By now, it’s conventional wisdom: culture can ultimately break even the most seemingly harmonious corporate match. The list of mergers that have faltered or failed because of culture clash is long. Yet despite the many high-profile cautionary tales, very few companies involved in a post-merger integration (PMI) deal with the culture question as fully and aggressively as they do with, say, capturing value from cost synergies.

To be clear, by culture we are referring to an organization’s values and characteristic set of behaviors, which collectively define how things get done in support of the organization’s purpose and strategy. Culture is what people say and do around others—and, tellingly, what they say and do when no one else is around.

There are several reasons why so many companies fail to address something so fundamental to a merger’s success. For one thing, culture can seem vague. Most people don’t know how to deal with it in an analytical, systematic, and practical way. In addition, in the midst of a merger, most executives are already stretched beyond capacity. Some deal with culture, but in a superficial way; others wait until the dust settles, not realizing that postponing action will jeopardize success. But even those who take the time to identify cultural differences are rarely able to apply their understanding in a way that leads to actions that truly change behaviors.

In our work with hundreds of PMIs, we have gained some important (and surprising) insights that have significant implications for PMI success. Cultural differences, we’ve discovered, are often not where you expect them to be. And ignoring them can put not only the integration in jeopardy, but also the performance of the organization after the integration is complete.

Tackling culture during a PMI is challenging, but we have identified four proven practices that, if taken seriously, will lead to much more successful outcomes during and long after the integration. First, companies must identify cultural differences. Doing so is a critical first step in a PMI, and ideally one that should happen well before the integration begins—even during due diligence, if possible. Second, and equally important, companies need to commit to addressing these differences at the outset, given their profound impact on everything from talent retention to sustaining value. Third, it’s essential to take a systematic approach to addressing cultural differences. Finally, companies must migrate to the target culture while preserving and harnessing desirable differences and making sure to measure success.

Identify Cultural Differences (Focusing on Behaviors)

Most executives expect some cultural differences between two merging companies. But generally they don’t know the extent of those differences and what they really mean. (See “Differences Are the Default.”)

DIFFERENCES ARE THE DEFAULT

Are marked differences between merging companies uncommon? Actually, no: BCG has uncovered material differences in 100% of the culture diagnostics we’ve conducted for merger deals.

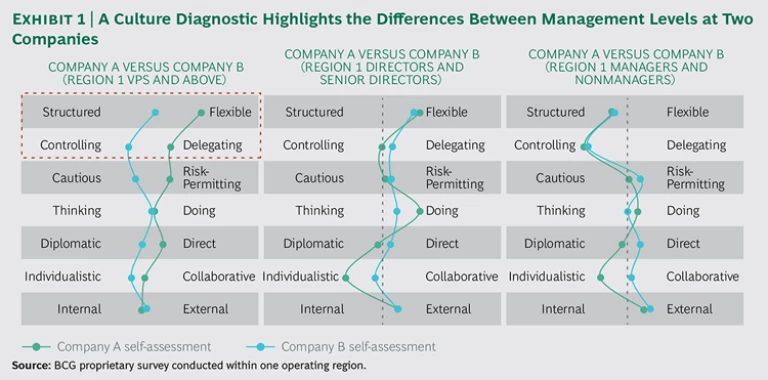

BCG’s culture diagnostic assesses behavior across seven key dimensions that we identified as crucial to a high-performance culture—one that is aligned with the company’s purpose and strategy and that ensures high employee engagement. (See the exhibit below. For more on these high-performance cultural characteristics, see High-Performance Culture: Getting It, Keeping It , BCG Focus, June 2013.) For example, the diagnostic asks, How structured or flexible are the definitions of processes and acceptable behaviors? Is power controlled at the top or delegated? Is diplomacy prized over directness? Do employees care more about their own individual performance or about collaborating? Are organizational processes and behaviors more outwardly or internally focused? The diagnostic also assesses the degree of employee engagement, another indicator of a high-performance culture—and one that is critical to a successful integration, which asks people to perform above and beyond the usual requirements.

From the more than 20 deals we examined, four major patterns emerged:

- Cultural differences are common even within the same industry. In every deal involving companies from the same industry, we found cultural differences. In half of the deals, there was a material difference in at least one key strategic dimension. One-third of the deals revealed substantive differences in at least three dimensions.

