View infograpic here

Everybody focuses on the numbers, which are impressive: almost 200 million connected consumers now and another 200 million in the next few years. Some estimates put the total number of Internet users in India at as many as 550 million—40 percent of the population—in 2018. We expect the Internet to contribute $200 billion to India’s GDP (5 percent of total GDP) by 2020.

But the more interesting story lies in the changes taking place behind the numbers. The Indian connected consumer is already a very different individual (or group of individuals) than he or she was a year or two ago. And the universe of users only a few years from now will be far more varied in terms of age, occupation, wealth, location, and, importantly, digital sophistication than users today. These new users will approach the online experience with very different expectations, needs, priorities, and goals.

Understanding the changes taking place in Internet adoption and use in India and how these shifts will affect existing markets and ways of communicating—and create entirely new ones—is essential for anyone doing business in the world’s second-most-populous country, which is soon also to be the world’s second-largest nation of connected consumers.

Tomorrow’s Connected Consumer

The next wave of growth in India’s online population will lead to significant changes in who is using the Internet and how. In 2018, a much larger proportion of Indian Internet users will share the following demographic characteristics:

- They will be older. In 2013, 40 percent of Internet users were 25 years old or older; in 2018, 54 percent will be 25 or older. Because older users have more disposable income, they will likely transact more online.

- They will be more rural. In 2013, 29 percent of Internet users lived in rural areas; in 2018, approximately half of users will reside in smaller towns and villages. This shift will open up significant growth opportunities for those marketers and service providers that keep in mind the dynamics of the rural market in India—for example, using online distribution through e-commerce to ensure wider product availability.

- They will include more women. In 2013, 25 percent of Internet users were female; in 2018, women will represent a third of all users. The increasing gender parity will have a major bearing on the Internet economy—women control 44 percent of household spending in India.

Similarly, the way they use the Internet will change:

- Mobile connections will increase from 60 to 70 percent in 2013 to 70 to 80 percent in 2018. Approximately 200 million Indians used their cell phones to access the Internet in 2014. A majority of Indians who embrace the Internet, particularly rural consumers, have bypassed the PC and are using mobile devices to get online on the go. Some 70 percent of rural users access the Internet from their mobile handsets.

- Content will be more vernacular as the user base diversifies and grows to include larger numbers of rural consumers. The use of vernacular content online is estimated to increase from 45 percent in 2013 to more than 60 percent in 2018, mirroring broadening consumption patterns in off-line media such as print and television.

Perhaps the most significant of these factors is that the evolution of the digital experience in India will take place entirely through users’ mobile phones. This means that users will have to adjust to the inherent constraints of a four- or five-inch screen. But it also means that they will interact from the get-go with connectivity that’s local (it’s always where they are), personal (it’s tailored to their needs and preferences), social (all their friends are there as well), and always on.

In developed countries, continuous access to information, communication, friends, and entertainment—among myriad other things—has turned out to be addictive for many users. Already in India, connected consumers are spending 35 percent of their media consumption hours online—a percentage that far outstrips time spent with newspapers and approaches that spent watching television. (See the related article and infographic .)

Companies that move quickly to reach out to this growing universe with content that is personal and based on where people are, what they are doing, and who they are doing it with have a massive opportunity to engage consumers in entirely new and powerful ways.

The Factors Affecting User Growth

The full rate and extent of future Internet penetration depends on several factors, but we expect the number of Internet users to at least double, from 190 million in 2014 to 400 million in 2018. Our most aggressive forecast predicts as many as 550 million users in 2018. In this scenario, the connected urban Internet population will increase from 130 million to 300 million, but the real action will take place in more-rural areas, where the user base could easily expand by up to 40 percent per year—from 60 million in 2014 to 280 million in 2018.

Three factors—expanding reach, more affordable access, and improved awareness—will be the primary drivers of online growth.

First, network availability needs to catch up with the expected increase in the installed base of Internet-enabled devices, meaning that the current universal coverage of 2G networks in urban areas must be replicated in the countryside and a similar improvement must take place in the penetration of 3G and 4G services in major cities.

