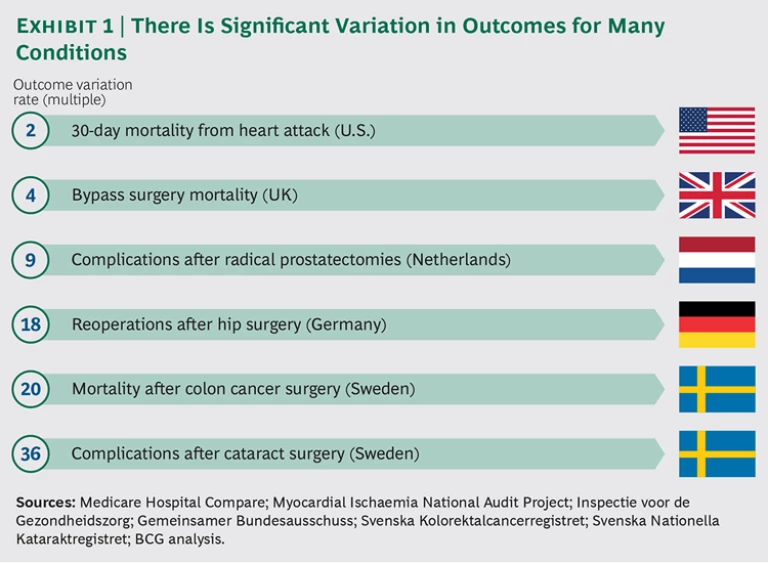

In most developed markets, health care suffers from two large and growing problems. The first is the significant variation in patient outcomes, even for routine procedures. For example, one in seven people in Europe will likely need either hip or knee replacement surgery at some point in their lives. Germany has some of the world’s best orthopedic clinics, yet patients who undergo hip surgery in that country experience a vast range of outcomes. Those who are treated at the country’s worst-performing hospitals require follow-up surgery within two years at rates that are 18 times higher than for patients at the best-performing hospitals.

That same disparity is seen for other medical conditions and in other markets. (See Exhibit 1.) In the Netherlands, whose health care consistently ranks among the best in Europe, there is a ninefold variation in the rate of post-surgical complications from radical prostate surgery, a procedure that can have a major impact on a patient’s quality of life. In Sweden, the complication rate for some patients who undergo cataract surgery can be 36 times that of other patients. These variations are mainly the results of differences in medical practices—rather than demographics or other complicating medical conditions in patients—and can, therefore, be addressed.

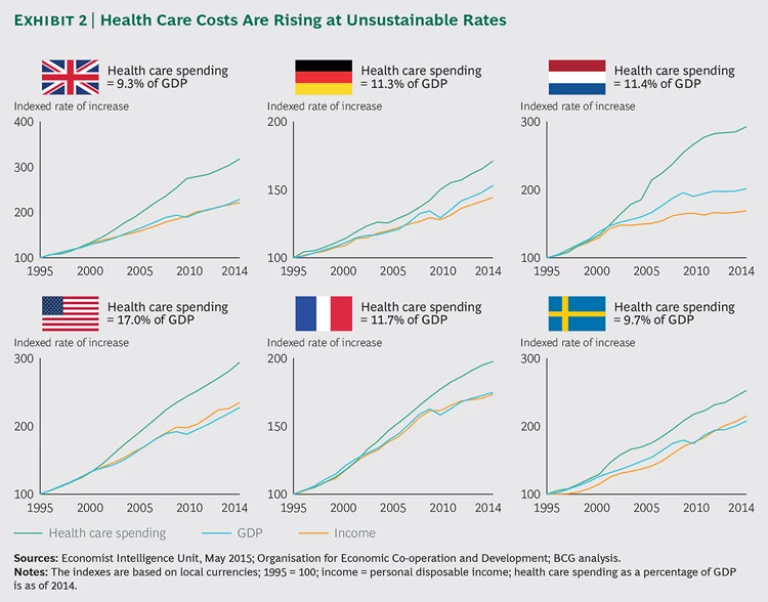

The second major health-care problem is spiraling costs. In the Netherlands, for example, health care spending rose seven times faster than GDP from 2004 through 2014. Most developed countries are experiencing similar increases in spending—rates that are simply unsustainable. (See Exhibit 2.) Given these two challenges—variations in outcomes and spiraling costs—there is an urgent need to find new ways to create value in health care.

