Growth is a key driver of shareholder value. For high performers, say the top-quartile value creators of the S&P 500, growth creates twice as much value as margin or cash flow improvement. Yet most companies—those that lack the tailwinds of a hot industry such as technology—must “grow uphill,” facing maturity and commoditization (which erode advantage) or disruption and changing customer behaviors (which erase it). (See “ Growth for the Rest of Us ,” BCG Perspectives, January 2014.) One question is: Can companies buy their way to growth? Or, put another way, do acquisitive companies grow faster than those that avoid acquisitions?

Economists and other experts have long debated whether acquisitions create value. The most oft-cited statistic—which has become almost a corporate rule of thumb—is that acquisitions destroy value, at least in the short term, in more than half to two-thirds of all cases. Business leaders who participated in our 2015 Corporate Leaders M&A Survey confirmed that this has indeed been the case for their companies. (See “ Why Deals Fail ,” BCG article, October 2015.) In-depth research on the impact of acquisitions on growth is harder to come by, however. Using our proprietary database, which includes more than 40,000 transactions that have taken place since 1990, we set out to examine just this impact. We asked three questions:

- Do acquisitive companies grow faster than nonacquisitive companies in the long term? While it is easy enough to buy a short-term revenue boost, over a 25-year time horizon, does a dollar spent on acquisitions yield a higher growth rate than a dollar spent on organic capital expenditure?

- To what extent can profitable bottom-line growth be achieved from acquisitions? Again, buying top-line growth is a straightforward task. But covering integration costs and realizing the synergies that generate growth for the bottom line is far more complex.

- Does acquiring growth actually generate value for shareholders? (See “ From Acquiring Growth to Growing Value ,” BCG article, October 2015.)

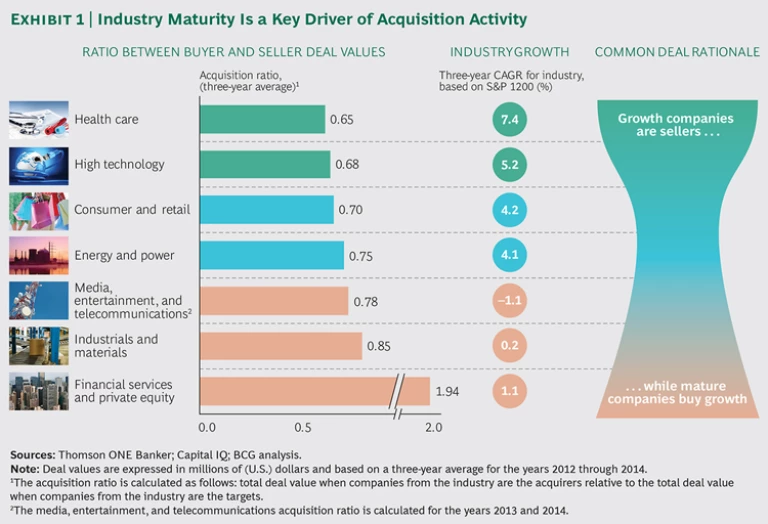

The results are both eye opening and instructive for any company considering acquisitions as part of its growth strategy. They are particularly relevant for companies in mature industries such as industrial goods, financial services, and media and telecommunications. Companies in such industries, which have evidenced low or no organic growth in recent years, are far more likely to be buyers in M&A transactions, as they depend more on growth through acquisition. Companies in higher growth sectors, such as health care and technology, are much more often sellers. (See Exhibit 1.)

