers.

Global Corporate Banking 2015

- The Look of a Winner

- Five Trends Disrupting the Corporate Banking Landscape

- What the Winning Corporate Bank Will Look Like in 2020

Adopt a rigorous portfolio strategy. The first and most strategic initiative is a rigorous review of the corporate bank’s portfolio. There is often considerable variation in an institution’s performance in different segments, ranging from small businesses to large corporations, as well as in different product areas and regions of operation. Responding to disruptive trends takes resources—and not just balance-sheet resources such as capital, funding, and risk capability, but also operating resources such as people, IT investment, and senior management capacity. Every bank has a unique starting point, and rare is the institution that can afford to invest simultaneously in every segment, product, and region. Furthermore, the relative attractiveness of each area will differ.

To prepare for the future, corporate banks need to start with a pure strategic review, asking questions such as the following:

- Which clients are the most attractive from the perspectives of growth, product mix, and profitability (including liquidity, risk, and capital appetites)? How do the differences play out by client size? By industry? By some other dimension?

- Which products are the most attractive in light of Basel III, and which ones can the bank build to create competitive advantage?

- Which domestic and international regions are ultimately the most attractive, and what is required to win in each?

The answers to these questions will provide a strategic road map that will help the bank prioritize its investments and decide which clients, products, and regions it needs to pare back or exit. Early decisions about what not to focus on can release additional resources for investing in priority areas.

Enhance industry specialization. As mentioned above, top corporate banks are increasingly driving industry specialization, ranging from large corporations down to midmarket and even small-business clients. They use structured assessments to identify priority industries, examining fundamentals such as size, growth, product mix, and risk, as well as the ability of the bank to build and deploy a product and service offering that is competitively advantaged. Such players also carefully think about which model of industry specialization is appropriate. These models include the following:

- No specialization, for the part of the client portfolio that remains “generalist” because of undifferentiated needs or a lack of sufficient attractiveness for a specialist offer

- Light specialization, where RMs may focus particularly on one or two industries but remain part of the generalist sales force

- Full specialization for a few targeted industry verticals, including dedicated RMs, risk officers, and, potentially, product development teams within a standalone organization

In planning the right path forward, it is critical to determine exactly how industry specialization provides an advantage to the bank versus its competitors. Do dedicated RMs understand client financial needs better—and tailor solutions that clients prefer? Are a certain industry’s risk characteristics unique, so that teams of specialized RMs and risk officers can make better decisions and offer better risk-based pricing? Are there functional product needs, perhaps related to payments and cash-management products and the industry’s payment cycles, that allow the bank to differentiate itself? Can industry-specialized transaction-banking solutions attract and lock in clients, generating capital-light fee revenues, deposits, and transaction data for improved risk management and pricing?

Essentially, industry RMs must be able to realize more revenue through client acquisition, cross-selling, and pricing in order to more than offset the additional cost and complexity that specialized industry models sometimes involve. BCG has observed successful industry specialization models even in small corporate banks. Indeed, in the U.S., there are a number of modest-sized players that have managed to differentiate themselves through focused offerings for industries such as energy, entertainment, health care, and professional services.

Develop new client solutions. Traditionally, competing corporate banks have provided relatively undifferentiated product offerings. This practice is now changing, thanks to a number of converging trends:

- Growing industry specialization (as already discussed)

- The pursuit of clients previously viewed as unattractive for cost or risk reasons, and the development of lower-cost digital platforms and products such as asset-based lending, equipment finance, or franchise lending that allow banks to serve such clients at an acceptable risk level

- Rising client demand for convenient, end-to-end solutions such as financial supply-chain services that integrate procurement, payment, and financing activities

- The emergence of new digital platforms that enable both banks and nonbank competitors to offer new services or combine traditional banking products with third-party services

New client solutions can be very powerful. On the transaction banking side, for example, specialized health-care offerings have helped clients better manage complex revenue cycles and reduce administrative costs. Although national medical systems vary widely, there are always patients, doctors, hospitals, insurance providers, and other players that must exchange not only invoices and payments but also confidential information about treatments and payment plans. Banks that can build effective platforms and attract a critical mass of industry players become valuable partners for clients, and make it difficult for banks with undifferentiated platforms to win these clients back.

The situation is similar in lending. One major European bank developed a program that helped serve a large retailer’s entire value chain, from supplier to franchisee. The key was a packaged product for franchisees that included working capital, leasing, cash management, and point-of-sale solutions. This offering enabled the bank to better understand its clients, deepen its client relationships, and manage risk through access to sales data from franchisees.

