New technologies are bringing efficiency to the search for employment and transparency to the job market. It’s never been easier for people to learn about job opportunities and present themselves as candidates. In 2014, our research has demonstrated, nearly 20% of employed people around the world started a new job. As recruiting technologies continue to spread, that figure could increase.

The Boston Consulting Group and Recruit Works Institute set out to assemble a truly global view of the job search process today. (See “About the Research.”) Our survey of more than 13,000 individuals from 13 countries—one of the largest surveys of its kind—sheds light on the channels people are finding most effective in the search for employment, how long job seekers are spending on the search, and the resulting increase or decrease in their incomes and overall satisfaction.

About the Research

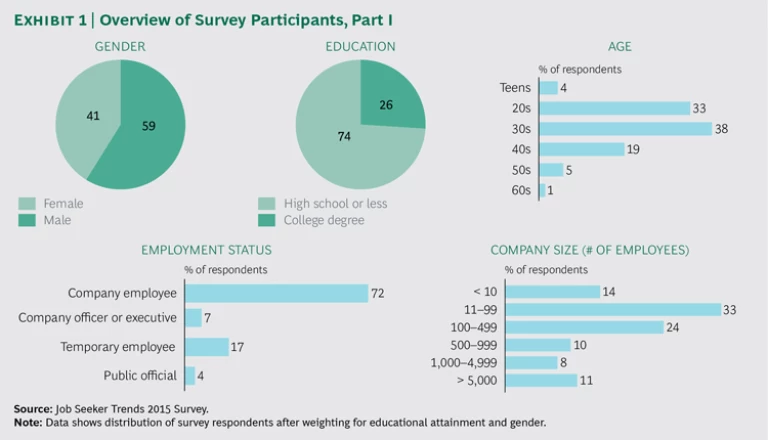

Respondents were individuals 15 years of age and older who found a new job in 2014. Only people seeking employment opportunities (for instance, as company employees and officers, temporary staff, and public officials) were included. Freelancers, the self-employed, full-time homemakers, students, retirees, and the unemployed were excluded. Nearly 75% of respondents had a high school degree or less; as a result, the sample was socioeconomically diverse.

We conducted online surveys in Brazil, Canada, France, Germany, Italy, Japan, Russia, the UK, and the US. Both on- and off-line surveys were used in Australia, China, India, and South Africa to ensure representative samples. Our results may overweight the responses of Internet users.

To mitigate biases in our sample, survey results were weighted to each country’s educational attainment and gender ratios, provided by UNESCO and Barro-Lee.

Many job seekers today are competing in global labor markets, but an individual’s experience of searching for employment is shaped by local political and economic forces. For example, there are now a wide variety of job search channels, many of them enabled by the Internet, but the channel you end up using may depend on where you live. And your level of education may influence how long you spend looking for a job.

Our findings—which illuminate both global and local trends—demonstrate the increasing importance of the Internet for job seekers around the world. They also reveal a complex and evolving job search market, to which government agencies, HR organizations, recruiters, and job seekers themselves should be paying close attention.

Job Search Channels

The Internet changes everything, and it has changed few activities more profoundly than it has the job search process. Thirty or 40 years ago, job seekers were limited largely to paper media such as newspapers and magazines and to introductions from family and friends. The widespread access to the Internet and to mobile devices in the 21st century, however, has given rise to new sources and tools. Today, despite differences across countries, the job search process is more standardized globally, and most people are able to find information and search for opportunities casually and efficiently.

We asked job seekers about the channels they used to search for and select a job in 2014. The channels included:

- Commercial channels such as paper media (newspaper and magazine advertisements), Internet job sites (résumé portals, job forums, job posting sites, job aggregators), temporary- and permanent-employment agencies, and job training programs

- Public channels such as government-run job services, including information centers and online job services

- Referral channels such as alumni networks and family and friends

- Direct inquiries with employers (such as applications through a company website, contact with a company employee, and walk-in inquiries)

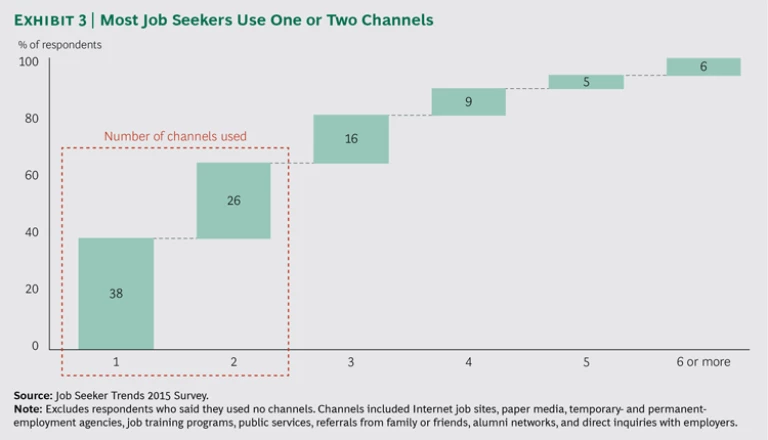

Despite the wide variety of choices, 38% of respondents used only one channel in their search, and 26% used two. (See Appendix, Exhibit 3.)

