For nearly 15 years, BCG has been conducting a proprietary benchmarking of wealth management organizations from all over the world, running the spectrum from small boutiques to wealth management units of large banking groups—and covering multiple business models, ranging from onshore to offshore and from banking to brokerage.

Global Wealth 2015

- Winning the Growth Game

- Five Keys to Consistent Success in Wealth Management

- How Wealth Managers Invest in Themselves

Our study involves more than 1,000 data points concerning growth, financial performance, operating models, sales excellence, employee efficiency, client segments, products, and trends along a number of dimensions, including locations, markets, client domiciles, and different peer groups.

With such a wealth of data available, this year’s report focuses on what the most successful players in today’s wealth-management industry are doing right. In seeking to explore why certain players outperform others, we have identified the continuously strongest organizations among our benchmarking participants over the past three years, drawing on information for the years 2012 through 2014 gathered from more than 200 banks in Western Europe, Eastern Europe, Asia-Pacific, North America, Latin America, and the Middle East.

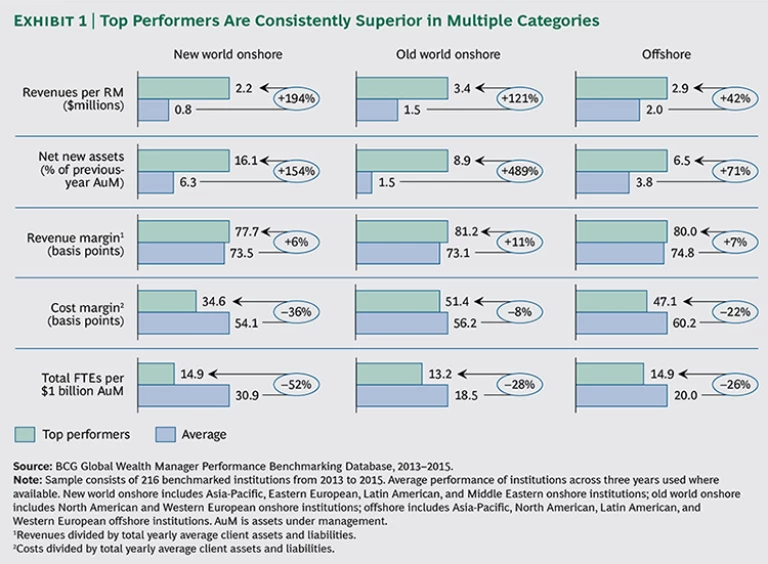

While strong asset performance over the past three years has fueled growth for most players, our top performers clearly stand out in generating high revenues per relationship manager, acquiring new assets, achieving best-in-class revenue and cost margins, and doing all of this with a lean organization. (See Exhibit 1.)

What drives these significant differences in performance? On the basis of our extensive experience working with wealth managers globally, we have identified five key attributes that these winning organizations possess, as described below.

Segment-Specific Value Propositions and Coverage Models. The one-size-fits-all approach is no longer viable in today’s wealth-management arena. This is the case not only from an operating and cost perspective, but also from a client perspective. Customers will no longer accept paying too much for services that they do not need or understand, or for insufficient guidance and advice.

Out of all survey participants that shared their internal segmentation criteria with us, a mere 5 percent said that they do not segment clients at all in their service models. Most institutions segment the client base into affluent, high-net-worth (HNW), and ultra-high-net-worth (UHNW) categories. These wealth bands tend to vary from player to player.

Some top performers go a step further by tailoring their segmented offerings. A truly tailored offering is built in a modular way, and is less about the number of products or services than about adapting the offering to the client segment’s specific needs. Successful wealth managers systematically prune their product trees to avoid excess proliferation and complexity. Market specifics are considered, as well as the cost to serve the client.

Another key is a dedicated coverage model for each segment, one that clearly defines who interacts with the client for which needs at which times. Relationship manager (RM) client loadings, contact frequency, specialist involvement, and performance targets will differ depending on the type of client served. Digital channels play an increasingly important role in a well-designed coverage model, making interactions with the client both more efficient for the bank and more value-adding for the clients.

