The intensifying competition between rising emerging-market companies and established multinationals remains at the top of the agenda for CEOs. Challengers not only are radically disrupting a wide range of industries but also are increasingly becoming global leaders themselves. This article is part of a new report, Dueling with Dragons 2.0: The Next Phase of Global Competition , that analyzes the sea change under way in the global automotive-supply, construction-equipment, and chemical industries and the implications for both multinational corporations (MNCs) and emerging-market players (EMPs). The report, along with its recommendations, is based on comprehensive quantitative and qualitative research that included interviews with more than 100 executives and industry experts in China, India, and Latin America.

We found that even though the nature and competitive landscape of these three businesses vary significantly, MNCs in each industry are facing urgent challenges to their leadership from EMPs. Key executives from both MNCs and EMPs expect that competition will further intensify in all three industries. Improving global competitiveness, therefore, must be a top priority of CEOs.

The global automotive-supply industry—which has long been dominated by companies based in developed economies because of close relationships with the leading automobile manufacturers there—illustrates the rapid changes in the competitive balance between MNCs and challengers based in emerging markets. We assessed the current competitive landscape, its likely evolution over the medium term, and the best strategic options available to both MNCs and EMPs.

The Current Landscape: Signs of Change

In 2008, 25 million light vehicles—a category that includes passenger cars, sports utility vehicles, and light and pickup trucks—were produced in emerging markets, equaling 37 percent of global production of light vehicles. In 2013, that share had grown to almost 50 percent, and China alone—by then the largest car producer in the world—had an annual output of 21 million units. The emerging markets, then, are the growth engine of the car industry.

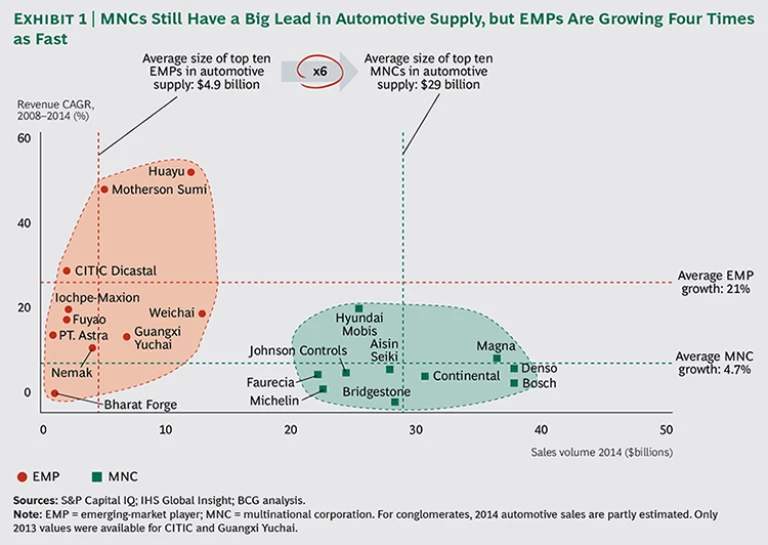

This shift to emerging markets, however, is not yet reflected in the size of automotive suppliers: the ten largest MNC suppliers have an average of $29 billion in annual revenues, which is almost six times the average annual revenue level of the top ten EMPs. (See Exhibit 1.) Nevertheless, the shift of car manufacturing to emerging markets enabled these EMPs to achieve rapid growth that averaged 21 percent annually from 2008 through 2014; the MNCs grew at a much slower pace during that period.

The top EMPs fall into two categories. Some are already global: Nemak, Iochpe-Maxion, and Bharat Forge have a sales presence, a manufacturing presence, or both on several continents. Others, however, especially Chinese companies, were until recently very busy satisfying their explosively growing home markets. They are now looking for expansion opportunities abroad and seeking to catch up in technology. (See “Weichai Power: Vaulting Ahead Through Technology Partnerships.”)

