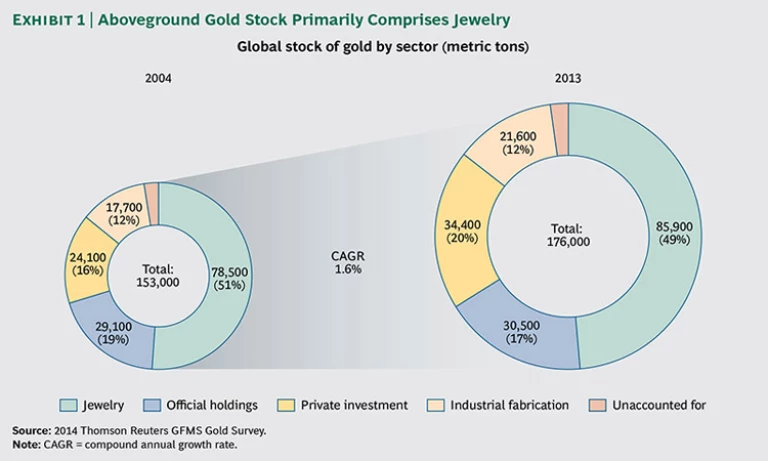

Gold has long captured humankind’s imagination. It is malleable, ductile, and corrosion resistant, and it has many uses—from jewelry to technologies such as mobile phones and spacecraft safety equipment. Since gold does not tarnish or decay, all the gold ever mined still exists in some form. The 2014 Thomson Reuters GFMS Gold Survey estimates that at the end of 2013 the aboveground stock of gold amounted to 176,000 metric tons. This stock comprises jewelry, official holdings, private investment, and industrial fabrication. A small amount is lost to the market over time and is thus unaccounted for. (See Exhibit 1.)

While the entire aboveground stock has the potential to be recycled, very little of it should be considered near-market supply. Indeed, when gold recycling hit record levels in 2009, it amounted to just 1 percent of the entire aboveground stock. Much of this stock may never come back on the market, for the following reasons:

- For many people, jewelry has sentimental value and evokes powerful emotions, making them reluctant to part with it.

- Some people’s connection with gold is religious. Much of the gold stored in Indian temples, for example, is viewed as sacred.

- Many investors view gold as an intergenerational asset, to be handed down through families rather than sold.

- Central banks view gold as an important reserve asset, and recent trends suggest they are more likely to buy than sell gold.

- Some people are not aware of the value of gold in their technological devices, and they throw out old mobile phones and computers. Much of the gold in electronics from the 1980s and 1990s is likely in landfills.

Still, thanks to its unique properties, gold lends itself to recycling—so much so that recycled gold accounted for about a third of

The gold-recycling industry comprises two segments, each constituting a unique market with its own value chain:

- High-value recycled gold accounts for roughly 90 percent of the total supply of recycled gold. Although this segment is mostly made up of jewelry, gold bars and coins often get recycled, too.

- Industrial recycled gold makes up the remaining 10 percent, up from less than 5 percent ten years ago. It consists primarily of gold found in

waste electrical and electronic equipment (WEEE)2 2 Unless otherwise stated, we use “WEEE” in this report according to the definition used in the EU WEEE Directive 2002/96/EC. 2 2 Unless otherwise stated, we use “WEEE” in this report according to the definition used in the EU WEEE Directive 2002/96/EC. .

But what exactly is gold recycling? The World Gold Council, which produced this report jointly with The Boston Consulting Group, defines recycled gold as that sold for cash by consumers or other supply-chain players, such as jewelry manufacturers that sell old stock. The definition does not include exchanges of gold for gold—when consumers exchange old jewelry for new pieces at retailers, for example. Nor does it include what the U.S. Geological Survey describes as process, or new, scrap, which is generated during manufacturing. Because of gold’s high value, manufacturers strive to recover and reuse such material; it seldom leaves the plant. (If a manufacturer does sell gold for cash and the gold is processed through a refiner, it is captured in the data for recycled gold.)

