Retail banks continue to adjust to a postcrisis environment of patchy growth, changing regulatory demands, and margin pressures. At the same time, banks are confronting a digital and data revolution that is disrupting their industry. Digital innovation is shifting the behavior and expectations of customers, who are increasingly eager for the convenient digital channels, interactive services, and transparent pricing that are being pioneered by leading global retailers. Meanwhile, technology has opened the door to new and innovative competitors. (See The Emerging Equilibrium in Banking: A Tool Kit for Success , BCG report, December 2014.)

Read more on this topic

Operational Excellence in Retail Banking: The Series

- Creating Digital Banks with a Human Touch

- No Compromise: Advocating for Customers, Insisting on Efficiency

- Committing to Customers in the “New New Normal”

- Raising Performance in Turbulent Times

- How to Become an All-Star

For the smartest retail banks, the digital revolution also provides a path to operational and client excellence . Enhanced digital and IT capabilities now enable the leaders to automate processes, boost efficiency, and reduce costs, while also improving the customer experience and gaining market share.

Technology is, however, just part of the equation. The Boston Consulting Group’s most recent benchmarking shows that the

- As the top-quartile banks migrate their low-value transactions and interactions to digital channels, they are freeing up time previously spent on customer service and operations and reinvesting some of it in an increased share of client-facing full-time equivalents (FTEs) who advise customers.

- To further enhance the focus of their branch advisors, top-quartile banks are accelerating their use of direct channels faster than their competitors—not only for customer service but also for sales of simple products.

The process of building a bionic bank is different for every institution: each bank’s value proposition and strategy—as well as its starting position—are unique. The transformational roadmap for each, therefore, is distinct.

Four Levers of Operational Excellence for Creating a Bionic Bank

BCG’s benchmarking profiles the evolving operational practices of the world’s leading retail banks—a group of 35 institutions we call the

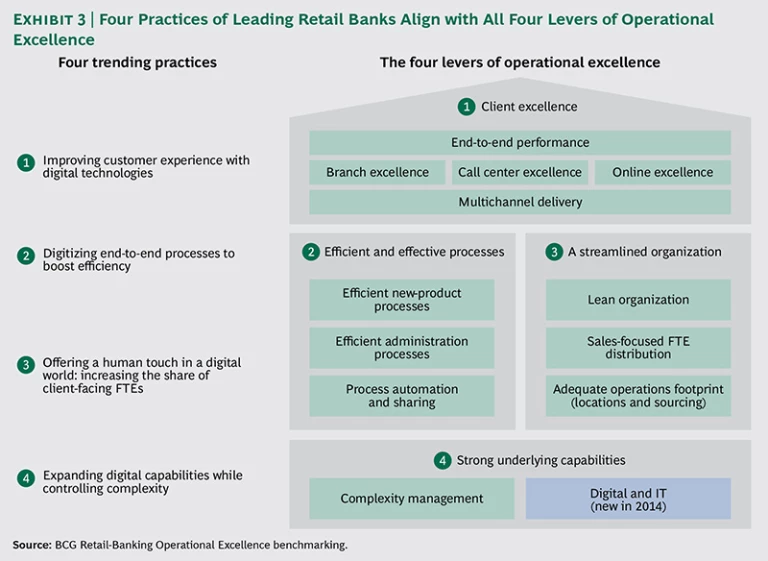

The benchmarking, conducted in 2014, assessed premier-league banks’ performance against four levers of operational excellence: client excellence, efficient and effective processes, a streamlined organization, and strong underlying capabilities. (See “The Four Critical Levers of Operational Excellence.”) The core of the benchmarking, as in previous years, comprised metrics such as activity-based FTE-productivity measures, cycle times by product line, degree of automation, booking ratios, and customer service by channel.

THE FOUR CRITICAL LEVERS OF OPERATIONAL EXCELLENCE

Retail banks that aspire to improve overall must perform well in the four levers of operational excellence. Drawn from our annual benchmarking and our experience with clients, the following are among the best practices and success factors for each lever:

- Client Excellence. Succeed in “moments of truth” for the customer, providing effective sales and service across channels, contacting and assisting customers proactively, and delivering easy-to-buy, easy-to-sell, easy-to-service products with critical features that are instantly functional.

