bionic

adjective

1. of or relating to bionics

2. having certain physiological functions augmented or replaced by electronic equipment: the bionic man —The Collins English Dictionary

3. blending digital technology and a human touch to deliver the right products and services to target customers: the bionic bank —The Boston Consulting Group’s proposed definition

Banks of all types are still adjusting to a postcrisis environment characterized by forces such as changing regulatory frameworks and risk cultures, the digital and data revolutions, shifting client behaviors, new competitors, and a multispeed world. In order to thrive in such a challenging, dynamic climate, banks need a tool kit that offers practical steps to attaining or maintaining market leadership. We explored those steps in

The Emerging Equilibrium in Banking: A Tool Kit for Success

(BCG Focus, December 2014).

But what about retail banks in particular? Are there parallel or related initiatives specific to their type of business that must be undertaken to achieve success? According to our work with more than 100 leading retail banks in 75 countries—supported by detailed benchmarking of over 40 institutions and proprietary research involving more than 30,000 retail-banking customers—the answer is a resounding yes.

Indeed, in today’s market, the expectations of retail-banking customers are becoming increasingly complex. Customers naturally want a bank that helps them achieve their financial goals and that protects their assets, but they also want regular and convenient interactions, total reliability, simple ways of doing things, and adaptability when life circumstances change.

To succeed in meeting these and other expectations, retail banks must combine digital technology with a human touch. Offering just one or the other is no longer enough. In a sense, retail banks must become “bionic” : they must provide digital functionality for speed and convenience, as well as thoughtful, caring human interaction when the customer needs and demands it.

Leading retail banks around the world are at varying stages of the journey to become bionic, so the transformational roadmap will differ for each one. But the prize will be significant for the winners, which could see return on equity improve by 8 to 10 percentage points.

The Six Key Strengths of Bionic Retail Banks

In our view, bionic retail banks are anchored by six key strengths. (See Exhibit 1.)

- Clear vision

- A future-proof distribution model

- Customer centricity

- Technology and operational excellence

- Organizational vitality

- Financial and risk control

Each bank has its own starting point on the path to becoming bionic. It can treat the journey as a series of one-off projects or as a unified program of change—a transformation. In our experience, banks that embark on a unified program have a greater chance of success. Let’s look at each aspect of bionic retail banks more closely.

Clear Vision

A bionic retail bank does not try to be everything to everyone at all times. Instead, it carefully defines a vision and a business model that set the parameters for its target customer segments, geographical reach, product range, and channel mix. This aspiration drives prompt internal decision making, fosters effective prioritization in investments, and helps attract the right customers. Moreover, a bionic retail bank understands what it is as well as what it is not. BCG believes that there is no one “correct” target state for such an institution; indeed, different business models can work well. However, articulating the vision coherently is a prerequisite for success.

Strong Strategic Positioning. A bionic retail bank develops a strategic position that describes the scope and focus of its business. This position must answer the following questions:

- What are the bank’s target customer segments? Are they, for example, mass market, mass affluent, or both?

- Is the geographic focus of the business local, regional, or global?

- What set of products will the bank offer its customers? Will it include products such as everyday banking, secured lending, protection, and investments?

- What mix of branch, digital, and virtual channels will the bank use to reach its customers?

In a world of limited capital, the CEO of a bionic retail bank must act as an investor, ruthlessly focusing the institution’s portfolio to align with its strategic position. Business lines, products, and markets are assessed using well-defined criteria. Activities that do not align with the vision are removed.

A Compelling Brand. A bionic retail bank translates its strategic position into a compelling brand, establishing a sharp identity in the market and evoking a distinctive idea of the value propositions that it offers. The bank communicates a clear promise, such as focusing on value for money, great service, or relationship banking. It allows customers to understand the outcomes they should expect when compared with other offerings in the market. People recognize the bank’s name, logo, and brand marketing, which engender an immediate functional, technical, and emotional association with the underlying brand promise.

