It pays to look below the surface. At $16 billion in 2014, e-commerce sales in Brazil represented about 4 percent of the nation’s total retail sales of $429 billion, enough to edge the country into the top ten e-commerce markets worldwide. Brazil leads the rest of Latin America, but it still ranks far behind such behemoths as China and the United States, as well as several other economies. According to eMarketer, which compiled the statistics, the three leading e-commerce categories in Brazil during the first half of 2014—fashion and accessories, health and beauty aids, and household appliances—together accounted for almost half of all transactions.

But delve more deeply and a different picture emerges. A comprehensive study of digital’s impact on consumer commerce in Brazil by The Boston Consulting Group’s Center for Customer Insight shows that the Internet is a much more pervasive force in the country than the bare statistics suggest, and one that marketers and retailers must contend with. The Internet influences more than half of all retail purchases in Brazil. Nearly all connected consumers—some 106 million people, accounting for more than half the Brazilian population—use the Internet at some point for some purchases. Digital’s impact on consumer commerce is already big, and it’s set to get much bigger in the next few years.

Digital’s Evolving Impact

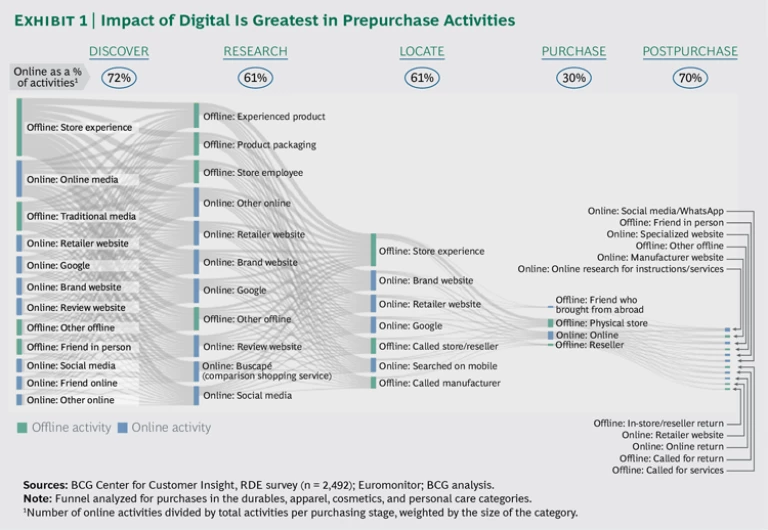

Digital technologies affect each stage of the purchasing journey—prepurchase, purchase, and postpurchase—differently. But along this route, marketers and retailers are looking at big changes in how and where people buy, shifts that will evolve over the next several years. So far, the Internet’s impact is most extensive and powerful in the pre- and postpurchase stages. (See Exhibit 1.) With online activities playing a role in almost three-quarters of all product discovery activities and in nearly two-thirds of all research activities, the Internet is substantially altering consumer behavior, making the various phases of prepurchase much more complex and the overall consumer journey harder to predict. Moreover, with more than 70 million Facebook users, Brazil is the social network’s third-largest market by number of users, and consumers’ opinions postpurchase—whether positive or negative—often have a wide audience.

Digital’s influence varies depending on the type of consumer, the product category, and the state of regional connectivity. Internet usage is still predominantly an upper-income, urban/suburban, and coastal phenomenon. Issues of telecommunications infrastructure, income, and personal inclination have restrained growth in digital penetration and usage in interior communities. But this is changing, and we expect the pace of change to accelerate in coming years. Projections show Internet penetration reaching 65 percent nationwide by 2019. Some 40 percent of Brazilian households today have fixed-line broadband access, and—more significantly—more than 140 million customers have mobile subscriptions connected to fast 3G and 4G networks. Many of these mobile users will become mobile Internet users as smartphone sales capture 70 percent of all mobile handset sales from 2016 on. As we’ve pointed out in previous publications, small cities deep within Brazil’s interior account for more than half of the country’s population, and they will become important drivers of growth at least through the rest of this decade. (See Capturing Retail Growth in Brazil’s Rising Interior , BCG Focus, April 2015, and Brazil’s Next Consumer Frontier: Capturing Growth in the Rising Interior , BCG Focus, June 2014.) Millions of households located outside Brazil’s major metropolitan areas and 26 state capitals have vaulted from poverty into the ranks of the middle class. They will be especially important sources of growth in sectors such as financial services, automobiles, and apparel. As these people come online, most will be mobile-first—and mobile-only—users. They will have to contend with the inherent constraints of a 4- or 5-inch screen, but they will interact from the get-go with connectivity that’s local (it’s always where they are), personal (it’s tailored to their needs and preferences), social (all their friends are there as well), and always on.