- Efficient and Effective Processes. Design processes that are simple, fast, and, ideally, paper free—and get things right the first time so that customers do not experience delays or errors. When fulfillment cannot be provided at the point of sale, have the ability to hand off the task to operations through data or images. Then route the task to the right individual for completion.

- A Streamlined Organization. Create and support a lean organization with a clear sales-and-service focus, as few layers as possible between the front line and executives, high single-point accountability, and minimal bureaucracy.

- Strong Underlying Capabilities. Establish robust enabling capabilities that allow the bank to continually improve its end-to-end operating model and cost performance through complexity reduction, incentives, and extensive digital capabilities for optimizing, for example, the accessibility of products, payment options, and a single view of the customer.

The most recent

Operationally and Digitally Strong Banks Outperform Financially

The latest results showed once again that the banks with the lowest country-adjusted

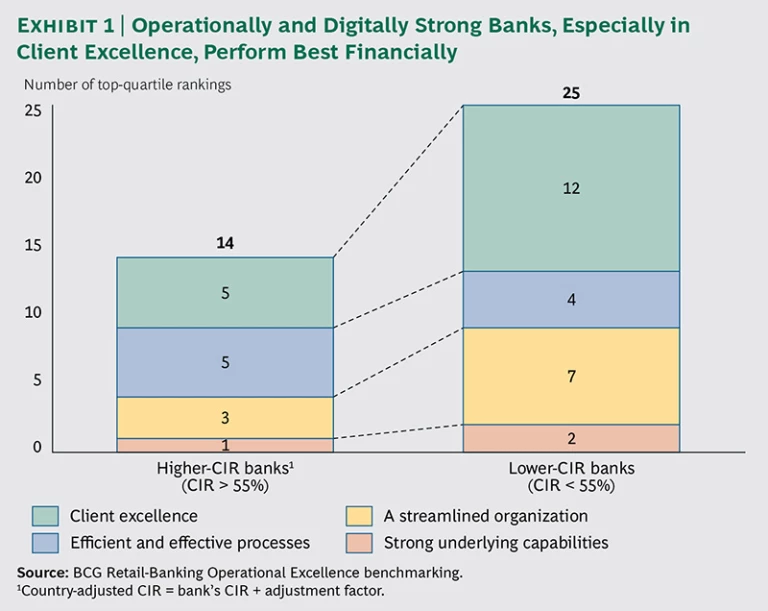

The banks with lower CIRs scored 25 top-quartile performances collectively across the four levers of operational excellence—nearly 80 percent more than the 14 top-quartile performances of the higher-CIR banks. (See Exhibit 1.)

Two-thirds of the lower-CIR banks achieved top-quartile performance in at least these three of the four levers: client excellence, efficient and effective processes, and streamlined organization. Client excellence, in particular, differentiated the leading premier-league banks from the rest of the pack.