Build new credit capabilities. Despite crisis-era moves to adjust pricing and reduce low-productivity risk-weighted assets, most corporate banks still need to do more to adapt to Basel III and other corporate banking dynamics. The requirements include the following:

- Completely integrate Basel III into target setting, tools, and performance management from the executive level to the front line. The sales force must steer clients into products with sound economics, including the full cost of risk, liquidity, and capital charges. Despite recent efforts, many corporate banks have not fully incorporated the impact of Basel III into their business models and remain overly focused on traditional corporate lending volumes.

- Develop capabilities to deliver new capital-light financing solutions to clients, either through specialty lending products such as asset-based lending or more complex solutions involving areas such as debt capital markets.

- Create origination-to-distribution models that allow assets to be passed on to funding partners such as insurance companies and pension funds, enabling the corporate bank to rotate its balance sheet more quickly and generate additional fee revenues.

This last opportunity in particular requires that the corporate bank deepen its understanding of the kind of assets that its funding partners are looking for. European insurers, for example, have a strong interest in diversifying their investment mix to include more corporate assets. But they often lack the origination and credit-risk capabilities that are part of the corporate banking model. Building this business requires breaking down organizational silos between corporate lending and capital markets teams, reviewing revenue-sharing practices, updating credit portfolio management activities, and ensuring that the funds-transfer pricing system is sophisticated enough to support these activities.

Drive value-based pricing. Relationship managers often assume that they must offer discounts in order to win business, so actual pricing is often much lower than bank guidelines. On average, we see 30 to 40 percent discounting across products, with wide disparities in price realization per client. Such discounts can rarely be explained by rational criteria. Indeed, expected drivers such as client volumes, relationship size, number of products bought, or new-versus-renewal business combined typically explain less than 7 percent of the price variation. This circumstance holds true both for transaction banking and lending products, taking into account the differences in risk ratings across clients.

In light of this situation, pricing can give corporate banks an immediate and much-needed performance lift. Our experience suggests that the opportunity can often reach 10 percent or more of total revenue, with two-thirds of the increase obtainable within 12 months. Superior pricing capabilities also help steer both the bank and its clients toward a product mix that better reflects risk, capital, and liquidity characteristics, and forces banks to pay closer attention to the quality of their underlying client data. For example, the liquidity coverage ratio, net stable funding ratio, and capital and leverage ratios all have a significant impact on the relative attractiveness of different products. Most banks, however, have not fully reflected this impact in their pricing guidelines and funds-transfer pricing. Moreover, pricing in corporate banking often suffers from bank cultures that place a higher value on closing the deal than on optimized pricing performance.

To support better pricing decisions, banks should move from “pricing as an art,” driven by RM perceptions of required discounts, toward “pricing as a science,” where the RM is equipped with analytical tools that provide client-specific guidance on pricing. One North American bank, for example, built a detailed pricing algorithm into an RM tool to give pricing guidance based on specific client situations. If the RM wanted to deviate from the guidelines, the approval process was automated into the workflow, and specific tools made the impact of different price points on the RM’s incentives fully transparent.

Improve the digital model and big-data capabilities. Digital technology is already fundamentally changing how corporate banks do business along the entire value chain. It has had a significant impact on new ways to do many things: acquire clients, develop and sell products, manage pricing, integrate across channels, manage risk, and streamline internal and client-facing processes.

Of course, some corporate banks have moved much faster than others on digital technology, which is both an enabler of other initiatives and a business opportunity in its own right. While some banks are simply moving traditional products online, digital leaders in corporate banking think about the technology differently. Taking the client perspective, they look to produce a steady stream of value-adding services and applications that clients will embed in their own business processes. Such banks are offering their customers new services that help them manage their working capital, reduce administrative costs, and manage risk better.

The change agenda is daunting, yet corporate banks must move quickly. Nimble nonbank competitors, often backed by leading venture investors or top Internet companies, are innovating rapidly. Examples in payments include PayPal, Square, and Alibaba. In digital financing, big-data players such as OnDeck Capital and Kabbage, and even nonbank players such as Amazon, are competing. Product-specific monolines such as OzForex are proliferating. And companies like Ariba and PrimeRevenue are creating new end-to-end digital solutions in spaces such as financial supply chains.

A deeper look can show just how new entrants are trying to compete against traditional corporate banks on both the functional value proposition and the customer experience. For example, we spoke with a U.S. Internet merchant who does business on Amazon’s marketplace. He received a preapproved loan offer from Amazon, and found that the lending process was much quicker and simpler than dealing with his bank. (He also noticed that Amazon had a significantly higher loan margin.)

Ariba, for its part, offers an end-to-end digital solution for business-to-business buying and selling. It has more than 1.6 million companies signed up and more than $600 billion in annual transactions. It offers a wide array of services, including supplier management for buyers and invoice management for sellers, as well as payment and cash management services.