Buying Long-Term Growth

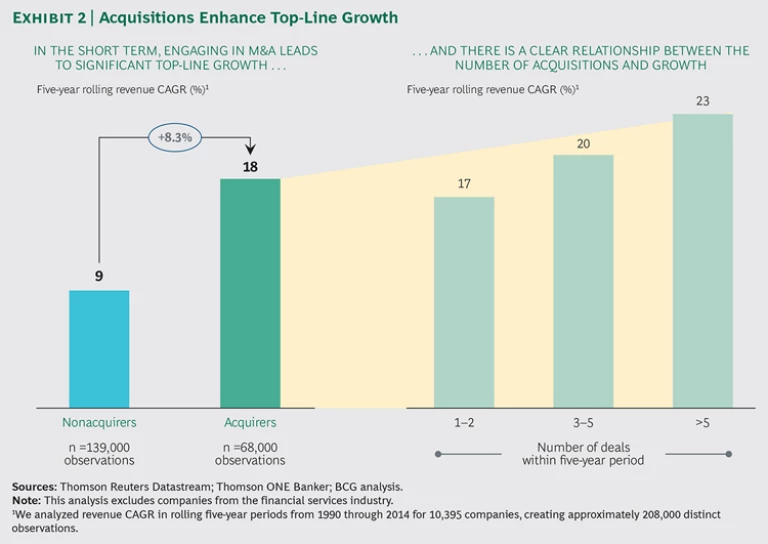

As one might expect, companies that make acquisitions have higher short-term revenue growth rates than those that do not—8.3 percentage points higher in a typical five-year period. Not surprisingly, the more acquisitions a company makes, the higher its rate of revenue growth—17 percent a year for those making one to two acquisitions over a five-year time frame, and 23 percent for those doing more than five deals. (See Exhibit 2.) (To get a balanced sense of the impact of acquisitions over time, we analyzed compound average revenue growth rates over rolling five-year periods from 1990 through 2014 (20 five-year windows) for 10,395 companies. This translates into approximately 208,000 data points, which consist of 37 percent M&A activity and 63 percent non-M&A activity observations.

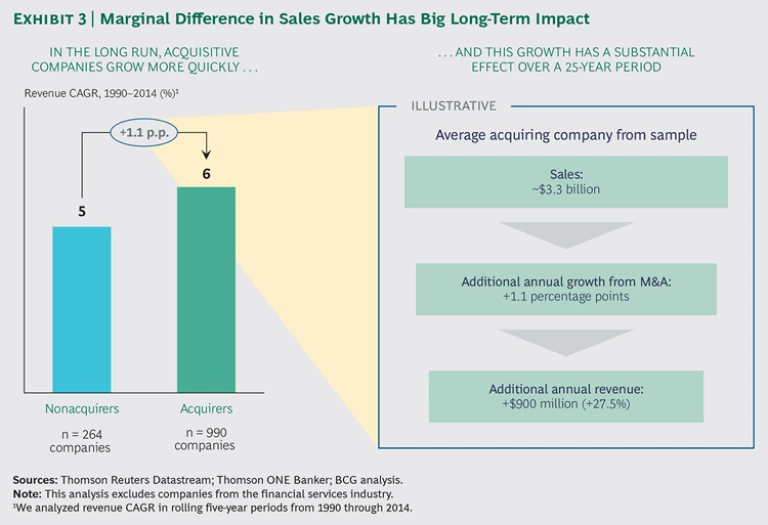

A bit less obvious: acquisitive companies also grow faster over the long term—25 years or more. Companies that made acquisitions grew a full percentage point faster each year from 1990 through 2014 (6 percent a year compared with 5 percent) than those that spent their cash fostering nonacquisitive growth through capital expenditures and other investments. The average acquisitive company in our sample generated some $900 million in additional annual revenue after 25 years (on a sales base of $3.27 billion a year). (See Exhibit 3.)

To be sure, a lot depends on the individual company, as well as its circumstances and decisions. Companies can make good or not-so-good investment decisions, just as they can make successful or unsuccessful acquisitions. But, if revenue growth is a goal, acquisitions can be a more effective way to achieve it than organic capital expenditures—especially for those companies with track records of M&A experience.

Growth for the Bottom Line

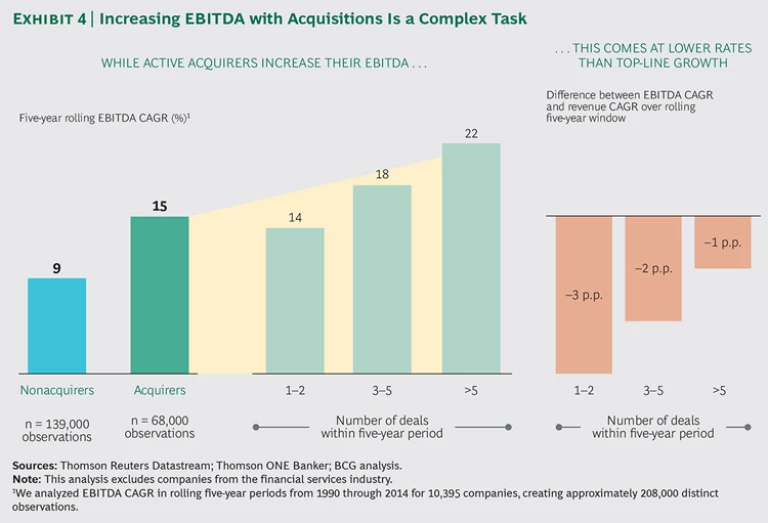

But what about the value generated by that acquired growth? Let’s look at profitability first. Acquirers buy an EBITDA stream along with revenues. But increasing EBITDA over time is a much more complex task. Big issues, such as the respective margins of buyer and target and postmerger integration (PMI), come into play.