A Marketplace That’s Segmenting by Consumer…

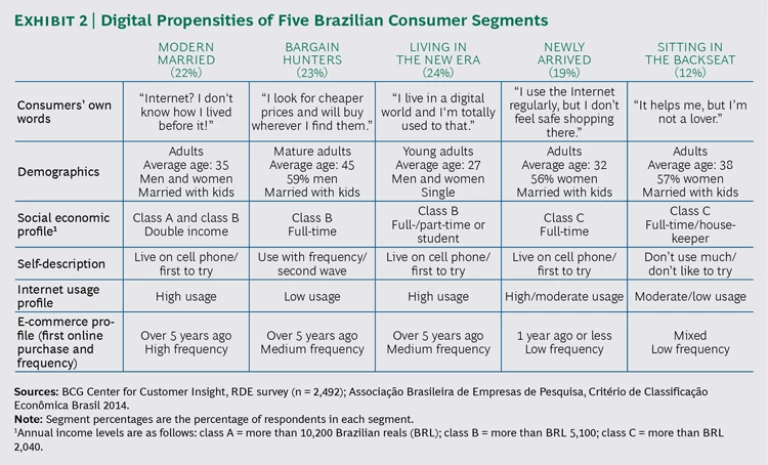

BCG’s research, which included both a quantitative survey of some 2,500 Brazilians and interviews about their online use, indicates that distinct categories of connected consumers are already taking shape in coastal areas where digital penetration is high. Because these groups are evolving, marketers will likely encounter fluid segments of consumers for the next several years. At the moment, we see five discrete segments based on demographics, occupation and income, extent of digital adoption and usage, and online shopping habits. Each segment has distinctive common characteristics and displays its own particular usage patterns, lifestyle preferences, and online evolutionary path. (See Exhibit 2.) But each is also undergoing its own metamorphosis in size and makeup, and new segments could well emerge.

Two segments should be of particular interest to Brazilian marketers and retailers today, especially those in product categories with high digital intensity or high levels of e-commerce. These are the sophisticated digital consumers we call “modern married” and “living in the new era,” which together comprise almost 50 million people—25 percent of the population. They have been buying online for five years or more, and they value the selection, convenience, and interaction of the online experience. As the digital maturity (length of time online) of these two segments increases, we expect their ranks to swell significantly.

…and Segmenting by Product

Consumers use digital tools in different ways, depending on the product category involved. At one end of the spectrum are big purchases that people want to get right—computers, mobile devices, large appliances, and consumer electronics, for example. Price and choice are important considerations in this area; brand engagement is high; and prospective purchasers have only a moderate need to touch and feel the product before buying. In consumer electronics, for example, e-commerce accounts for 13 percent of all sales, but nine out of ten connected consumers have researched the products online, and the Internet has influenced multiple activities in the early, decision-making stages of the purchasing journey—before these consumers go to the store to buy their TV, camera, or home entertainment system. Companies and brands that lack strategies for engaging consumers in the prepurchase stages are very likely losing out.

The other end of the spectrum involves products that are purchased repeatedly, such as health and beauty aids. Price is a much less critical factor in the purchase decision, and brand engagement is high—as is the need to replenish frequently. Consumers often try such products in a store (in order to see the color of lipstick or nail polish, for example), and then use online merchants for repeat purchases. Less than 2 percent of health and beauty aids are sold online today, but buyers’ decisions about which products to purchase have been shaped by a mix of both online and offline channels long before they click (or touch) the buy button. As one middle-class consumer from Recife put it, “I’m crazy about perfume; but before buying it online, I will go to a local store to smell its fragrance. Then I go home and order it on the Internet.”

New digitally based business models for repeat-purchase products are emerging, among existing companies and start-ups. These models try to lock in consumers with the convenience of subscription-based ordering, and they encourage experimentation with new products. Examples in Brazil include Dolce Gusto, Home Shave Club, Wine Club, and Beauty Box.

Implications for Marketers and Retailers

The influence of digital technologies on consumer shopping behavior is bound to increase, driven by wider connectivity, advances in technology, and new services. The disruptive effect in developed markets is well documented. (See The Digital Future: A Game Plan for Consumer Packaged Goods , BCG report, August 2014, and Delivering Digital Satisfaction: U.S. Consumers Raise the Ante , BCG Focus, May 2013.)

Marketers and retailers in Brazil need to start preparing now for an increasingly digital and omnichannel future. The challenge is to develop offerings based on well-defined user groups and to tailor those offerings to meet the particular needs and situations of each category of user. But in the digital—and especially the mobile—world, there is an opportunity to go further and craft offerings that address the personal preferences of microsegments or even individuals on the basis of data that defines their online behavior. With respect to new users especially, companies that move quickly to reach out with personal content based on where people are, what they are doing, and whom they are doing it with have a massive opportunity to engage consumers in entirely new and powerful ways.