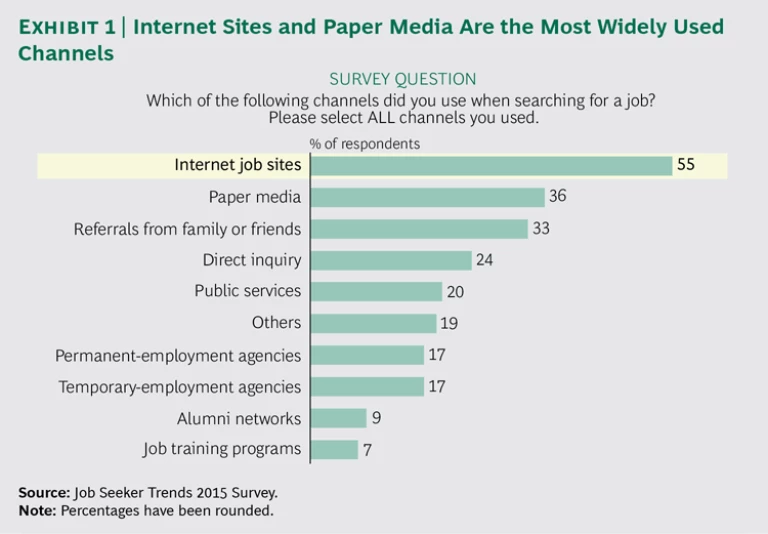

The Popularity of Internet Job Sites. Globally, Internet job sites were the most frequently used channel: 55% of all respondents had used such sites during their most recent search. In second place was paper media, used by 36% of job seekers, followed by referral and direct inquiry channels, through which 33% and 24%, respectively, searched for jobs. Twenty percent of respondents used public services. (See Exhibit 1.)