Value-based health care, which focuses on patient outcomes and the costs of delivering these outcomes, can address both challenges. Moreover, the medical technology, or medtech, industry is in a unique position to boost value-based health care. Thanks to its design innovations, therapeutic and business experience, and deep relationships with health care providers , medtech—probably more than any other sector of health care, including pharmaceuticals—can help providers deliver better care at more reasonable costs.

However, public procurement can represent a major barrier. Most hospitals and health systems purchase medical products—including devices, supplies, and equipment—primarily on the basis of up-front purchase costs. This shortsighted approach—often driven by a crude focus on short-term cost savings—does not address the needs of patients and clouds the true cost of care.

If the health care industry is to shift to value-based care, hospitals and health systems must revamp their approach to public procurement, allowing medtech to become part of the solution. Last year, the European Parliament passed a new public- procurement directive that encourages contracting authorities—including hospitals and health systems—to move away from price-only-based procurement. Instead, the directive established a more holistic perspective for procurement that factors in quality, total costs across the product life cycle, and broader socioeconomic considerations in the purchasing of medtech products.

This move represents a major turning point in the progress to value-based health care. To seize the opportunity, The Boston Consulting Group and Eucomed (part of MedTech Europe, an alliance of European medical-technology trade associations) partnered to design a framework that can help contracting authorities make smarter procurement decisions. We collaborated closely with specialists from leading health-care institutions who have already implemented innovative procurement practices. Our ambition was to create a simple logic and nomenclature that will help purchasing officials create tendering processes for medical products that can promote better patient outcomes in the most economically advantageous way.

Some medtech companies are already partnering with hospitals and health systems to develop value creation programs. Increasingly, these companies are selling solutions rather than products. If the medtech industry is to build on this progress, however, the prevailing approach to procurement in health care will have to change.

The Current Approach to Procurement Falls Short

In their groundbreaking book, Redefining Health Care, Michael E. Porter and Elizabeth Olmsted Teisberg defined value in health care: outcomes that matter to patients divided by the cost to achieve these outcomes. This deceptively simple approach is becoming the most effective means for measuring health care delivery. It aligns all stakeholders around a common viewpoint. Most important, it shifts the discussion, which has been focused mainly on cost, to a more holistic perspective.

Medtech can improve both components of the value equation, leading to better outcomes and lower overall costs. Yet the procurement process at most hospitals and health systems is not set up to achieve this. An estimated 70% of global medtech sales go through a public-procurement process, and 70% of the decisions in those cases are determined on the basis of price. Both numbers are rising.

The focus on the up-front purchase price of medical products has many unintended consequences—for the medtech industry as well as health care as a whole. Our research shows that it may lead to reduced competition over time. Unsustainably low prices could make the market unattractive for smaller players or force suppliers to exit markets owing to large-volume tenders that effectively block supply for three to five years. In addition, a focus on low prices reduces innovation and discourages the adoption of new technologies.

However, the biggest problem with the current, price-based approach to procurement is that it addresses neither quality nor the total cost of patient care. The public-procurement system is widely plagued by organizational issues—silos within hospitals and health systems, misaligned incentives, and bureaucratic administrative structures. In the course of this investigation, we interviewed many procurement officials who explicitly told us that they didn’t directly consider patients when creating tenders for medical devices , equipment, and supplies. Significantly, these officials were also generally unconcerned about costs that were outside the procurement budget, which was, for the most part, limited to the sourcing of medical products (and pharmaceuticals). Most procurement officers consider only their own budget. This is surprising, given that medical products make up only 5% to 10% of the total health-care expenditure. If organizations are going to reduce costs systematically, they cannot leave the bulk of the costs of care unaddressed.

In fact, shortsightedness in procurement decisions leads, in many cases, to higher total costs, even for basic supplies, such as IV catheters. We were told of low-cost IV catheters that broke easily, were not user-friendly, required considerable time to handle properly, and posed safety risks to clinical staff. The extra costs triggered by such price-based purchases do not affect the procurement budget and are hard to identify and quantify—unless there is good communication between clinical and procurement units.

A New Framework

In 2014, the European Parliament sought to alleviate some issues associated with price-only-based procurement. The directive, which puts far more emphasis on the concept of the best price-quality ratio in procurement, presents a unique opportunity for the health care industry to act. (See “The EU’s Public-Procurement Directive.”)