Drivers of Global Gold Recycling

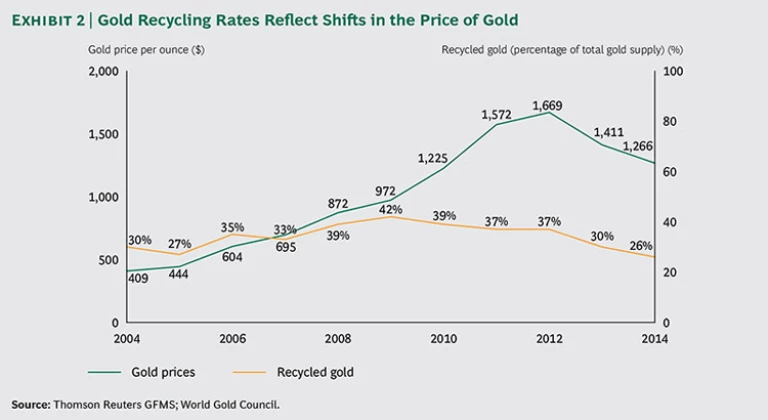

Gold recycling fluctuates fluidly with gold prices and economic conditions. (See Exhibit 2.) In 1999, it accounted for just 17 percent of the total gold supply. In 2009, with higher gold prices and the global economy faltering, recycled gold hit a record 1,728 metric tons, accounting for 42 percent of the total gold supply. When the global financial crisis struck, a new breed of recycling collectors sprang up in Western markets to collect high-value recyclable gold from cash-strapped consumers selling their jewelry. In the U.S., a swarm of cash-for-gold shops descended onto Main Street, many supported by large call centers and big-budget media campaigns. They enjoyed healthy profit margins—for a while. Indeed, in 2009, Cash4Gold.com, a mail-in refinery that snapped up gold, silver, and platinum jewelry, ran a 30-second advertisement during the Super Bowl, a lavishly expensive investment. Just three years later, it filed for bankruptcy. Its fate exemplified the sharp contraction of the cash-for-gold business. And in recent years, as gold prices fell and the global economy began recovering, gold recycling decreased: 2014 saw the lowest level of recycling since 2007—1,122 metric tons—accounting for just 26 percent of total supply.

Drivers of Global Gold Recycling

Gold recycling’s responsiveness helps keep the global gold market in balance. Mine production, which generates the lion’s share of the total annual gold supply, takes longer to respond to price changes. For example, for 126 mines that started production during the period from 2004 through 2013, the

To better understand the drivers of gold recycling, the

- The recycled-gold supply increases over time. Over the long run, it grows by 4 percent annually, in part owing to increases in jewelry consumption. According to Thomson Reuters GFMS, the stock of jewelry has grown 2 to 9 percent per year since 1982, standing at nearly 86,000 metric tons as 2013 ended.

- Economic crises boost recycling. When financial crises strike, people turn to gold as a liquid asset to raise cash. The Asian financial crisis in the late 1990s boosted recycling by 19 percent, mostly in Asian countries. The 2008-2009 global financial crisis exerted a bigger impact, increasing global recycling by 25 percent. However, the effects of a sharply higher gold price as well as the financial crisis would have been combined over this period. We believe that, in general, financial crises boost gold recycling, over and above a price effect, by about 20 percent.

- Changes in gold price have an immediate but temporary effect. Price changes account for around 75 percent of annual changes in gold recycling once we account for major economic crises. For every 1 percent increase in price in a year, the supply of recycled gold will increase 0.6 percent. If the price stabilizes at this higher level, the increase in recycling will reverse in the following year. This is probably because a price increase flushes out the near-market supply, a dynamic that does not recur the next year.

There are regional differences in gold recycling, too. For example, North America and Europe’s contribution to total recycling grew from 27 percent in 2004 to 43 percent in 2011, largely driven by the global financial crisis. Within Asia, as China’s stock of gold has grown, so too has its level of recycling. Meanwhile, India’s level of recycling has remained fairly stable and makes up a remarkably small proportion of its total stock of gold—less than 0.5 percent of the estimated annual 22,000 metric tons in India.

We also analyzed country-level data to see how economic conditions and price changes affect a nation’s share of global gold recycling. We found that measures of economic distress, especially the unemployment rate, explained 60 to 65 percent of annual changes in this share. In India, for example, a 1 percent rise in unemployment leads to a 1.3 percent increase in

Taking into account these insights and recent macroeconomic trends, we expect global recycling to remain low in 2015.

The Technology of Gold Recycling

There are two types of source materials for gold recycling, each with distinct processes.