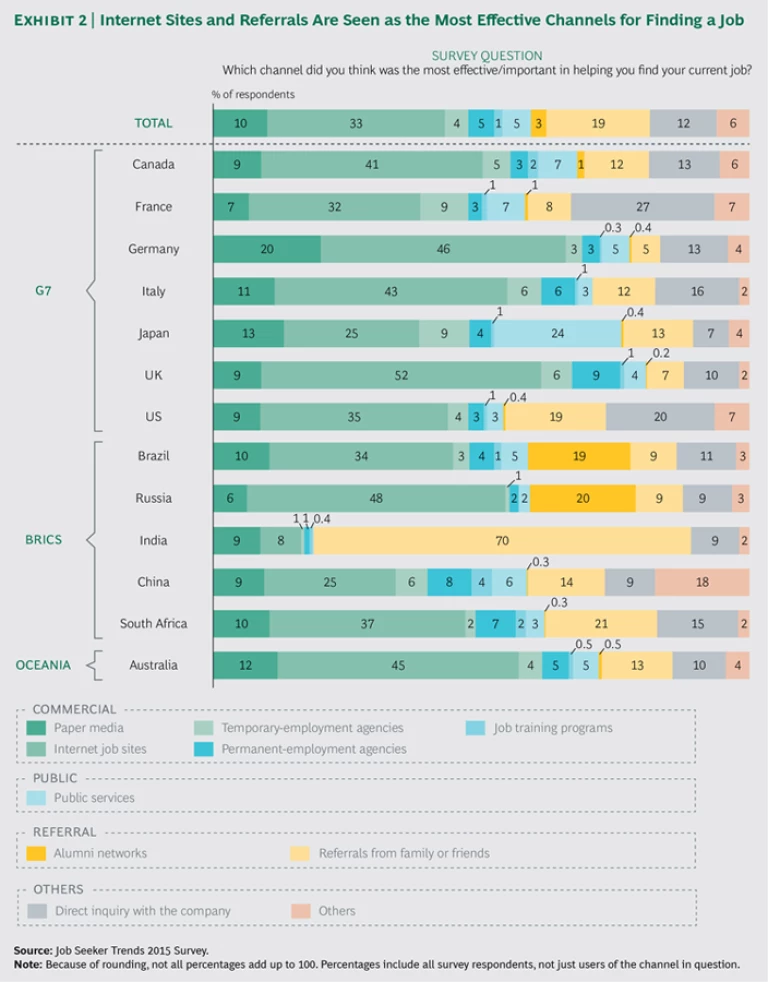

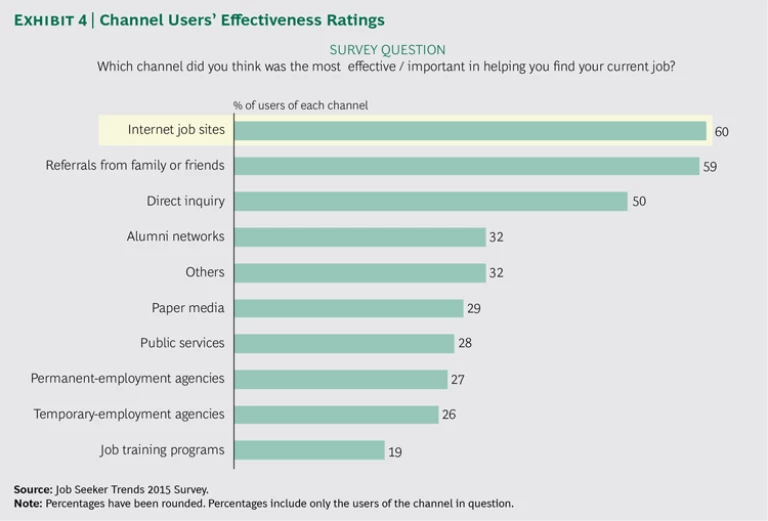

Thirty-three percent of all survey respondents said that Internet job sites were the most effective channel for finding employment. In second place was not paper media—considered the most effective by only 10% of respondents—but referrals, at 19%. Only 5% of respondents thought that public services were the most effective channel. (See Exhibit 2.) Considering these ratings as a percentage of the users of the channel in question, 60% of Internet job site users, 59% of referral users, and less than 33% of the users of paper media and public services said that the channel was the most effective. (See Appendix, Exhibit 4.)

As Exhibit 2 shows, in all countries except India, 25% to 52% of survey respondents said Internet sites were the most effective channel in helping them find a job. The ranking of the other channels varied by country—a testament to the influence of national policies, economics, and culture on the job search process. For example, in India, the referral channel took the top spot, with 70% of job seekers calling it the most effective. In Japan, the public channel was almost tied for first place with Internet job sites, with 24% of respondents giving it the top ranking. Overall, job seekers in European countries such as Germany, Italy, and the UK found commercial channels (including paper media, the Internet, employment agencies, and job training programs) to be more effective than the average respondent did.

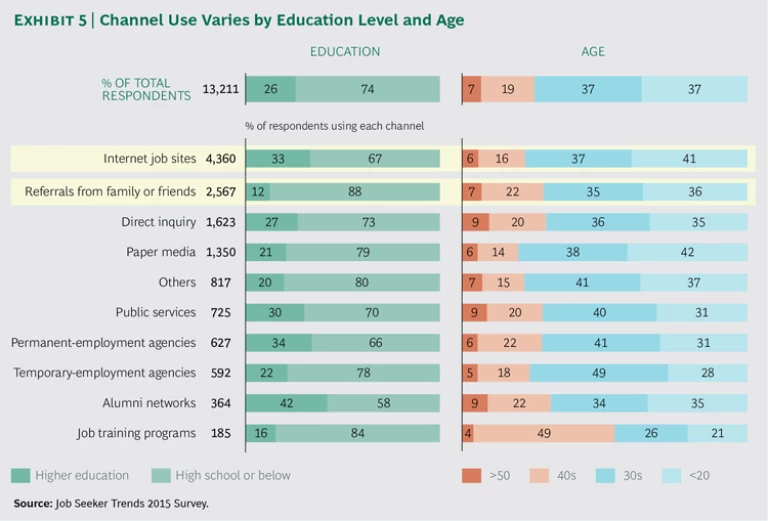

Different channels cater to different job seekers. In particular, the two most effective channels (Internet job sites and referrals) appealed to different demographics. The average Internet job site user was more educated and younger than the average job seeker. The average user of referrals was less educated and older. (See Appendix, Exhibit 5.)

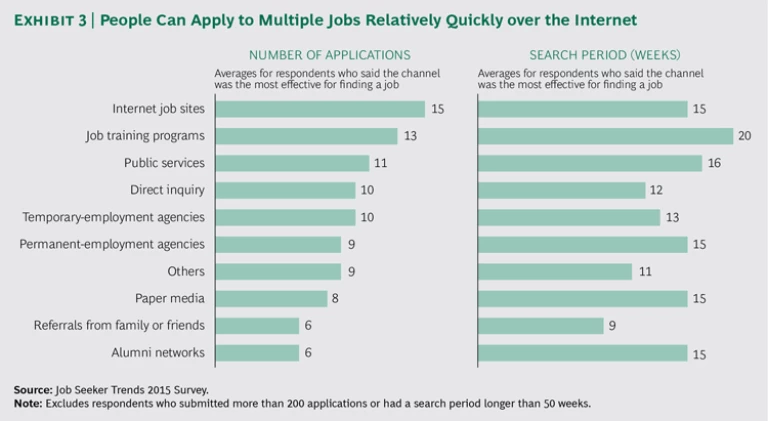

What makes Internet job sites such an attractive search option? They enabled survey respondents to apply for more jobs than any other channel. Furthermore, they allowed job seekers to apply to the highest number of jobs in the shortest amount of time. We believe that such ease and speed have increased the popularity of these sites. (See Exhibit 3.)