Meanwhile, some traditional competitors are moving forward aggressively. One well-known bank, for example, has been expanding the capabilities of its treasury-management portal for more than a decade and now offers dozens of online services, many of which its competitors offer either offline or not at all. Its number of portal users has increased dramatically and its corporate banking division now generates about twice as much transaction-banking fee revenue as our benchmark average. Slower-moving banks face an uphill battle against such competitors.

Ultimately, too many corporate banks have digital strategies that are little more than hodgepodge collections of minor Web initiatives and are unlikely to move the needle. To be well positioned in 2020, corporate banks need to take a step back and develop a robust digital strategy starting from the client’s perspective, clearly defining how they can use digital technology to improve the client value proposition, reduce costs, and improve risk management. Banks may have to consider initiatives that could possibly cannibalize existing revenues, such as direct channels for small and midmarket clients.

Pursue operating excellence. In a recent BCG survey of corporate banking executives, 100 percent of the respondents agreed that operating excellence (OE) is a “critical” competitive lever. Yet less than half said that their corporate bank had a well-defined OE vision, and only a third thought that their bank was doing a good job defining and tracking OE metrics.

BCG’s latest corporate banking OE benchmarking analysis, which involved a deep, end-to-end review of corporate banking divisions around the world, revealed that even top corporate banks struggle to track and report their performance on key OE topics. In fact, the OE gaps are often in the areas that are most important to client satisfaction and sales force productivity—such as turnaround times on loans, account opening times, or the split of RM time between selling and internal administrative activities. Furthermore, our benchmarking revealed that even top performers have many gaps in key dimensions.

Such findings underscore the fact that the “industrialization” of key business processes is less advanced in corporate banking than in many other industries. This trend is changing, however, as corporate banks come under increasing pressure to simultaneously cut costs, improve client service, and release their sales forces from paperwork burdens. Indeed, the pressure on sales forces has never been more intense. (See “Why Sales Force Effectiveness Is More Critical Than Ever.”)

WHY SALES FORCE EFFECTIVENESS IS MORE CRITICAL THAN EVER

Sales force effectiveness is an “evergreen” topic in corporate banking, one that has been the objective of many improvement initiatives over the years. Yet each of our benchmarking studies over the past decade shows high variation in sales force performance among competitors.

BCG’s latest study of value contribution per sales force FTE for corporate banking divisions from developed markets shows that for those serving small, midmarket, and large corporate clients alike, the average of the top-quartile players was two to three times the median. (See the exhibit below.) We observed similar variation in other standard metrics such as revenue per RM. Banks with struggling sales forces will find it very challenging to compete. Indeed, a strong sales force is a critical enabler for all of the 2020 strategies outlined in this report.

BCG’s casework shows that there are certain characteristics common to nearly all top-performing sales forces:

- Deep client insight, obtained from wallet-sizing analytics linked to account-planning tools that are both easy to use and implemented in a rigorous and disciplined way

- Excellent pricing capabilities, backed up by tools that both encourage the right RM behaviors and discipline the wrong ones

- Rigorous talent-management strategies that cover recruiting, engagement, and retention as well as performance coaching (including more discipline with regard to managing low performers)

- A greater focus on operating excellence, featuring leaner processes that allow RMs to spend more time with clients and that improve discipline to reduce variation among RMs in such areas as client loadings

In our client work, we are increasingly leveraging big-data tools to enhance the predictive power of wallet sizing (such as identifying the client’s “next best product”) and to improve the effectiveness of account planning and sales-force prioritization.

Our client work has also revealed some variations in optimal approaches for sales forces dedicated to different client segments. With small business clients, individual RM productivity and the ability to independently sell a broad set of lending and nonlending products is especially critical. One reason is that the small ticket size of this segment makes it uneconomical to have too many product specialists and sales support staff. Clean processes that maximize RM selling time are extremely important.

Serving midmarket and large clients requires a different logic. Overall, RMs play more of a quarterback role, coordinating a team selling approach that involves highly sophisticated products and the relevant product specialists. Large clients require the most complex approach, with a relatively high number of products and specialists. These segments also frequently present the challenge of a hard-to-navigate organizational boundary between the corporate banking division and the capital-markets products division.

In our view, the winning corporate banks in 2020 will have significantly improved their OE performance in four dimensions:

- Client excellence, which includes defining, tracking, and delivering an experience that drives not just client satisfaction but also client advocacy

- Efficient and effective processes, especially with regard to the classic pain points found in the corporate lending and account-opening processes

- Streamlined organizations, with fewer layers, a greater percentage of client-facing staff, and a more rational operating model along the value chain

- Underlying capabilities, including enhanced performance management, a culture of continuous improvement, and rigorous simplification initiatives

Some corporate banking executives may point out that other levers, such as loan losses, pricing, and cross-selling, may have a bigger impact than OE. This is often true, but we believe that leading corporate banks in 2020 will have made dramatic progress in leaving behind the manual, paper-based, error-ridden processes that are so onerous today for many corporate clients and bank employees. OE is also critical in improving speed, quality, and transparency, all of which help corporate banking executives make robust decisions.

