It may not be widely recognized as such just yet, but digital technology is probably one of the best things to happen to luxury brands in a long time.

Digital is happening fast and forcefully, whether brands are ready for it or not. It enables new products and services. It opens up opportunities to create personalized offers and provide bespoke services to many more customers. Its distribution channels widen the playing field for luxury brands, allowing them to reach consumers not reached before and to engage with customers online in markets where a brand has no stores. In the US alone, consumers anticipate spending 20% to 35% of their total outlays online in the next few years, according to research by The Boston Consulting Group. (See How Millennials Are Changing the Face of Marketing Forever , BCG Focus, January 2014.)

But not all brands are there yet. In fact, luxury lags other consumer sectors when it comes to understanding and applying digital technologies. Disney, Nike, Nordstrom—these are just a handful of the household names that have mastered digital. For more than a few luxury brands, then, the issue really is do or die: the speed of technology development is endangering their current business models faster than you can say “celebrity-chef-catered safari.”

The Hard Reality of Digital Everything

Luxury brands are up against tough growth challenges. In the previous decade, their growth was all about consumer spending and new store openings in emerging markets—notably in China. But today China has more luxury stores than its consumers have demand, and consumer spending has cooled. Nor are consumers in any other nation about to make up the shortfall in growth rates.

The upshot: luxury brands must find new sources of growth—particularly in consumer groups that they typically have not reached before. Digital can make a transformative difference in their ability to reach and retain such customers. Luxury goods and services are now sought, sampled, and purchased in very different ways than they were in the past; consumers expect efficient e-commerce, engaging and exciting interactions on social media, and multiple channels through which to interact with brands.

But for many luxury firms, digital is a hard new reality. They cannot control what, when, and how vociferously consumers talk about their brands on social media. They can do nothing about the ubiquity of information or the instantaneous price comparisons it enables. They have to confront the new tension between their traditional world of exclusivity and the web world of access for everyone.

Moreover, brands cannot delay the move toward more virtualized interactions with consumers; although consumers will still want to interact physically with luxury products, they see virtual experiences as a path to more immediate gratification. So brands should likewise value digital technologies as a way to extend and individualize their services far beyond the store.

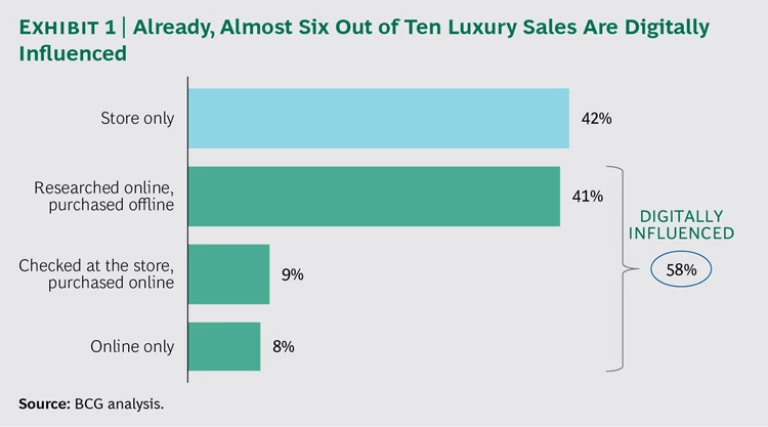

The fact is, digital is an inevitable, inescapable business shift. New research from BCG indicates that already today, almost six out of ten luxury sales are digitally influenced. (See Exhibit 1.) The research (a survey of approximately 10,000 consumers in ten countries plus interviews with industry leaders) also found that online commerce, which now accounts for 7% of the global personal-luxury market, will grow further to make up 12% of that market by 2020.

Furthermore, digital is changing the very shape and composition of the luxury sector. It has already birthed new products, novel business models, and new channels. The Apple Watch Hermès is a good example of new partnerships brought about by digital. Birchbox, whose subscribers receive a box of selected beauty products each month, helped pioneer a new business model in luxury. And Net-a-Porter, in creating a global online luxury retailer and fashion magazine, illustrates how digital is reshaping distribution channels.