WEICHAI POWER: Vaulting Ahead Through Technology Partnerships

China’s Weichai Power, a diversified maker of engines, transmissions, and heavy-duty trucks, illustrates how a strong emerging-market player in the automotive-supply industry can take advantage of inorganic moves to leap onto the global stage—even in high-tech categories that are commonly considered to be the clear domain of multinational corporations. With one move—the 2012 purchase of a 25 percent stake in Germany’s Kion Group—the Chinese company became a global leader in forklifts and hydraulic technology. In so doing, it also created awareness of its entire product range.

The year after the Kion acquisition, Weichai made another big splash by forging a strategic partnership with Ferrari. Serving as the Ferrari Formula 1 team’s global sponsor enabled Weichai to leverage the Ferrari brand globally for its own purposes. In China, which is now the second biggest market for Ferrari, Weichai collaborated with the Italian automaker to develop a concept car.

Together, these moves placed Weichai—until a few years ago known only to industry insiders—squarely on the global map of leading automotive suppliers.

From an MNC perspective, the forward march of the EMPs puts many component segments under threat. The manufacture of critical core components such as engines, transmissions, and car electronics is still perceived to be dominated by MNCs. But in segments such as interiors, passenger restraints, wheels and tires, fuel systems, and body glass, leading EMPs are rapidly closing in on the MNCs in terms of quality and performance. One example is China’s Fuyao Group, which was unknown even to many industry insiders until a decade ago. Today, the company is one of the world’s leading manufacturers of automotive safety glass, producing windshields not only for local Chinese clients but also for Western and Japanese multinationals.

The Future Landscape: A Shifting Center of Gravity

By 2020, as many as 102 million light vehicles could be produced globally, with most being built in emerging markets. At that point, China alone could be producing about one-third of the global output, adding another 10 million units to its current volume—more than the current output of Japan.

This trend will put additional pressure on MNC suppliers, which already suffer from a geographical misalignment between their global sales and global car production; most today make only 10 to 20 percent of their revenues in Asia. Many of the executives interviewed for this report believe that most MNCs will react by establishing large investment programs to globalize their businesses quickly enough to keep up with this trend.

Nevertheless, most executives also expect that despite MNCs’ efforts, the increasing home-field advantage will help EMPs, especially those based in China, achieve a second wave of growth that will enable them to further expand outside their own markets.

Our simulations indicate that select EMPs will catch up with the top ten MNCs in sales volume by 2020 even if they grow only half as fast as they did during the past six years. (See Exhibit 2.) But in even the most aggressive scenario, it would still take about 13 years for three EMPs to join the ranks of the world’s five largest automotive suppliers.

Winning Globally in the Automotive-Supply Industry

In the face of tectonic changes, MNCs and EMPs need to develop the right set of strategies along three dimensions: products and technology, operations, and go-to-market approaches. The automotive-supply executives we interviewed cited a number of actions that are essential for companies to remain successful and win in the increasingly competitive global environment.

Key Strategies for MNCs

MNCs will need to take action in the areas of products and technology, operations, and go-to-market approach.

Products and Technology. From the interviews, the following top priorities emerged:

