Digital Initiatives: Stemming—And Turning—The Tide For Telcos

It does not take many words to explain the biggest finding of this year’s telco IT benchmarking study (TeBIT). To put it simply, digital initiatives pay off. This turn of events warrants the headline treatment—and perhaps a sigh of relief from Europe’s telecom operators.

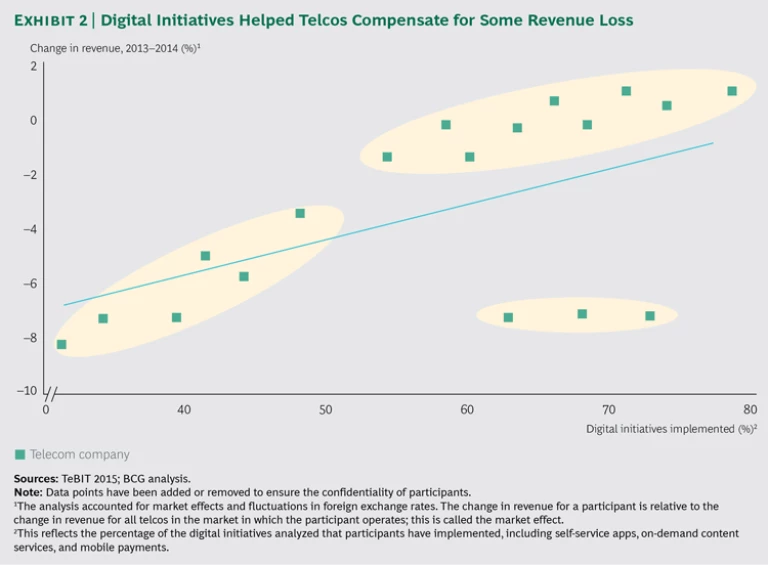

This year’s study found that of the participating telcos, those that were most active in the digital space—deploying the widest variety of initiatives—suffered the smallest revenue declines. The correlation was clear, compelling, and significant. Telcos have struggled in recent years, often unsuccessfully, to maintain their revenue level, so the validation that digital initiatives are a way to stem or even turn the tide would seem to be break-out-the-champagne news.

But a couple of findings also revealed by this year’s survey suggest that telcos should not pop the cork just yet. Many participants—representing a mix of integrated, fixed, and mobile operators from both mature and emerging markets—are pursuing digital initiatives without a comprehensive, long-term strategy. Instead, they are trying a little bit of everything. In addition, at many telcos, there are few business-transformation initiatives—or none at all—being undertaken. The lack of strategy and transformation initiatives may well be tempering the payoff. As Gian Enrico Paglia, Telecom Italia’s director of IT and convergent architecture, put it, “Digital has to be a concerted, company-wide effort, with telcos not only implementing new capabilities but also changing internal processes.”

Now is an opportune time for telcos to think bigger, and deeper, about digital initiatives, particularly given our other major finding: participants are in the beginning stages of deploying digital products and services. The bulk of telcos’ support, sales, and marketing efforts are still conducted through traditional off-line channels. In addition, most TeBIT participants are only just starting to develop capabilities in big data, an area closely related to, and dependent on, digitization; digital offerings generate data, and companies will gain actionable insights by analyzing it.

Indeed, more traditional areas—such as fulfillment and billing—continue to be the focus of telcos’ investment budgets. Emphasizing these areas has long been a sound move, because they affect the customer experience and can help operators differentiate themselves. But digital initiatives can also help companies stand out from the crowd. And by demonstrating the payoff—even through scattershot approaches—TeBIT 2015 raises the question of whether telcos should embrace digital initiatives a bit more boldly. This question doesn’t cast doubt on telcos’ current investment focus but rather asks if they should spend more than they do today on digital initiatives.

Over the years, TeBIT participants—and their IT departments in particular—have always found ways to maneuver in light of business challenges and opportunities, recalibrating their approaches to best suit their circumstances and needs. A case in point is IT operating models: as these models have become more complex, telcos have improved the way they manage the costs. TeBIT 2015 found participants better at this than ever.

Telcos are running a tighter ship even as they operate a more complicated one, and this points to their ability to adapt. Digital initiatives are a new lever that operators can apply in their ongoing quest to innovate and optimize. How telcos apply this lever will have a major effect on how far they step beyond—or fall behind—the competition.