Our analysis shows that nonacquisitive companies increased EBITDA at the same rate as they increased sales—an average of 9 percent. Acquirers increased EBITDA faster—an average of 15 percent—and, once again, the more companies they acquired, the faster the absolute earnings increased (up to 22 percent for companies that made more than five acquisitions in a five-year period). But, interestingly, the growth in EBITDA was, on average, slower than the growth in sales by 1 to 3 percentage points (again, depending on the number of acquisitions made). (See Exhibit 4.)

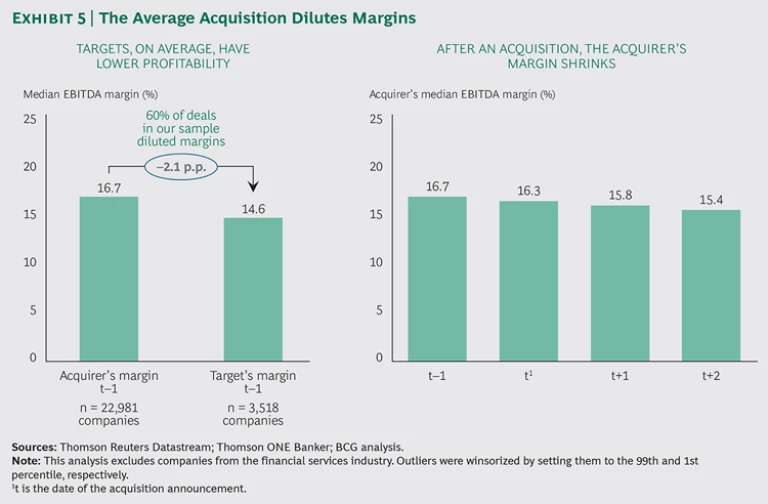

Translating organically generated top-line growth into profit is generally a straightforward matter of managing costs and productivity effectively. As we explore in the next chapter, profiting from acquisitions—even when a good (high margin) target is selected—means managing the integration of the two companies well. This is something that relatively few companies (other than the ones that acquire frequently and strategically) are good at. In 60 percent of the cases in our sample, the target’s margin was significantly lower than that of the acquirer—on average 2.1 percentage points lower, a tough deficit to make up. In addition, over the years following an acquisition, the margin of the acquirer declines, even for experienced acquirers. (See Exhibit 5.) This raises a question: Do the synergies acquirers often point to as justification for a deal actually materialize? (See Divide and Conquer: How Successful M&A Deals Split the Synergies , BCG Focus, March 2013.)

The results do show, however, that as with revenue growth, the more experienced the acquirer, the better its chances of overcoming the margin challenge. These companies are often better able to achieve profitable growth from acquisitions, in large part because of their willingness to invest large amounts of leadership time, money, and organizational focus in support of their M&A strategy—in advance of any particular deal. For these serial acquirers, each completed transaction is often the result of years, or even decades, of consistent, patient, and methodical preparation. (See “ Unlocking Acquisitive Growth: Lessons from Successful Serial Acquirers ,” BCG Perspectives, October 2014.)

M&A involves minefields and pitfalls, and the challenges companies face are not necessarily proportional to the size of the transaction. A company may well need to devote more resources and attention to a small deal in an emerging market than to a far larger transaction in its home market because cultural and market differences complicate integrating the two companies’ businesses, which is prerequisite to realizing synergies. Many acquisitions fail to realize their potential—and plenty just flat out fail—even in high-growth markets because of unsuccessful PMI, which can result not only in lost synergies but also in damaging misunderstandings between the acquiring company and the target. (See M&A in China: Getting Deals Done, Making Them Work , BCG Focus, January 2015.)

Companies can indeed acquire their way to growth. But neither growth nor value creation is assured, and achieving either one through acquisition is tough—especially for those companies that are relatively inexperienced. The companion article, “ From Acquiring Growth to Growing Value ,” explores how companies can overcome the odds.