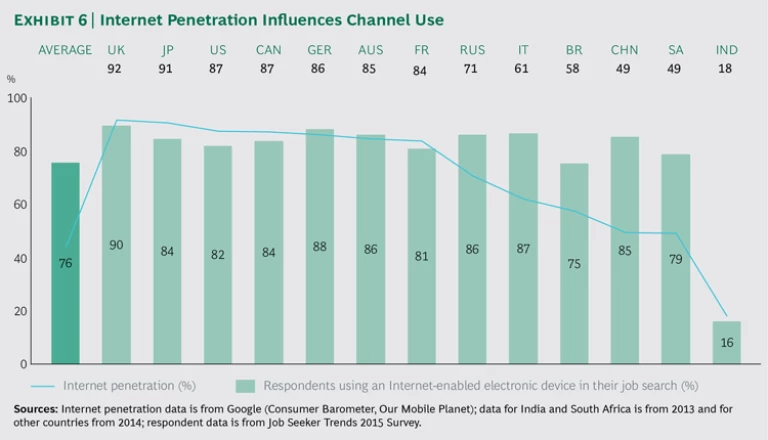

The Use of Electronic Devices. Having observed the success of Internet job sites, we examined electronic device use during the search process to better understand how this channel may evolve. In 2014, 76% of the job seekers we surveyed used an electronic device with Internet capability (PC, tablet, or smartphone) in their job search.

Most countries in our sample had rates of electronic device use of 80% to 90%. India, at 16%, had the lowest use rate and the lowest rate of Internet penetration, 18%. (See Appendix, Exhibit 6.) Unlike job seekers in other countries, those in India relied heavily on regular mobile phones (as opposed to smartphones); 60% of respondents in India named regular mobile phones as the type of device they used most frequently.

As Internet penetration in a country increased from less than 80% to more than 80%, the proportion of job seekers not using an Internet-enabled electronic device dropped from 32% to 15%. In countries with Internet penetration higher than 80%, about 85% of respondents used one or more devices. As India’s Internet penetration continues to increase—it grew from 7.5% in 2010 to 18% in 2014—we can expect to see more Indian job seekers shift to Internet-enabled electronic devices.

Roughly 70% of respondents used a PC in their job search, and 85% of them cited it as their most frequently used device. In contrast, 35% of respondents used a smartphone, and only 18% used a tablet.

About 50% of all PC users employed PCs exclusively in their job search. In contrast, only 14% of smartphone users employed only smartphones, and 11% of tablet users employed only tablets. For now, smartphones and tablets appear to serve as secondary devices.

The Search Period

New recruiting technologies have made the job search process more efficient and transparent, but not necessarily shorter. On one hand, Internet advertisements allow employers to reach a wide audience at the click of a button. On the other hand, job seekers today are able to subscribe to job posting updates and may thus spend a long time casually browsing online.

We asked survey participants how much time they spent searching for their current job, including the research period (from search to application) and the application period (from the application to an offer). Job seekers took an average of eight weeks to complete their research and waited five weeks to receive an offer.

Our results suggest that several factors influenced the length of the search period:

The Number of Applications Submitted. We observed that job search times were proportional to the number of applications job seekers filed, regardless of their education level or age. The more applications an individual submitted, the longer the search.

GDP Growth. During an economic boom, job creation is on the rise and demand for workers is high. As a result, offers tend to come more quickly. Job seekers in countries with GDP growth higher than 2% took an average of 11 weeks of search time, more than a month less than people in countries with GDP growth lower than 2%, who spent about 16 weeks on the process. Job seekers in high-growth countries saw a reduction of two to three weeks in the research period and in the application period. (See Exhibit 4.)