THE EU’S PUBLIC-PROCUREMENT DIRECTIVE

In February 2014, the European Parliament passed Directive 2014/24/EU, which focuses on public procurement, repealing a previous directive from 2004. The directive aims to improve procurement by promoting quality and innovation while considering longer-term costs, as well as, for example, environmental and social factors. Specifically, it provides more freedom to contracting authorities by encouraging the use of flexible procedures and allows greater interaction with the market. For example, rather than the traditional, one-way tendering format, the directive introduces negotiation and competitive dialog formats. These new procedures allow closer collaboration between the contracting authorities and suppliers in the tendering process.

In addition, the directive encourages industries—including medtech—that sell to public authorities to define the best price-quality ratio, which is equivalent to value for money and allows public authorities to consider full life-cycle costs rather than just the up-front purchase price. The new directive mandates that member states must convert it into national law by April 2016. (The UK has already done so, enacting a set of public-contract laws that took effect in February 2015.)

To a certain extent, the new directive is promoting and spreading some advanced procurement practices already under way in a few areas. The concept is neither new nor untested: some organizations are already using some form of value-based procurement, and it is leading to better purchasing decisions. (See “Value-Based Procurement: Four Case Studies.”)

VALUE-BASED PROCUREMENT: FOUR CASE STUDIES

Although price-based procurement is still the norm at many institutions, others are adopting a more advanced approach that factors total costs and outcomes into the process. In our research, we identified four success stories.

Sweden: Innovative Tender Criteria

In 2014, Karolinska University Hospital issued a large, 14-year tender for imaging services—including MRI, ultrasound, and CT scanners.

The Role of Patient Outcomes. The tender’s criteria regarding R&D and innovation stipulated that the hospital wanted to procure imaging services—not simply pieces of equipment. The specifications covered the maintenance of technical standards over the entire contract period and included details related to service, upgrades, and replacement scanners.

Three of the five tender participants fulfilled the basic requirements and were invited to participate in a competitive dialog format. The winning bidder, Philips, won through a combination of attractive pricing and high quality. The company gained a high score in R&D and innovation by offering to establish a local innovation hub for research and education focused on improving outcomes in ten high-priority therapy areas. Philips focused its bid on patient value as defined by Michael E. Porter and Elizabeth Olmsted Teisberg and the International Consortium for Health Outcomes Measurement, as well as on studies of Swedish quality registries by Stefan Larsson, the global leader of BCG’s health-care payers and providers sector.

Best Practice. Innovative tender criteria—concerning, for example, services to measure and improve patient outcomes, technological support, and access to newer imaging systems during the contract period—helped Karolinska identify a supplier that would add value and improve the way the hospital treats patients.

Sweden: Total Cost of Care

In 2012, the Stockholm County Council (SCC), which runs most of the city’s hospitals, offered an innovative tender for wound care products.

Hypothetical Wound-Care-Patient Cases. Instead of looking solely at product price, the request for bids included three hypothetical patient cases and asked bidders to calculate the total cost of treatment for each.

As part of the tendering process, suppliers needed to determine the total cost of the wound care element using a calculation model that the SCC provided: the calculation included the unit cost of wound care dressings, the number of dressing changes, staff costs for time spent changing dressings (hourly rates for nursing were provided), as well as transportation costs to and from patients’ homes. The tender also considered the expected level and frequency of complications caused—or avoided—by using the suppliers’ wound care dressings. It is notable that the winning bid came from the bidder with the highest-priced products: the company was able to show a lower total cost of care over time and could document its claims with clinical evidence.

Best Practice. Requiring that bidders calculate the total cost of care—including costs related to complications—for a variety of patients helped SCC move beyond purchase price to consider costs on a more holistic level.

Norway: Patient Feedback

Helseforetakenes Innkjøpsservice AS (HINAS), a company owned by the four regional health authorities in Norway to coordinate public procurement, opened a tendering process for IV catheters for the country’s hospitals in 2011.

Patient Feedback as a Procurement Factor. A previous tender had led to purchasing IV catheters that had caused problems. Patients complained about pain levels, and a high rate of failed injections led to unplanned costs. Together with the regional health authorities, HINAS set up the new tender to include low levels of patient-reported pain as one of the award criteria, as well as other qualitative aspects such as ease-of-use and perceived safety in handling by the nursing staff.