- Company trumps country. Culture is more a function of company than of country. In 80% of the deals examined, we found marked differences between a company’s divisions within the same country.

- The higher up in the ranks, the greater the differences. In most dimensions, senior managers showed differences two to three times greater than nonmanagers.

- If you’ve seen one deal, you haven’t seen them all. We looked for trends in a number of parameters—executive tenure, geography, size, organizational function—but could not find any clear patterns across the deals in our study.

To illustrate, consider the acquisition of CleanNation, a small, successful private company operating in the UK, by BrightWorld, a leading global commercial-cleaning-products company. (Both companies and their names have been disguised.) CleanNation, a leader in its regional market, sold its products primarily through franchisees, while BrightWorld sold through distributors and wholly owned retail stores. The potential synergies were abundant—from economies of scale in procurement to optimized distribution and faster growth through cross-selling. Importantly, CleanNation offered BrightWorld a stronger foothold in its market.

When BCG began working with BrightWorld, it was clear that its leaders had no illusions about the presence of cultural differences. But their congenial relationship with CleanNation’s leaders and their common passion for the industry boded well. Still, the acquiring company’s executives sought to identify differences that could potentially thwart integration.

In terms of their values, executives at the two companies were more alike than different. Both viewed their companies as family, both prized loyalty, and both focused on results. But whereas BrightWorld’s leaders valued their company’s history and deep operational expertise, CleanNation’s executives emphasized entrepreneurialism and creativity.

Where the two sides really diverged, however, was in behavior. BrightWorld was more product-oriented, while CleanNation was more customer- and consumer-oriented. In decision making, BrightWorld’s leaders delegated more but also favored deep analysis and consensus building. Employee roles and responsibilities were clearly articulated. At CleanNation, decisions were mostly made in the C-suite, quickly and intuitively. The two companies’ financial practices also differed. BrightWorld kept a tight rein on spending with a disciplined budgeting process. It used a variety of financial metrics that focused on profit and loss, return on capital, and total shareholder return. CleanNation focused more narrowly on revenue and profitability metrics.

It’s not hard to imagine how behavioral differences such as these could create stumbling blocks in the PMI.

Commit to Addressing the Differences—Now

Many executives ask, Do we really need to address these differences now, when we have so many other pressing PMI issues to deal with? The answer is yes, for three major reasons: to capture the value of the deal, to retain talent, and to avoid getting mired in “perpetual integration” mode.

Capturing the Value of the Deal. The characteristics that make a company an attractive merger target are reflected in the way people work—in how the organization gets the job done. In other words, culture is often the underlying reason for the deal. As part of the merger, an acquirer will often make numerous organizational changes to the target. But by changing how people work at the target company—and ignoring its culture—an acquirer can unwittingly destroy the target’s value. Preserving desirable elements of the acquired company’s culture requires deliberate and thoughtful effort.

A major industrial manufacturer we worked with had acquired a high-growth company in order to access its customer base and longstanding customer relationships. But the manufacturer’s extensive corporate processes and reporting requirements quickly got in the way. The target company’s CEO found that, between the added corporate processes and his integration responsibilities, he was spending 20% of his time engaging with customers, rather than the 80% he had devoted to this role in the past. When the acquirer’s leaders realized this, they appointed a deputy to execute the compliance duties, restoring most of the CEO’s customer face time.

Retaining Talent. In any merger, people from both organizations are expected to go above and beyond their “day job” requirements. And they will do so, if they are engaged (for example, if they are motivated and feel accountable) and if they are inspired by the company’s purpose. When culture clashes are left to fester, it’s easy for people to get frustrated and for engagement levels to drop. When deep differences remain unreconciled—or critical traits are neglected—talent will head for the exits.

Professionals at an entrepreneurial biotech company struggled with how they would fit in when their company was acquired by a storied 150-year-old chemical enterprise. The company tended to compete against other entrepreneurial companies for talent and embraced the typical West Coast culture—casual dress, flexible hours, and compensation with a high equity upside. Respectful of this ethos, the acquirer showed great flexibility in allowing the unit to forgo many standard practices in order to preserve its work environment. (For more on this company, see “Anatomy of a Culture Preservation Effort” in the section "Take a Systematic Approach.")