To thrive in Brazil’s rapidly evolving digital marketplace, companies need to do five things.

Understand the changes taking place. It’s tough to lead from a position of ignorance. Senior executives need firsthand knowledge of how digital technologies are changing consumer behaviors; many need to raise their digital IQs. Recognizing his lack of digital awareness, one executive recently decided to go on a “digital diet.” He forced himself to use digital technologies in as much of his daily routine as possible—ordering food and other services online, summoning taxis on his smartphone, using airline and hotel apps for boarding and check-in when he traveled. He went so far as to hire a digital coach to keep him on course and to provide a continuous stream of new apps and tools.

Not everyone will want to go to such extremes, but digital transformation workshops can help an executive team gain understanding, define an inspirational vision for the company, engage in self-assessment, and set priorities for the transition ahead.

Define the digital strategy. Based on their product mix, target consumer segments, and geographical footprint, companies need to determine what it will take to win online and how to leverage their existing brand and organization to deliver the best results. As we have noted before, true digital transformation starts with the basics: a well-defined strategy rooted in a firm understanding of consumer needs, a clear competitive differentiation, and sound economics. (See “ The Omnichannel Opportunity for Retailers ,” BCG article, July 2013.) Online-only companies have built their businesses around digital (and increasingly around mobile) technologies, and they have advantages that brick-and-mortar and click-and-mortar companies (models that integrate offline and online presences) cannot duplicate. But the click-and-mortar approach has its own ace to play—the power and reach of omnichannel interaction.

There are major opportunities for companies to rethink category management—including promotion, pricing, distribution, the role of the store, advertising, and point of sale—for an omnichannel world. What are the critical consumer touch points? What are customers’ concerns, and what makes them happy? Where are decisions made? What services do you want to offer across channels? How do you want to take customers along?

Connect with the consumer. The digital age offers companies more and more-powerful opportunities to connect with consumers, from websites and integrated apps to digital magazines to online discussion platforms. BCG’s most recent annual consumer sentiment survey (see Why Emerging-Market Consumers Remain Bullish , BCG Focus, November 2013), shows that Brazilian consumers are particularly sensitive to the feeling of being valued as customers—almost 60 percent of Brazilian respondents said that if they feel valued, recognized, or rewarded for their business, they stay loyal to a brand, even if they like other products or services slightly better. This percentage compares with a developing-market average of 38 percent and a developed-market average of 45 percent. Modern techniques such as digital targeting and branded content deepen relationships and engagement while at the same time collecting valuable consumer data that can shape future marketing programs. (See The Agile Marketing Organization , BCG Focus, October 2015, and Branded Content: Growth for Marketers and Media Companies , BCG Focus, July 2015.) A good place to start in Brazil is to address the needs of the 50 million consumers in the “modern married” and “living in the new era” categories, who are already heavy digital users.

Respect the role of the store. Stores remain important in Brazil. Despite a growing array of digital resources, consumers still see the store as critical for both information and transaction—especially in segments where the value of the purchase is high. More than 80 percent of affluent consumers in the Brazilian interior and 63 percent of those in capital cities prefer to touch a product in a store. Among interior households, 52 percent reported that they had made their most recent luxury-item purchase in a store in their city, and 31 percent said that they had purchased it in another city.

Retailers should think about how they can take advantage of this critical point in the purchase process—for example, by enabling store staff to make instant offers to keep customers in the store or to connect with them after a visit. The store is equally critical for consumer goods companies. Consumers still can’t touch, hold, try on, or taste a product online. The Internet cannot provide the immediate gratification of instant ownership. Consumer goods companies should evaluate how they can best support preferred retailers through early or in-store assortments, special services, or even special trade terms. (See Winning at Omnichannel Pricing , BCG Focus, May 2015.)

Develop a geographic strategy. Location matters in Brazil, which means that companies can benefit from adapting their levels of service by city. Consumer expectations for availability, choice, and speed of delivery are much higher in capital cities and other metropolitan areas than in the interior. In the former, for example, people expect next-day delivery for most categories, while interior consumers are happy to accept a delivery term of a week—and they are also more flexible about return policies. They appreciate having broader retail options, even if they have to wait longer for items to arrive.

Interior consumers can also be very inventive in overcoming local constraints to digital commerce. In the southern state of Rio Grande do Sul, for example, faced with the issue of not being able to touch or feel a product before buying it online, and the difficulty of returning unwanted purchases, consumers have created vibrant secondary markets for these goods in their communities. Briques, informal street markets organized and advertised through Facebook, have become commonplace venues for buying and selling goods originally purchased online.

It’s easy to be overwhelmed by the pace of innovation, but Brazil is still in its early days of digital development. Most companies face the same challenges. Those that fully and rapidly embrace the changes digital is bringing, define a digital strategy, and start the transformation process can build a lasting advantage.