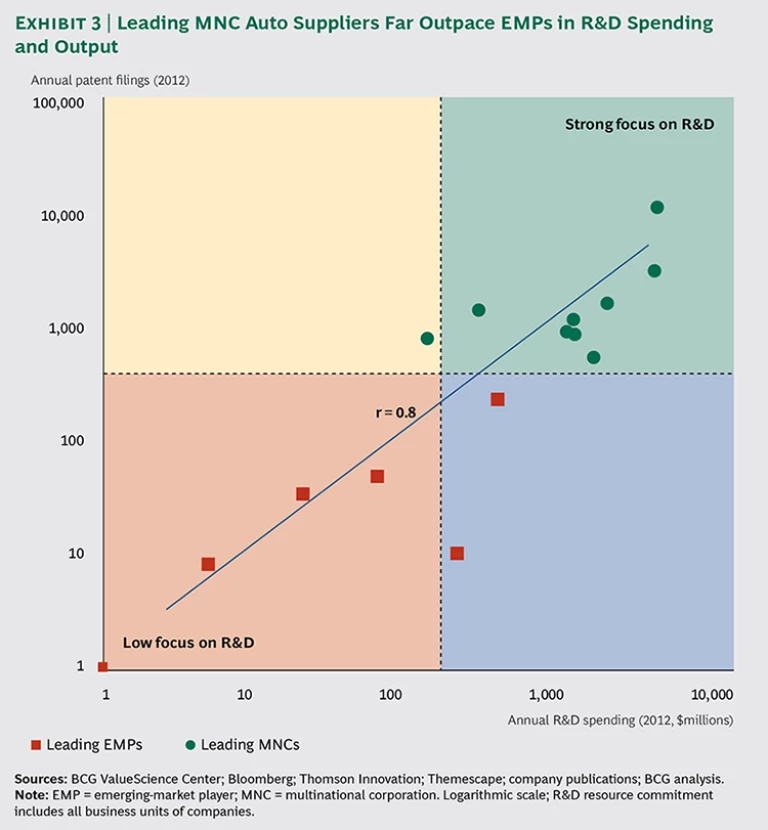

- Retain leadership in technology. The majority of MNC executives we spoke with ranked innovation and maintaining an advantage in technology as their highest priorities. Currently, we see the top EMP suppliers investing only 1.8 percent of sales in R&D, compared with 4.7 percent for top MNCs. (See Exhibit 3.) In most segments, innovation will come in the form of specialized high-end products and hard-to-imitate technological solutions. For example, in tires, a product category under heavy threat from EMPs, Bridgestone offers highly specialized products—such as fuel-efficient, grip-optimized, or “comfort” tires—that address the specific needs of the end customer.

- Target the middle market. Most of the growth in light-vehicle sales is in emerging markets, and a large portion of that growth will come from the value and middle-class segments. Industry experts believe that MNCs cannot afford to leave these segments to their emerging-market competitors, even though most MNCs find them challenging to conquer. Many standard MNC products are overly complex and expensive. Others have not been adapted to the specific usage patterns of emerging-market customers and to local conditions, such as heat and humidity. Using rigorous design-to-cost approaches, rather than simply stripping down existing products, will often be required. For example, by converting conventional instruments such as speedometers and fuel gauges to a fully digital dashboard, component costs for this module can be reduced by up to 40 percent.

Operations. Key findings from the interviews include the following:

- Build local production and distribution partnerships. Given the close integration of OEMs and suppliers in the automobile industry, there can be no doubt that suppliers need to localize their production to where car production is moving. In other words, they must expand in emerging markets. Executives in our interviews clearly see this as a challenge that requires long-term commitment. The necessary capabilities must be built step by step, rather than through a onetime effort. Localization should be pursued in light of a coherent, long-term strategy rather than through individual opportunistic decisions. (See “Faurecia: Catching Up by Using a Persistent Strategy in China.”) But it is also clear that suppliers will not be able to move into all emerging markets at once. Rather, they need to make smart bets. They have to decide which cases require proactive investment to get into position to win further business and in which cases the company will be better served by following OEMs only after a commitment is secured. Given their capital constraints, MNCs should carefully consider the full spectrum of alliances with domestic manufacturers and distributors and be open to unusual partnership formats, such as minority stakes.

FAURECIA: Catching Up by Using a Persistent Strategy in China

Although Faurecia is one of the world’s leading automotive suppliers, the French company was not among the MNCs that pioneered markets in Asia. In the early 2000s, the region accounted for only about 5 percent of the company’s sales, and Faurecia had only eight plants in China—fewer than many of its MNC competitors. From 2005 through 2012, however, Faurecia built 25 additional plants in China. By the time its so-called industrialization wave was complete, the company had localized all four of its business areas in China.

Currently, Faurecia is undergoing what it calls an R&D and innovation wave. The company has formed a series of collaborations with strong local players. The first, with Chinese automaker Geely, was launched in 2010. In 2013, Faurecia established a joint venture with Changan Automobile for automotive interiors and built a new 800-engineer R&D center in Shanghai to develop applications specifically for the needs of the Chinese and Asian markets. These moves helped Faurecia to increase its revenues in 2014 at an above-market rate of 19 percent annually, to $2.4 billion. By doing so, it has almost tripled its share of revenues from Asia, to 14 percent.