High-Value Source Materials. High-value source materials for gold recycling contain a significant proportion of gold alloyed with one or more metals. Separating these metals from one another is relatively straightforward, and the processes available to refiners are all well-established chemical- and physical-separation procedures. Some refiners separate metals simply by heating and melting an alloy. Jewelers can do this themselves on a small scale because little specialist equipment or knowledge is required.

However, such simple procedures are not adequate for refining to the higher levels of purity often required by the industry. To achieve this purity, more complex procedures have been developed, often relying on chemical reactions. Examples include the aqua regia process, which involves dissolving the alloy in strong acids and then recovering the gold electrolytically through the Wohlwill process, enabling removal of all residual platinum-group metals and thus delivery of extremely pure gold.

Refiners’ choice of method depends on several variables. The desired purity of the output is the first and most important. Gold destined for realloying into new jewelry does not need to be refined to the 99.999 percent purity standard, so a company would select a simpler (and cheaper) process. Input quality also matters, as certain alloying metals can negatively affect some processes. (For instance, the aqua regia process cannot be used to efficiently recycle silver-rich alloys.) Finally, availability of chemicals, equipment, and expertise is critical. Some techniques are appropriate only for large-scale refiners.

Industrial Source Materials. Reclaiming metal from WEEE is considerably more complicated than from high-value sources. Gold is used in the electronics industry primarily in the form of thin wires and as a plating metal. In 2010, printed circuit boards and mobile phones

Yet these materials can contain up to 60 different elements as well as numerous complex and often dangerous chemicals. Plastics and steel tend to dominate by weight, but gold and other precious metals dominate by value. For example, in 2010, gold, palladium, and silver made up an

Some companies have developed state-of-the-art recovery operations to surmount the challenge of extracting gold and other metals from WEEE material. For example, Umicore’s plant in Hoboken, Belgium, recovers 17 metals at high yield from a range of waste streams, such as spent catalytic converters and chemical catalysts, industrial materials, and various types of manufacturing waste. The facility uses an

Not all recycling operations are run at such high standards, however. The lure of the urban mine, combined with higher precious-metal prices, has driven growth in the unregulated recovery of metals from WEEE. Chemical leaching involving cyanide and aqua regia is sometimes used without proper safeguards, particularly in the developing world. In untrained hands, this is a polluting and inefficient way to recover metals, and it offers no protection from the dangerous chemicals in these source materials.

Numerous agencies and companies are working to resolve problems associated with WEEE recycling, with an eye toward turning challenges into opportunities. WorldLoop, for example, cooperates with recycling companies to train African entrepreneurs to establish environmentally sound solutions for WEEE collection and dismantling. Thanks to these partnerships, numerous African countries now have sustainable operations. To date, these operations have collectively dismantled more than 1,000 metric tons of WEEE and have sent more than 25 metric tons of circuit boards to high-standard recycling sites.

Gold-Recycling Industry: Value Chains and Business Models

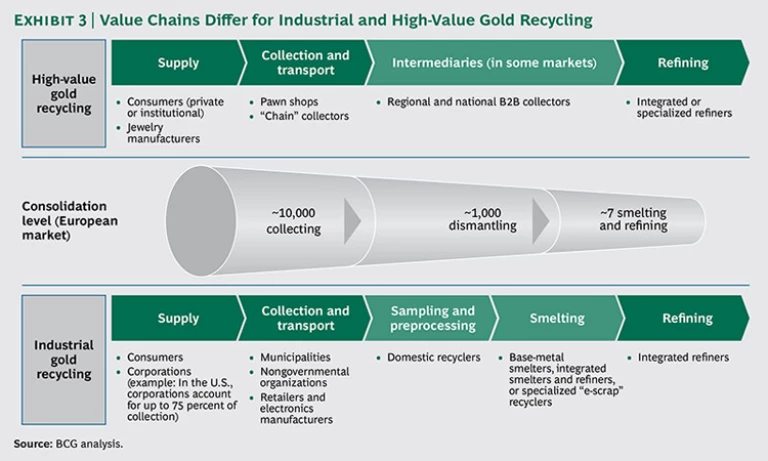

Value chains differ for industrial and high-value recycling. The value chain for industrial gold recycling, in particular, is longer, comprises more players, and is more complex than the value chain for high-value gold recycling. These differences stem from the additional process steps (disassembling, preprocessing, and smelting) and more sophisticated technology required for industrial gold recycling. (See Exhibit 3.)

