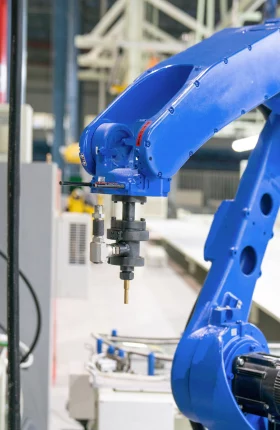

It has been roughly four decades since industrial robots—with mechanical arms that can be programmed to weld, paint, and pick up and place objects with monotonous regularity—first began to transform assembly lines in Europe, Japan, and the U.S. Yet walk the floor of any manufacturer, from metal shops to electronics factories, and you might be surprised by how many tasks are still performed by human hands—even some that could be done by machines. The reasons are simple: economics and capabilities. It is still less expensive to use manual labor than it is to own, operate, and maintain a robotics system, given the tasks that robots can perform. But this is about to change.

The real robotics revolution is ready to begin. Many industries are reaching an inflection point at which, for the first time, an attractive return on investment is possible for replacing manual labor with machines on a wide scale. We project that growth in the global installed base of advanced robotics will accelerate from around 2 to 3 percent annually today to around 10 percent annually during the next decade as companies begin to see the economic benefits of robotics. In some industries, more than 40 percent of manufacturing tasks will be done by robots. This development will power dramatic gains in labor productivity in many industries around the world and lead to shifts in competitiveness among manufacturing economies as fast adopters reap significant gains.

A confluence of forces will power the robotics takeoff. The prices of hardware and enabling software are projected to drop by more than 20 percent over the next decade. At the same time, the performance of robotics systems will improve by around 5 percent each year. As robots become more affordable and easier to program, a greater number of small manufacturers will be able to deploy them and integrate them more deeply into industrial supply chains. Advances in vision sensors, gripping systems, and information technology, meanwhile, are making robots smarter, more highly networked, and immensely more useful for a wider range of applications. All of these trends are occurring at a time when manufacturers in developed and developing nations alike are under mounting pressure to improve productivity in the face of rising labor costs and aging workforces.

To assess the potential impact of the coming robotics revolution on industries and national competitiveness, The Boston Consulting Group conducted an extensive analysis of 21 industries in the world’s 25 leading manufacturing export economies, which account for more than 90 percent of global trade in goods. We analyzed five common robot setups to understand the investment, cost, and performance of each. We examined every task in each of those industries to determine whether it could be replaced or augmented by advanced robotics or whether it would likely remain unchanged. After accounting for differences in labor costs, productivity, and mix by industry in each country, we developed a robust view of more than 2,600 robot-industry-country combinations and the likely rate of adoption in each.

The Global Impact of the Robotics Takeoff

The following are some of the key findings of this research:

- Robotics use is reaching the takeoff point in many sectors. The share of tasks that are performed by robots will rise from a global average of around 10 percent across all manufacturing industries today to around 25 percent by 2025. Big improvements in the cost and performance of robotics systems will be the catalysts. In several industries, the cost and capabilities of advanced robots have already launched rapid adoption.

- Adoption will vary by industry and economy. Among high-cost nations, Canada, Japan, South Korea, the UK, and the U.S. currently are in the vanguard of those deploying robots; Austria, Belgium, France, Italy, and Spain are among the laggards. Some economies, such as Thailand and China, are adopting robots more aggressively than one might expect given their labor costs. Four industrial groupings—computers and electronic products; electrical equipment, appliances, and components; transportation equipment; and machinery—will account for around 75 percent of robotics installations during the next decade.

- Manufacturing productivity will surge. Wider adoption of robots, in part driven by a newfound accessibility by smaller manufacturers, will boost output per worker up to 30 percent over the medium term. These gains will be in addition to improvement from other productivity-enhancing measures, such as the implementation of lean practices.

- Savings in labor costs will be substantial. As a result of higher robotics use, the average manufacturing labor costs in 2025—when adjusted for inflation and other costs and productivity-enhancing measures—are expected to be 33 percent lower in South Korea and 18 to 25 percent lower in, for example, China, Germany, the U.S., and Japan than they otherwise would have been.