Avoiding Perpetual Integration Mode. When cultural differences are not tackled from the start—overtly and with a clear plan—employees will cling to their legacy-company identity. This forces the new entity into perpetual integration mode, unable to move ahead as a newly constituted organization. Ultimately, either the acquirer destroys the culture of the target company, or—in the case of a bona fide merger between two similarly sized entities—the two never fully combine. In times of pressure, employees revert to their former behaviors and are unable to work together effectively.

This situation arose with the merger of two telecoms. In an attempt to carry out a “merger of equals,” executives chose to play down the companies’ differences—and wound up failing to leverage their respective strengths (one in retail, the other in B2B). They retained the two companies’ headquarters and tried to staff equally from both, rather than in a way that supported the strategy of the combined company. Employees grew frustrated, talent fled, and the merger ended up a historic failure that cost both companies dearly.

Take a Systematic Approach

As complex as culture may be, aligning culture in a PMI is not only feasible but achievable within a reasonable time frame. And executives need to think proactively about this task because they will be making decisions during the merger itself that will affect culture—decisions about the structure of the organization, for example, or the choice of financial and operating metrics to be used. Through a systematic, analytical, and practical approach, you can mitigate culture clash. The merger process in effect becomes an opportunity to migrate to the target culture.

First, companies need to identify the cultures of the merging organizations. Next, they need to align on the desired culture and behaviors. Finally, they need to identify the elements of the organizational context that will reinforce that culture and those behaviors. From there, they can go on to devise a culture plan.

Identify the cultures. Step one involves conducting what we call a “cultural beliefs audit”—ideally before the close of the deal, but certainly as early as possible so the results can be acted on from the get-go. This diagnostic consists of interviewing and surveying executives and senior managers (and, in some cases, selected middle managers) from both companies to assess their characteristic behaviors and level of engagement. The results can be plotted and graphed to show how similar or different the two companies’ cultures are at different management levels. (See Exhibit 1.) The exercise provides a common language with which to discuss cultural factors that are often difficult to clearly describe.

The results of the cultural beliefs audit should be high on the agenda of the integration team’s workshops. The team must reinforce common values and behaviors, and identify and discuss any values and behaviors that differ between the two companies. Leaders should then find specific ways to resolve culture clashes up front. For example, if the acquiring company conducts more analysis before taking action than the target company, its leaders will need to establish a threshold for decision making. During the merger, when speed matters, that might mean suggesting a straightforward process whereby executives at the target company confer with their direct reports before making decisions. That way, leaders can mitigate culture clashes while still enabling the top teams to work together quickly. In the longer term, they can agree to institute a more granular process, particularly for higher-impact and riskier decisions.

When identifying cultural differences, you should not shy away from stipulating nonnegotiable items. For example, a large, established pharmaceutical company produced a 100-page sales report each month. The target company, in contrast, never bothered to document sales on a monthly basis. Clearly, detailed analytics were essential to the acquirer. But rather than impose the detailed report on its target—which would have impeded the company’s coveted agility—the acquirer instead established a new, more streamlined monthly report: ten critical, action-oriented pages.

Align on the desired culture. Once the new team is in place, leaders can quickly create cohesion by holding a series of workshops to align on the vision, strategy, and purpose of the combined entity. Translating that vision, strategy, and purpose into a set of behaviors is the way to foster the desired culture. For instance, if the new strategy calls for putting more leading-edge products on the market faster, you will need to establish a culture that promotes innovation—one that enables people to take more calculated risks and that supports the ability to execute quickly.

In the case of the pharmaceutical merger described earlier, leaders at the target company reinforced the need for speedy decision making, collaboration, and accelerated learning loops. They encouraged risk taking and “failing fast” as a means of driving growth. Similarly, two Asia-based building materials companies sought to differentiate their combined offering by providing a superior customer experience. The leadership team of the new entity identified several behaviors necessary for achieving that strategic goal, such as delegating decision-making authority to employees who directly interacted with customers and making them accountable in resolving customer issues.

Identify the elements of the organizational context that reinforce the desired behaviors—and make a plan. Banners festooned with slogans like “Better together” won’t encourage strangers to collaborate. Certainly a unifying message is necessary, as are campaigns that reinforce desired behaviors. But these are not the drivers of behavior; they merely inform and reinforce. Context is what drives culture.