Business models also differ across value chain players. Upstream, collectors operate in what’s considered a cash business. They need relatively little working capital and have low financing power and fixed costs. Their revenue streams fluctuate in line with the changing value of the metal content in what they collect. Downstream, the preprocessors, smelters, and refiners have much higher working-capital and capital-expenditure needs. Fixed costs can constitute as much as 75 percent of total costs. According to BCG analysis, a refiner’s fixed costs can comprise up to the following:

- 50 percent for energy (mostly electricity to run blast furnaces)

- 25 percent for labor

- 20 percent for financing (such as amortization)

- 5 percent for logistics and transportation

Revenue streams come mainly from handling fees for refining services and financing fees (for instance, for early delivery). However, a considerable part of downstream players’ revenues is also based on metal return, such as retention rates—when the company keeps a percentage of refined gold as payment—and operational yield, or “free metal.” (Refiners often agree to return certain metals, such as gold and copper, in agreed-upon quantities to their customers. If, during the recycling process, the refiners retrieve excess quantities of gold or other metals or by-products, the refiners can keep them. Metal return makes these companies vulnerable to gold price fluctuations.)

High-value and industrial gold recycling also differ in terms of market structure:

- Geographical Focus. The high-value gold-recycling market is generally served locally. For example, Umicore has six high-value recycling sites worldwide that serve customers in their respective regions. Other smelters and refiners focus on one key region, such as Canadian Mint and OPM in North America, Tanaka and the Perth Mint in Asia, and Rand in Africa. By contrast, the industrial recycling market is mostly served globally, with preprocessed feedstock shipped from around the world to single smelting and refining sites. The reason is that industrial recycling requires large sites and complex equipment, so recyclers consolidate their operations in one location to serve the global market.

- Operational Scale and Flexibility. High-value gold recycling requires relatively small, simple processing equipment, which allows for more flexible on-off operations. Meanwhile, the large blast furnaces required for smelting of recyclable WEEE must be operated around the clock to ensure high rates of equipment utilization. As a result, smelters have difficulty quickly adapting their operations to changes in feedstock volume and quality, making it ideal to have high-quality feedstock flowing continuously into their plants. However, smelters have an advantage if they can accept lower-quality stock to trade off lower yields and lower feedstock cost to maximize profitability. Capital expenditure is highest for base-metal smelters, followed by refiners and preprocessors.

- Market Maturity and Drivers. Industrial gold recycling is a much smaller and younger industry than high-value gold recycling and is driven primarily by legislation. The industry originated with implementation of the Electric Household Appliance Recycling Law in Japan in 2001 and the Waste Electrical and Electronic Equipment Directive in Europe in 2003. Recycling of industrial materials happened before those dates, but the legal frameworks helped “professionalize” the industry by defining collection rate requirements—which led to reliable forecasts of upcoming feedstock.

Thanks to these early laws, the European and Japanese industrial-recycling markets are more mature than the North American market. Only 28 U.S. states have introduced legislation to regulate used-electronics products, and this legislation varies in rigor. (California has the most comprehensive framework, while other states do not impose mandatory take-back standards at all.) Currently, the only smelting and refining capacity in North America is provided by Glencore in Canada. For similar reasons, the industrial recycling industries in China, India, and South America are immature. Such countries have large, informal recycling sectors characterized by backyard smelting.

Despite the above-described differences, high-value and industrial gold recycling share similarities. In both industries, relationships are built on reputation, customer loyalty, and operational excellence. A collector or preprocessor chooses its smelters and refiners based on past experience, assaying accuracy, and value-added services, such as metal management and financing, rather than price only. But even though price is not a key selection criterion, getting the pricing right to ensure margin is vital for all participants.

The Organisation for Economic Co-operation and Development’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas has influenced how refiners do business. Refiners accredited by the London Bullion Market Association (LBMA) or certified by the Responsible Jewellery Council (RJC) cannot accept a new source of gold without first going through a comprehensive certification process outlined in the refiners’

Challenges and Opportunities

A number of significant challenges in the gold-recycling industry also present a wealth of opportunities.