Making It Count: Lower Budgets Raise Pressure To Spend Wisely

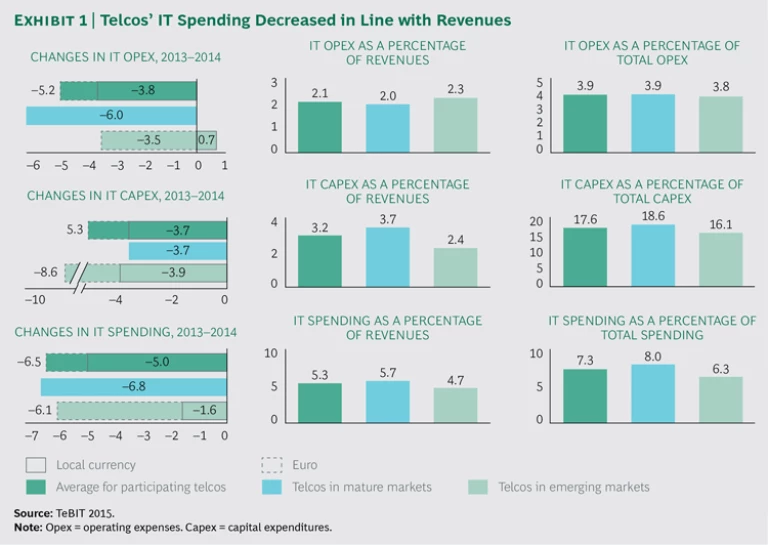

Although the news about digital initiatives was welcome, the finding of another trend was not: a decline in revenues—experienced by the majority of TeBIT participants—hampered their ability to invest. From 2013 through 2014, IT capital expenditures (capex) declined by 3.7 percent, on average, after fluctuations in exchange rates were accounted for. Telcos in mature markets saw the same drop (3.7 percent), while those in emerging markets saw IT capex fall 3.9 percent. (See Exhibit 1.) The irony, of course, is that a revenue decline is often best attacked through increased investment, because it can fund the differentiation and innovation that creates competitive advantage—and growth.

TeBIT 2013 and 2014 found telcos adopting a “spend money to make money” strategy. But the latter study also showed that with revenues down for many participants, pulling off that strategy was no simple endeavor. Overall, IT spending rose only 1 percent in 2014, and IT capex increased 3.4 percent. This year, with revenues down even more steeply, telcos had to dial back investment. (See “The Business Environment.”)

The Business Environment

A look at the markets in which TeBIT participants do business revealed that telecom companies as a group seem to have held their own in the past year. Total revenues stabilized in 2014—even inching up over 2013. Yet a look at the individual performance of TeBIT participants shows that a majority still could not keep their revenues stable, let alone grow them.

Several telcos were negatively affected by exchange rate fluctuations. But even after comparing year-over-year results in their respective local currencies, revenues for most companies declined. The average revenue per user (ARPU) dropped by 1.8 percent across all participants, with operators in mature markets suffering a significant 5.7 percent decline. Telcos in emerging markets saw, on average, an ARPU increase of 4.1 percent, but in more than one case, exchange rate volatility negated any gain.

Like last year, a decline in ARPU translated directly into a drop in revenues. This year, that revenue drop was, on average, 2.7 percent. The market breakdown for revenues followed the pattern seen for ARPU, with participants in mature markets seeing a 4.9 percent drop and those in emerging markets having a slight gain of 0.5 percent. When we looked at earnings before interest, taxes, depreciation, and amortization (EBITDA) as well as profitability, the difference between market types was more marked still. On average, participating telcos in mature markets saw EBITDA drop 9.2 percent and EBITDA margin decline 2.3 percentage points. The averages for telcos in emerging markets, meanwhile, were an increase of 10.4 percent for EBITDA and a rise of 1.9 percentage points for EBITDA margin.

But why did many participants underperform the market? The TeBIT survey revealed some clues. Most of the participating telcos are incumbents, and in Europe, as in other regions, incumbents are facing heated competition from challengers, many of them agile and less burdened by legacy IT and legacy processes. We also saw that, like last year, customer growth is coming from newer areas, such as digital products and IT services. Indeed, while the number of customers for fixed service fell by 0.8 percent across participants, and the number of customers for mobile service declined 1.0 percent, the number of users in other revenue segments (including content, value-added, and over-the-top services) rose by an average of 6.1 percent. This trend toward the nontraditional rewards flexibility and speed—traits that can help telcos develop innovative, differentiated offerings and that challengers, at least for the moment, are most likely to possess.

Yet a closer look at participants’ spending reveals a more encouraging sign. Although the average IT capex fell in absolute terms, it actually rose, if only slightly, as a percentage of revenues (from 3.0 percent in TeBIT 2014 to 3.2 percent this year) and as a percentage of total capex (from 16.2 percent in 2014 to 17.6 percent in 2015). This suggests that these telcos are trying, as much as possible under difficult circumstances, to maintain their IT investments and even, perhaps, give them some priority.