A Future-Proof Distribution Model

A bionic retail bank adapts its distribution model to current market conditions. It offers human interaction to build relationships through sales, and it provides complex service supported by digital and virtual functionality for speed and convenience—all designed to deliver optimal customer outcomes at appropriate levels of cost.

Multichannel Delivery. The number of client touch points has dramatically increased in retail banking, and the mix of channels is shifting toward digital. (See Exhibit 2.) Digital functionality should focus on enabling quick sales of simple products and convenient execution of high-volume transactions. (We will explore this topic in greater detail in an upcoming BCG publication devoted to digital retail banking.) Human interaction should focus on relationship-driven sales and complex service. Increasingly, multichannel delivery will be anchored by the digital experience but will still need to meet the customer’s need for human interaction.

Effective multichannel delivery makes interactions smoother and more straightforward so that channels support one another and facilitate natural customer pathways. For example, for many customers, the natural pathway for a mortgage application begins with online research and simulations, continues with a phone call to explore options, and then involves meeting with a mortgage advisor to complete the sales process. A bionic retail bank also seeks to migrate transactions over time to the most convenient and cost-effective channels. Our work with retail banks around the world suggests that customers who are active on multiple channels are typically two to three times more profitable than single-channel customers.

Branch Excellence. In many developed markets, branch transactions decreased by roughly 3 percent per year from 2004 to 2012, a trend that has accelerated recently with the emergence of mobile functionality. Consequently, we have seen branch rationalization in many of these markets, with some notable exceptions, such as in the U.S. Yet despite this winnowing out, we continue to witness a strong correlation between share of branch footprints and share of banking relationships, no doubt influenced by customers’ preference for personal interaction when making key purchases and by legacy stock. In many developing markets, branch networks are still expanding as banks pursue the unbanked population.

A bionic retail bank adjusts the role, density, and format of its branches to maintain distribution reach at a lower and more variable cost. It keeps its branch network under constant, critical review. We find that, typically, 80 to 90 percent of revenues are generated by 50 to 65 percent of branches in a given network, creating considerable opportunity for rationalization.

Beyond its branch footprint, a bionic retail bank maintains an energetic and consistent operating rhythm across its network. It sees branch employees as working on the front lines and trains them well. It tailors coaching to each individual’s strengths and development areas, giving everyone an opportunity to succeed. But it also actively manages out people who are unable or unwilling to succeed.

Telephony and Digital-Channel Excellence. The digital expectations of retail-banking customers are calibrated by their experience with online retailers, technology providers, and other digital innovators. Customers expect simple and intuitive access, the ability to customize their interactions, and excellent service. They expect an interactive relationship that offers tailored advice and differentiated propositions. As it stands, most retail banks struggle to meet these standards.

But benefits would be substantial if banks could raise their games. We estimate that the very best institutions could gain a competitive advantage of 15 percentage points in cost-to-income ratio, driven by improved cost leverage, deeper relationships, reduced customer attrition, and higher customer satisfaction.

A bionic retail bank also facilitates “one click” sales of simple products, executed with straight-through processing. It offers customized advice and active support through “click to call” or online-chat functionality. It uses digital services to make existing interactions, such as balance checking, more convenient for customers. But it also provides services designed to actively help and educate them, including budget visualization tools and financial planners.

Sales Effectiveness. A bionic retail bank uses its sales model to identify and meet customer needs, selling to those needs and not to sales targets. It knows where it must deploy its advisors, both in branches and remotely. It aims for high levels of productivity to do the right thing for the largest number of customers. Following these practices, the most productive banks average 20 total sales per advisor per week.

A bionic bank also actively manages its entire sales funnel, from leads to appointments, interviews, sales, activation, and early-tenure management. It rigorously monitors customer volume and conversion rates, with a balanced focus on both the quantity and the quality of leads, achieving twice as many sales from its leads as banks that focus on either quantity or quality alone. It carefully manages the on-boarding and early tenure of its customers, focusing on quality sales that meet customer needs and that endure over time.