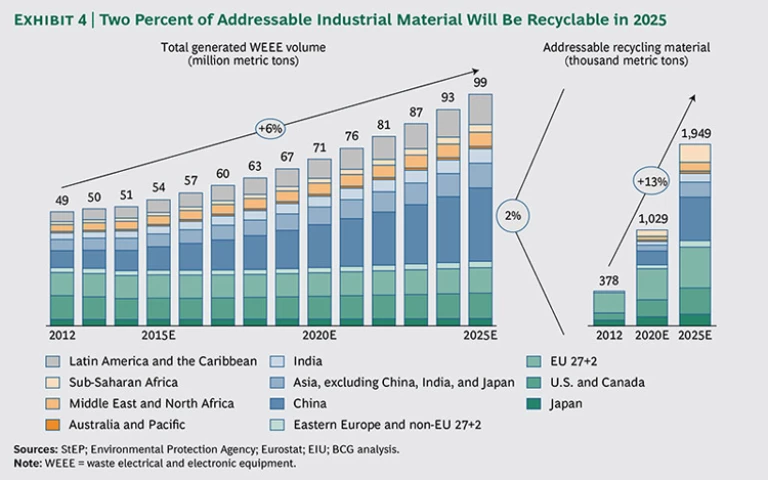

Expanding WEEE Volumes. Thanks to rising global consumer-electronics sales and ever-shorter product life cycles, the volume of industrial materials produced will expand. Mobile phone sales are expected to grow from

Although this volume seems large, the amount of industrial material that is addressable—that lends itself to gold recycling through smelting and refining—is rather small. The source materials have to be collected and then brought into the formal recycling system. Only some of these materials come from IT, telecommunications, and consumer electronics—the products most relevant to gold recycling. Many end-of-life electronics can be refurbished and reused. But with those that cannot, medium- to high-grade industrial materials—such as printed circuit boards and mobile phone components—are dismantled and processed in smelting and refining facilities. Some companies have already exploited this opportunity. In the UK,

For 2012, BCG estimates addressable industrial material volume at less than 400,000 metric tons globally. In 2025, addressable volume will make up only about 2 percent of overall industrial source materials. (See Exhibit 4.)

BCG’s industrial-materials forecast model takes into account expected recycling rates in each region, average product life, the amount of gold used in the industrial applications (the “thrift factor”), and trends such as increased repair and reuse of electronic products in the developed world. It also factors in expected recycling legislation in each country. Examples include the Responsible Electronics Recycling Act in the U.S.—which has been discussed in Congress—and required take-back schemes in Thailand. If enacted, such legislation would bolster recycling volumes in those countries. Improved enforcement of existing legislation to decrease informal waste disposal could further expand volumes. In 2011, Chinese authorities passed the Regulation on Management of the Recycling and Disposal of Waste Electrical and Electronic Equipment, which resembles the EU’s WEEE Directive. (China has also signed the Basel Convention, limiting the export of nonhazardous waste.) However, the new regulation in China has not yet been enforced. In the event that it becomes enforced, more industrial waste could find its way into the formal recycling system, contributing about 30 percent of total global WEEE by 2025.

Stiffening Competition and Overcapacity Risk. There is currently excess capacity in industrial and high-value gold recycling. New niche players are entering the industrial-recycling market, and base metal smelters seeking new revenue streams are increasing capacity to take on more industrial recycling. As a result, we expect competition to heat up in the near future, particularly in industrial-gold recycling. Some players just starting out may even be poised to disrupt the recycling industry by introducing new business models focused on low-cost recycling of high-volume, low-grade WEEE. (See “Is BlueOak Disrupting Industrial Recycling?”)

IS BLUEOAK DISRUPTING INDUSTRIAL RECYCLING?

BlueOak is a first-of-its-kind urban mining refinery. It aims to process the growing supply of industrial materials through a mini-refinery using an innovative, low-cost process. The company was founded in 2010 and is headquartered in California; its first production site is in Arkansas, where production is expected to begin in 2015 with an initial annual capacity of about 7,000 metric tons—with further expansion planned.

BlueOak’s business model has much in common with the recycling and refining operation of Nucor’s minimill model, which disrupted the steel industry. BlueOak’s model relies on plasma arc technology15 for precious metals recycling, coupling high recovery rates and operational flexibility with a low environmental impact and cost base. During refining, precious metals are hydrometallurgically extracted through leaching. The distributed, small-scale approach may enable recycling of vast volumes of low-grade materials that cannot be profitably processed at commodity price levels today.