Still, there is no getting around one hard truth: lower revenues and capex make it more important than ever for telcos to place their bets wisely when they do invest. Are companies doing this? TeBIT 2015 suggests that operators are on the right track, but there may be room for improvement.

Compared with last year, TeBIT 2015 showed that investments were slightly less focused: on average, telcos steered 25 percent of their IT capex budgets to their top-three initiatives, down from 29 percent. But like last year, the highest shares of IT capex went to initiatives related to fulfillment and customer relationship management (CRM), general infrastructure, and billing and revenue management. This makes sense because investments in these areas can reduce operational costs or improve the customer experience—both of which can help telcos in a challenging market. Yet TeBIT 2015’s chief finding, that deploying a wide variety of digital initiatives has appeared to stem revenue losses, also suggests that such initiatives should get special attention. To be sure, this year’s survey found that investments in those areas are growing. But they still receive less emphasis—and less funding—than the traditional priorities.

Without shortchanging their traditional investment priorities, telcos may want to double down on digital initiatives, which not only reduce costs and improve the customer experience but also foster new products and new revenue streams. Those are no small things, given that participants are continuing to see growth not in their traditional fixed and mobile services but in other areas, such as IT, cloud, and content services. Those areas may be varied, but they share one important trait: they are largely centered around digitization.

Tapping the Potential: Realizing—But Not Maximizing—Digital Initiatives’ Payoff

TeBIT 2015 found that telcos are beginning to reap tangible benefits from digital initiatives. We saw a clear correlation between the breadth of digital initiatives a telco has implemented and the improvements in its revenues. (See Exhibit 2.) In general, the telcos that are most actively pursuing digital initiatives are performing best. But the question is this: Could they further improve performance?

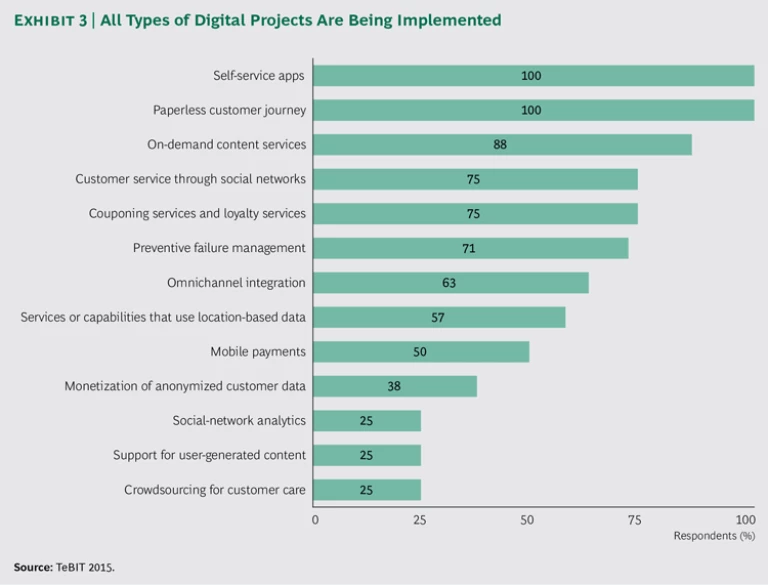

Survey responses suggest that telcos are taking more of a slapdash approach to digital initiatives, embracing all manner of them. On average, telcos are implementing more than half of the digital offerings we asked about—a list that included customer self-service apps, paperless sales and contract management, on-demand content services, customer service through social-media sites, and mobile payment capabilities. (See Exhibit 3.) Yet only slightly more than one-third of respondents said they have an overall, company-wide digital strategy in place. For the majority, investments seem to be less concerted; standalone efforts are made here and there.

Moreover, for many telcos, their investments in digital initiatives have not yet reached critical mass. Although spending levels vary widely among participants, the majority did not report significant expenditures for digital initiatives—at least not when compared with their top investment priorities, such as fulfillment and CRM. Also, what is invested in digital initiatives is being steered almost exclusively to IT—not to the business side. Together, these factors—a lack of strategy, comparatively low investment levels, and the absence of business-side digital capex—suggest that digital initiatives are often seen mainly as an IT effort, one that can be performed without business transformation.