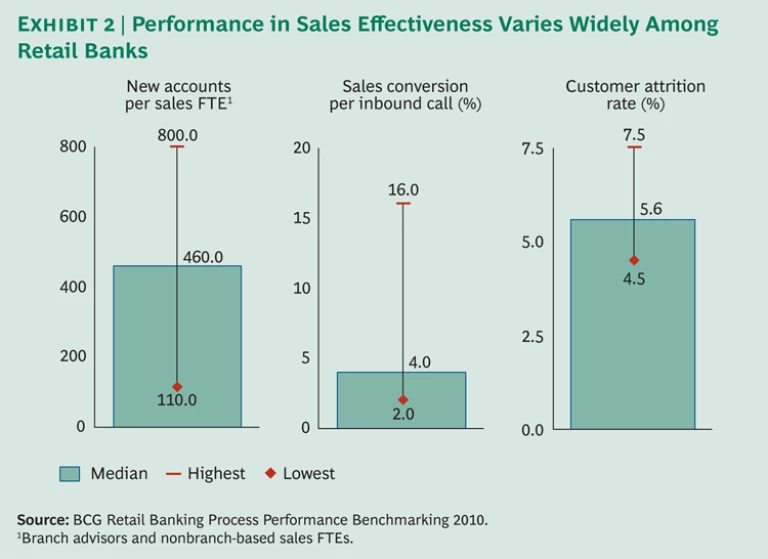

The lower-CIR banks achieved more than twice as many top-quartile performances in client excellence as the higher-CIR banks. In short, the battle for efficiency and profitability is being won not only in the back office but also through front-office achievements in channel and client excellence. Many levers related to costs and income act together to influence CIR. (Exhibit 2 illustrates selected metrics.)

As the leading banks become increasingly bionic, their enhanced end-to-end digital capabilities and direct-channel prowess support customer service and sales as well as efficiency. For example, the latest survey found that the percentage of customers enrolled online correlated with bank profits per customer and transactions per customer. The leaders are accelerating their shift to digital channels and sales efforts to improve performance and customer experience while driving down costs, as we detail later in this report. Their cost per customer was 29 percent lower than the benchmark median, while their income per customer was 17 percent above the median.

This dual advantage was enabled partially by the leading banks’ superior digital capabilities, which allowed them to increase the number of customers supported per FTE and thereby reject the traditional trade-off between boosting efficiency and providing superior customer service. These results are consistent with those in our Operational Excellence in Retail Banking 2014 report: top-quartile banks surpassed competitors in efficiency gains, simultaneously becoming more customer-centric. (See Operational Excellence in Retail Banking 2014 , BCG report, May 2014.)

Despite banks’ increasing focus on productivity and customer excellence, none of the high-performing banks in this year’s benchmarking achieved top-quartile results in all dimensions. This absence of complete mastery reflects the fundamental reality that each bank’s value proposition and strategy are unique. Some banks, for example, pursue strategies focused on relationship banking—pushing hard to expand share of wallet of their customers. Others focus most keenly on the pursuit of lean and efficient processes. Those two approaches yield different top-quartile performance profiles, underscoring that even the highest-performing banks have potential to improve in one or more of the four levers of operational excellence—

especially by enhancing digital capabilities as a differentiator.

Four Trending Practices of the Leading Banks

We observe four trending practices among the leading banks as they increase the digital divide between themselves and competitors:

- Improving customer experience with digital technologies

- Digitizing end-to-end processes to boost efficiency

- Offering a human touch in a digital world: increasing the share of client-facing FTEs

- Expanding digital capabilities while controlling complexity

- It is no coincidence that these four practices align with all four key levers of operational excellence. (See Exhibit 3.)

Improving Customer Experience with Digital Technologies. Convenience is king for today’s bank customer, motivating a surge in digital banking, particularly for basic transactions and interactions. The top banks are winning the race to facilitate and capitalize on this shift in preference for direct channels by expanding mobile, online, and other always-on platforms. The leaders are streamlining services and improving the customer experience—both online and at branches—by adopting the digital best practices pioneered by nonfinancial retail-focused businesses, such as Amazon.com, Apple, and Google.

Top-quartile banks are striving to reduce complexity and provide hassle-free interactions, as detailed later in this report. For example, they are simplifying product portfolios, providing prepopulated customer forms, and offering products and services through integrated Web portals.

The results of these digitally focused efforts are evident in banks’ sales and service metrics. Top-quartile banks’ reliance on online channels for origination of savings and current accounts is significantly higher than the median: 39 percent versus

14 percent.

Since 2012, the top-performing banks have doubled the number of interactions per client in direct channels, while branch transactions decreased only marginally. The strong overall increase in direct interactions is allowing the top banks to learn more about their customers and to capitalize on that deepened relationship by making more tailored and attractive offers.

To accelerate the shift to digital, 71 percent of banks in the survey employed positive customer incentives to use direct channels. Positive incentives include higher interest rates offered for direct-channel savings products, in contrast with the negative incentive of fees assessed for branch monetary transactions.