15. Plasma arc technology works by generating an intense, controllable heat source that vaporizes WEEE components and separates them into different streams.

Yet succeeding as a newcomer is difficult. Small, new companies lack the scale and strong capital foundation to withstand drops in gold prices. Take TerraNova. Established in 2006 in France, the company set out to take advantage of new regulations requiring recycling of industrial waste. Production began in 2011, with an annual capacity target of about 30,000 metric tons, but falling precious-metal prices forced TerraNova to file for bankruptcy in 2013. The company was acquired by Metallica Commodities in 2014.

In addition to the newer entrants, some established companies—particularly base-metal smelters—have invested heavily to expand capacity for industrial-materials recycling. Aurubis, for instance, invested €62.5 million in 2011 to ramp up capacity from 75,000 metric tons to 140,000 metric tons. Boliden dedicated €200 million in capital expenditure to boost its recycling capacity from 45,000 metric tons to 120,000 metric tons per year.

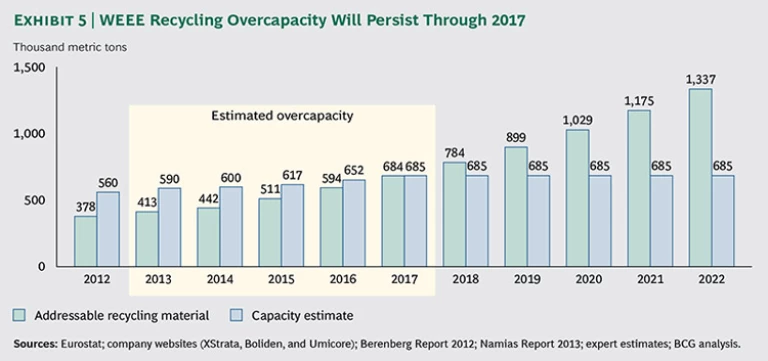

Thanks to these and other expansion moves, global capacity for WEEE recycling leaped from an estimated 337,000 metric tons in 2008 to 600,000 metric tons in 2014. Currently planned expansion projects could drive capacity to 690,000 metric tons by 2018. BCG analysis suggests a high risk of overcapacity in the next two to three years, because the supply of industrial recyclable materials is estimated at only about 442,000 metric tons in 2014—considerably lower than total capacity. Nevertheless, we expect that addressable recycling materials volume will outstrip capacity by 2018. (See Exhibit 5.)

In high-value gold recycling, BCG industry analysis suggests up to a 40 percent idle-capacity rate. Such recycling has boomed in recent years, thanks to consumers’ increased jewelry recycling. And with recent growth in bar and coin demand, refiners have profited from turning gold into investment-grade bars and coins. Until 2013, refiners had a steady stream of business producing LBMA “good delivery” bars to meet institutional investors’ demand, including from exchange-traded funds. And in 2013, as global gold-bar and -coin demand soared and gold flowed from West to East, refiners processed gold into bars and coins for consumers in India, China, and Southeast Asia. For a while, there were even bottlenecks in the value chain as refining capacity was exhausted. However, the decrease in high-value recycling and investment demand in 2014 has resulted in major underutilization of refining capacity in the current market. But as noted above, high-value recyclers have more operational flexibility to adjust to volume changes than industrial recyclers do.

Margin Pressure from Lower Precious-Metal Prices. Short-term decreases in precious-metal prices have squeezed margins along the recycling value chain, spurring consolidation among collectors and intermediaries. The price of gold dropped from peak levels of $1,920 per ounce in 2011 to about $1,200 per ounce in December 2014. Numerous upstream players (pawn shops, collectors, preprocessors, intermediaries), especially newer entrants, have struggled to stay in business.

Moreover, industrial material for recycling has become commoditized. Much of it is now categorized and standardized—making selling prices and sampling processes transparent. Consequently, purchasing prices for such material are expected to continue to rise. If they do, recyclers will have an even harder time adding value from their processes. For example, intermediaries in the U.S. make a profit of just half a cent to one cent per pound of WEEE. These margins are expected to tighten further.

Electronics: Rising Complexity and Shrinking Gold Content. Electronic products are growing ever more complex. Devices are smaller than ever, and manufacturers are increasingly substituting other metals for gold. Although gold made up 90 percent of bonding wires in 2008, it now constitutes just 50 percent. From 2004 through 2014, the gold content in printed circuit boards fell by roughly 40 percent per metric ton, according to our analysis, which is based on industry experts’ estimates. To extract the same amount of gold from electronic products as they did previously, recyclers will have to process larger volumes of WEEE.