Many elements make up an organization’s context: its leaders (and the behaviors they exhibit), its structure, its systems, its incentives, even the nature of the informal interactions that take place among its people. BCG has identified seven such elements, or “context levers,” that influence key aspects of behavior—and in that way, shape culture. Among them are the style and actions of a company’s leaders, organization design, people and development (how talent is promoted and what kind of people are recruited and hired), and the performance management system. So, for example, if you want to preserve the innovation-mindedness of your acquisition, you will need to consider all the aspects of its organizational context that foster the underlying behaviors—and keep the critical ones in place.

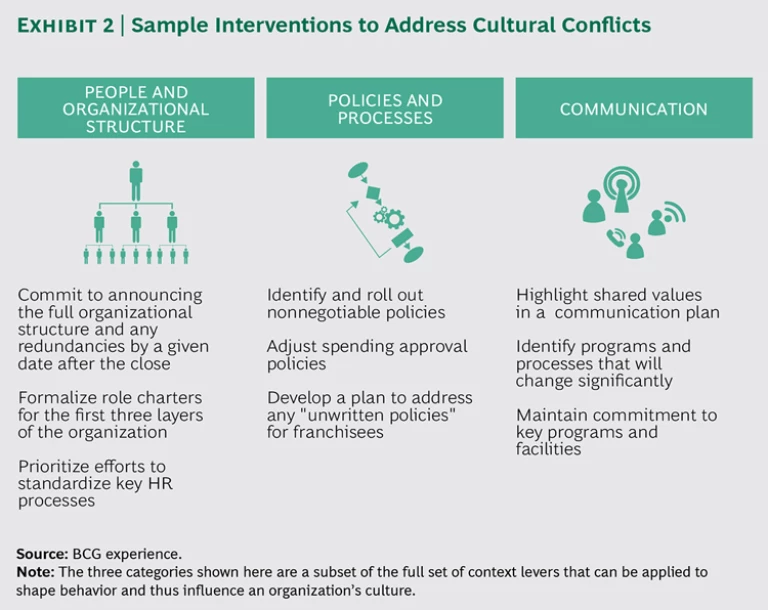

Without a fundamental understanding of how context drives behavior, it’s difficult to see how the decisions made during a merger will shape the culture of the combined entity. (That’s precisely why it’s important to consider the elements of context early on, since many will change in the course of the merger.) So to diagnose the two cultures properly—and lay the foundation for ultimate postmerger success—it’s crucial to understand more than the behaviors themselves. You must also understand which elements of the organizational context are driving those behaviors. Coming back to the example of BrightWorld and CleanNation, to mitigate the cultural differences between these two companies, BCG recommended a plan of action that focused on three broad categories: people and organizational structure, policies and processes, and communication. (See Exhibit 2.)

Regarding people and organizational structure, given the big differences in how decisions got made, it was important that the two organizations focus on clarifying roles and responsibilities, accountabilities, and strategic objectives to support consistent decision making throughout the new entity. In policies and processes, BrightWorld’s leaders drew distinctions between nonnegotiable activities (such as fulfilling public-company reporting requirements) and other processes that could be amended over time (such as instituting a full budgeting process and relaxing spending policies for senior executives). This helped minimize disruption during the early stages of integration. Finally, because CleanNation was a franchise-based business, we urged the combined entity to establish formal rules on how to manage and engage with franchisees, including creating new contracts that formalized the relationship.

(For another example of a culture change plan, see “Anatomy of a Culture Preservation Effort.”)

ANATOMY OF A CULTURE PRESERVATION EFFORT

The goal is not always to create a blended culture or to fold the target company’s culture into the acquirer’s. Sometimes, the greatest value in a merger comes from preserving the acquisition’s culture. So what’s the right way to proceed?

Consider the efforts made by a mature, US-based global industrial-goods company (referred to here as AmeriCompany) with its European acquisition (EuroCompany). EuroCompany was a much smaller, nimbler bioingredients company whose entrepreneurial strength had led to considerable success with accelerated go-to-market strategies. AmeriCompany, a process- and policy-oriented company, was risk-averse and deliberate in its decision making.

EuroCompany’s two business units were entirely independent. At its “heritage” unit, senior leaders were accustomed to autonomy, and decision making was less structured than at AmeriCompany. In fact, the unit’s leaders perceived AmeriCompany as bureaucratic (although the difference in style wasn’t nearly as deep as people believed). The heritage unit was seen as having stronger go-to-market capabilities than its new parent, but weaker operations.

