The US consumer packaged goods industry registered its strongest growth in four years in 2015, and much of the fuel was provided by small and midsize producers of healthy, protein-rich foods and beverages. In fact, our research found that companies such as Quest Nutrition, Fairlife, Bai, Vita Coco, and Sargento Foods—all of which target the market for high-protein foods and beverages and healthy, “mindful” snacks—are among the top performers in the entire industry.

The growing popularity of healthier food options does not mean that US consumers have lost their willingness to indulge. Several large, high-performing CPG companies derived most of their growth in 2015 from such product categories as confections, ice cream, and alcoholic beverages. Strong sales in convenience stores—last year’s fastest-growing retail channel—helped power these sales.

These findings are based on research by Information Resources, Inc. (IRI) and The Boston Consulting Group. For the past four years, IRI and BCG have analyzed the growth performance of more than 400 CPG companies whose annual US retail sales exceed $100 million.

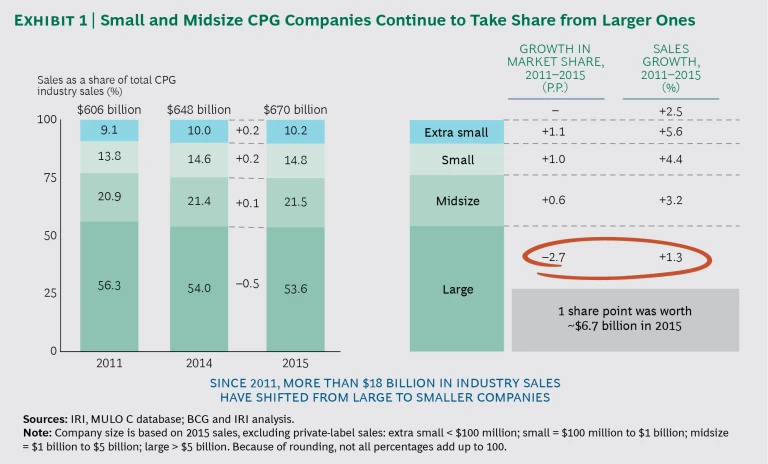

The research found that in the US, CPG sales in 2015 rose by 3.1% to $670 billion, a pace last achieved in 2012. Furthermore, companies with less than $1 billion in sales and companies with $1 billion to $5 billion in sales accounted for about 46.5% of total CPG sales, a 0.5 percentage-point gain since 2014 and 2.7 percentage-point gain since 2011. That translates into a shift of more than $18 billion in market share since 2011. (See Exhibit 1.) The growth of these small and midsize companies was driven largely by their ability to gain wider distribution for their products, according to IRI data. By contrast, the growth of most high-performance large CPG companies is driven by higher sales of their products in existing retail channels.

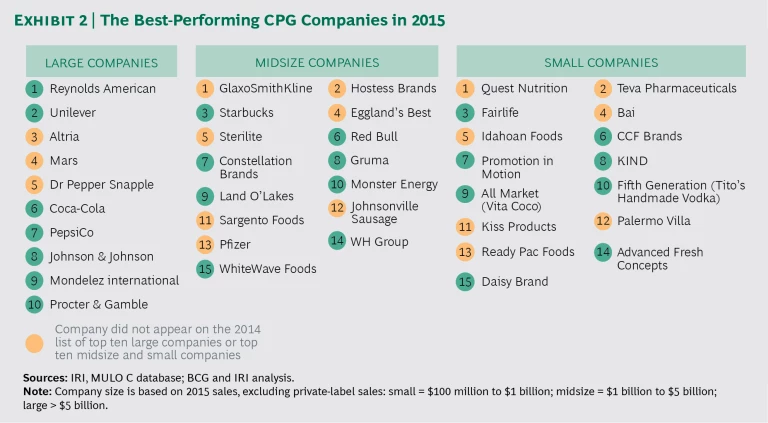

IRI and BCG generated three lists of best-performing companies: small companies ($100 million to $1 billion in IRI-measured retail sales), midsize companies ($1 billion to $5 billion), and large companies (more than $5 billion). The analysis covered both public and private CPG companies and focused on what consumers actually bought in measured channels, as opposed to what factories shipped. Companies were ranked on the basis of a combination of three metrics: dollar sales growth, volume sales growth, and market share gains. The study also analyzed the trends that are driving performance in the sector.