This is a notion telcos should challenge—and, indeed, some already are. “Even if the execution is an IT responsibility, the process is more than a technical effort,” says Telecom Italia’s Paglia. “Operators need to develop new ways of working, across the enterprise, to ensure the required speed and agility.” (See “ Building a Faster, More Agile Telco: An Interview with Gian Enrico Paglia of Telecom Italia .”)

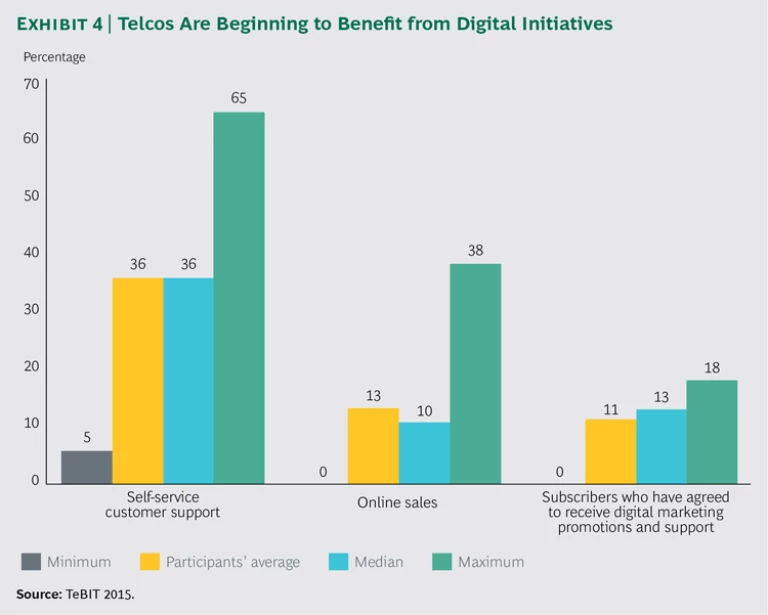

For telcos, these are still early days. Among participants, the TeBIT survey found that, on average, 36 percent of customer support is self-service, 13 percent of sales are online, and only 11 percent of customers have agreed to receive digital marketing promotions. (See Exhibit 4.) The bulk of these activities continue to take place the old-fashioned way, through traditional channels. As telcos ramp up their digital efforts—and digital’s role in their business—they may want to think not only bigger but also more strategically and more holistically, making digital initiatives a collaborative, company-wide focus. That may mean more radical changes for the business, but it may also bring more dramatic changes in revenues.

Big Data: Uncovering Business Insights

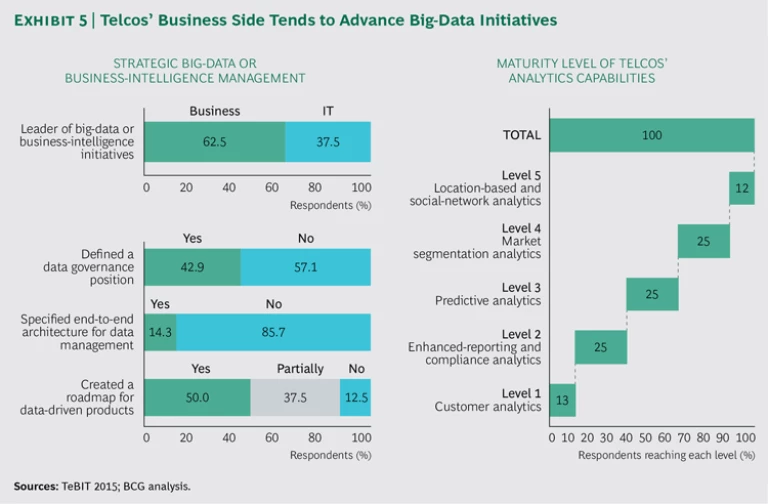

Although digital initiatives may not be seeing as much business-side involvement as perhaps they should, the story is different for another hot industry topic: big data. Indeed, TeBIT 2015 revealed that for nearly two-thirds of participants—62.5 percent—big-data initiatives are led by the business side rather than IT. The survey also showed that more than half of the participating telcos have reached at least a midlevel of maturity in their analytics capabilities. (See Exhibit 5.) The influential and apparently beneficial role the business side has played in big data may be a blueprint—and present an opportunity—for advancing digital initiatives, as well.

That big data would be a focal point for the business side makes sense. By analyzing customer transactions, behavior, and demographics, the business side can uncover valuable insights into how the company can better serve, and win, subscribers. Yet as with digital initiatives, many operators lack an overall big-data strategy: only half of the telcos that responded said they had a roadmap for data-driven products in place.

