With over 1 billion consumers eager to buy everything from beauty products to luxury cars, China is an irresistible target for multinational corporations (MNCs) seeking growth. But in some industries, regulatory restrictions on foreign ownership make joint ventures the only viable option for producing goods locally. It’s no wonder, then, that JV activity is booming. Of all foreign direct investment in China, 19%—or $23 billion—came from JVs in 2014, and 21% of new foreign-investment ventures are JVs. According to a BCG survey, almost 80% of MNC respondents said that they plan to maintain or increase their JV activity in Asia, but only 40% plan to do so outside of Asia. The number of JVs in China reached 6,500 in 2014. (See Getting More Value from Joint Ventures , BCG Focus, December 2014.)

Despite their enthusiasm for JVs, most MNCs believe that they could get more value from these partnerships—and that they give more value than they get. One of the biggest challenges is managing a joint venture once the ink dries on the deal. A mismatch of management skills, approaches, and controls between partners can be a source of conflict and undermine a JV’s outcome. Typical problems include organizational and governance models that don’t work well, cultural differences, and difficulties collaborating.

Lessons from the Auto Industry in China

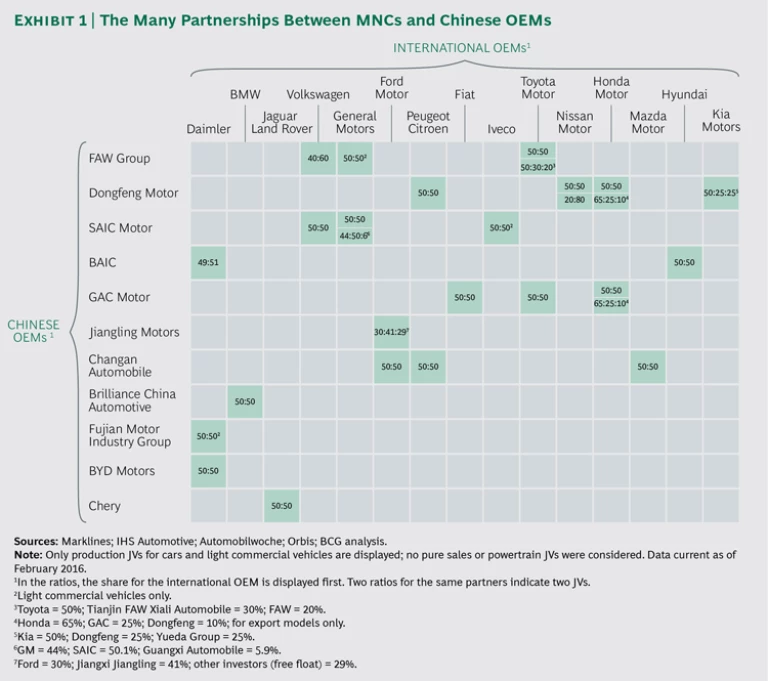

China’s auto industry is a case in point. JVs in this industry have a long history and are strategically important to the country. (See Exhibit 1.) The government’s original intent was to provide MNCs with access to its markets in exchange for technology that would strengthen local OEMs and improve their global competitiveness. But even though China’s auto market is developing rapidly, only a few local OEMs are gaining momentum beyond recent successes in the SUV segment.

The transfer of knowledge and development of JV brands is happening more slowly than expected. For instance, after Volkswagen (VW) and FAW Group set up their JV, it took 21 years to establish a local R&D center—and the JV has yet to produce a branded car. Similarly, Toyota Motor and FAW didn’t set up a local R&D center for 8 years after creating a JV, and they didn’t release their first JV-branded car, the Ranz, for 13 years. Shanghai General Motors established a local R&D center in the same year that SAIC Motor and General Motors formed their JV, but it didn’t begin producing a JV-branded car, the Baojun, for 14 years. Because of this slow progress, no local champions have yet emerged—although SAIC-GM-Wuling, Changan Automobile, and Great Wall Motor come the closest on the basis of sales and market share.

Because the local auto industry has fallen short of the government’s expectations, JV activities are in transition. The slowing growth of China’s GDP and the continuing rollout of legislation to improve the environment are expected to further increase the likelihood of coming changes. Many are predicting that the Chinese government will pressure JVs to become more independent and accountable and to increase their global reach. Others predict that JV regulations will end as JVs themselves become less important and relevant. Either way, change is likely on the horizon, and MNCs need to be aware of these developments.

