The consumer packaged goods (CPG) industry is in the midst of a major transformation driven by changes in technology and dramatic shifts in consumer preferences. At the same time, the pressure to keep costs low and operate more efficiently has never been so intense. CIOs in the CPG industry need to successfully navigate these turbulent forces to position IT as an enabler of business value within their companies.

To understand how the IT function in CPG companies is responding to the ongoing technology and industry transformation, The Boston Consulting Group and the Grocery Manufacturers Association (GMA) conducted extensive benchmarking on a variety of strategic IT topics. This report is based on a survey of 37 CPG manufacturers in the U.S. and Europe, conducted in the first half of 2015, and supplemented by interviews with more than 15 CIOs of participating companies. It also draws on BCG’s experience working with many of the leading CPG manufacturers and retailers globally.

While the research was conducted collaboratively by BCG and GMA, BCG is wholly responsible for all analyses, conclusions, and recommendations.

Many CIOs aspire to drive innovation, shape digital and e-commerce business decisions, and play a pivotal role in the success of the business overall. But day-to-day operations, burdensome legacy technologies, talent shortages, and a relentless focus on costs are significant hindrances.

Despite these challenges, a number of CPG companies have been able to make tangible progress on their innovation agenda. What are the innovation leaders doing that others are not?

Enablers of IT Innovation

BCG’s Navigating the New World of IT in Consumer Packaged Goods identified three hallmarks of IT innovation leaders in the CPG industry: they typically run broadly scoped IT budgets that go well beyond core IT infrastructure and applications, experiment with a wide variety of new technologies, and invest heavily in IT-enabled capabilities across the business.

Consequently, IT innovation leaders spend more on IT. The analysis showed median spending of 1.8 percent of revenues on IT, which is 30 basis points higher than the spending of conservative operators, which is 1.5 percent. While that difference can be attributed partly to variations in scope, the reality is that IT innovation is not free. CIOs looking to innovate need to either increase their IT budgets or reshape spending to carve out the necessary funds.

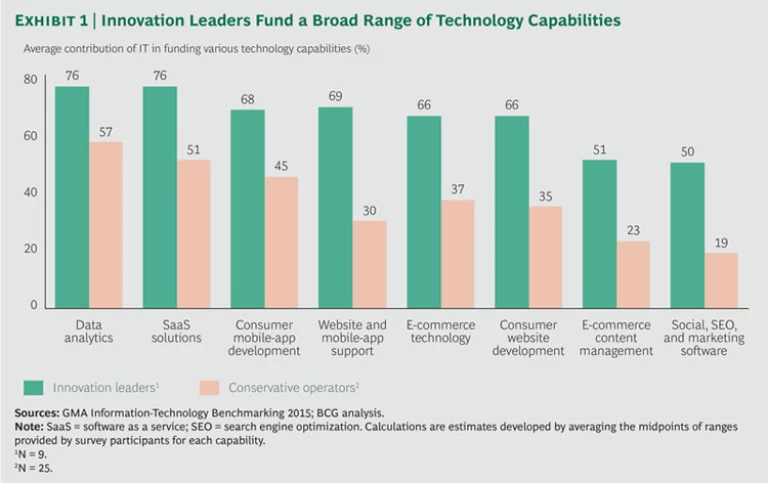

Broadly Scoped IT Budgets. Innovation requires the ability to back new-technology deployments with sufficient funding to support development, experimentation, and company-wide adoption. CPG IT innovation leaders provide the lion’s share of funding for a raft of advanced technology capabilities, such as consumer websites and mobile apps, e-commerce technology and content management, Next-Generation IT for Consumer Packaged Goods Companies , and data analytics. (See Exhibit 1.)

