For insurers that are considering a digital transformation of their business, technology is at the heart of the endeavor. How companies transform their IT can be as important as where they end up.

Most insurers have been slower than other types of financial services companies, such as banks, to rethink their business from the customer’s point of view—and to invest in end-to-end transformation of legacy technology systems that makes shaping customer journeys possible. It’s a long, complex, and expensive undertaking, to be sure, but as digital technologies upend all aspects of the business, from consumer engagement to policy administration to claims, delay becomes a less and less viable option. Comparisons with industry peers no longer define customer expectations. Instead, digital leaders, such as Netflix, Apple, and Google, or new players, such as Oscar, Lemonade, and Wealthfront that aim to disrupt the industry, serve as reference points. The pace of change is fast and the future unpredictable; companies need technology platforms that provide maximum flexibility.

Forward-looking insurers first need to alter their approach. Industry leaders are making the transition from digitizing products and processes to delivering digital customer journeys that serve all of their customers’ needs, and from offering more guidance and advice to tailoring coverage to individual requirements and providing seamless omnichannel interaction, online and offline. (See, for example, “ Digitizing Customer Journeys and the New Insurance IT Model ,” BCG article, August 2016.) But almost all insurers in the US and Europe use complex legacy technology that constrains their ability to operate in today’s digital world. (See “ Building a Digital Technology Foundation in Insurance ,” BCG article, August 2016.)

Full-scale transformations may take years, and most require massive investment. They can also be highly disruptive to the organization. Insurers still have businesses to run, customers to serve, and investors to reward. How do insurers balance the need to transform their technology with the equally critical need to manage their business during the transformation? How do they transform IT and avoid a costly multiyear program that generates value only at the very end?

Drawing on our transformation experience, we have developed a flexible, staged solution that produces value fast and resolves the digital versus legacy system question for both the near term and the long term.

End State: A Digital Technology Stack

A fully digital IT stack looks very different from the legacy systems that insurance companies have built over the years. The functionality of the new stack typically uses cloud-based platforms—such as platform as a service (PaaS)—which tend to be service enabled, decoupled, and based on flexible components rather than full-fledged core insurance suites. Companies that regard technology as a strategic advantage will likely lean toward an open-architecture model that is modular and flexible. There are six layers to consider:

- The front end, or customer engagement layer, provides device-, location-, and context-aware customer interfaces and enables digital companies to deliver tailored advice and recommendations, as well as a rich, multichannel, multidevice digital customer experience.

- The smart-process and decision management layer uses automated decision engines and artificial intelligence to offer customer-centric tailored services based on microsegments and personalized risk profiles.

- The back end, or core insurance systems layer, contains all systems of record for the core insurance business (the policy administration, claims, and billing functions) and its support (risk management and finance, for example).

- The central data layer captures all data (both structured and unstructured) for real-time processing and analytics. This layer provides access to key data, including a “single source of truth” that gives insurers a 360-degree view of customers, reduces customer churn, detects fraudulent claims, and features product masters and product rules—capabilities that can speed claim processing.

- The cloud-based digital infrastructure layer permits scalable high-performance digital services and rapid time to market for new digital solutions.

- The integration and security layer manages these two functions by decoupling front-end from back-end platforms, integrating applications with external parties on the basis of open application programming interfaces, and managing security and privacy across the IT landscape.

Getting There Is a Journey

Even though the destination is clear, the journey for most insurers is typically longer, costlier, and more difficult than they expect. In our experience, many technology transformations fail because they do not produce results that the rest of the organization can see until the end of the trip. Too many IT transformations focus on the technology to the exclusion of the customer experience.