Mobile is the fastest-growing direct channel in retail banking, cutting into the share of online activity, particularly at the top-quartile banks. In two years, mobile’s share of transactions has risen from 1 percent to 13 percent at the top-performing banks, and from less than 1 percent to 10 percent for the median. Mobile now accounts for more than 25 percent of customer interactions at leading and median banks alike. This growth has reduced the share of online interactions in the overall channel mix, from 44 percent to 34 percent at top-quartile banks and from 44 percent to 40 percent for the median.

Still, customers’ mobile transaction and interaction rates leave much space for growth—even at banks with the highest mobile enrollment—and many banks’ mobile capabilities remain limited. As a result, there is a rich opportunity for banks to differentiate themselves among customers by introducing advanced features and services. Today, real estate and consumer loans and investment products—all accessible online—are generally unavailable by mobile, even among the top-quartile banks. Banks have not yet adopted the latest mobile-payment capabilities already in use by online and brick-and-mortar retailers. Seventy-five percent of banks do not offer digital-wallet services. Only 13 percent offer camera-supported check deposit.

Centralized calendars are an underdeveloped and differentiating digital capability that can streamline customer service and convenience, simultaneously boosting bank performance through higher income and reduced costs. Centralized calendars work across channels, allowing customers to choose their own point of contact with the bank while enabling the levels of speed and convenience that digital-age customers expect. Booking meetings through direct channels also frees up the time of expensive branch resources. Yet today, just 50 percent of banks have advanced centralized-calendar capabilities, and 17 percent have no centralized calendar at all.

Digitizing End-to-End Processes to Boost Efficiency. From a bank’s point of view, digital technologies offer opportunities to boost efficiency by automating and standardizing processes, while improving the customer experience.

Over two years, account-opening productivity across product categories has increased by approximately 25 percent. Median performers today can open roughly the same number of accounts as top-quartile performers two years earlier. The productivity of postsale administration teams has risen even more strongly although less evenly across banks.

Credit card processes illustrate the importance of automation to account-opening productivity. Overall, 83 percent of survey participants reported having automated preapproval processes for credit card applications. But straight-through processing (STP) for end-to-end account opening is the norm only among top-quartile performers. Most median performers still have largely manual processes. As a result, top-quartile banks can open approximately 15,000 credit cards per account-opening FTE, compared with only 8,000 for the median.

This STP-driven performance gap between the top quartile and the median is similar for account openings of other simple products, such as current accounts and basic investment products. But the gap is narrower for more complex loan products, such as mortgages and unsecured consumer loans, for which even top-quartile performers still use semimanual processes.

Banks, therefore, have substantial scope for efficiency-enhancing improvements by, for example, developing advanced workflow tools and paperless processes, which are still the exception. Tick-and-flick task management, channeling tasks to appropriate lower-cost teams, is practiced by just 20 percent of banks. About 65 percent of banks now scan all paper-based forms, but most of the rest still work exclusively with paper.

Digitization also provides more seamless cross-channel banking solutions for both sales and service. It encourages customers to migrate from branch activities to more convenient, more efficient, and less expensive online interactions. But providing a smooth journey among direct channels—allowing banks to increase sales by making more personalized and appropriate offers—requires banks to develop a number of advanced capabilities. Identifying natural cross-channel customer pathways that yield the highest results will require the study of customer behavior and increased IT capabilities.

Among the key capabilities for enabling a smooth customer journey is a single view of the customer. Yet today, 43 percent of banks still do not offer a unique customer ID across all channels. They therefore lack a key enabler for a single customer view.