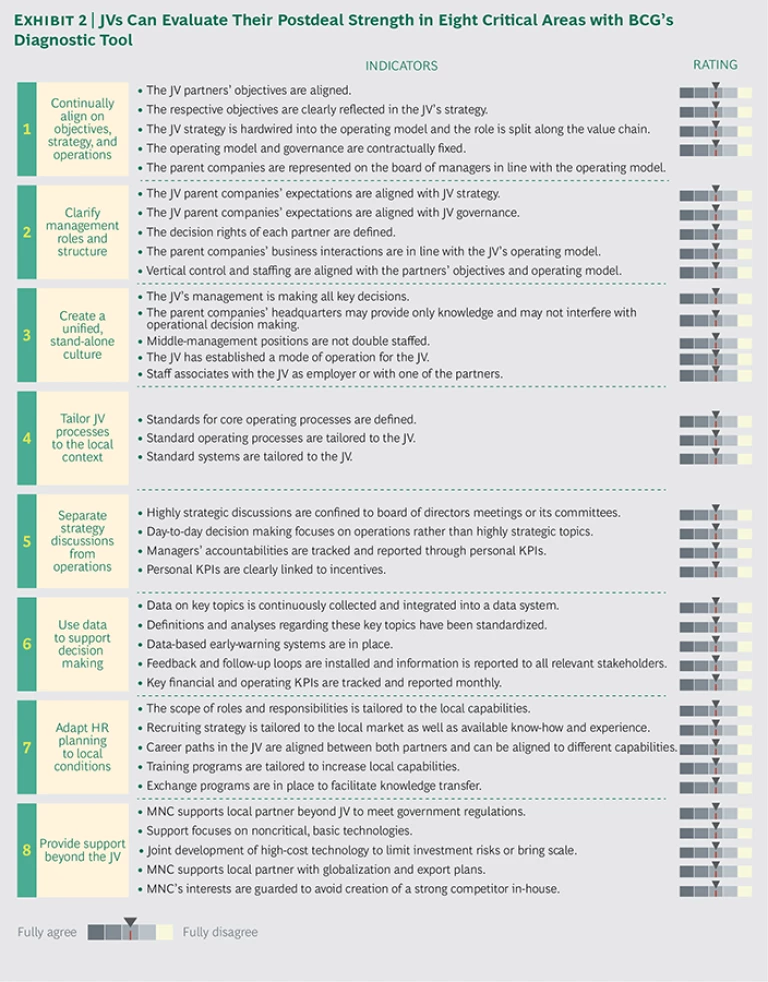

Drawing on BCG’s experience over the past decade working with 20 JVs in China’s automotive industry, we’ve identified eight critical actions for success: continually align on objectives, strategy, and operations; clarify management roles and structure; create a unified, stand-alone culture; tailor JV processes to the local context; separate strategy discussions from operations; use data to support decision making; adapt HR planning to local conditions; and provide support beyond the JV. These moves can help address the inherent management challenges and improve the value that JVs deliver across all industries—especially in light of the changing JV environment. BCG has also developed a diagnostic tool to help JVs evaluate their relative postdeal strength in each of these critical areas. (See Exhibit 2.)

Continually Align on Objectives, Strategy, and Operations

Alignment in these critical areas is an ongoing process. Before entering into a joint venture, or even discussing the possibility with a potential partner, make sure that you’ve defined a clear vision and a strategy—and then make sure that your future partner does the same. Openly share the vision and strategy with each other before setting up the JV, and mutually agree on an operating model for the venture. Then formalize the vision, strategy, and operating model by stipulating them in the JV’s contractual agreement. Once the partnership is formed and operating, be sure to check back regularly to ensure that this alignment continues as the JV matures.

For instance, one global MNC and its Chinese OEM partner made a point of openly communicating their interests up front when they formed their JV. The MNC was very clear that its objectives in China were to gain market share and profitably sell low-cost cars. The local OEM’s plan was to increase its R&D skills, production capacity, and global reach. To achieve its goals, the MNC had to build new capabilities; rethink how it develops, manufactures, and sells its vehicles; and capitalize on China’s low-cost environment. Success meant cooperating fully along the entire value chain.

When the JV started producing its first auto, 70% of the suppliers the JV used were either local or part of the OEM’s supplier base. Combined with the MNC’s procurement power, this kept costs low. Tooling was also done by Chinese suppliers. The JV developed engines through another collaborative venture owned by the partners. Because of this arrangement, the JV paid no licensing fees either for intellectual-property rights for the engines or for using the MNC’s brand. As a result of value chain savings such as these, the JV was able to sell its vehicle for about 30% less than the amount a similar car sold for in the Western market. And the MNC’s newly developed ability to manufacture low-cost vehicles gave it a competitive advantage that extended beyond China.