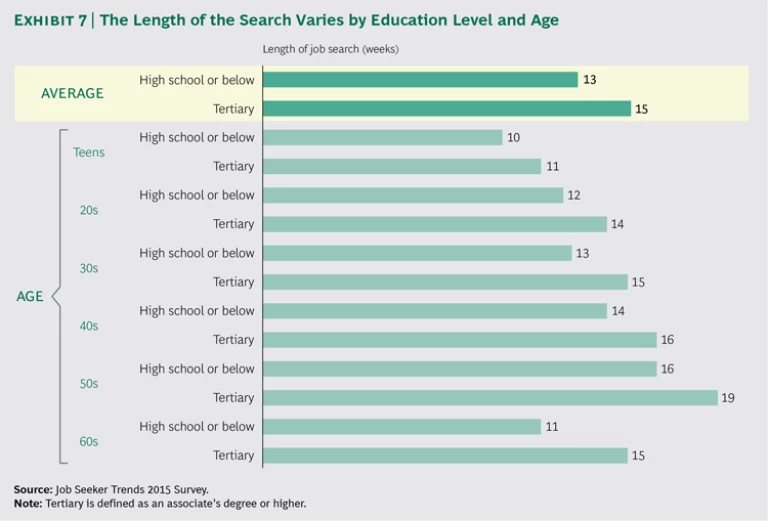

Education. The most highly educated job seekers in our sample consistently spent the most time searching, regardless of age. Respondents with tertiary-level qualifications (an associate’s degree or higher) tended to apply to more jobs and as a result spent more time on the search process—the research period, in particular. (See Appendix, Exhibit 7.)

Income Change and Overall Satisfaction

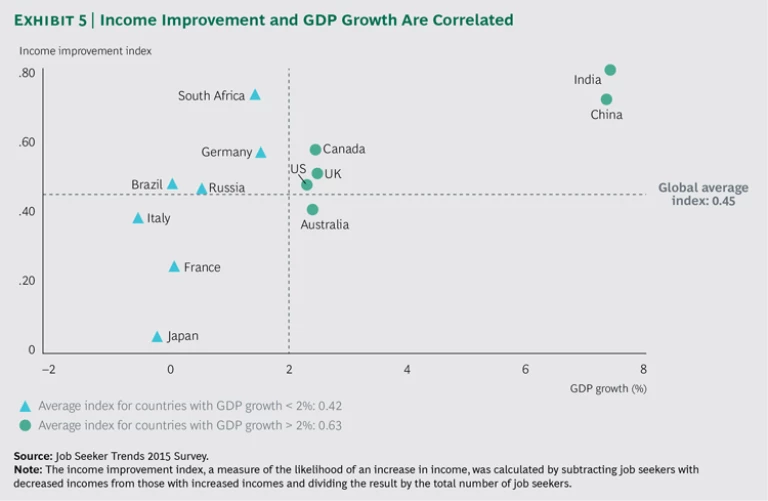

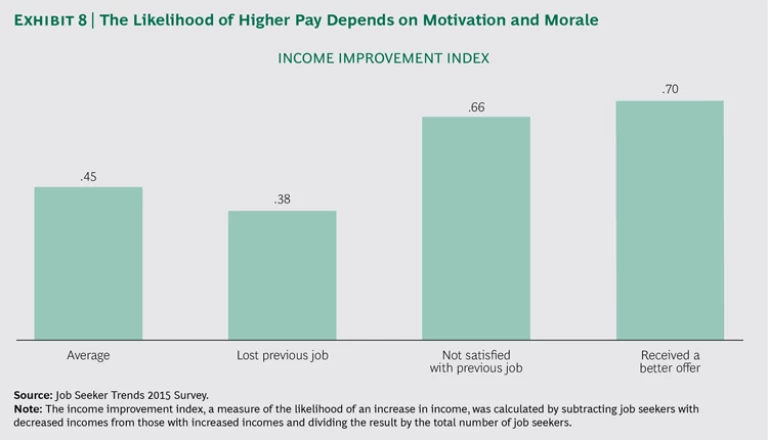

One reason why people look for new employment is to earn a higher income. But how often do employees achieve that goal? In our survey, we asked respondents if their incomes had increased, decreased, or stayed the same as a result of their job search. From their responses, we subtracted the number of people with decreased incomes from those with increased incomes and divided the result by the total number of respondents. The resulting income improvement index is an indicator of the likelihood of an increase in income. Our respondents’ average income improvement index was 0.45.

Income improvement is closely tied to an individual’s motivation and overall morale. Respondents who had lost their previous jobs recorded an income improvement index of only 0.38. Those who were merely not satisfied in their previous

positions posted an index of 0.66. Not surprisingly, those who were motivated to switch because of better offers saw the highest index, about 0.70. (See Appendix, Exhibit 8.)