Experimentation with a Wide Variety of New Technologies. CPG innovation leaders are prolific users of new application-development frameworks and tools, new software technologies, and cloud-based IT infrastructure. Nearly two-thirds of innovation leaders in the 2015 survey use responsive Web design (an approach that provides an optimal user experience regardless of screen size), and nearly one-third are deploying nonrelational databases to replace the traditional tabular (or relational) databases used since 1979. A high proportion of innovation leaders are also becoming more nimble by moving from code-heavy, monolithic applications to small, self-contained “microservices.”

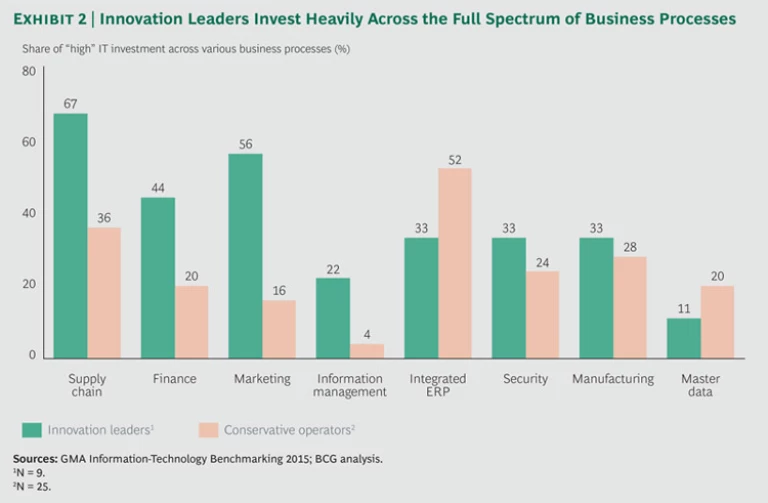

Investment Across the Full Spectrum of Business Processes. Survey participants rated their level of investment in IT projects across various business processes on a qualitative “high, medium, low” scale. Innovation leaders consistently reported high IT investment levels in business-critical areas, such as supply chain, finance, and marketing. (See Exhibit 2.) In other words, rather than simply focusing on the trends of the day—such as marketing and information management—innovation leaders invest across the board. We believe this approach is more effective because the best technology-enabled innovations require integration across multiple business functions. Success at e-commerce, for instance, requires a technology transformation that goes well beyond the website to enable complex demand planning and manufacturing, reconfiguration of supply chains and logistics, updates to financial systems, and improvements to customer service.

Innovation’s Starting Point: The CIO

CIOs must tend to the daily cadence of planning, budgeting, managing daily operations, handling incidents, and putting out fires—that’s all business as usual. Day-to-day concerns can fill every hour on the job. But as time passes, CIOs may find that they are treading water—or falling behind. This is especially true in the CPG industry, where IT budgets tend to be more constrained than in other industries. It’s therefore up to the CIO to establish an innovation agenda to ward off stagnation and meet the challenges of a changing industry.

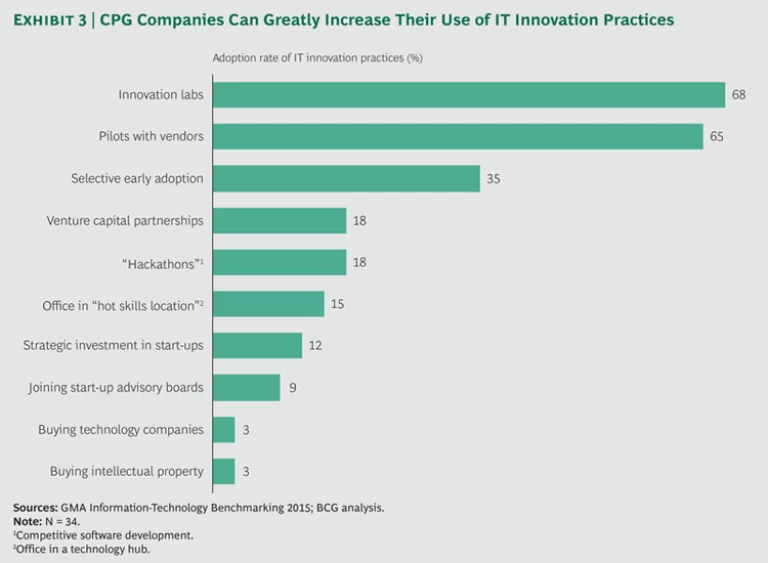

Surprisingly few IT-innovation practices are in use by CPG companies. Although many companies have set up technology innovation labs and run pilots with vendors, most innovation practices are vastly underutilized. (See Exhibit 3.)