Second, the availability of low-cost Internet-enabled devices will be key to increasing Internet penetration among the lower-income population. Nearly two-thirds of mobile phones sold in India today are Internet ready, but the least expensive models still cost $60 or more. This is too expensive for many; prices need to come down. There are signs that this is happening. For example, Intex Technologies has launched a $33 smartphone (the same price as a feature phone), powered by Mozilla’s new mobile operating system. Access—the other cost factor—is expected to continue to expand as disposable incomes continue to climb. The proportion of households that can afford Internet connectivity—typically defined as those with more than $3,300 in annual income—is projected to rise from 56 percent in 2013 to 67 percent in 2018. The continuing decrease in data plan prices has also helped to make Internet consumption more affordable. Telecom carriers are increasingly offering a range of inexpensive, “bite size” plans while facilitating the ease of making payments with onetime-processing options.

The third big variable is simple awareness. According to a study on digital consumers in rural areas by market research company IMRB International and the Internet & Mobile Association of India, 70 percent of nonusers are currently unaware of the Internet and the benefits it offers. This lack of understanding represents the most formidable barrier to online adoption, with the unavailability of devices a distant second at 36 percent. At the same time, almost four-fifths of urban nonusers, despite being aware of the Internet, are disinclined to go online. More than half of the nonusers living in towns and smaller cities do not yet see any value in using the Internet.

New Consumer Segments Emerge—and Evolve

The bottom line for businesses is that the Internet in India is no longer a limited-reach or principally urban phenomenon, accessed primarily by young, high-income users. As more consumers have become connected, the user base is both expanding and diversifying to include rural and lower-income consumers across all age-groups. Companies that overlook this shift risk missing out on a rapidly growing channel for marketing, brand influence and engagement, and, ultimately, commerce.

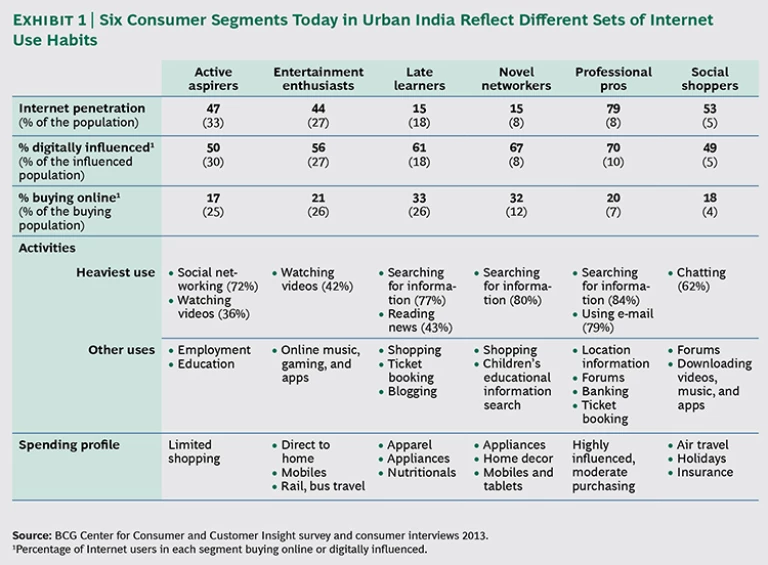

Given the sweeping nature of the changes under way, marketers will encounter fluid segments of consumers for the next several years. At the moment, we see six discrete segments based on digital consumption habits, demographics, and location (most of the users are urban). Each segment has clear common characteristics and displays its own particular usage patterns, lifestyle preferences, and online evolutionary path. (See Exhibit 1.) But each is also undergoing its own metamorphosis in size and makeup, and new segments could well emerge.

Many current “active aspirers” in the 15- to 22-year-old age-group, for example, will morph into “entertainment enthusiasts” and “novel networkers” over the next five years.

At the moment, some 30 million of these users spend eight to ten hours a day online, accessing the Internet primarily on their phones and laptops. They use social-networking sites and apps such as Facebook and WhatsApp to keep in touch with friends, play games, and download content, habits that could become ingrained. These are mostly young users, but they span all locations and their ranks will swell to more than 55 million in 2018. Many of these new users are still in college and regularly access informational sites while working on class assignments. They also use online job portals to find employment after they graduate. Over time, their usage behavior will shift in line with the changing demands of adult life—even as the intensity of the usage itself persists.