The affluent segment, which is often caught somewhere between the retail and HNW segments, particularly benefits from a well-defined—and, from a bank’s perspective, efficient and more standardized—value proposition. Banks do not want to over-serve smaller clients at the expense of their target clients. At the other end of the spectrum, UHNW clients are increasingly demanding and globalized. Wealth managers unable to meet their evolving needs will find themselves left behind in a segment that is growing faster than all others.

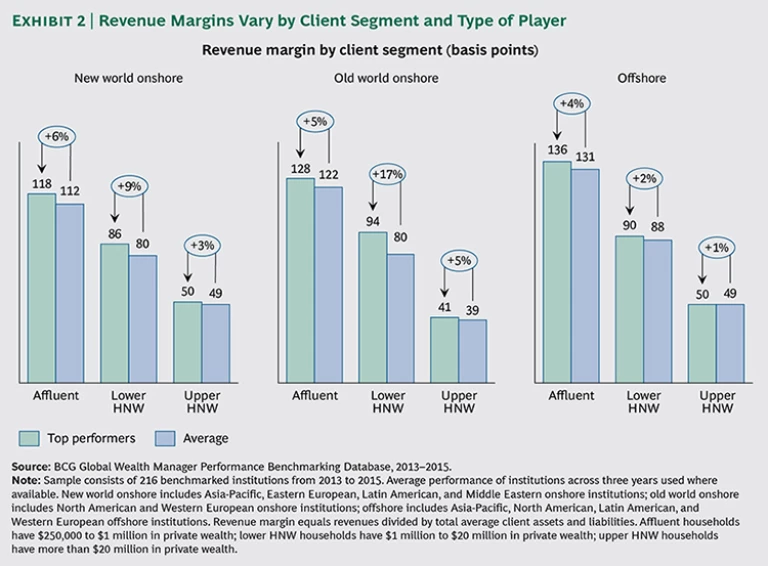

Rigorous Price Realization in Target Client Segments. As we have seen, the most successful wealth managers have clearly defined their target client segments. They are usually able to enforce price realization effectively. Indeed, clients are less inclined to ask for discounts when the value proposition of the bank’s services is evident. Overall, the potential revenue increase for players that improve their pricing dynamics is substantial. Although revenue margins vary by client segment and type of player, top onshore performers in the old world are particularly strong in achieving above-average margins. (See Exhibit 2.)

A Differentiated Advisory Offering. Clients using advisory services demand a clear value proposition in our age of low-cost online brokerage services and automated advisors. Many clients hesitate to delegate all of their investment choices, having lost a degree of confidence in their wealth manager’s ability to achieve superior returns on discretionary mandates. Transparency brought about by regulation is higher than ever and makes comparison shopping by clients even easier.

In this difficult climate, many high-performing wealth managers have invested in building a truly value-adding advisory package. While the average share of assets under management from advisory services stands at 30 percent, top performers have a share of 48 percent, and are able to offer a number of attractive features such as different service levels, fully transparent pricing, and digital elements such as automatic alerts.

The point of differentiation is not necessarily the advisory process itself but the experience that the wealth manager offers—making the role of the RM critical in bringing the value of the bank to the client. A well-structured advisory offering will increase and systematize the frequency of interactions with the client, generating an experience of proactive and timely service.

Ultimately, successful advisory offerings will lead to diversified client portfolios with asset allocations that are aligned with investment objectives and risk appetites. Such portfolios will benefit from systematic trading activities, bringing the bank’s full range of capabilities to bear, and feature frequent reviews of progress against investment objectives. Wealth managers can also benefit from linking pricing to advice, rather than to trading activity, thus ensuring more stable, recurring income flows.

While wealth managers in all regions have begun to ramp up their advisory offerings, the trend has been most prominent in Western European offshore banks—and, interestingly, in full-service brokerages in North America.