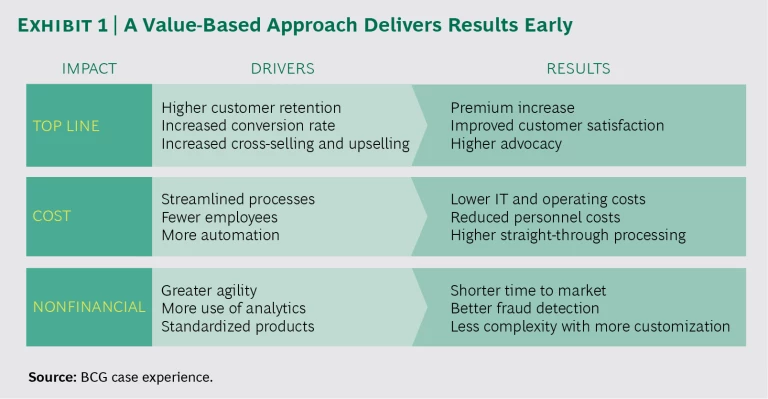

We believe that if a transformation is to succeed, it must show value for customers quickly—by offering new services that help customers make the right decisions about their plans, for example, or by introducing new loyalty programs that facilitate collection of customer information. A company can measure gains in value in several ways, including increased cross-sales and higher retention or conversion rates that lead to better customer satisfaction and more advocacy. Improved efficiency and lower costs in an insurer’s operations or distribution resulting from more-effective process automation are additional measures of success. Revenue boosts and cost reductions in the early days can help fund the journey at a stage when investments are typically bigger than benefits. (See Exhibit 1.)

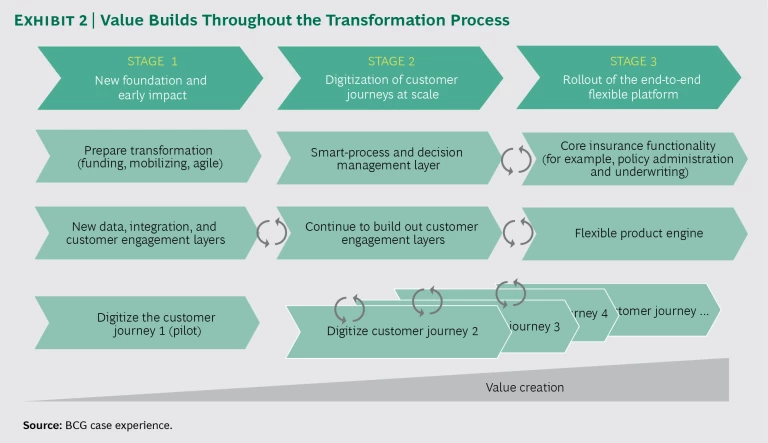

Insurers should think of transformations as occurring in three stages. (See Exhibit 2). The key, we have seen, is to focus first on digitizing the central data layer of the end-state platform rather than on dealing with the process layers (such as the front- and back-end layers). This approach allows much earlier value realization than traditional approaches do: from the initial stage of the transformation onward, users can take advantage of the new platform’s digital capabilities. Moreover, it facilitates the full integration of legacy systems with significantly less effort and with a greater chance of success.

The duration of the transformation journey overall and of each stage will depend on each company’s unique situation—in particular, on how its data is currently structured and how scattered its legacy landscape is. We typically see a full journey time of 24 to 36 months, but real immediate value creation can start in the first few months and continue throughout.

Stage 1. Combining a New Foundation with an Early Impact

The goal at Stage 1 is to create the foundation of the target architecture while having an early positive impact on the customer experience. By the end of this stage, companies should have built new data, integration, and customer engagement layers while running their legacy platforms in parallel. The new data layer can draw data from legacy systems for use in big data applications while the legacy systems continue to serve as the master for all systems of record.

As they build the new technology, companies can begin to enhance the customer experience by establishing modern user interfaces for digital channels (following standards set by high-tech beacons such as Google and Netflix). The new data layer allows integration of data from diverse sources, both internal and external (web traffic, social media, and offline channels, for example). Analytics capabilities support new digital services such as peer comparison in auto insurance, location-based services in health insurance, and life insurance and retirement advice. Early lighthouse projects, typically involving customer self-services, fraud detection, or cross-selling, can demonstrate value within the first few months of their existence, energizing the organization. Customers begin to experience the capabilities of the “new” digital insurer right away.

We also advise companies to use the first stage to prepare for the transformation and to mobilize the organization. A critical aspect of this process is the opportunity it offers to free up funding by identifying quick-win efficiencies such as suspending existing projects, improving sourcing and procurement, and reducing general expenses.