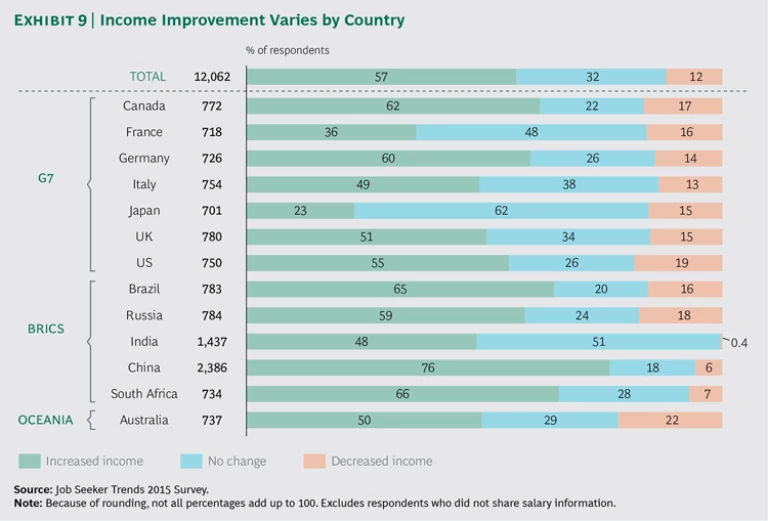

We expected that countries in good economic health (with GDP growth above 2%) would experience upward pressure on incomes in order to maintain hiring competitiveness. The survey results illustrated that the income improvement index was about 0.60 in those high-growth countries, compared with about 0.40 in countries with GDP growth lower than 2%. (See Exhibit 5 and Appendix, Exhibit 9.)

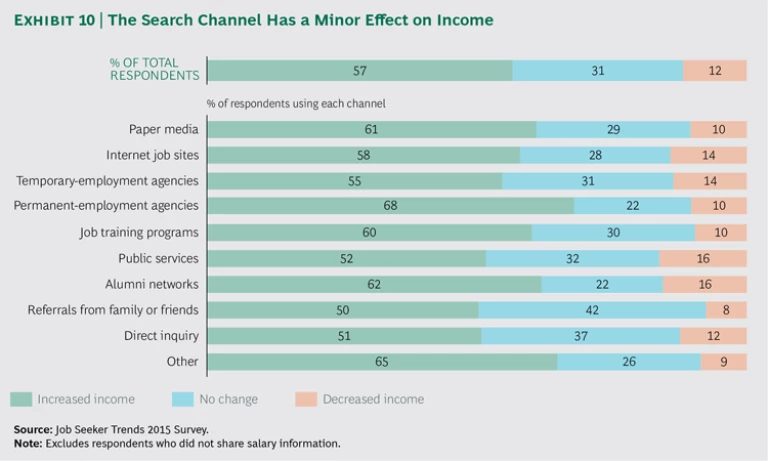

The choice of search channel did not have a big effect on income improvement. Strong income improvement was observed in channels used by a larger proportion of highly educated job seekers, such as permanent-employment agencies and alumni networks. Among the users of other popular channels—paper media, the Internet, and job training centers—roughly 60% experienced an income increase. About 50% of people who used the public, referral, and direct inquiry channels saw their incomes increase. (See Appendix, Exhibit 10.)

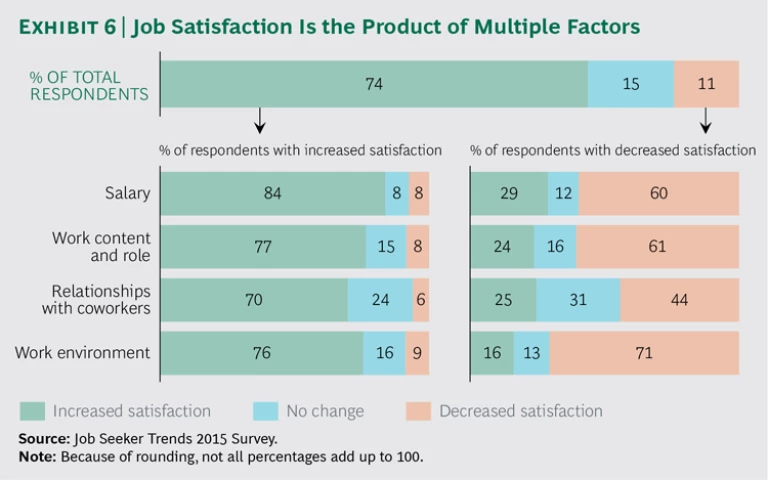

Of course, income is not the only factor in a job seeker’s satisfaction. In today’s job market, there are multiple ways to evaluate a search. We collected information on respondents’ satisfaction with their new jobs by considering four factors:

- Salary

- Work content and role

- Coworker relationships

- Work environment (including hours and nonsalary benefits)