A Focus on Front-Office Excellence. High-performing organizations can achieve more than double the revenues of average performers, as measured by the average revenue per RM. A similar dynamic applies to the net new assets that each RM can acquire. Yet despite such clear potential benefits, many players struggle with optimizing front-office operating excellence.

Over time, we have seen top wealth-management organizations significantly improve their front-office performance by taking steps such as the following:

- Making leaders accountable for team (not just individual) performance

- Fostering cross-functional approaches to clients across retail, corporate, and private-banking divisions

- Developing a client-centric (as opposed to product-centric) sales culture

- Complementing the sales-management system with activity-based measures

Still, true front-office excellence is less about processes and setups than about changing the way the front office works on a day-to-day basis. The desired result is RMs who spend time with the right clients, proactively approach clients with appropriate investment ideas, minimize price discounting, and generate referrals in order to reach new prospects.

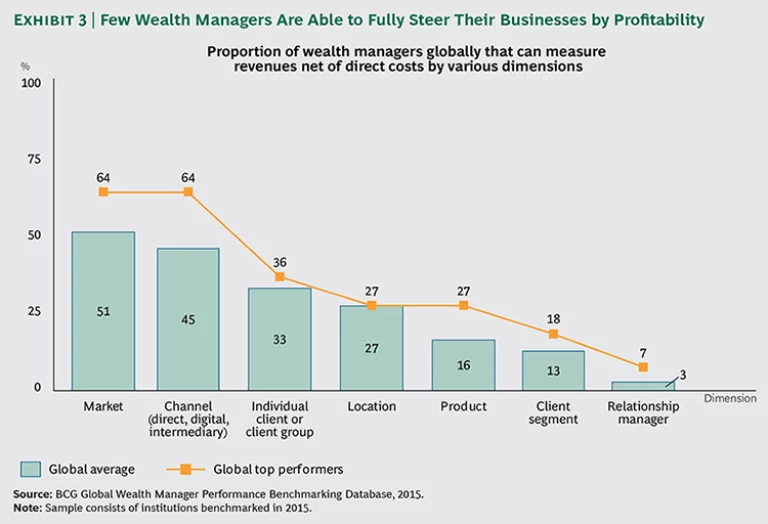

The Ability to Measure and Manage Profitability. Among our 2015 benchmarking participants, very few steer their businesses on the basis of profitability. Revenue-based measures are much more common. For example, 89 percent of all participants were able to measure revenues per RM, but only 3 percent (7 percent for top-performing players) monitored RM profit contribution after direct costs. (See Exhibit 3.) At the product level, only 16 percent had a view of product profitability net of direct costs (27 percent for top performers). Similarly, only 13 percent of participants (18 percent of top performers) measured client segment profitability after direct costs.