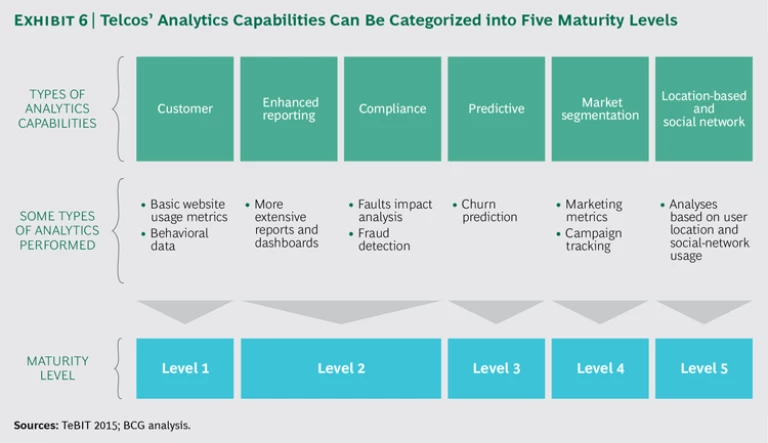

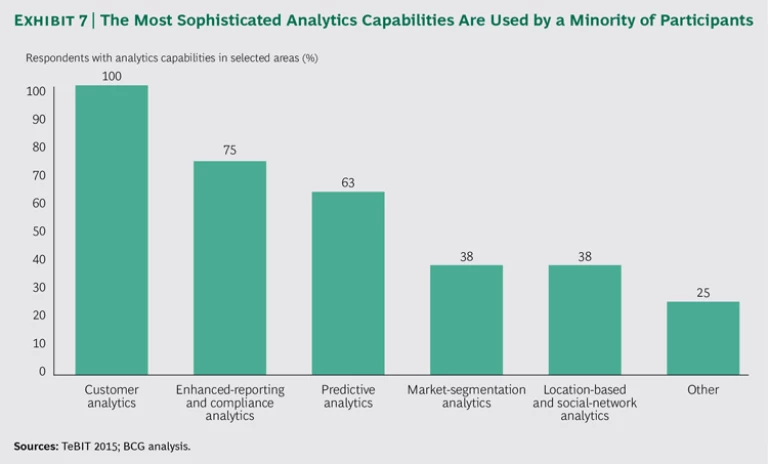

We also saw that the volume of data being managed varies widely (from 0.2 to 3.5 megabytes of data per customer), as does the sophistication of telcos’ analytics capabilities, which fell into five maturity levels. (See Exhibit 6.) The vast majority of participants have customer and enhanced-reporting analytics capabilities, while a smaller majority—63 percent—have more advanced predictive capabilities (forecasting churn, for example). Fewer still (38 percent) have achieved the most sophisticated capabilities, such as market-segmentation analytics or location-based and social-network analytics. (See Exhibit 7.)

Despite telcos’ increasing adoption of analytics, the TeBIT data did not show operators gravitating toward a particular analytics software vendor. The majority of telcos are using commercial off-the-shelf (COTS) solutions for analytics, with Google Analytics, IBM SPSS Statistics, Oracle BI, and SAS Business Intelligence and Analytics all broadly deployed. Significantly, these are all relatively traditional analytics tools, though some have been upgraded to include big-data functionality. Newer software that has been developed specifically for big data (and used with great success by many Internet start-ups) is rarely used in the telecom industry—and TeBIT 2015 found no evidence that this is changing.

Also noteworthy was the finding that the majority of telcos (57.1 percent of respondents) have not yet defined a data governance office or position with a clear mandate—and accountability—for setting and enforcing data policies (such as those that govern the creation, deletion, storage, use, and archiving of information). An even greater number of telcos (85.7 percent of respondents) has yet to create an end-to-end data-management architecture. This is a surprising and worrisome finding, as such an architecture is essential for ensuring that multiple systems can seamlessly access data and access consistent data—a single version of the truth. Without a data-management architecture, various systems are likely to be using different, and potentially conflicting, sets of data—a recipe for errors.