Customer Centricity

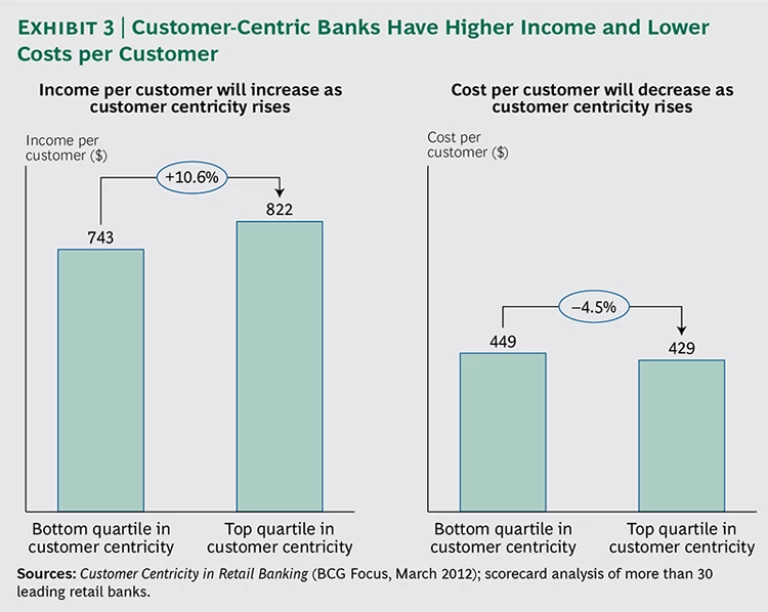

A bionic retail bank is customer centric. It uses knowledge of its customers to meet their needs and achieve sustainable, valuable, long-term relationships. It recognizes that there doesn’t have to be a trade-off between customer centricity and operational costs. In fact, BCG research indicates that customer-centric banks have both higher income and lower costs per customer than their non-customer-centric competitors. (See Exhibit 3.)

Customer Insight. A bionic retail bank is grounded in deep knowledge of its customers. It understands not only their demographic profiles but also their financial needs, behaviors, and life stages. Grasping these elements is especially important in creating digital strategies. A recent BCG survey of customer behavior revealed wide disparity in channel preference and digital aptitude in a typical retail-banking customer base.

Banks can also take into account their customers’ life stages to tailor financial advice—such as by offering loans or savings plans to students, mortgage services to young adults settling down, and retirement services for people nearing the end of their careers. Our research shows that retail-banking customers are typically pleased to receive relevant prompts that are triggered by life events.

Smart Data and Customer Relationship Management. A bionic retail bank stores customer insights in a rich and robust data set that facilitates better lead generation, sales effectiveness, risk management, and product development. Thorough data allows the bank to generate more promising leads, strengthen segmentation models, improve know-your-customer processes, and develop innovative products. But a bionic bank’s first priority should be rich data rather than big data. The bank must ensure that data is comprehensive, meaning that all relevant fields are included; complete, meaning that all fields have data; current; and consistent across sources.

Great, Simple Propositions. The customer value propositions of a bionic retail bank satisfy the needs and profiles of each customer segment. The bank leverages its range of products, features, channels, and service models to ensure that it can deliver strong propositions for all target customers. It avoids an overproliferation of distinct products and price points, however.

Overall, simplicity is the key to managing operational cost and risk. Indeed, a number of leading banks have recently rationalized and simplified their product ranges by as much as 40 percent and reduced documentation by as much as 80 percent. Their products are clearly explained, simple to use, fast to start up, and contain features and alternatives that are easy to understand. These banks also take care to ensure that all key details are prominent and not buried in the fine print. One CEO of a leading bank has insisted that everything be captured “on one page—without my reading glasses!”

A bionic retail bank also ensures that propositions are economically viable, basing cost-to-serve on the revenue potential of any given customer. It cultivates main banking relationships with customers who have an active primary account plus at least two high-quality cross-holdings, are registered online, and use the bank’s online services. The bank adopts fair and transparent pricing, avoiding one-price-fits-all structures and bait-and-switch pricing.