Besides ensuring alignment before a contract is signed, JV partners must continually revisit and refine their objectives, structure, and respective roles. One partnership between an MNC and a Chinese OEM has deliberately evolved its approach over the years. Recent changes include distributing board seats more evenly between the partners, increasing the involvement of local staff in all functions, improving governance and decision making, and sharing financial commitments more equally. These changes have reduced silo thinking, further aligned objectives between the partners, and helped move the JV toward a more shared culture.

Clarify Management Roles and Structure

Design a governance structure that leverages the key capabilities of each partner. To avoid conflicting expectations, make sure that all JV partners understand their respective roles and responsibilities—and that MNC headquarters, local JV partners, and any other third parties understand and respect these accountabilities, too.

One global automaker partnered with two Chinese OEMs and set up two JVs in different regions. In general, the MNC’s vehicles are positioned differently in each location, which helps to mitigate market risk but does lead to some competition between the Chinese partners. Nevertheless, the MNC is able to control the JVs’ strategies and manage its Chinese partners very tightly because of the strength of its brand and product reputation.

To successfully orchestrate the JVs, the MNC carved out a clear leadership role for itself and made its partners more responsible for execution. The JV management structure is set up accordingly. The board of managers is equally split between MNC and Chinese executives. At the middle-management level, an MNC executive holds the position of department head, and the deputy department head is Chinese. The operations teams are made up primarily of Chinese staff, along with select MNC experts. MNC managers head up a number of functions as well. (It is interesting to note that some Asian MNCs send five to ten times more operations people into their JVs than Western OEMs do.) Any controversial, strategy-related decisions involving the JV partners are vetted with the MNC’s headquarters in advance. This “shadow governance” arrangement works well, given the strong loyalty of the MNC’s middle managers to their parent company.

Asian companies use the term “control tower” to describe the alignment that unites headquarters, the CEO, and team leaders within a JV. All speak with one voice, all acknowledge and respect the different roles and governance structure, and expatriates are deeply embedded in JV management and execution.

Create a Unified, Stand-Alone Culture

To prevent silo thinking and an “us versus them” mind-set, build a unified JV culture and organization. Minimize the direct interference of parent companies in daily operations to avoid hurting morale and undermining employee engagement. One JV in China created a strong culture by setting up an organization, processes, and systems designed to foster a strong sense of unity. The JV takes the lead in all decisions in order to reduce silo thinking. The MNC’s headquarters contributes only know-how. By minimizing double staffing—that is, not having people from each partner hold the same job—the JV ensures cooperation. Unlike some JVs, which limit the leadership level that local staff can achieve, there is no glass ceiling in this organization. This equal opportunity improves morale and staff retention. Although the MNC initially provided the JV with processes and systems, the partners jointly established JV-specific processes and systems early on.

Tailor JV Processes to the Local Context

Define processes and systems that fit the JV’s specific operating model and local conditions, drawing on best practices from both partners. Review the processes and systems on a regular basis and adapt them to any changes in operations or the environment. The JV mentioned in the previous section imported the tool kit for HR assessment from the MNC but set up an HR assessment center managed by the Chinese partner. The tool kit’s details were modified to fit the local situation and talent pool. For training, the center uses the MNC’s concepts and tools, and decisions about who should participate in what training are made by the local team.

Similarly, another MNC forming a JV in China found that local conditions were different in several ways from those it was used to in other, more developed, markets. Because of bad road conditions, for instance, transporting new cars resulted in higher rates of damage. The transportation company that had contracted to work with the JV was unresponsive to damage claims filed by the dealers, whose profits took a hit as a result. In response, the JV adapted the claims process by centralizing it. When the dealers banded together and pooled their claims, they increased their negotiating power.

Travel expense reimbursement was another system that had to be adapted to local conditions. JV employees with relatively low income had to pay for their travel expenses in advance and then submit them for reimbursement. But few of these employees had their own credit cards, and reimbursement typically took two to three weeks. As a result, these employees were spending less time in the field, which hurt the business. To correct the problem, the JV cut reimbursement times from an average of 15 days to 5 and negotiated with local banks to provide the employees with personal credit cards.