A Reversal of Fortune: Outsourcing—Finally—Is Linked To Lower It Spending

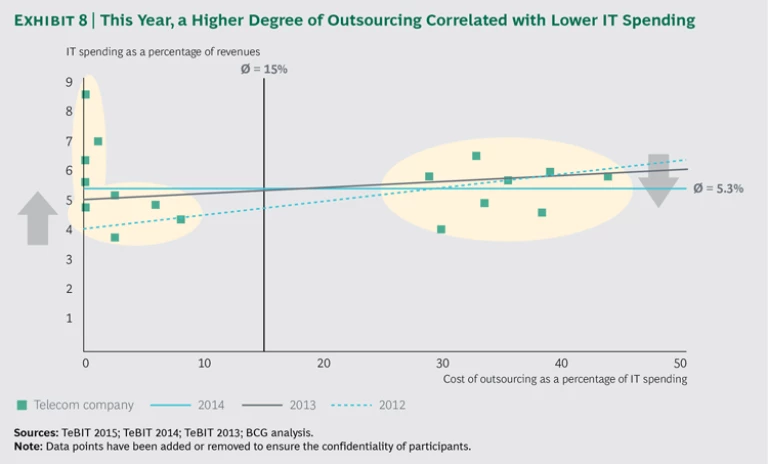

Year after year, cost reduction has been TeBIT participants’ most commonly cited reason for outsourcing. But year after year, the survey data did not show a link between the two. In fact, historically, TeBIT has found that an increase in outsourcing was linked to an increase in IT spending.

This year was different. TeBIT 2015 found that a higher degree of outsourcing correlated with lower IT spending. (See Exhibit 8.) As a means of lowering costs, outsourcing—at long last—is paying off.

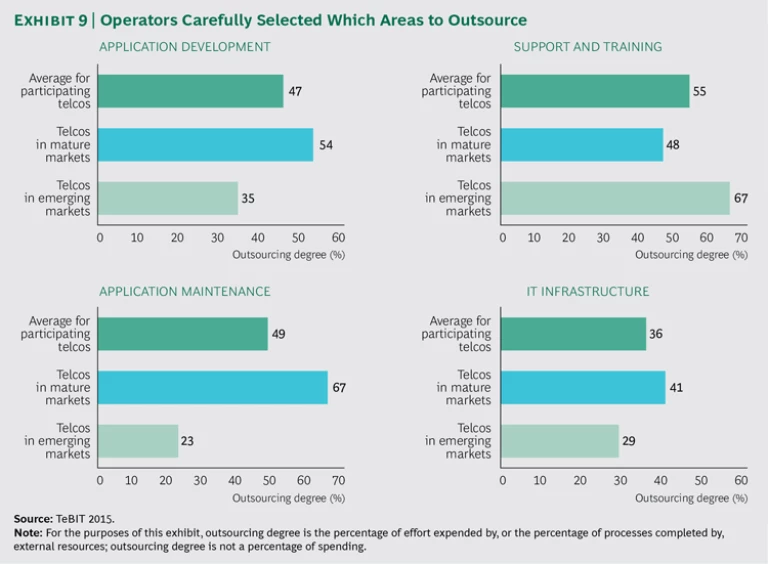

Although this change could be an exception, there is reason to believe it is a sustainable trend. The survey data supported the idea that telcos are taking a more efficient approach to outsourcing. We found that participants are being more selective about which processes are outsourced and which stay in-house. In effect, telcos are outsourcing where it can make the most difference.

We saw evidence of this—and a hint of the payoff—last year, when the historical correlation between outsourcing and costs weakened. In that survey, the data showed that the areas with the greatest degree of outsourcing—such as application development and maintenance—were areas where skills and capabilities were more likely to be found externally than in-house. Conversely, areas where telcos generally had ample internal expertise and resources—such as IT infrastructure—were areas that had lower levels of outsourcing.

This year, these trends continued. Application development and maintenance, for example, had a higher degree of outsourcing than IT infrastructure. (See Exhibit 9.) Moreover, TeBIT 2015 revealed that telcos are devoting a smaller share of their IT budgets to outsourcing than they have in the past: on average, telcos allocated only 15 percent of total spending to outsourcing, compared with 23 percent and 26 percent in TeBIT 2014 and TeBIT 2013, respectively. This lends weight to the notion that operators are continuing to use outsourcing in a more selective and more efficient manner—and as a result, outsourcing is becoming more effective. The cost payoff we are finally seeing, then, is likely here to stay.

The use of commercial off-the-shelf (COTS) software, however, continued to drive total IT spending. A likely reason is that in addition to paying licensing and maintenance fees, telcos often customize such software packages significantly to meet their unique needs. (See “ Fostering Collaboration Between IT and the Business Side: An Interview with Thorsten Albers of Hrvatski Telekom .”) Furthermore, like last year, we saw that for many process areas—such as enterprise resource planning—only two or three vendors dominate. A strong market position, combined with telcos’ reliance on their software, puts these vendors in a good position to charge premium prices and maintenance fees. Yet TeBIT participants also reported high levels of satisfaction with COTS software: only 10 percent of respondents indicated room for improvement. One hypothesis for this finding is that COTS software may cost more than telcos expect, but it also gives them a wealth of new—and much needed—functionality.