Building on these successes, Faurecia in early 2015 announced a joint venture with a unit of Dongfeng Motor. The agreement targets $2.2 billion in annual revenues in the medium term, further reinforcing Faurecia’s aspiration to become a leading player in China.

- Address the cost challenge. In an industry as efficiency oriented as automotive supply, declaring the need to address costs to stay competitive may be stating the obvious. But industry executives believe that this should be approached from a transformational perspective, not with a view toward just improving the efficiency of the supply chain. Such a holistic view is especially important at a time when one traditional cost-reduction method—moving production from high-cost to low-cost countries—is becoming ever more complex. According to BCG’s Global Manufacturing Cost-Competitiveness Index, automotive manufacturing costs in MNC home countries, such as Germany, are currently more than 20 percent higher than in India and China. But this gap will shrink, and advanced robotics may actually produce a significant cost advantage for some developed economies. (See “ Why Advanced Manufacturing Will Boost Productivity ,” BCG article, January 2015.)

Go-to-Market Approach. In our research and interviews, the following key strategies emerged:

- Defend core client relationships. The top executives interviewed in our study ranked investments in customer relationships as their second-highest strategic priority. Thus, one approach for MNCs would be to closely integrate production footprints and product development activities with those of their OEM clients. For example, deploying resident engineers at an OEM’s facilities can deepen relationships on an operational level and gain priceless insights into the needs and challenges of customers. Japanese suppliers have been the first to show the tremendous value that resident engineers can contribute to their companies’ relationships with OEMs.

- Differentiate through value-adding services. Experts agree that the current movement away from only supplying parts and toward providing solutions will continue as suppliers seek to protect key accounts and differentiate themselves. This is an especially important strategy for smaller players. Austria’s AVL Group illustrates this very well. With $1.4 billion in revenues in 2014, AVL is the world’s largest independent developer of power train systems with internal-combustion engines. But it remains much smaller than the leading MNCs. By offering advanced simulation methods and testing instrumentation as well as development services, AVL seeks to provide the ideal solutions for clients’ specific demands. This is especially helpful for OEMs in emerging markets, which may not have these abilities themselves. Executives state that the more commoditized the fundamental product technologies become, the greater will be the importance of these value-adding services.

Key Strategies for EMPS

EMPs will also need to adopt new strategies for their products and technology, operations, and go-to-market approaches.

Products and Technology. The top priorities cited by executives include the following:

- Close the technology gap. The majority of EMP executives we interviewed cited catching up in technology as their first strategic priority. Despite progress by EMPs in segments such as interiors, passenger restraints, wheels and tires, fuel systems, and body glass, MNC suppliers are still perceived as dominating technology in core components, such as engines and transmissions. Closing the technology gap will require EMPs to overinvest in R&D, yet many continue to underinvest. Pressure to innovate is coming not only from the aggressive R&D agenda of many MNCs but also from stricter regulatory standards in both emerging and developed markets. Rising standards for emissions and fuel efficiency, stricter car-recall policies, and enforced repair and replacement guarantees by OEMs will require EMP suppliers, as well as MNCs, to improve product technology and quality just to stay in the market.

- Adjust the product portfolio. Six of the ten leading MNC suppliers are active in more than 7 of the 20 product categories we examined. By comparison, only two of the top ten EMPs cover more than seven categories. The questions for EMPs then become: Should we broaden our product portfolio, with the risk of spreading our resources too thin? Or should we focus on a few sectors, with the risk of becoming “too niche” to qualify as a global tier-one supplier to MNCs? The answers will vary by industry segment and companies’ specific strengths and weaknesses. But executives should make it a priority to discuss these questions explicitly and make strategic decisions accordingly.