Service Excellence. Digital technology creates the opportunity to reimagine the customer experience. A bionic retail bank translates its brand into positive and engaging interactions with customers. Providing just the right experience is a strong driver of customer satisfaction: more than two-thirds of advocates cite service excellence as a reason for their endorsement. The bank defines its service proposition by segment, providing a clear articulation of priorities, such as whether it aims to be the most available, reliable, or helpful bank. It considers the offer, execution, and tone of service, thereby satisfying the technical, functional, and emotional demands of its customers. The best banks translate their service propositions into a series of signature actions that resonate in the minds of customers. Increasingly, bionic retail banks will identify innovative ways to engage and serve their customers with digital functionality. Banks are increasingly documenting and managing customer journeys—such as the steps involved in opening an account or taking out a loan—so they can consider such factors when designing operational processes. A bionic retail bank actively identifies and addresses pain points along key customer journeys and ensures high service standards, such as “walk out working” sales from branches and a limit of one hand-off in call centers. The bank concentrates on so-called moments of value that can make or break the customer relationship.

Technology and Operational Excellence

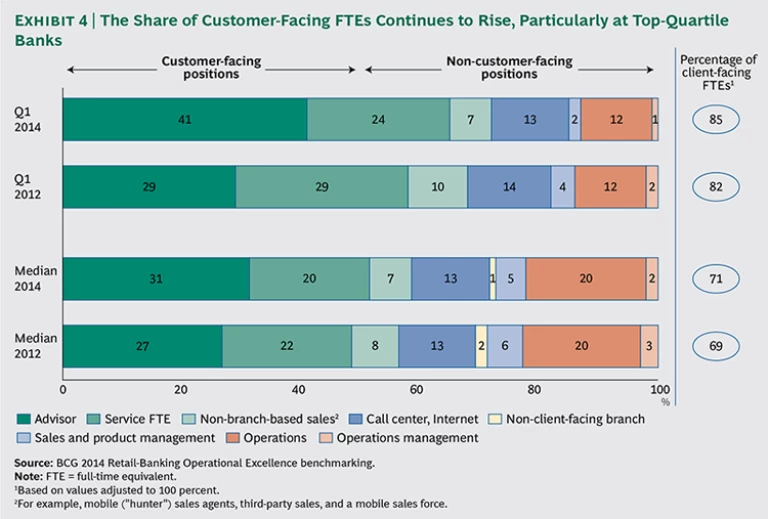

Technology and operations arguably constitute the domain that most differentiates bionic retail banks from more traditional institutions. More than 80 percent of staff in the world’s leading retail banks hold customer-facing positions, with less than 20 percent in back-office or head-office roles. Compared with an average ratio of 70:30 among other banks—and the frequent occurrence of 60:40 or even 50:50 ratios—the value at stake is substantial. Overall, the share of customer-facing full-time equivalents continues to rise, particularly at top-quartile banks. (See Exhibit 4.) What’s more, we find that the world’s most operationally advanced retail banks tend also to be the most customer centric.

Limited Business Complexity. A bionic retail bank is ruthless in its quest to reduce business complexity. Complicated products, pricing, and service lead to complicated operations, especially in an environment of increasing regulation and tighter competition. Lowering business complexity reduces the operational costs and risks of running the institution.

A bionic retail bank regularly rationalizes and simplifies its product portfolio, evaluating each offering in terms of its economics, overall fit, and market demand. Low-value products that require a disproportionate level of back-office support are dropped. Recent BCG research found a 10 percent median reduction in actively sold products among leading banks. Some institutions are going further by harmonizing their back book with their front book to minimize the cost of complexity going forward.

Efficient and Effective Processes. A bionic bank aims to design and maintain processes that are simple, fast, and paper free. Processes are mapped to customer journeys and focused on getting things right the first time. The bank digitizes or scans a document as soon as it is received and uses straight-through processing as much as possible. Where immediate fulfillment cannot be provided, clear hand-offs occur by means of data or images that are rerouted to the right individual for completion. Where digitization of a document is inappropriate or undesirable, skills-based routing is used to ensure the best outcome.

