Research, including that done by The Boston Consulting Group, repeatedly shows that acquisitions more often than not destroy value. (See Riding the Next Wave in M&A: Where Are the Opportunities to Create Value? , BCG report, June 2011.) Yet companies continue to acquire, each secure in the belief, apparently, that it can buck the trend.

Cast a Wide Net, but Prepare to Seize Opportunity

Acquiring companies are selective—as they should be. Our research shows that the average acquirer reviews roughly 20 candidates before closing a deal, eliminating high percentages of potential targets at each stage of the review process before finally making a binding offer. There is good reason. The two reasons for failed acquisitions most cited by respondents to our 2015 Corporate Leaders M&A Survey were unclear strategic fit and lower than expected synergies. Acquirers ought to be able to surface both of these issues with a disciplined review and selection process. On the basis of our experience with corporate acquirers, we recommend that the following five principles guide the target selection process:

- Take a step back before you start; understanding key industry dynamics is critical. Begin with a sound analysis of your industry and understand the factors influencing direction for the next five to ten years.

- Don’t pursue M&A without a strategy. A sound portfolio analysis is the starting point for a target search. Decide which are the growth businesses in your portfolio, and prioritize your search accordingly.

- Follow a systematic approach and focus efforts on quantifiable value creation. Pay particular attention to the strategic fit between candidate and acquirer and the feasibility of a deal.

- Be rigorous—shortcuts don’t pay off. Make sure you have a disciplined analytical approach, and that you invest the requisite time to analyze targets in depth.

- Embed the target search process in your organization. M&A is not a one-time effort. Approach the target search as an opportunity to set up a permanent screening process for future acquisitions.

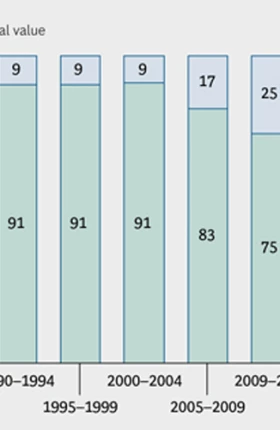

One word of caution, however. The process should not be so rigid—or so rigidly adhered to—that it actually hinders the buyer from moving quickly and opportunistically when an attractive prospect presents itself. A surprising finding of our research is that extensive selection does not by itself guarantee success—or vice versa. Companies that consider and reject relatively few candidates—an elimination rate of 20 percent or less—have a better success record than those that cast a very wide net before narrowing the field. (See Exhibit 2.)