For many family-owned businesses, succession planning is the proverbial “elephant in the room.” Despite recognizing the importance of selecting and preparing a successor, the leaders of a family business often do not give succession planning the attention it deserves.

In a recent survey by The Boston Consulting Group, family business leaders ranked succession as the second-most-important subject on the their minds, topped only by the closely related issue of achieving alignment among family members on critical topics. Even so, our research found that more than 40 percent of family businesses have not adequately prepared for succession during the past decade.

The consequences of not focusing on succession despite its obvious importance can be profound; a leadership void and the resulting discord can significantly undermine the company’s performance. Indeed, poorly planned successions are among the biggest value-destroying events for family-owned businesses.

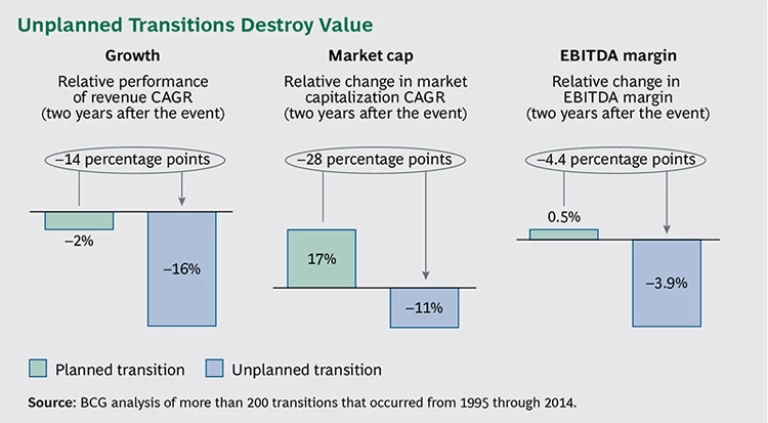

BCG’s research sheds light on the extent to which poorly planned successions can harm revenues, market capitalization, and margins. Although our study focused on family-owned businesses in India, the findings offer cautionary insights for companies in any country. We found a 14-percentage-point differential in revenue growth over two years when comparing family businesses that had planned transitions with those that had not. (See the exhibit.)

We also found a 28-percentage-point differential in market capitalization growth between companies that had planned transitions and those that had not. Moreover, unplanned transitions yielded EBITDA margins that after two years were more than 4 percentage points lower than those achieved by companies that successfully planned succession; margins remained below the trend line for the peer group for more than four years after unplanned transitions. Clearly, an enormous amount of value is destroyed by unplanned transitions, with potentially catastrophic consequences for the business.

A Difficult Subject to Discuss and Address Head-On

What lies behind the reluctance of many family-business leaders to openly discuss succession planning and tackle the challenges head-on? Succession planning sits at the intersection of family considerations, which typically involve emotions and feelings, and business considerations, which are typically driven by merit and economics. This juxtaposition of sentimental and financial concerns can make succession an especially complex topic.

Moreover, many incumbent leaders are unwilling to talk about relinquishing the helm, because their personal identity is often tightly linked to the family business itself. A charismatic founder having a strong personality, formidable capabilities, and a long record of managing all aspects of the business often casts a lengthy shadow over younger generations. In such cases, succession can be a nearly taboo subject that is difficult to broach.

Even when succession is high on the leadership agenda, family businesses face significant challenges to getting it right. First, they need to decide whether to select a successor from within or outside the family. Several family members may each aspire to take the reins, and talented nonfamily executives may also be interested in leading the company. Then, if the business designates a young family member as the successor, it must define a plan for how he or she will prepare for the role and gain acceptance as the leader by other family members and executives. Finally, the departing leader must be willing to let the successor emerge from under his or her shadow and take charge as planned.

Succeeding with Succession

Planning for a smooth succession starts with recognizing that it will be one of the most complicated transitions that a family business will experience. The family must also recognize that it is never too early to start discussing succession and that the costs of getting succession wrong will be nothing short of catastrophic for the business. These challenges mean that family members must focus strongly on succession planning, giving it their undivided attention on many occasions. Based on our experience advising family businesses on succession, we have identified ten principles that improve the chances of succeeding with succession.