The tender included a two-month evaluation period, during which the products from competing bidders were tested in several hospitals. Patients and nursing staff scored the products after using them in multiple settings. The tender was awarded on the basis of a combination of cost and qualitative ratings: the lowest-priced bid did not win. One of the losing bidders sued, claiming that the evaluation had been based on subjective, qualitative criteria, but the tendering process was deemed legal.

Best Practice. By including a short evaluation period to assess products on the basis of feedback from clinical staff and patients, HINAS was able to use qualitative criteria as part of its tender.

Canada: A Risk-Sharing Arrangement

A Canadian provincial health authority issued a tender in 2014 for approximately 22,000 pacemakers, implantable cardioverter defibrillators, and cardiac resynchronization therapy devices over a four-year period. One of the critical award criteria was the expected median life span of the devices, including normal battery depletion. When pacemaker batteries wear out, patients require surgery to replace them. The potential for complications and hospital stays can mean significant swings in outcomes and the total cost of care.

Risk Sharing on Device Performance. As part of the tendering process, suppliers were asked to indicate the expected longevity of their devices under various usage scenarios. In most cases, the clinical data required to back up supplier claims was not available to the health authority. For example, some newer devices described as having a seven-year life span had not been in patients long enough to confirm this claim. To overcome the lack of reliable data, the contracting authority required suppliers to share some of the risk. If a device needed replacement before the end of the promised seven-year time period, the supplier would be obliged to pay the cost of the patient’s replacement surgery. This commitment served as a powerful incentive for suppliers to provide realistic life-span information and eliminated the need for them to provide clinical proof of expected longevity at the time of the tender.

Best Practice. Risk sharing obviated the manufacturers’ burden of clinical proof while ensuring that the health authority would get products that met its technical requirements for better patient outcomes.

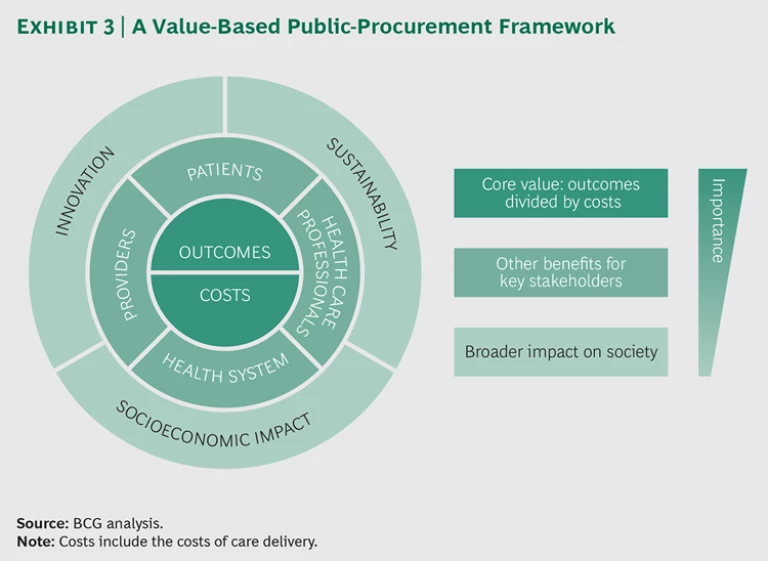

The directive also encourages each industry to define the best price-quality ratio for its specific situation. To that end, we analyzed the efforts already under way to align value-based health care with procurement and worked with MedTech Europe to develop a framework for value-based procurement. (See Exhibit 3.) The new framework is intended to serve as a guide for contracting authorities building a tender, as well as medtech companies shaping their product and service solutions. It lays out a menu of recommended quality and cost criteria to be used in evaluating tenders.

At the core of the framework is the value-based health-care equation—patient outcomes relative to the cost of delivering these outcomes, including not only initial product costs but also the total cost of care delivery. This means, for example, that if a device can reduce the length of a surgical episode, shorten the length of a patient’s hospital stay, or eliminate the need for a second hospitalization for the same episode, the equivalent cost savings should be captured. The same principle applies to the outcomes side. Meaningful differences in outcomes or willingness to engage in joint programs to measure improvements should be quantified and factored in. The core is the most important component of the new framework.