Shifting Center of Gravity for the Supply of Recyclable Gold. The center of gravity for gold recycling will shift east as Asia’s stock of gold keeps growing. India’s and China’s gold-jewelry consumption rose from 28 percent of the global total in 2004 to 60 percent in 2014, as populations expanded and household incomes rose. In China, regulatory changes opened up the gold market. We expect India and China—and Asia more generally—to remain major centers of global gold demand.

Given these trends, local competition for gold-recycling business could heat up in Asia. The lack of (or failure to enforce) environmental regulations in the region has created a huge, informal, and very cheap recycling market. Western players with highly advanced but expensive recycling processes could find it difficult to compete in this arena. However, these regions could present opportunities for Western recyclers if stricter regulations result in a need for cleaner and more sophisticated recycling processes.

Strategies for Success. It is beyond the scope of this report to detail the best-in-class strategic approaches that will allow each industry player to address the challenges and opportunities in the gold-recycling industry. However, we have identified broad strategic considerations in three key areas:

- Building Scale Through M&A. As we noted earlier, the upstream market is a cash business driven by local conditions—including customer behavior, environmental regulations, and collection infrastructure. Thus, the economies of scale gained by M&A and global consolidation have only limited relevance for these businesses. However, for downstream players such as regional and global smelters and refiners, M&A can provide the portfolio diversification needed for companies to weather metal price fluctuations. It can also help them secure a stable supply of feedstock on a global scale as well as profit from cost synergies gained through reductions in overlapping activities and markets.

- Managing Overcapacity. Given the threat of overcapacity, companies must boost the value provided to customers while also securing their bottom lines. They can do so by maximizing efficiency and effectiveness in their operations. Smelters and refiners can learn much about this approach from the value-in-use operating models adopted by industries facing similar overcapacity challenges,

such as steel and shipping25 25 See Coping with Overcapacity: Navigating Steel’s Capacity Conundrum, BCG Focus, October 2014. 14 14 See Coping with Overcapacity: Navigating Steel’s Capacity Conundrum, BCG Focus, October 2014. . In particular, they should reconfigure their operating models to achieve maximum efficiency in energy usage, higher operational stability, faster output time, and higher operational yield—rather than trying to achieve maximum capacity utilization. This will have the desired side effect of limiting collective overcapacity in the industry. - Minimizing Reputational Risk. In gold recycling, an impeccable reputation is critical for cultivating enduring customer relationships and securing supply—especially in the current challenging market. Companies that adopt a transparent and risk-managed pricing mechanism to minimize reputational risks while getting their pricing right will have the best chance of riding out the coming ups and downs in the gold-recycling market.

Recycled gold forms a large part of the total gold supply. Although the volume of recycled gold increases over the long term, in the short run it responds quickly to changes in prices and economic shocks. In 2014, gold recycling fell to its lowest level in seven years, and we expect it to remain low throughout 2015. The World Gold Council’s econometric analysis presented in this paper provides industry participants and gold market analysts a framework for thinking about how gold recycling will evolve over time.

Meanwhile, industry players—whether in the high-value or industrial recycling segment—face a complex blend of challenges (particularly overcapacity) and opportunities. What’s more, while industrial waste volumes may be increasing (total volume could grow by 6 percent annually in the foreseeable future), addressable volume (which is relevant for the recycling industry) will likely make up only about 2 percent of overall industrial source materials for gold recycling. Given these challenges, BCG believes that companies will need to rethink their competitive strategies and operating models.

Acknowledgments

The authors would like to acknowledge the BCG team that contributed to this report, including Konrad von Szczepanski, Martin Feth, Christian Niebuhr, and Stephen Amery. They would also like to acknowledge the World Gold Council team—Johan Palmberg, Louise Street, and Krishan Gopaul—as well as Andrew Leyland (GFMS, Thomson Reuters) and Christina Meskers (Umicore). The authors would also like to thank Lauren Keller Johnson for her writing assistance, as well as Katherine Andrews, Gary Callahan, Sarah Davis, Kim Friedman, Abby Garland, and Sara Strassenreiter for their help with editing, design, and production.