- Robots will influence national cost competitiveness. Countries that lead in the adoption of robotics will see their manufacturing cost competitiveness improve when compared with the rest of the world. South Korea, for example, is projected to improve its manufacturing cost competitiveness by 6 percentage points relative to the U.S. by 2025, assuming that all other cost factors remain unchanged. High-cost nations—such as Austria, Brazil, Russia, and Spain—that lag behind will see their relative cost competitiveness erode.

- Advanced manufacturing skills will be in very high demand. As robots become more widespread, the manufacturing tasks performed by humans will become more complex. The capacity of local workers to master new skills and the availability of programming and automation talent will replace low-cost labor as key drivers of manufacturing competitiveness in more industries. There will be a fundamental shift in the skills that workers will need in order to succeed in advanced-manufacturing plants.

Few manufacturing companies will be left untouched by the new robotics revolution. But getting the timing, cost, and location right will be critical. Investing in expensive robotics systems too early, too late, or in the wrong location could put manufacturers at a serious cost disadvantage against global competitors.

Preparing for the Robotics Revolution

The right time for making the transition to advanced robotics will vary by industry and location. But even if that time is several years away, companies need to prepare now.

To gain competitive advantage, companies need to adopt a holistic approach to the robotics transition. We recommend that companies take the following actions:

- Understand the global landscape. First, companies need a clear picture of the trends in robot adoption around the world and in their industries. They need to know how the price and performance of robots are likely to change in comparison with the total cost of labor in each economy where they manufacture—and how this comparison is likely to change in the years ahead. They must also factor in other considerations, such as the flexibility of labor rules and the future availability of workers, that support or hinder wider robotics adoption in a given economy. It is important to keep in mind that these are moving targets.

- Benchmark the competition. Companies need to be well aware of what their competitors are currently doing and understand what they will do in the future. If robotics adoption is expected to rapidly increase in their industry, they should assume that the total cost of systems will fall. This knowledge will help companies more accurately estimate the cost and timing of investments as well as make decisions about where to locate new capacity.

- Stay technologically current. Rapid advances in technology mean that companies must stay abreast of the evolving capabilities of advanced robotics systems. They should have a clear view of whether and how quickly innovation is resolving technical barriers that so far have inhibited the use of robots, such as the ability to manipulate flexible or oddly shaped materials or to operate safely alongside workers. Just as important, when will these new applications be cost-effective? As they take stock of the new capabilities and the improvements in price and performance, many companies—even small and midsize manufacturers—may discover that installing robotics is more cost-effective than they once thought. In some cases, having a view on the evolution of robotics and automation can help a company determine whether it is better to wait for a better technology to emerge or to implement a new process that allows them to upgrade technology without having to duplicate what they have already done. In many ways, timing is crucial.

- Prepare the workforce. As more factories convert to robotics, the availability of skilled labor will become a more important factor in the decision about where to locate production. Tasks that still require manual labor will become more complex, and the ability of local workforces to master new skills will become more critical. The availability of programming and automation talent will also grow in importance. Companies and economies must prepare their workforces for the robotics revolution and should work with schools and governments to expand training in such high-compensation professions as mechanical engineering and computer programming.

- Prepare the organization. Even if the economics don’t yet favor major capital investment, companies should start preparing their global manufacturing operations now for the age of robotics. They should make sure that their networks are flexible enough to realize the benefits of robotics as installations become economically justified in different economies and as suppliers automate. They should get themselves up to speed on new advanced-manufacturing technologies and think about how they will transform their current production processes so that these technologies can achieve their potential. For many manufacturers, adapting to the age of robotics will require a transformation of their operations.

Manufacturers do not have the luxury of waiting to act until the economic conditions for robotics adoption are ripe. Our projections show that when the cost inflection point arrives, robotics installation rates are likely to accelerate rapidly. This will provide the opportunity to create a substantial competitive advantage. Companies and economies that are ready to capitalize on the opportunity will be in a position to seize global advantage in manufacturing.