Stage 2. Digitizing End-to-End Customer Journeys

Stage 2 creates near-term value by enabling capabilities that automate customer journeys (and back-end processes) through the application of business rules to data extracted to the data layer in Stage 1. This stage typically generates significant value by eliminating expensive manual processes and workarounds. It also boosts top-line growth by improving the customer experience, leading to higher retention and lower attrition rates.

In this stage of the transformation, companies build out the smart-process and decision management layer and extend the customer engagement layer. Because the digital data layer is largely in place, insurers can begin to digitize such processes as claims handling while legacy systems remain untouched and continue to function as the systems of record.

Companies can also start to reimagine products and processes in the context of customer journeys—how life events trigger the need for new or different products and services. By digitizing the interactions with the insurer that these journeys entail and by adding functionality to the smart-process and decision layer, insurers create superior experiences. For example, companies can provide better real-time results (such as processing a claim in a single day, under many circumstances, or enabling a life insurance advisor to provide high-quality advice tailored to a customer’s individual needs and circumstances).

Stage 3. Rolling Out the End-to-End Flexible Platform

Stage 3 creates further value by rolling out core insurance functionality (policy administration systems and underwriting, for example) and bringing the full functionality of the new platform online. Typically, this activity accompanies the rollout of a new product engine capable of generating flexible product offerings that eliminate complexity in IT processes and reporting, and that are readily configurable to meet market demands.

The new platform is often built out on a cloud-based PaaS (at much lower cost than facilities-based legacy systems) and based on an open-architecture concept, which means that the company can modify or replace individual components as needed in the future—also at much lower cost.

The insurer gradually migrates customers to the new stack. It transfers all relevant data to the new platform, which is now the system of record, and uses the new platform to conduct all subsequent business. And finally, it digitizes relevant, high-value customer journeys and decommissions legacy systems.

The new technology environment supports advanced capabilities that require the use of full-target architecture, such as real-time underwriting. The system simplifies the product experience and creates possibilities for new product combinations and offerings for customers. It also permits experimentation with new business models and adjacent businesses.

New Operating Model, New Skills, and Leadership

Building an entirely new technology platform over a two-to-three-year time frame requires a different way of working and new types of talent, both of which depend on leadership.

Operating Model. As they move through the three stages of digital transformation, insurers will need to embrace agile methodologies and approaches, and this can be a transformation in and of itself. We have observed that many companies struggle with the transition to agile. (See “ Five Secrets to Scaling Up Agile ,” BCG article, February 2016.) It is not easy to integrate self-directed, cross-functional agile teams into the existing hierarchy of large companies. But making the transition is crucial because a company’s ability to create value throughout the transformation process depends on its ability to design and release new technology and customer experience features in periods of weeks or months as opposed to years.

Skills. The digital insurer requires new types of talent as well. Insurers that cannot attract, develop, and retain staff with advanced digital skills risk falling behind: talent in today’s increasingly transparent marketplace is quick to recognize companies that do not measure up. The reverse is also true: talent attracts talent. It’s important for a company to foster a digital culture that favors experimentation over risk aversion, customer-centric over channel-centric strategies, and collaborative over siloed approaches. Companies that transform their capabilities first will benefit from a head start that others may find difficult to overcome.

Leadership. To initiate the digital transformation, the CEO and CIO, backed by the board, must play an active leadership role. In our experience, the leaders of companies that successfully transform take the following actions:

- They emphasize to the entire organization that transforming legacy IT is more than just another IT project—that it requires multidisciplinary teams comprising business and IT people.

- They communicate the critical advantages of a digital customer experience and technology to their staff, providing clear proof of value and evidence of economic viability.

- They work with the strategy department to create a robust change management and governance structure.

According to the old saying, getting there is half the fun. Most company leaders might disagree, but they would agree that it’s half the challenge, if not more. Insurers that adopt a phased approach to the transformation of their business and technology will find that getting there can be a manageable (and exciting) process—and one that delivers results and value all along the journey.