EuroCompany’s “innovation” unit, headquartered in the US, applied innovative emerging technologies to serve manufacturers of traditional industrial and consumer products. Its culture was more like that of a tech company than of the typical industrial-goods company: it had a novel compensation structure, casual dress code, and many company-sponsored social activities. These features were considered essential for attracting and retaining the right kind of talent.

The culture plan had two overall objectives: understanding perceived cultural gaps and preserving EuroCompany’s culture, which was critical to the merger’s goal of driving long-term growth. To meet the first objective, AmeriCompany carried out major communications and change management initiatives. For example, it assigned a “buddy” to every senior leader at EuroCompany, who was coached on navigating the larger company. New senior leaders at AmeriCompany (those who had joined through the acquisition) spoke with leaders at EuroCompany about their experiences. AmeriCompany’s CEO and C-suite executives visited more than 30 locations on three continents during the first week (after close) to meet and talk with employees.

Shortly after the close, AmeriCompany held values-training seminars for all top executives and employees. It also held weeklong workshops for the leadership teams at both parts of the new company to align people on company objectives, strategy, team charters, and priorities for the coming year. And “gatekeepers” were put in place to prevent AmeriCompany from overwhelming EuroCompany with its numerous processes and procedures, which it knew could smother the latter’s entrepreneurial culture. The gatekeepers helped oversee the implementation of processes, policies, and training from AmeriCompany’s corporate center to EuroCompany’s units and locations.

To preserve EuroCompany’s culture, AmeriCompany took four important steps. First, it imposed on its acquisition only those processes that drove operational efficiency, while encouraging EuroCompany to maintain its own cross-functional, entrepreneurial go-to-market approach. In addition, AmeriCompany retained the senior leaders of both units in visible positions; this not only allowed them to carry on successfully, but also sent a strong signal to the workforce. Third, it relocated the innovation unit’s headquarters to Europe. Finally, the company instituted policy exceptions for this more freewheeling unit, preserving its special compensation structure and allowing it to define its own organizational structure.

Migrate—and Measure Success

Migrating to the target culture will take time, but it should start as soon as possible in the planning phase—even before the deal closes. Analyze the behavioral differences, define the cultural aspirations, and identify ways to bridge the gaps. Prioritize your actions and initiatives, creating implementation “waves” that will help the new cultural imperatives gain traction over time. Start with quick wins: a president’s award that rewards desired new behaviors, a switch in office seating to inspire a new type of collaboration—anything that can inculcate the desired behaviors from day one.

Conduct a broader culture diagnostic. Before the close, because of limited access, the culture diagnostic can often be conducted only with the senior leadership team. After the close, however, you’ll want to survey a representative sample of the whole organization to understand cultural differences at a deeper level—and amend your action plan accordingly.

Measure the success of cultural changes as closely as you measure synergies. How you measure the success of the business should also determine how you manage the success of the integration. What business objectives indicate whether the target culture has been reached? If, for instance, the focus is on innovation, you’ll need to identify metrics such as the number of ideas in the development pipeline, time to market for new products, or even conversion and success in attracting the right innovation talent from target schools. If customer centricity is an essential part of the strategy, you might want to consider metrics related to customer satisfaction and retention, or the time needed to resolve customer issues.

Cultural differences can be managed and overcome if they are properly addressed in an analytical, systematic, and practical way. And that’s a good thing, considering that culture is a key enabler—not only of the success of a merger but, ultimately, of the new organization.

Companies must first identify the differences in not just values but also behaviors. Leaders need to determine the desired culture of the combined entity and identify the elements within the organizational environment—the context—that will foster and reinforce the right behaviors to achieve their objectives. With a game plan in hand, they can migrate to the target culture in a timely, organized fashion, measuring the success of cultural changes as they would measure synergies. This will allow them to dramatically improve the odds of capturing the value of the merger, retaining talent, and preventing the new entity from being stuck in perpetual integration mode—all critical to breaking the culture barrier in postmerger integrations.

Acknowledgments

The authors would like to thank their BCG colleagues Niamh Dawson, Axel Reinard, Patrick Staudacher, Grant Freeland, Dean Tong, Mila Albertzart, and Rachel Kriete for their contributions to this report, and Jan Koch for writing assistance.