Overall, the picture TeBIT 2015 paints is an encouraging one: participants appear to be better managing their IT operating model—and in more effective ways. This progress is crucial, as digital and other initiatives that enhance revenues will require further investment, and efficiencies gained in running the business can free up funds for growing it.

IT Complexity: Growing but Well Managed

The opportunity to provide services to the digital marketplace provides telcos with the perfect incentive to replace outdated, inefficient legacy systems and processes with lean, automated ones—and ideally, as operators implement digital initiatives, that is exactly what they will do. But in the meantime, complexity in IT operating models is increasing. In many cases, digital processes are coming online in addition to existing processes. More selective outsourcing is also raising complexity, as are new computing paradigms, such as the cloud and software as a service. This additional complexity raises a crucial question: Are telcos doing a good job of managing it?

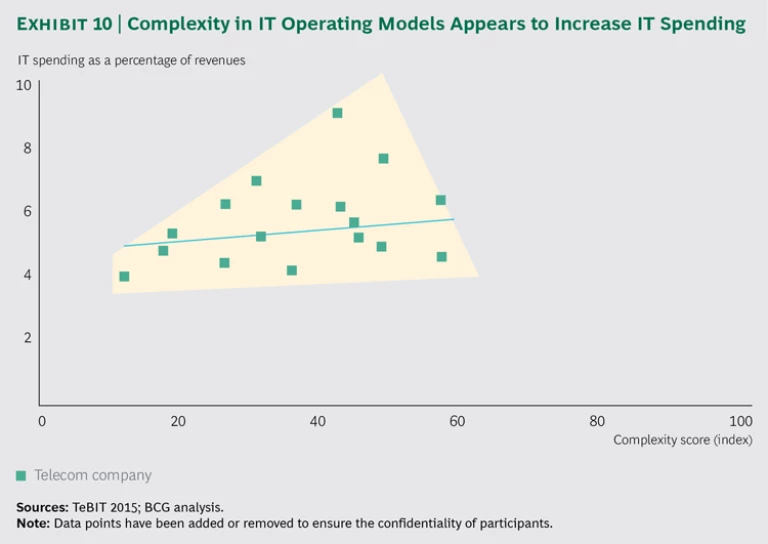

The TeBIT data suggested that they are. This year’s participants scored, on average, 36 (out of 100) on TeBIT’s complexity index, about a 6.5 percent increase over 2014’s average score of 34. Yet participants’ IT spending was the same as last year’s: 5.3 percent of revenues. This suggests that telcos are improving the way they manage complexity in their operating models—a welcome sign given that complexity, at least in the short term, is likely to rise. (See “ The Payoff of IT Transformations: An Interview with Erdal Altintas of Türk Telekom .”)

The TeBIT data also confirmed an important finding from last year, the first time the TeBIT benchmark examined in depth the relationship between complexity and costs. Overall, complexity in a company’s IT operating model seems to significantly influence IT spending. (See Exhibit 10.) But once again, when we looked at individual complexity levers, the link was more nuanced—something telcos should keep in mind as they adjust their models going forward.

For example, the higher the percentage of external professionals in a telco’s workforce, the more complicated it is to manage and the higher the level of IT spending tends to be. Overall, outsourcing was not found to push up costs. However, like last year, we found that telcos that take a mixed approach to outsourcing—that use outsourcing for about half of their processes—had the most complicated operating model to manage and tended to have higher cost levels than companies that use outsourcing either zealously or in moderation.

Similarly, COTS software, which in theory should lower complexity, seemed to increase IT spending. We first uncovered this finding last year, and the likely reasons cited then for the correlation still apply: COTS software often requires customization, which can get expensive, as can ongoing maintenance fees. COTS software, however, also provides standardized, best-practice processes that can boost efficiency on the business side. So the benefits can often outweigh the costs—as evidenced by the high satisfaction rates we found among participants.

Overall, however, this year’s story was one of costs being under control, not out of hand. The majority of telcos reduced IT’s operating expenses (opex) in line with—or even ahead of—revenue decline. On average, IT opex decreased by 3.8 percent; as a percentage of revenues, it fell from an average of 2.4 percent in 2014 to 2.1 percent this year. As in previous surveys, we saw a significant gap in IT costs (the sum of IT opex and IT capex) among participants, ranging from 3.7 to 8.6 percent of revenues. Even after TeBIT’s normalization process, which accounts for differences in size, business mix (fixed-only, mobile-only, and integrated services), and IT complexity, the gap was still wide. A possible reason for the disparity is that some telcos are still trying to reduce costs, while others have kicked off IT transformations or are investing heavily in previously postponed programs to improve the customer experience.