Operations. The following key strategies emerged from our interviews:

- Build global manufacturing and operations footprints. Large MNC suppliers have a comparably robust competitive advantage in that the world’s leading OEMs increasingly require their suppliers to match their global footprints. This is a very significant barrier to growth for smaller local players, even at home, since large OEMs account for a significant portion of car sales in emerging markets. For this reason, the road to global leadership requires a global manufacturing network, including a considerable footprint in the developed world (with the cost disadvantages that this implies). Given the massive capital investment required, making smart bets on where to go is critical to the strategic trajectory of any EMP. Nemak is one example of an EMP that has become a leading supplier, in a high-tech category no less, by extending its footprint and capabilities on a global level. A producer of high-end aluminum components, such as engine blocks, Nemak started the journey in its home country of Mexico. Today, the company has an international production network consisting of 34 plants, and it supplies many of the leading global OEMs.

- Develop the organizational capabilities needed to realize global aspirations. Bigger size, global operations, and a broader product portfolio increase organizational complexity. EMPs need to make sure that their core processes are up to this challenge. They should ask: Is our talent management international enough? Are we able to successfully integrate an acquisition target? Are our IT platforms secure, and do they support efficient processes? EMPs struggle with these issues, we often find, because the hypergrowth that they experienced during the previous few years did not leave them sufficient time to professionalize corporate processes and capabilities.

Go-to-Market Approach. Industry experts recommend that EMPs follow a global branding strategy. It is important for EMPs to create brands outside their home markets. In our experience, this is a challenge for many EMPs, both within and outside the automotive-supply industry. However, several have found creative ways to overcome this challenge. For example, Hankook Tire is aggressively investing in sponsorships of racing series to create a strong brand for its products, while Weichai—an engine manufacturer—is partnering with Ferrari’s Formula 1 team. (See “Weichai Power.”) Our experts believe that EMPs will make this type of bold move more often in the next couple of years as their ambitions continue to grow.

The strategies of leading MNCs and EMPs in the automotive-supply industry reflect the fact that they are starting from different places. But the vast majority of executives in both types of companies shared one sentiment in our interviews: the pace of change is faster than they would have expected it to be a few years ago, and it’s accelerating. Executives must act with resolve to prepare their businesses for the inevitable shifts to come.

Winning the Next Phase of Global Competition

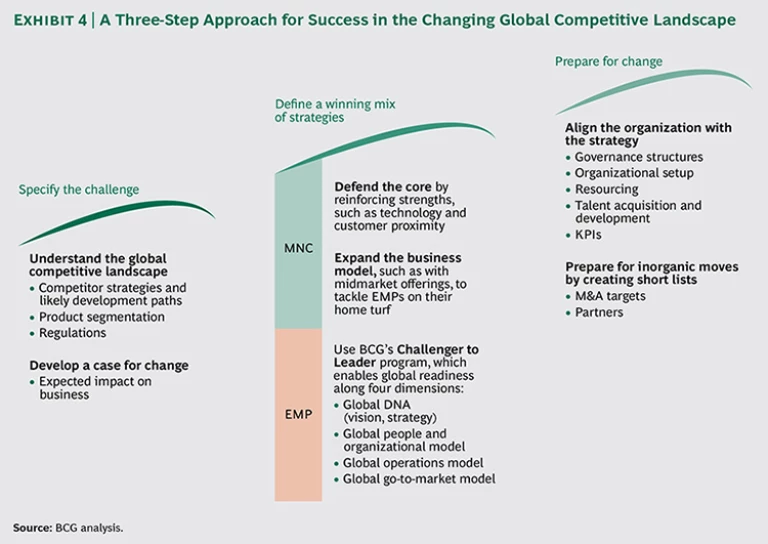

As a result of our extensive work with leading companies on their globalization strategies and the findings from this study, we have defined a three-step approach for companies to succeed in the quickly changing global competitive landscape. (See Exhibit 4.)

Step One: Specify the Challenge. Most companies today take stock of market developments and key competitors in their regular strategy and planning processes. We have found, however, that these standard processes often fall short of establishing a commonly shared opinion when it comes to the opportunities and risks of globalization. Also, the remarkable speed with which new competitors from emerging markets have arrived on the scene requires companies to maintain extensive intelligence on their competition. Many organizations have found it useful to track in detail the development of their top 20 or so competitors regarding major wins, investments, partnerships, and geographic footprints.