Among large companies, the top growth leaders are Reynolds American (which has acquired Lorillard), Unilever, Altria, Mars, and Dr Pepper Snapple Group. The leaders among midsize companies are GlaxoSmithKline, Hostess Brands, Starbucks, Eggland’s Best, and Sterilite. Topping the growth-leader list of small companies are Quest Nutrition, Teva Pharmaceuticals, Fairlife, Bai, and Idahoan Foods. (See Exhibit 2.)

These findings confirm that consumers’ desire for more healthful eating remains a powerful trend that packaged-food companies can’t ignore. The trend is particularly noticeable among companies with annual sales of less than $5 billion. Quest Nutrition, whose leading products include protein bars, protein powder, chips, and shakes, is the top-performing small company on the list. Fairlife, the third highest-performing small company, sells ultrafiltered milk, which is richer in protein than conventional milk. The brands of WhiteWave Foods, which is among the best-performing midsize companies, include Horizon organic dairy, Silk plant-based beverages, and Vega plant-based food and beverage products.

Several makers of mindful snacks, which promote health and wellness, also made best-performer lists. Bai makes low-calorie, antioxidant fruit drinks infused with the outer layer of coffee berries. Vita Coco, which made the best-performing small CPG company list for the third year, markets coconut beverages and oil. Ready Pac Foods makes a wide range of on-the-go salads, and KIND makes whole-grain bars and clusters. The growth of Sargento Foods, a top-performing midsize company, is driven by its Balanced Break brand fruit, nut, and cheese snacks.

Most of the best-performing large companies also offer health-focused foods and beverages. Still, much of their growth is driven by consumer indulgences. Strong sales growth in M&M’s chocolate, Juicy Fruit gum, and Dove chocolate and ice cream helped make Mars a leading performer in 2015, for example, while the Ben & Jerry’s and Breyers ice cream brands were major contributors to sales growth at Unilever. Soft-drink giants Dr Pepper Snapple, Coca-Cola, and PepsiCo were all among the top large-company performers, while Constellation Brands, whose growth was driven by Corona and Modelo beer, made the midsize list.

Strong sales growth in convenience stores, which was helped by lower gas prices and higher employment in 2015, contributed to solid sales of tobacco, beer, and soft drinks for such companies as Altria, PepsiCo, Red Bull, and Constellation Brands. Convenience stores registered 6.9% sales growth in 2015, compared with 3.1% for all outlets. Athough convenience stores accounted for 18.7% of all measured channel sales, they contributed 39.6% percent of retail sales growth. Manufacturers of categories of products that are top sellers in convenience stores delivered some of the strongest growth.

Several pharmaceutical manufacturers also ranked among 2015’s best performers, largely by successfully bringing prescription drugs to the over-the-counter market. For example, Pfizer and GlaxoSmithKline began marketing nonprescription Nexium and Flonase, respectively, while Teva Pharmaceuticals introduced Plan B One-Step, an over-the-counter contraception product.

Another significant finding of the research was that small CPG performance leaders are achieving strong growth primarily through wider distribution of their products. In some cases, this is because small companies are getting better placement on retail shelves or they are having their brands distributed by large CPG companies. According to BCG’s analysis, small companies are boosting sales through online retailers and promotion on social media as well. By contrast, IRI data shows that the growth of most high-performance large CPG companies is driven by higher sales of their products at existing retail channels.

Despite challenging market conditions, CPG growth opportunities remain numerous and diverse. The top performers will invest to gain a granular understanding of key consumer trends and stimulate fundamental demand by dialing into high-growth segments with tightly targeted pricing, promotion, and distribution strategies.