Start early. Families may hesitate to plan succession because they are uncertain how the interests, choices, and decisions of different family members will play out over years or decades. But succession planning should start as soon as possible despite this uncertainty. Although things may change along the way, leaders can often anticipate the potential scenarios for how the family will evolve. Issues to consider when developing scenarios include the number of children in the next generation and whether those individuals are interested in the family business as a source of full- or part-time employment or purely as an investment. Families should also consider how the scenarios would be affected by marriages or the sudden demise of a family member or potential successor. It is important to plan a succession process and outcome that will work for the different foreseeable scenarios.

Set expectations, philosophy, and values upfront. Although setting expectations, philosophy, and values is central to many family-business issues, we have found that doing so is essential when it comes to succession planning and must be done up front, even if the specific mechanics of succession come later. In our experience, the family businesses that thrive and succeed across generations are those that possess a core philosophy and set of values linked not to wealth creation but to a sense of community and purpose.

Long before decisions will be made about specific potential successors, the family must agree on overarching issues such as whether family unity will take precedence over wealth creation, whether all branches of the family will have an equal ownership right and voice in decisions, and whether decisions will be based purely on merit and the best interests of the business. These guiding principles will provide the framework for more specific decisions.

Understand individual and collective aspirations. Understanding family members’ aspirations, individually and collectively, is critical to defining the right succession process. Leaders of the succession process should meet with family members and discuss their individual aspirations for involvement in the business. For example, does an individual want to work for the business or lead the business, or, alternatively, focus on the family’s philanthropic work? Or does an individual want to chart his or her own course outside of the business? The family’s collective aspirations can emerge from the effort to establish a philosophy and values. Does the family want its business to be the largest company in the industry? Is maintaining the business as a family-owned-and-operated company of paramount importance, or does the family want to relinquish operational responsibility in the coming years? Understanding these aspirations helps in managing expectations and defining priorities in the succession process.

Independently assess what’s right for the business. Although the best interests of the business and the family may seem indistinguishable to some family members, in reality the optimal decisions from the business’s perspective may differ from what family members want for themselves. This distinction makes it essential to consider what is right for the business independent of family preferences when developing a succession plan. It is therefore important to think about succession from a purely business perspective before making any adjustments based on family preferences. This allows leaders to be transparent and deliberate in the trade-offs they may have to make to manage any competing priorities.

Develop the successor’s capabilities broadly. A family business should invest in developing the successor’s capabilities and grooming him or her for leadership. The preparation should occur in phases starting at a young age—even before the successor turns 18.

The challenges of leading a family business are even greater than those faced by leaders of other businesses. In addition to leadership and entrepreneurship, a successor needs to develop values aligned with the family’s aspirations for the business and its role in society—capabilities that constitute stewardship of the company. Given the rapidly increasing complexity of business in the twenty-first century, we often strongly recommend that potential successors gain experience outside the family business in order to broaden their perspective.

Some of the best-managed family businesses have elaborate career-development processes for family members that are the equal of world-class talent-management and capability-building processes.

Define a clear and objective selection process. A company needs to define a selection process to implement its succession model—whether selecting a successor exclusively from the family or considering nonfamily executives as well. The selection process should be based on articulated criteria and delineate clear roles among family governance bodies and business leaders, addressing who will lead the process, propose candidates, and make decisions.

An early start is especially important if several family members are under consideration or the potential exists to divide the business to accommodate leadership aspirations. To obtain an objective perspective on which members of the younger generation have the greatest leadership potential, some families have benefited from the support of external advisors in evaluating talent and running the selection process.

It is important to note that the selection process, while critical, is the sixth point on this list. Points one through five are prerequisites for making the selection process itself more robust and effective.

Find creative ways to balance business needs and family aspirations. Striking the right balance between the business’s needs and family members’ aspirations can be complex. Addressing this complexity often calls for creative approaches—beyond the traditional CEO-and-chairperson model.