Given the sometimes volatile and difficult-to-forecast developments in global markets, it is very important to form a common vision of what the industry will look like in three to five years. This requires an understanding of the areas for action. What are the fundamental trends in demand, for example, regardless of economic or political turmoil in some countries? How does a company compare with its competitors? What will be the next breakthrough in technology? How are regulations likely to change? This vision should guide efforts in the second step of the process and the big bets a company takes.

Step Two: Define a Winning Mix of Strategies. In this article, we have outlined the most common areas requiring action by MNCs and EMPs in the automotive-supply industry.

At the most basic level, MNCs must first defend the core—their home markets and the global premium segment—by reinforcing strengths such as technology and customer proximity. Second, they must expand their business model to tackle EMPs on their home turf. Because we believe it is helpful to think about both targets from three angles—products and technologies, operations, and the go-to-market approach—we have offered our analysis from those perspectives.

Depending on the industry and the specific position of a company within it, the relative importance of these three levers varies greatly. We strongly recommend taking a holistic view, because many companies find that they need to undergo a transformative approach that comprises a wide range of diagnostics and change measures in all three categories to address their globalization challenge.

EMPs typically enjoy the benefits of a relatively low cost position and a growing home market. However, it has been our experience that during the phase of hypergrowth, many EMPs are not able to build the organizational and technological capabilities that they need to continue their global expansion. On the basis of our broad experience in working with emerging-market challengers, we have defined a dedicated, comprehensive approach that enables an EMP to go global. The global Challenger to Leader Program covers four areas and ensures that they are aligned with the company’s globalization agenda:

- Global DNA: vision, culture, and master strategy

- Global People and Organization: leadership, talent management, organization, and governance

- Global Go-to-Market Model: product strategy, sales approach, partnerships, and stakeholder management

- Global Operations: global footprint, innovation, and operations model

Step Three: Prepare for Change. We see two key enablers of a successful globally competitive strategy. One is to properly align organization and governance structures. Adjusting key performance indicators and defining the right balance of decision authority between headquarters and country operations are two important issues that must be resolved.

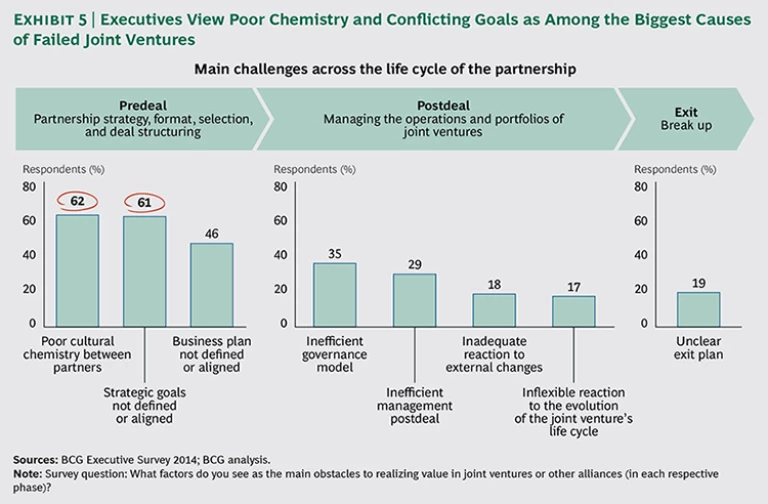

The other key enabler centers on partnerships and joint ventures, which many companies will find are key elements in their strategy mix. A recent BCG study on mergers and acquisitions revealed that the vast majority of executives are disappointed by the performance of their cross-border joint ventures. (See Getting More Value from Joint Ventures , BCG Focus, December 2014). The analysis identified several critical measures that can help avoid such disappointment. (See Exhibit 5.) They include ensuring that there is cultural chemistry between partners and that there is alignment on strategic goals and business plans, including a clear process for when business plans are not met along the way. Other measures are a sound governance model and an exit plan.

Globalization will continue to bring significant shifts to the automotive-supply industry—and undoubtedly to many more. But despite these shifts, most of the executives we surveyed agreed that for the well-prepared company—whether from the developed or the developing world—the globalized market offers much more opportunity than risk.