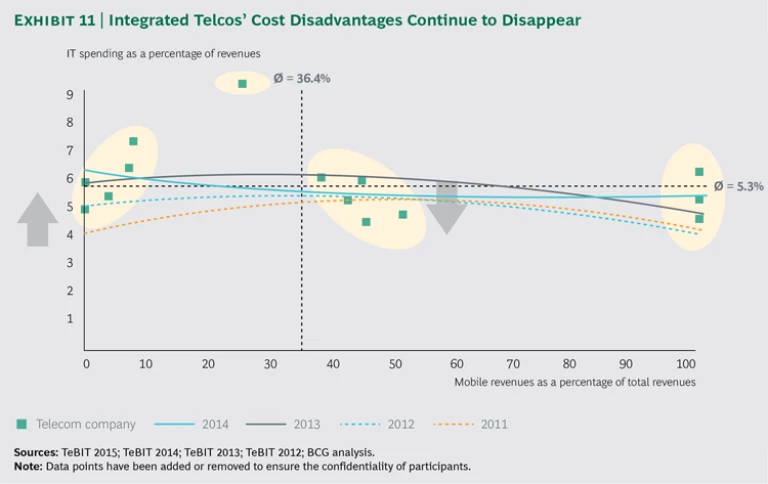

Finally, TeBIT 2015 found integrated providers continuing to reduce their cost disadvantages. In the past, these players had typically seen their IT spending account for a higher percentage of revenues than fixed- or mobile-only providers. But the gap is closing. (See Exhibit 11.) And as integrated providers continue to consolidate their fixed and mobile IT onto a single platform and replace legacy systems, this trend should continue.

Doubling Down on Digital Initiatives: A New Way Forward

Is the telecom market stabilizing or undergoing fundamental change? Although one can make a case for the former, with overall revenues holding steady for the first time in years, TeBIT participants are experiencing a new kind of competitive environment. It is one where traditional services—and traditional ways of doing business—do not bring the returns they once did.

Most participants did not see their revenues rise last year; in fact, the opposite was the norm. And as a group, participants did not see growth in their tried-and-true (or at least, previously true) fixed and mobile services but in new areas, such as digital products and services. Providers are facing more—and increasingly successful—challenges from agile competitors, many of them new to the sector.

Telcos need to understand how to make adjustments. At the top of the list should be digital initiatives. TeBIT 2015 showed that these pay off; they can help participants compensate for some declines in revenues. The survey also showed that e-sales and e-services—which by their nature help reduce manual effort—are beginning to gain traction and, in the process, are starting to reshape how telcos sell to and support their customers.

Yet this year’s survey also showed that most telcos have yet to develop an overall digital game plan, one that coordinates the digital strategy for the business side with that of IT. Creating an overall strategy—and continually tweaking it—is essential for fully realizing, and taking advantage of, the benefits that digital initiatives can bring. The good news is that a model for such a joint effort may already exist: big data. Although the full potential of big data has yet to be discovered by telecom operators, it is an area where the business side plays a crucial and influential role.

Telcos may also want to take a close look at their investments. Their current focus on initiatives that improve the customer experience is a sound one—as are their investments in the levers that reduce or manage operating costs (freeing up funds to keep those customer-experience initiatives coming). These should continue. But given the payoff of digital initiatives, investments should be stepped up there as well—and once again, with collaboration and joint prioritization between IT and the business side.

We also saw how TeBIT participants appear to be doing a better job of managing their IT operating models, even as those models become more complex. This is a welcome development, one that telcos need to continue. To that end, cost transparency is important, but so, too, are KPIs (such as the share of sales made and services provided through digital channels) that can help telcos measure progress toward greater efficiency and automation.

Indeed, telcos will want to continuously adjust their operating model, taking into account new factors—and increasingly crucial ones—such as the cloud and software as a service. In the new telecom environment, agility, flexibility, and openness to new ways of thinking and working are important. Nothing—neither IT operating models nor telcos themselves—can stand still.

Acknowledgments

The authors thank all participating telecom operators and individuals who contributed to TeBIT and to this publication, including Thorsten Albers, Erdal Altintas, and Gian Enrico Paglia. They also want to acknowledge Benjamin Mosig, Géza Nádai-Móritz, and Henri zu Knyphausen for their assistance with data validation and analysis.