There are also second-tier benefits for patients, health care professionals, providers, and health care systems. We have reflected these around the core. For example, contracting authorities might consider the following benefits:

- The relative convenience and comfort for patients

- The safety and the ease of use for health care professionals

- Better care pathways for providers

- Reduced overall costs for the health system

Encircling this middle layer, we have added an outer ring, with tertiary considerations that reflect the broader impact on society and are of direct interest to policymakers: innovation, sustainability, and socioeconomic impact.

For each element of the framework, we have defined a broad set of criteria that contracting authorities can use in developing a specific tender. We have also developed a simple tool that they can use in this process. Rather than being prescriptive, these criteria are meant to inform the tender-building process. From the complete set of criteria we have defined, contracting authorities should be able to choose those that are most important for their specific application.

It is worth noting that the framework is not intended to serve as a formal algorithm that yields a mathematical solution. It is, instead, a set of considerations that contracting authorities can modify for individual tenders on a case-by-case basis—and that medtech companies can use to improve their offerings. The crucial aspect is that it creates a common language that can make it easier for health care providers and companies in the industry to improve value, and it moves the focus away from price as the central consideration.

Factoring in Outcomes

One key element of this value-based procurement framework lies at its core: patient outcomes. However, obtaining information on outcomes from various bidders can be a highly contentious process. In our framework, we recognize these challenges and propose to conduct evaluations that use pragmatic steps to measure what is relevant and achievable within a tender procedure. We believe that demonstrating and awarding outcomes—at a level that the contracting authority can define and assess—is a good way forward. (See “Including Outcomes in Tender Evaluations.”) In fact, the support of medtech companies in measuring and reporting on outcomes—or a willingness to offer outcome-dependent contractual agreements—should also be recognized in the tendering process. Not all suppliers operate this way, but some have begun to, and purchasers should reward that kind of forward thinking.

INCLUDING OUTCOMES IN TENDER EVALUATIONS

Traditionally, tenders have not given much weight to patient outcomes; at most, they set minimal performance requirements, giving suppliers little incentive to aim for better outcomes and potentially slowing innovation in health care. We therefore recommend that purchasing authorities factor outcomes—including patient-reported outcomes—into relevant aspects of the tender evaluation process and that suppliers that make investments to improve outcomes receive proper recognition.

The lack of adequate data on existing products is a central challenge in this effort. There are not enough programs that track real-world outcomes involving patients and health care professionals. Is there a way around this issue? We believe that purchasing authorities should consider two categories of criteria during the evaluation process.

The first category—outcomes and evidence—includes the evidence of relevant improvements, supported by high-quality data. Ideally, the evidence has been published, but in the absence of published data, it is still relatively simple to set up processes to measure the impact on outcomes during the evaluation process. For example, consider the Norwegian agency described in the sidebar “Value-Based Procurement: Four Case Studies” that asked nurses and patients to evaluate new IV catheters before it awarded the tender. We believe such simple processes could be used more broadly to gauge patient-relevant outcomes along with potential benefits for care providers.

In addition, purchasing authorities should consider a second category—outcomes focus—to assess the willingness of each supplier to participate in a program that measures outcomes and/or to include incentives or risk-sharing arrangements as part of the contract. (The Canadian pacemaker case study discussed in the sidebar referenced above is a good example.) On the basis of these criteria, contracting authorities can reward suppliers—and suppliers can commit to delivering on their related claims—even if they do not yet have detailed evidence at the time of the tender.

Using these measures, procurement can efficiently include patient outcomes during the tender process and reward innovation that leads to better value.

Furthermore, the framework offers a new way to evaluate tenders: assigning a monetary value to each qualitative criterion on the basis of the purchasing authority’s willingness to pay. For bids in which a supplier meets a particular criterion, the corresponding monetary value should be subtracted from the overall bid cost, resulting in a net bid value. (See “Assign a Monetary Value to Each Criterion.”)

ASSIGN A MONETARY VALUE TO EACH CRITERION

A wealth of literature describes the pros and cons of various mathematical formulas that combine qualitative criteria and prices. The most common method involves assigning a score to each criterion, totaling the scores to generate a complete quality rating, and combining that result with the bid price (using predefined weights) to achieve an overall score. However, there are major challenges in converting a price into a score. For example, a “ranking paradox” occurs when multiple bids are ranked in relative terms (rather than according to absolute criteria). The departure of one bid—particularly one that is very high or very low—can affect the ranking of the remaining bids, throwing off the selection process.