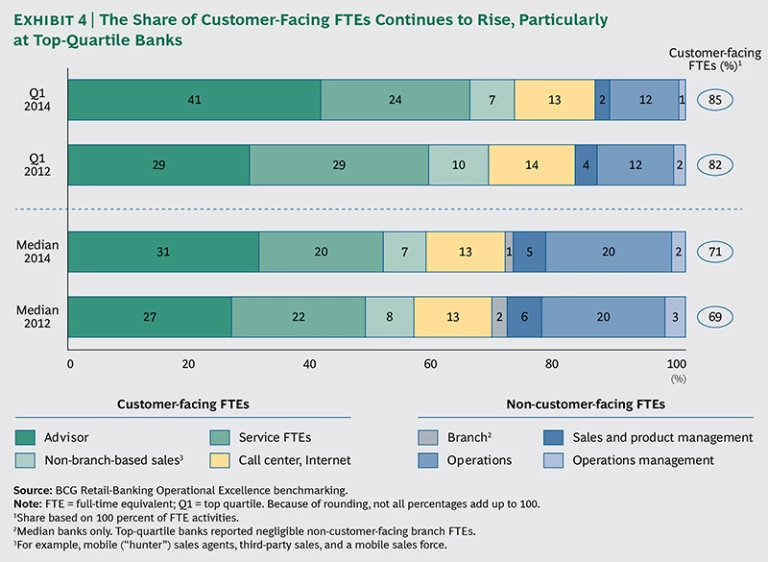

Offering a Human Touch in a Digital World: Increasing the Share of Client-Facing FTEs. As customers migrate to digital channels and processes are automated, top-quartile banks are achieving significant efficiency improvements, freeing up time in the back and front offices. As a result, the number of customers per total FTEs has risen 14 percent in two years at top-quartile banks, while improving just 3 percent for the median.

Rather than releasing all of the freed-up capacity, however, the leading banks are shifting some of it from operations and service tasks to client-facing advisory functions. The share of branch advisory activities among total FTEs rose from 29 percent to

41 percent over two years at top-quartile banks, while increasing from 27 percent to just 31 percent for the median. Customer-facing service personnel decreased by 5 percentage points at top-quartile banks, enabled by the shift of transactions and interactions to digital channels. (See Exhibit 4.)

When top-quartile banks improve their efficiency, they are focusing head count reductions on their back-office functions. As a result, the top banks are increasing the relative share of customer-facing FTEs. Yet they are doing so without a negative impact on sales productivity. In fact, new accounts per customer-facing FTE rose over two years at top-quartile banks, while virtually stagnating for the median.

Expanding Digital Capabilities While Controlling Complexity. Today, the digitization efforts of retail banks focus largely on the front end. More than 86 percent of banks’ digital roadmaps are designed primarily to enhance customer experience, with just 14 percent focused on process automation. The opportunities of fully end-to-end digitization are therefore not yet thoroughly exploited even by many premier-league banks.

Data management using digital technologies is among the critical underlying capabilities in which banks should invest. Data analytics are proving crucial to superior lead generation and the creation of a bespoke client experience. In terms of sales per client, banks with a balanced quantity-quality approach to lead generation had twice the advantage of banks that focused strictly on quantity. Furthermore, banks that focused on quality did 15 percent better than those focusing on quantity.

Even though high-quality leads are clearly a significant enabler of sales productivity, most banks use need-based analytics to generate just 32 percent of leads. The remaining leads—the majority—were largely the result of inbound inquiries from clients.

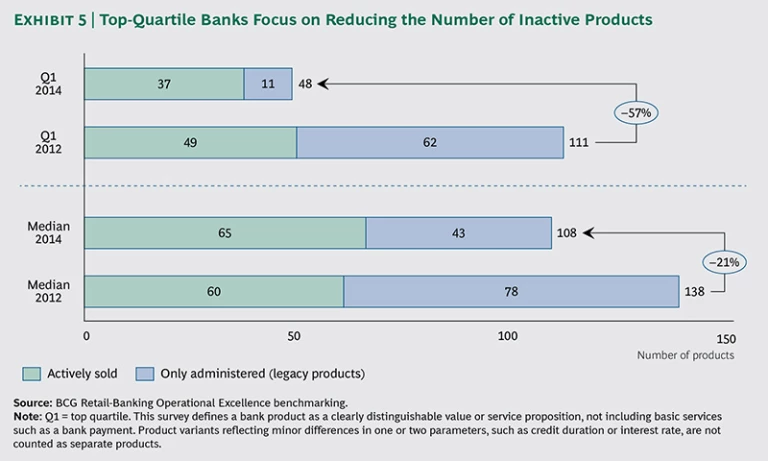

Another important underlying capability of banks is complexity management, notably the reduction of product

How to Create a Digital Bank with a Human Touch

Achieving true operational excellence isn’t a simple feat in today’s competitive and regulatory environment. Customer needs and expectations are evolving. So, too, are programs to achieve operational excellence. One successful approach taken by leading banks combines lean and digital innovation to reimagine critical processes.