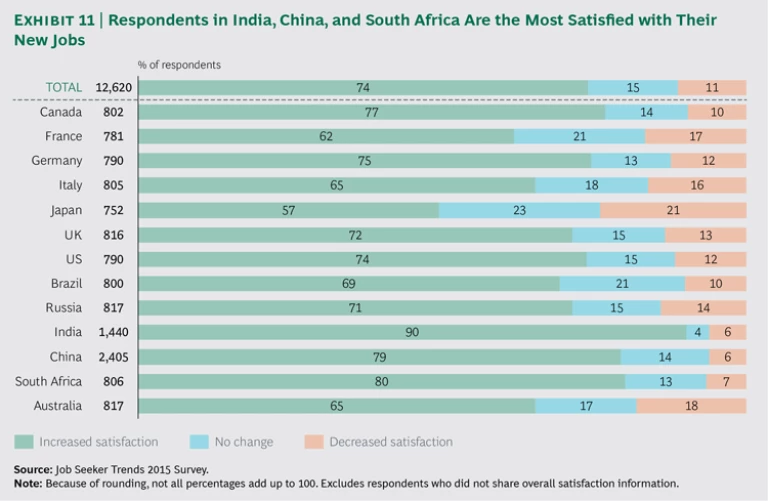

We asked job seekers if their new job was better, worse, or the same as their old one on each dimension. Seventy-four percent of respondents reported an overall improvement in job satisfaction. But overall satisfaction does not require improvement in all factors, nor is it caused by a single factor. Among satisfied respondents, only 41% experienced improvement in all four areas. Similarly, there was no single factor that improved for all satisfied respondents. Some 84% received an income increase, 77% saw an improvement in work content, 70% experienced better coworker relationships, and 76% found a better work environment. Overall satisfaction was highest among respondents in India, China, and South Africa. (See Exhibit 6, Appendix, Exhibit 11, and “Active Versus Passive Job Seekers.”)

ACTIVE VERSUS PASSIVE JOB SEEKERS

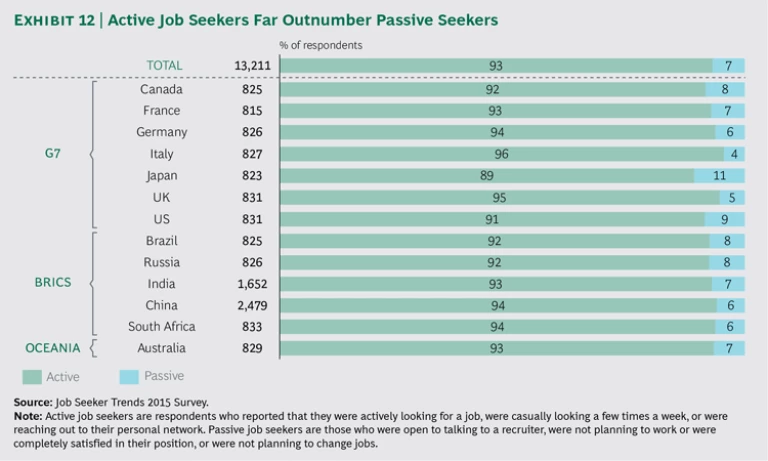

To account for such differences, we divided respondents into two categories. Active seekers were those who initiated the search. They looked for a new job, even if only casually, several times a week and reached out to their networks in search of referrals. Passive seekers were not actively looking for a job and were not dissatisfied with their current position, but they were willing to speak to a recruiter or to connections who sought them out.

Overall, 93% of the respondents to our survey were active seekers.

For passive seekers, the search period was about nine weeks, compared with 12 weeks for active candidates. The reason for the disparity is the shortened research period. Because most passive seekers are approached by agencies, referrals, or employers, they save on the time-intensive initial phase.

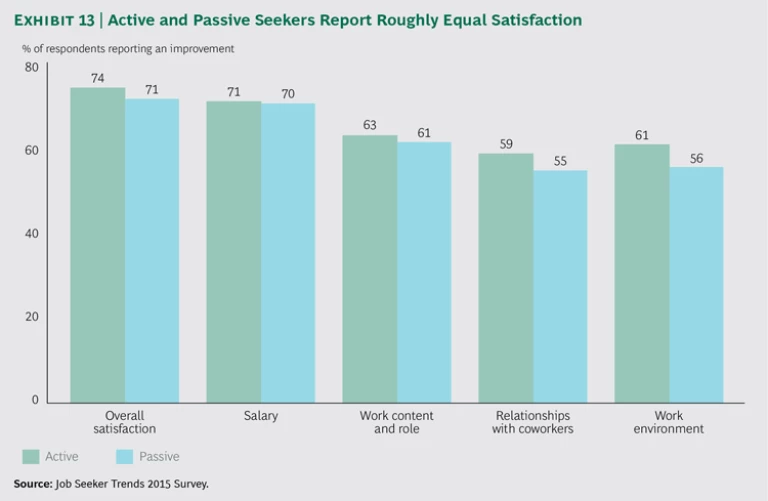

But apart from a reduction in the research period, passive seekers derived no benefits relative to active seekers. They did not see a significantly reduced offer period, and they reported slightly less improvement in work environment, coworker relationships, and work content. Our hypothesis is that passive workers may have been content with their previous jobs and were therefore less likely to feel a significant improvement than active seekers, who were motivated by various factors to change their circumstances.