Embed a high-performance organization. Corporate banks have challenging matrix organizations that require collaboration across product, client segment, regional, and functional boundaries. Initiatives that sound simple on paper, such as boosting cross-selling or streamlining the corporate lending process, often get mired in organizational complexity.

Corporate banks that can lead and engage their staffs to collaborate and resolve issues in today’s enormously complex financial environment will have a significant advantage. In fact, we believe that the winning corporate banks of 2020 will be distinguished by what outside observers might call strong, positive cultures.

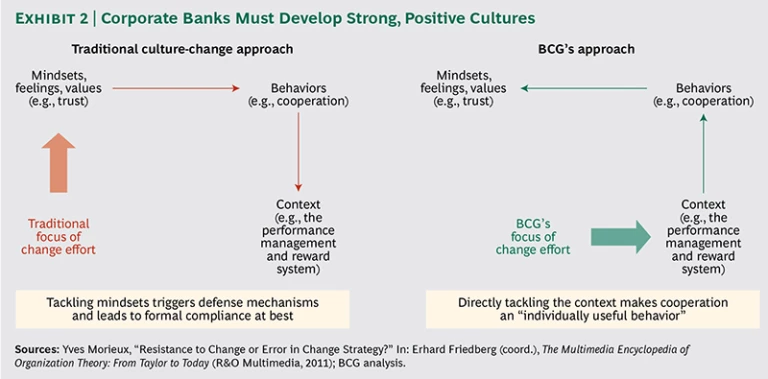

Traditional culture-change efforts have often used levers such as executive messaging and team-building events to try to change the mindsets and values of employees. (See Exhibit 2.) But such initiatives often fall short of the hoped-for impact because the well-meaning intentions of colleagues collide directly with the “same old” organizational blockers such as conflicting or unclear objectives, vague accountabilities, multilayered organizations, an excess of KPIs, performance management without teeth, and misaligned incentives.

BCG recommends a different approach to this challenge. Corporate bankers who want to make a fundamental change in their organization’s culture must first understand why people do what they do and then change what we call the organizational “context.” This means changing the business system in which corporate bank employees operate. Few people go to work with the objective of not cross-selling, or adding roadblocks to the corporate lending process. But the behaviors that cause these problems are typically the result of rational individuals acting according to the logic of their organizational context.

Consider an example from the corporate and investment banking division of a large European banking group. Although the company posted solid performance during the worst crisis years, growth slowed significantly thereafter. There was weak cooperation between RMs and product specialists and between regions and functions. Business managers, removed from the front lines, lacked the institutional clout to enforce accountability. That left employees with no clear direction—and ample freedom to set and pursue their own goals. With limited incentive to collaborate, teams focused on optimizing their own P&L or deal base, in some cases going so far as to hide deals from other teams and build alliances that helped funnel business their way. And those with the largest informal networks were the most successful in business and career terms.

As growth faltered, it became clear that a different approach was needed. The bank worked to create an organizational environment in which cooperation was supported by appropriate coaching, professional-development recognition, and incentives—elements that made cooperation an individually useful behavior. By stripping away complexity and management layers, employees gained more decision-making authority, which helped them feel that they had a greater stake in outcomes. Management cut the number of KPIs, moving to just four “what” KPIs (such as sales targets and loan-processing times) and three “how” KPIs (such as feedback from colleagues). The bank also enforced a requirement to differentiate employee performance evaluations—rather than ending up with everyone clustered around the average—and linked both monetary and nonmonetary recognition more tightly to KPIs. The institution also created a series of joint accountabilities among RMs and product specialists by introducing clear role mandates, ensuring that teams shared interlocked targets. Such measures helped employees understand what they were expected to accomplish and what their rewards or consequences would potentially be, and fostered a culture in which collaboration was in the employees’ best interest.

Ultimately, corporate banking is entering a period of unprecedented flux as multiple disruptive trends collide with traditional business models. Current industry dynamics will accelerate the trend of a widening performance gap between the top and bottom players. The winning corporate banks of 2020 will undoubtedly have charted a unique path to success. They will also have drawn heavily on the concepts that we have discussed in this report. Corporate banks that avoid fundamental change will continue to struggle, playing catch-up to faster-moving and more forward-thinking rivals. Courageous decisions will be required—and sooner rather than later.