For example, the leader of one BCG client split his conglomerate into different companies, each to be led by one of his children; the split occurred without acrimony and in a planned, transparent manner. Beyond helping family members fulfill their aspirations, such a planned split can often greatly enhance value for the business. Another client systematically expanded its business portfolios as the family grew and tapped family members to take over the additions, thus ensuring that several members of the family had a role in the leadership of the businesses.

Stepping into an executive position is not the only way family members can contribute to the business or help the family live its values. As an alternative, family members can serve on the board of directors or take leading roles in the family office or its philanthropic activities.

Build credibility through a phased transition. Successors should build their credibility and authority through well-defined phases of a transition into the leadership role. They can start with a phase of shadowing senior executives to learn about their routines, priorities, and ways of operating. Next, we suggest acting more as a chief operating officer, managing the operations closely but still deferring to the incumbent leaders on strategic decisions. Ultimately, the successor can take over as the CEO and chairperson and drive the family business forward.

It is important to emphasize that the family member who assumes leadership of the business does not necessarily also become the head of the family, with responsibility for vision setting, family governance and alignment, and wealth management. The transition of family leadership can be a distinct process.

Each phase of the transition often takes between two and six months. The transition should be defined by clear milestones and commensurate decision rights. A sudden transition can be disruptive, which is especially harmful if the intent is to maintain continuity in the family business’s direction and strategy.

Ask departing leaders to leave but not disappear. Most leaders bring something distinctive to a family business. Holding onto this distinctiveness in a transition is essential but requires a delicate balance. Although departing leaders should relinquish managerial responsibility for the business, they should remain connected to one or two areas where they bring the truly distinctive value that made the family business successful under their guidance. However, the leaders should be involved in these activities through a formal process, rather than at their own personal preference and discretion. Departing leaders should stay available to guide the new leader if he or she seeks their advice.

To help leaders strike this balance and overcome their reluctance to let go, companies can create a “glide path” plan that sets out how they will turn over control in phases and transition into other activities while the successor assumes control and builds credibility.

Family businesses should also consider the need to adjust aspects of the company’s governance model when the departing leader hands over the reins. Although such adjustments can be made outside the context of succession, they often become particularly relevant after transitions to the second or third generation. A strong leader’s hands-on governance approach is often no longer sustainable for the next generation, creating the need to divide and formalize roles and institutionalize many business processes.

Motivate the best employees and foster their support. Managing the company’s most talented nonfamily executives is especially challenging during the succession process. The company needs to ensure that these executives have opportunities to develop professionally and take on new responsibilities and that morale remains high. Involving executives in the succession process can help to foster their support for the new leader. For example, they can be asked to serve as mentors for the successor or lead special projects relating to the succession. Surrounding the new leader with a strong and supportive senior team is a key ingredient for success, and the departing leader should ensure that such a team is in place.

Assessing the Status of Succession Planning Today

As an initial “health check” to assess the current status of their succession planning, family businesses should consider a number of issues:

- Has the family clearly articulated its values and the principles that will guide its decisions and succession process?

- Has the current leader committed to a fixed retirement date?

- Has the family evaluated the pipeline of leadership talent within its younger generation? Has it looked at potential leaders who come from within the business but not within the family?

- Has the company defined a succession model and determined the timing for selecting a successor so that he or she has a sufficient opportunity to prepare for the leadership role and build credibility before the current leader retires?

- Does the family understand how it will accommodate the aspirations of family members not selected for leadership roles, in order to maintain harmony and avoid discord during the transition to new leadership?

In many cases, family businesses will find that the answers to questions like these indicate the need to devote much more time and attention to succession planning. Most important, the current leader, other family members, and the top management team will need to begin having an open and candid discussion about succession-related issues to enable the business to thrive for generations to come. These discussions are never easy, but they are essential. Getting succession wrong can be an irreversible and often fatal mistake for a family business.