A bionic retail bank also conducts regular reviews to ensure that its processes are efficient and effective, taking particular care with sequencing. In particular, the bank starts by eliminating unnecessary steps to avoid wasting time by optimizing defunct processes. The bank also centralizes key processes in dedicated centers both to drive efficiencies through scale and to maintain control. The bank does not centralize thoughtlessly, however, allowing specialization where gains in flexibility from keeping activity close to the businesses create value.

Simplified IT. In a bionic retail bank, the business and technology teams work together to ensure an effective yet simplified technology strategy. Technology development is led by business: business sets the goals, and technology decides the best way to achieve them. Technology uses intelligent demand management both to provide transparency into the true technology costs of business requests and to enable an open discussion on prioritization, in which both value and complexity are considered. Technology frames decisions and trade-offs in a way the business team understands and can use to make informed decisions.

But for a bank to become truly bionic, rationalization of the legacy systems is imperative. Bionic retail banks employ both top-down reviews for core applications and bottom-up reviews for noncore applications to drive rigorous consolidation. Defined criteria such as current use, future use, licensing costs, vendor strategy, and potential disruption are considered. By intelligently streamlining the number of applications, these banks reduce the complexity of application management as well as the cost of licensing fees. For some banks, this can mean halving and radically simplifying the number of applications.

Technology-Driven Innovation. A bionic retail bank is agile and adaptable. It is internally capable of identifying new digital technologies and assessing their likely impact on the business. To enable action on technologies or trends that pose a threat or an opportunity, the bank develops a technology organization that operates at both the traditional industrial speed and at digital speed. Industrial speed is the optimized pace at which technology, in its customary role, can deliver service to the business, including for projects that require deep systems integration with a high intolerance of failure, such as updates to the core banking system. Digital speed is necessary to enable and drive the company’s digital agenda, such as iteration of a mobile-banking application. This speed is characterized by rapidity, pragmatism, flexibility, and collaboration. It helps a bionic retail bank to better take advantage of technology to drive innovation.

Organizational Vitality

A bionic retail bank has clear structure and governance across segments, channels, and products. It is led by visible and motivational leaders who encourage single- point accountability, discourage organizational clutter, make key decisions promptly, and foster efficiency and effectiveness.

Simplified and Agile Organization. A bionic retail bank has simplified and agile organization. Its mix and level of resources are anchored by what the business model determines the institution can afford—the allowable cost dictated by the target revenue. It is organizationally lean, and it closely manages layers (a maximum of eight) and spans of control (a minimum of eight people). It creates high morale in the middle of the organization, where managers have traditionally been either over- or undermanaged.

Aligned Talent and Culture. Talent is carefully cultivated and managed. Well-informed, timely decisions on staff development and progress are a priority. Talent is rewarded using differentiated performance management by role but with consistency across business units. For example, the performance metrics for a call center manager will differ from those for a relationship manager, but they will look similar for two call-center managers—even if one is in the UK and the other is in Mexico.

Culture is actively managed to encourage the right behaviors. When thorny issues crop up, a bionic retail bank addresses the root causes, not just the symptoms, of any undesired behavior. The bank establishes clear guidelines on how sales agents, product specialists, and channel owners should interact. This fosters smooth internal collaboration, easy customer hand-offs, and an organization that is cooperative, not siloed.

Risk and Regulatory Relations. A bionic retail bank also creates a cooperative culture for strong risk and regulatory relations. It has three internal lines of defense. The business owns the risk as the first line of defense. The risk-management and audit functions form the second and third lines of defense, recognizing the need to assume risks but helping the business work within sensible parameters. Cooperation also extends outside the bank through the formation of strong relationships with regulators and other key stakeholders. By working closely with regulators, bionic retail banks keep abreast of potential future regulations and provide input on those regulations’ likely impact and potential unintended consequences.

Moreover, accountability is paramount for bionic retail banks. Clearly defined roles, responsibilities, and decision rights are obligatory, supported by transparent risk policies and structures for the day-to-day operations of the business.