While some innovation efforts require corporate-level commitment and investment, a number of low-cost options are possible:

- Join venture capital (VC) advisory boards. Most VC funds are eager to connect their portfolio companies with prospective enterprise customers. CIOs willing to invest time are usually well rewarded with early access to cutting-edge technologies.

- Engage with technology vendors. Technology vendors have many active R&D and innovation projects. CIOs who visit select companies two to four times each year can get a pulse check on emerging technologies and trends.

- Ask existing suppliers to develop proofs of concept and demos. One participant in the 2015 survey identified a number of technology-enabled opportunities that could enhance the business. One idea was to place sensors on beverage dispensers at customer sites to track consumption. By doing so, the company could monitor inventory (to prevent stockouts, for example) as well as track consumption to better understand consumer behavior and improve marketing tactics. The CIO then asked one of the company’s development vendors to cofund the development of working prototypes to show at a board meeting.

- Deliver an ongoing series of quick wins. To gain momentum and establish credibility, aim to launch a portfolio of technology solutions that deliver business impact in two quarters or less. Software-as-a-service-based solutions or mobile apps needing limited data integration are two examples of the feasibility of rapid execution.

Such moves can help CIOs build credibility with the business and establish the case for innovation funding and expansion of IT’s scope. (While there are no guarantees in the life of a CIO, the sidebar “High-Tech Spin-Off from a CPG Company” shows how far an IT-driven innovation experiment can go.)

HIGH-TECH SPIN-OFF FROM A CPG COMPANY

McCormick & Company is one of the world’s leading manufacturers of spices, seasoning mixes, and condiments. Over the years, the company’s R&D function has created a large data library of ingredients, products, and recipes and their more than 16,000 associated aroma chemicals.

In 2011, as part of an effort to drive growth, CIO Jerry Wolfe decided to green-light a tool that could recommend specific McCormick products to consumers. The development team worked with external technology partners to algorithmically map McCormick’s food-data library to create a unique “fingerprint” for every food item. Each resulting FlavorPrint is mapped to 33 flavors and 17 textures that characterize every food item. Each person’s taste preferences can also be represented by his or her unique FlavorPrint, which consists of familiar terms such as peppery, nutty, and buttery and is created by asking users to like or dislike a series of food images displayed in an online app. Consumers with FlavorPrint profiles can then get recommendations that match their taste profiles.

In 2012, the company launched FlavorPrint in a new flagship store near its historic spice factory in Baltimore’s Inner Harbor. In 2013, McCormick put the FlavorPrint recommendation-app online, gained 100,000 beta users, and saw a revenue increase of 4.9 percent. As a supplier of flavors to other food companies, McCormick realized that the technology could be sold as a stand-alone product; consequently, in December 2014, it spun off the start-up Vivanda. Jerry Wolfe became CEO and continues to lead the company today.1

NOTE

1. Learn more about the McCormick story in “Tech Spin-Off from Spice Maker McCormick Puts CIO in the CEO Seat,” Wall Street Journal, April 1, 2015.

CIOs given a mandate to innovate are operating with a larger scope, experimenting with a wide range of technologies and strategies, and investing in capabilities that can satisfy customer expectations and meet internal enterprise needs. By embracing technological innovation, forwarding-thinking CIOs are helping their companies stay agile, adapt to change, and set a course for success.