There are four key elements for success. Most of these involve digitally driven evolution:

- An agile implementation approach to create impact quickly

- A digital platform and data architecture to overcome legacy IT systems where appropriate

- Lean process reinvention and optimization, employing technology to make end-to-end, step-change advances in both efficiency and the customer experience

- Leadership and culture change to develop a customer mind-set and achieve client excellence

Successful digital-transformation programs start with the creation of a multidisciplinary team—representing marketing, front-office, risk, back-office, and IT functions—in charge of introducing a consumer-centric digital process. The teams take a start-up approach. They work in short agile cycles that are tied to consumer journeys and the most up-to-date proven digital trends. They focus on overcoming issues and generating impact quickly.

Legacy IT systems and operating models are a particular challenge for a digital transformation. Indeed, legacy IT is usually highly complex for incumbent players, having been built on partly unaligned or dedicated processes, with distribution channels progressively linked through intricate data flows. Transforming these complex systems requires significant change and testing across multiple platforms and interfaces. The results are high costs, constraints, and slow progress.

In contrast, a more successful approach is to develop a digital platform with a data architecture connecting it to legacy systems. The digital platform creates the environment necessary for an agile start-up approach to development—notably by

providing Web and mobile interfaces, channel and content integration, business-process-management engines, and a modern data stack. A data architecture progressively connects the digital platform with legacy systems to ensure that existing data flows populate the platform and that the platform can backfill data to the legacy and, especially, back-office engines.

Making step-change advances in both efficiency and customer experience requires a staged reinvention of end-to-end customer processes. This can be accomplished by combining digital-platform development with subsequent process reinventions in 12-week cycles, while building core assets. This agile approach avoids the limited-optimization traps and other compromises inherent in traditional concept-design-implementation initiatives. The latter require significantly more time to deliver first tangible results to customers.

To achieve success, banks must have an overall governance model through a digital transformation office that is linked to a senior executive—the CEO, the chief operating officer, or the chief security officer—who orchestrates collaboration with the chief information officer. Working together, they use the start-up approach, the digital platform, the data architecture, as well as a significant change program to develop a digital, lean, and customer-focused mind-set throughout the organization—at all levels. With the commitment and shared vision of senior management and a significant number of staff, they will work to achieve clear and specific objectives: to improve the customer experience and create an ingrained, high-performance culture. If goals at both the program and project levels are not fully transparent, uncoordinated team efforts will likely produce inconsistent and conflicting designs. Those divergent paths will, at best, create incremental and short-lived improvements. At worst, they will lead the institution in the wrong direction.

A true end-to-end redesign of critical processes that creates a digital bank with a human touch can be exceptionally rewarding. BCG has found that institutions with an operational-excellence mind-set embedded throughout the organization—with customer experience at the core—can increase the efficiency of certain critical processes by more than 30 percent. At the same time, they can shrink cycle times by more than 50 percent, reduce error rates, and improve the customer experience. By taking a fully end-to-end approach to operational excellence throughout the organization, even banks that have already optimized individual departments will be rewarded with substantial further gains.

Acknowledgments

The authors would like to express their gratitude to the financial institutions that participated in the benchmarking and the interviews that provided the foundation for this report. They are also grateful for the contributions of colleagues in BCG’s Financial Institutions practice, in particular Nicolas Harlé, Victoria Roig, and Niclas Storz, as well as Kai Angermeier for research. Special thanks go to Jonathan Gage for his editorial direction and to other members of the editorial and production teams, including Katherine Andrews, Gary Callahan, Philip Crawford, Elyse Friedman, Kim Friedman, Abby Garland, and Sara Strassenreiter.