We propose another evaluation method. Rather than scoring everything and then weighting the rankings, contracting authorities can invert the process and directly assign a monetary value to each criterion. For example, if “safety for users” is a key criterion of the tender, this might equate to a value of €1,000. That amount is not calculated using complex health economics. It is determined simply on the basis of the purchasing authority’s willingness to pay. The values for each of the quality criteria are then deducted from the bid price to determine a net bid price.

This method bypasses the mathematical complexity of converting prices to scores and also makes the process of building and evaluating tenders far more intuitive and transparent. The contracting authority—as represented by a group of specialists from all relevant departments, including procurement, physicians, nurses, and technical staff—evaluates a specific quality feature of incremental improvement in outcomes by answering a single question: How much extra are we willing to pay?

This approach has been used successfully by the Stockholm County Council, and many other Swedish procurement authorities are starting to apply it.

In preparing this methodology and the tool, we have been working closely with a large number of procurement experts from national and regional procurement organizations, as well as health care providers and medtech companies. So far, the consensus is that the new assessment methodology is the right way to go. However, it remains a high-level framework that still needs extensive testing and refinement for specific product categories. In the coming months, we will be working with national and regional procurement bodies and policy makers to evaluate and refine the framework.

The Potential to Transform the Industry

The new European public-procurement directive provides a unique opportunity for the medtech industry to drive value in health care. Our proposed methodology—including the framework and the advanced approach to assessing tender offers—represents a new way of thinking about procurement. If implemented broadly, it has the potential to transform health care, break down silos within hospitals and health systems, and shift the discussion focus from price to more holistic considerations. It will bring clinicians back to the table and drive innovation in medtech products and business models.

Bringing about the intended change to the procurement environment by broadly disseminating this methodology will take time and will not be easy. There is—at least so far—little use of real-world data on patient outcomes, as well as a lack of universal consensus on how best to measure outcomes. New capabilities need to be developed in procurement functions and supplier companies.

However, we have already seen innovative providers taking big steps in the right direction. BCG will continue to work with MedTech Europe to communicate this value-based framework broadly, involving national industry associations and provider associations as well. But making this a success requires that everyone play a part in driving the change through each organization.

Working together, contracting authorities and medtech companies can help reshape the future of health care. Patients deserve that.

Acknowledgments

The research and methodology described in this report were cosponsored by MedTech Europe and BCG’s Health Care practice. The authors would like to thank the many persons from procurement, government, hospital associations, and the medtech industry for their invaluable contributions and advice in the development and validation of the proposed value-based procurement method for medical technology. In particular, they would like to acknowledge the Eucomed board, procurement working group, and steering committee for their active support. In addition, they would especially like to thank the following experts, who have provided highly valuable input:

An Baeyens, legal and policy officer, Unit G4, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs, the European Commission

Jens Deerberg-Wittram, BCG director, formerly president of the International Consortium for Health Outcomes Measurement and, prior to that, chief executive of Schön Klinik, a German for-profit group of 15 hospitals

Trude Ertresvåg, special adviser on environment, procurement, and logistics, Sykehuspartner

Gunnar Goblirsch, senior purchaser, Stockholm County Council (SCC)

Adrian Griffin, vice president, health technology assessment policy, Johnson & Johnson

Sara Holst, purchaser, SCC

Kjetil Istad, director of procurement and logistics, Southern and Eastern Norway Regional Health Authority

Kaveh Katebian, partner, Beaconsfield Group

Nikos Maniadakis, professor of health services organization and management, National School of Public Health, Athens, Greece, and former CEO of multiple university hospitals in Greece

Eleni Pasdeki-Clewer, technical expert, sustainable procurement, UK National Health Service

Tom Penny, senior consultant, Environmental Resources Management and, previously, product sustainability advisor, UK National Health Service

Gabriela Prada, director, health innovation, policy, and evaluation, The Conference Board of Canada

Graham Rich, former CEO, University Hospitals Bristol NHS Foundation Trust

Rui Rocha, director of purchasing, São João Hospital

Sonia Roschnik, operational director, sustainable development unit, UK National Health Service

Laura Sampietro-Colom, deputy director of innovation and head of the health technology assessment unit, the Hospital Clinic of Barcelona

The authors thank Sophie Koettlitz, Robert McGregor, and Norman Brede for their work on this project.