Financial and Risk Control

In the current environment, characterized by ever-increasing regulatory measures and the growing importance of risk management, financial and risk control is paramount for retail banks.

Balance Sheet Rigor. Balance sheet rigor is core to the success of bionic retail banks. Such institutions have strong asset and liability management, enabling them to achieve low funding costs. They focus on strong capital ratios and high return on equity, and continuously improve them over time. They also use active scenario modeling to tightly manage liquidity and cash flow in preparation for any market stresses or uncertainties.

P&L Excellence. A bionic bank achieves P&L excellence as management focuses on sustainable revenues across products, segments, and time periods. Risk-adjusted net-interest margins are healthy, and impairment losses are low. This capability is paired with strict monitoring of cost efficiency that maintains a low cost-to-income ratio at minimum but strives for further decreases. We have seen a wide variety of cost-to-income ratios both across and within major markets, with leading banks ranging from as high as 80 percent to as low as 35 percent. While such a wide range can be partly explained by varying regulatory environments and pricing norms, factors such as poor cost leverage, lack of discipline, and weak productivity are significant among low performers.

Proactive Financial-Risk Management. A bionic retail bank also takes a proactive approach to managing financial risks. It has in place a first-rate risk-data architecture that enables a robust review of its asset quality. Credit tools are well established and effective, including behavioral scoring and asset classification. Funding risks are fully understood, especially the behavioral characteristics of deposits. Effective stress-testing capabilities are embedded in the organization. Risk teams are engaged in both the budgeting and capital-planning processes.

Built-In Conduct and Compliance. A bionic retail bank has developed and adopted leading conduct and compliance practices to deal with ever-increasing regulatory pressures. Today’s retail banks must not only build stronger compliance functions but also integrate the right behaviors in the way employees do business every day. We call this “built in” compliance. Business conduct and standards are integrated end to end, from product design to sales and distribution to ongoing customer management. Product design engages the risk function to ensure that all offerings are fit for purpose.

Becoming Bionic

To begin a successful transformation that can improve return on equity by 8 to 10 percentage points, a bank’s leadership needs to establish a clear call to action, building the case for change and sharing a vision of the future with the rest of the organization. Transformation does not happen overnight, so it is critical to start building the right capabilities from the outset. The transformation must be enabled by the right team, a sense of true urgency, efficient organization, and a culture of collaboration and cooperation.

Obviously, retail-banking executives are under constant pressure to deliver short-term earnings. A bank that wants to become bionic, therefore, needs to find short-term opportunities that are consistent with the medium-term vision but that also fund the transformation. Typically, initiatives such as pricing improvement, sales effectiveness, deepening of customer relationships, and branch footprint optimization fall into this category. Early success is critical because these initial wins not only fund future efforts but also demonstrate the value to the organization of transformation.

Once momentum has been gained, the bank should focus on winning in the medium term. In this phase, early successes are consolidated and longer-term capital-intensive programs are undertaken. The bank establishes a clear vision, builds a distribution model for the future, strives for deeper and more profitable customer relationships, achieves IT and operational excellence, streamlines the organization, and moves toward an ever-improving P&L and balance sheet.

Ultimately, the landscape for retail banks is changing—rapidly. Customers are more demanding of their banks and more able to share their displeasure publicly. Some commentators have interpreted current trends as a terminal threat to personal banking—perhaps even to the retail-banking industry itself.

We disagree. Yes, retail banks need to embrace technology to deliver great propositions to their target customers seamlessly, easily, remotely, and fairly. But as they work with their customers, banks must also act as both financial partners and custodians to identify needs and deliver the right solutions. This is what customers themselves demand. They want a combination of digital technology and human interaction. They want their retail banks to become bionic.

Acknowledgments

The authors would like to thank the following BCG colleagues, whose insights contributed greatly to the development of this paper: Lionel Aré, Reinhard Messenböck, Aymen Saleh, Sam Stewart, Steve Thogmartin, and Saurabh Tripathi. Special thanks go to Kasey Maggard for her support in drafting the paper.