Separate Strategy Discussions from Operations

To maintain JV focus on day-to-day operations, limit highly strategic discussions to board of directors meetings and hold managers accountable for execution by using performance metrics tied to incentives. For example, consider the approach of one JV, which holds discussions of highly strategic issues only during its annual board meeting or in separate one-on-one sessions. With this approach, managers are less distracted by strategic concerns and political issues and can focus on executing the strategy and running the business more efficiently. The JV also sets clear performance measures for each manager’s tasks, links incentives to those metrics, and defines repercussions when targets aren’t met. The performance appraisal process is strictly managed, and high performers are rewarded with exceptional career opportunities.

Use Data to Support Decision Making

Timely information is critical for tracking performance, monitoring inventory levels, making effective decisions, and flagging potential problems early. The most successful JVs have integrated systems for collecting and analyzing data across all sales levels. Earlier in the 2000s, information systems and data-sharing capabilities were hindered by technology limitations. Because the market was growing exponentially at the time, the dealers at one JV in China focused on walk-in buyers, did little to develop customer loyalty, and rarely tried to generate leads—often neglecting even to follow up on leads from headquarters. But as the market matured and a loyal base of customers became an important driver of market share, the JV realized that more professionalism was needed to ensure long-term success. This, in turn, required more data—and more data transparency—about the sales funnel.

The JV set up an integrated customer-relationship-management system that connects dealers, regional sales teams, and headquarters. Every week, the system assesses each dealer’s funnel performance on a predefined set of KPIs and provides that data to the regional sales teams and headquarters. Weekly results are also visible to dealers. This immediate feedback loop helps them see what’s working and what isn’t, so they can correct their course. In the case of underperformance in certain funnel steps or model lines, dealers are supported with targeted, centrally generated leads.

Adapt HR Planning to Local Conditions

JVs in China face a variety of problems related to finding, training, and retaining good employees. The country has a talent shortage, so the demand for skilled staff is much larger than the supply—an imbalance that will only increase over time. Even job candidates who are university graduates typically lack practical experience, skills, and the professionalism that business requires. As a result, the market for talent is very competitive, and staffers often have high expectations for salary and development opportunities. Loyalty tends to be low and attrition high. Since MNCs may have a bias for establishing expat leadership rather than promoting local talent, there may be a glass ceiling for local Chinese employees. To offset these problems, JVs must tailor training and exchange programs to increase the capabilities of local employees and to create an attractive career path for them.

The HR programs at one JV in China are designed to recruit and develop local talent and to improve their skills. Recruiting focuses on hiring junior management, and the JV builds up its talent base through a management training program. Project-based exchange programs with the MNC’s other sites build know-how in core topics. What’s more, career paths for local employees have no limits on advancement and offer the possibility of growing into a top executive position either in the JV or with a local OEM. Taken together, these factors—management training programs, a clear career path with executive potential, global exchange programs, and the absence of a glass ceiling—strengthen retention and give the automotive JV a competitive advantage over others in China.

Provide Support Beyond the JV

The Chinese government intends to strengthen local OEMs and improve their global competitiveness through JVs. To support this goal, forward-looking MNCs are helping their local partners stay independent and go global by providing intellectual property and strengthening their capabilities. Doing so pleases the government and prevents industry consolidation. At the same time, MNCs must protect their own interests and guard against creating a strong competitor in-house.

A JV that was set up to manufacture and sell Chinese- and European-made vehicles in China also created two other entities: a joint R&D center dedicated to developing products and technologies for developing markets, and a new JV to drive auto sales in Southeast Asia and possibly other emerging markets, including Russia.

Another leading Western automaker is making sure that its JV partner can compete in markets around the world and that it is positioned for the future. Building on China’s low-cost advantage, the JV plans to develop a best-value, competitive brand for the global market. The JV is being positioned as the operations center to support management, R&D, manufacturing, supply chain, and marketing for the JV’s worldwide business. In the future, the JV plans to set up companies in Russia, South Asia, and Central and South America as regional manufacturing and distribution centers. The JV’s branded products can be distributed through the MNC’s overseas sales network.

Automotive joint ventures in China have delivered benefits both to MNCs and to their local partners, providing market access in exchange for technical expertise and an overall strengthening of the country’s automotive industry. But many MNCs are dissatisfied by the value that the JVs deliver—in large part because of management challenges and the conflicts that can arise from mismatched expectations, capabilities, and cultures. The eight critical actions for success that we have identified are drawn from China’s automotive JVs, but they are applicable to any industry. They can help MNCs overcome the challenges and dramatically increase the value they get from these strategically important partnerships—especially given China’s changing JV environment.