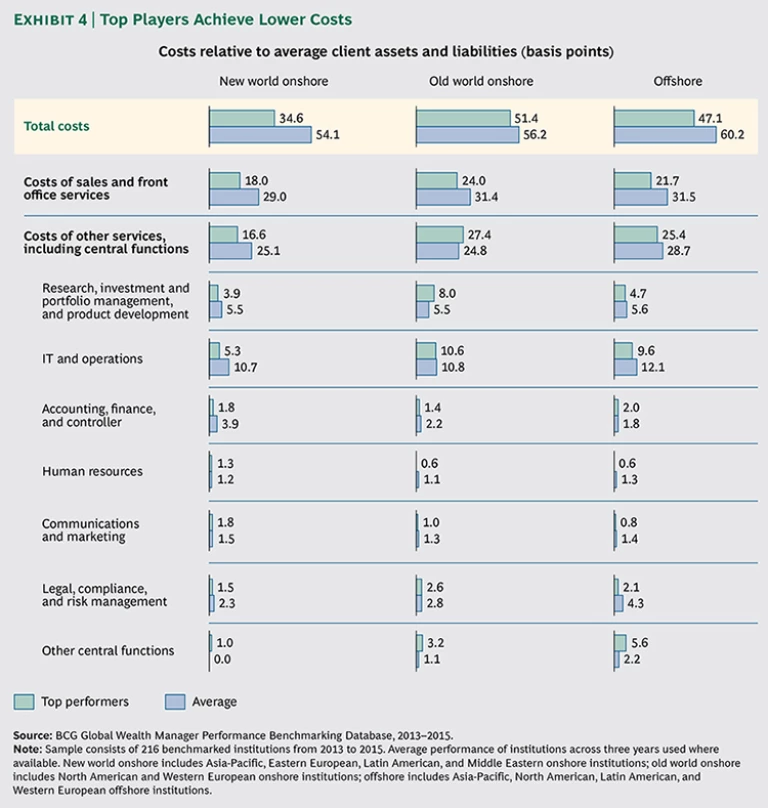

Top performers aim for full transparency on cost to serve, enabling them to clearly prioritize activities and investments on the basis of profitability. They also know that profitability must be measured along multiple dimensions, such as by market, client, product, and RM (as well as by alternative distribution channel such as the independent financial advisor), in order to accurately gauge the financial health of their business. More comprehensive measurement will reveal cost drivers such as organizational and product complexity, which sometimes go largely unnoticed. Obviously, accurate cost-allocation mechanisms are key to managing for profitability. As a result, top performers in all business models have achieved lower costs relative to assets and liabilities. (See Exhibit 4.)

In general, top players in both onshore and offshore wealth-management models can grow profitably despite the numerous challenges they face. (See “Is Offshore Wealth Management Still an Attractive Business?”)

IS OFFSHORE WEALTH MANAGEMENT STILL AN ATTRACTIVE BUSINESS?

While revenue margins in the offshore wealth-management industry have dropped by an average of 10 to 15 basis points since their peak prior to the 2007–2008 financial crisis, we still see an “offshore revenue-margin premium” compared with onshore players in some offshore centers, notably in Switzerland. (See the exhibit below, “Top Offshore Players Still Achieve Healthy Revenue and Profit Margins.”)

Obviously, the days when high revenue margins were achievable regardless of a client’s domicile are a thing of the past. Offshore players must now deal with return on asset (ROA) results that can vary widely by market, reflecting local and regional investment preferences and behavior. But clients are still willing to pay a premium for benefits such as political and financial stability, regional diversification, high-quality service, discretion, and broad expertise across products and asset classes.

When it comes to costs, offshore players have been hardest hit by tougher regulatory requirements, particularly in the know-your-customer category. Faced by the requirement for automatic exchange of information on client accounts across borders, they have had to regularize their client books and are subject to large fines for any negligence. Litigation in this area is likely to continue, and we expect the regulatory playing field to converge to rigorous standards in most parts of the world.

In addition to investments in legal and compliance staff, significant technology expenses have been required to ensure compliance in all markets served by offshore wealth managers—making offshore banking a cost-heavy structure. It is therefore no surprise that average pre-tax profit margins in offshore booking centers are converging with those in onshore booking centers for many players.

Nonetheless, the most successful offshore players are achieving bottom-line margins of up to 31 basis points, close to those of top onshore performers, demonstrating that both models can be operated in a profitable manner. What are top offshore performers doing differently? Most important, they have focused on profits, not volume, and are transforming their businesses to make them viable for the future. Among the steps they have taken are the following:

- Reduced their regional footprint to only those markets with the most attractive economics or growth potential, and stopped actively serving non-priority markets

- Sold or closed down subscale operations and booking centers, or acquired other players to reach scale

- Invested in differentiating segment- and market-specific value propositions, including those related to digital technology (to keep up with new competitors and higher client expectations)

- Reduced product ranges and adapted pricing models to attract only their target clients

- Managed sales forces on a market-by-market basis, adapting sales and coverage targets according to each market’s potential and specific characteristics

- Trained front-office staff carefully to ensure compliance with cross-border regulations

Ultimately, despite highly challenging developments in many areas of offshore wealth management, there is still potential for profits and future growth for those players that stay ahead of the curve.