Strategic Questions for Employers

Our survey findings give rise to important questions that can help employers fine-tune their recruitment and hiring strategies, develop better value propositions for potential employees, deliver their messages through the channel that best suits their target talent pools, and adapt to new recruiting technologies. In short, these questions can help companies master the skills and capabilities they need to win today’s global war for talent:

- How many attractive job candidates approach your company through referrals? Through the Internet?

- Is your company prepared for a surge in mobile device use by job seekers?

- Do your company’s recruiting messages stress job satisfaction as well as attractive compensation?

- Is your company prepared to recruit through multiple channels, including Internet job sites, referrals, and employment agencies? Is it prepared to process and evaluate an increase in queries and applications?

- Does your company understand the channel preferences and other cultural factors that influence the behaviors of job seekers in the countries where it recruits?

Different Strategies for Different Channels. Internet job sites and referrals are the most widely used search channels. Successful employers will adopt strategies specific to each. Internet users favor the channel for its ease of use and ability to process a large number of applications at once. Companies can leverage the speed, ease, and convenience of job sites to draw applicants and build traffic. Users of the referral channel take a more focused approach to their search, relying on friends and colleagues to steer them toward promising opportunities. Companies can tap that talent pool by implementing formal referral incentive programs, such as cash awards for employees who help facilitate successful hires through the referral channel. Has your company set up a mechanism for identifying the search channels candidates are using? Does your company reward employees who encourage attractive candidates to apply?

A Potential Surge in Searches from Mobile Devices. The Internet is the channel of choice for job seekers, especially the young, well-educated individuals most companies are eager to hire. But in many developing countries—in particular, those with low Internet penetration rates—smartphones and, increasingly, tablets are the most widely used devices for connecting with the Internet. Is your company recruiting in those regions, and, if so, has it tailored its user interface, messaging, and approach to smartphone and tablet users? Does it have the resources and infrastructure to handle large volumes of inquiries from mobile devices and to screen for the most desirable applicants? How does your company plan to attract visitors to its website and encourage an interactive flow of ideas—not just résumés?

Compensation and Other Components of Job Satisfaction. One reason for seeking new employment is higher pay. But survey respondents made it clear that good pay alone does not make a job satisfying. Improved roles and good colleagues are also important. Does your company have a strategy for delivering a satisfying work experience to demanding employees? Does its culture place a priority on creating a collaborative and supportive work environment, and do managers have well-designed incentives to make work satisfying for their direct reports? Is your company known for the quality of its work experience? If not, how do you plan to gain a reputation as an employer that not only pays well but also delivers job satisfaction in other ways?

Multichannel Job Searching. We found that job seekers use a variety of search channels and rate many of them as effective. Consequently, companies must be prepared to field inquiries and applications from an array of channels, including, among others, print media, referrals, and agencies, as well as the Internet. How good is your company’s coverage of multiple channels? Can you identify differences among candidates on the basis of the channels they use? Does your company tailor its message to each channel—for example, using referrals to attract older, relatively uneducated candidates for some posts and the Internet to draw in younger, better-educated applicants for highly skilled positions?

Local Differences. Although our survey revealed some global trends, such as the widespread use of the Internet, the job search is inherently a social and cultural activity that varies according to its milieu. For example, whereas referrals are the main search channel in India, where Internet penetration is low, print media is widely used in the US, despite the country’s high Internet penetration rate. It is crucial, therefore, for companies to recognize local differences in search behavior and tailor their recruiting strategies accordingly. That means developing the local expertise to recruit in multiple markets and a strategy for each channel. Does your company understand local search practices? If not, do you know where to find people who can offer practical, tested advice?

Options and Opportunities

Our survey reveals the immense changes that the Internet has brought to the job search process. It also sheds light on the many ways job seekers around the world are approaching their search for employment. Internet job sites and referrals are considered the two most effective channels, but it would be a mistake to say that one is better than the other. Each suits a particular kind of user. Internet job sites are the preferred channel of highly educated individuals and those in developed countries. Referrals are the preferred channel of people in countries with lower attainments in education and GDP.

Searches through the referral channel generally move more quickly than Internet searches, but Internet job seekers see better income improvement. Searches through referrals take nine weeks, on average, compared with 15 weeks for Internet searches. Among users of Internet job sites, 58% achieved income increases, compared with 50% for users of the referral channel.

The Internet is a scale enabler and force multiplier. It can process a much higher volume of applications than the referral channel. That key difference, we believe, will drive the continued growth and evolution of Internet job search. We look forward to seeing how future technological developments continue to decrease the time people spend searching for employment without limiting—and in fact expanding—their options.