Another fast-growing category, “novel networkers,” accounts for some 7 million of India’s total online population. Their ranks will quadruple in the next few years. This group is predominantly female and belongs to India’s emerging middle-income segment. These users are active online shoppers and are exposed to a high level of digital influence in the product purchase cycle. They use both phones and laptops to get access to brands and collections of apparel and accessories that are not available in their towns. They do extensive research using product reviews on various portals before purchasing.

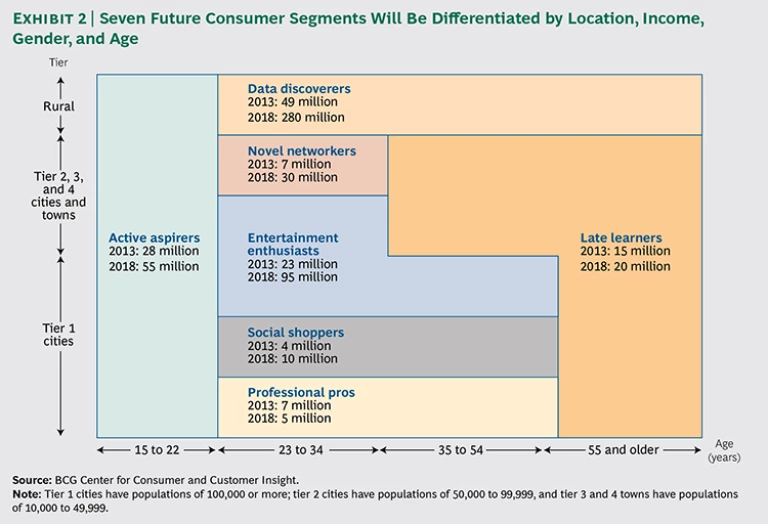

Then there is a huge, seventh segment of predominantly rural consumers coming online. This group—the “data discoverers,” who are new users in semiurban and rural areas and span most age-groups—is set to explode, from 50 million today to some 280 million in 2018. Their fast-growing ranks will propel much of the growth in overall Internet usage. (See Exhibit 2.)

This segment uses mostly mobile phones and cyber cafés to get online, and the Internet is transforming their lives as they discover data and information that has numerous practical uses. The expanding experience is changing the way they plan their travel and entertainment, for example. The Internet helps them apply for jobs and loans. It is a source of global information, including news and details on general topics. These users are not yet shopping or doing business online, because many online merchants don’t deliver to their villages, but this will change as these users mature in both age and online sophistication and companies cater more to this large and fast-growing segment.

For marketers, the challenge is clear: to develop offerings based on well-defined user groups and tailor those offerings to meet the particular needs and situations of each category of user. But in the digital—and especially the mobile—world, there is an opportunity to go even further and craft offerings that address the personal preferences of microsegments or even individuals, on the basis of data that defines their online behavior.

Accelerating the Revolution

The extent of the Internet’s influence on consumer decision-making and behavior will be constrained only by the rate of increase in penetration and usage. Already, a rising number of consumers in all segments are using the Internet as their first port of call in framing and driving their purchase decisions. BCG’s Center for Consumer and Customer Insight surveyed users in 25 cities and found that more than half of those who have access to the Internet go online to make informed purchase decisions. This number varies among different categories of products and services, but it is on the rise everywhere. Consumers climb the learning curve quickly. As they get more comfortable with digital capabilities, their usage patterns exhibit growth that belies age and other demographic variables.

Consumers, the government, and private-sector companies will all benefit from furthering Internet penetration and use. Six areas require attention:

- Increasing access through expanding network reach and bringing more-affordable devices and mobile plans to market

- Facilitating digital transactions and easing payments

- Developing a regulatory framework that facilitates content development and does not hinder the growth of local applications and services and the content sector

- Developing an Internet governance and regulation system that does not constrain private-sector innovation and does enable all stakeholders to function effectively

- Enabling entrepreneurial ventures through ease of financing, mentorship programs, and the development of a skilled digital workforce

- Facilitating the creation of local-language, or vernacular, Internet content to boost usage in nonurban areas

The sooner these priorities are addressed, the faster the development of India’s Internet economy will be and the sooner more consumers will begin to participate in the benefits. This will lead to more opportunities for growth and profit for forward-looking companies that capitalize on the developing sources of digital demand.