Consumers’ expectations are rapidly being raised by moves like these—and by a host of innovative digital initiatives coming from the wider world of consumer goods and retail brands with which consumers interact every day. Near-instant feedback, the ability to order quickly and easily online, the push for faster and faster delivery—these are just some of the factors that affect consumers’ purchase decisions today.

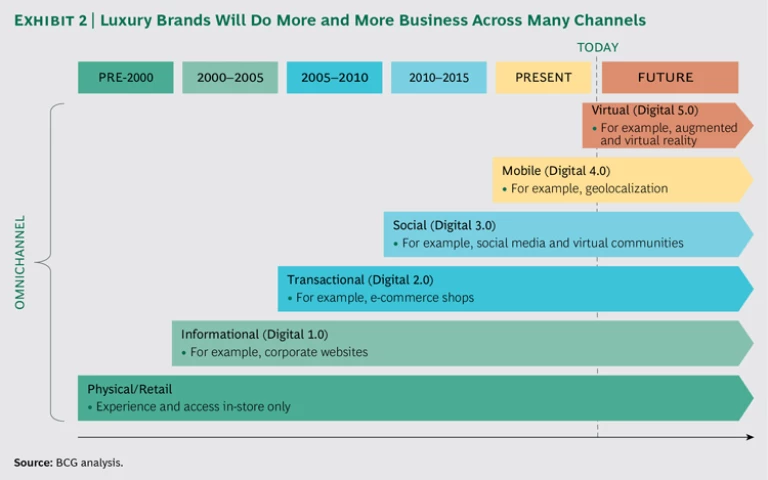

Luxury consumers have especially high expectations, and brands that fail to keep up with what consumers want now will quickly lose competitive advantage. Their leaders must understand how digital is changing their markets. Gone are the days when luxury revolved around traditional marketing and face-to-face interactions exclusively at the store. (See Exhibit 2.) Not only does the business of luxury now include e-commerce and social media, but it requires brands’ executive teams to ensure much more integration across a brand’s once-separate departments.

Not the Consumers (or Channels) You Thought You Knew

For evidence of how urgently luxury brands need to shift in the digital direction, look no further than the demographics. Millennials (loosely defined as those in their middle twenties to early thirties) are quickly becoming a huge group of consumers—more than 2.3 billion strong, making up about 32% of the world’s population. And since millennials and other young consumers will be tomorrow’s buyers of luxury goods, it’s important to track their attitudes and behaviors.

It’s no surprise that these consumers have markedly different values than their parents and grandparents. BCG’s study shows that they place a much higher premium on experiences than on things—the upscale safari rather than the watch or the car—reinforcing the idea that brands must think beyond products. Younger consumers also stand apart in how much the web is part of their shopping behavior and how much they share their opinions online: 60% rate products on the web, 60% upload content about products and services, 45% check prices via mobile (even while in the store), and 43% look for promotions online (likewise while in the store).

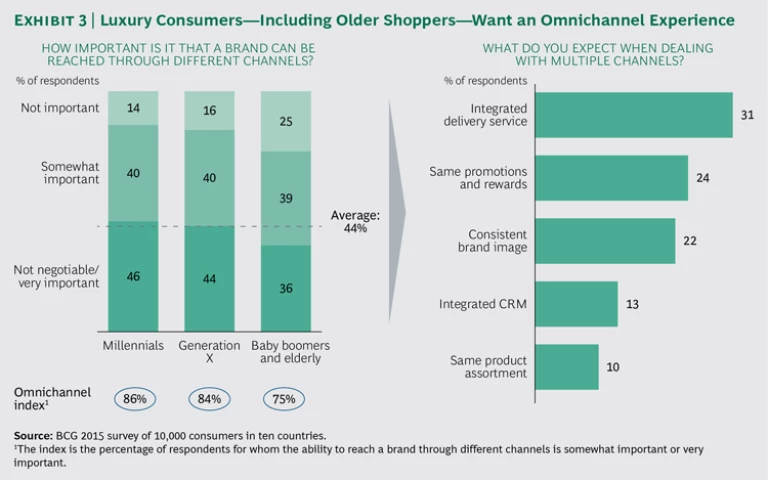

But younger consumers are by no means the only ones pulling luxury brands toward digital. Fully 75% of baby boomers and older people who buy luxury brands say they are ready for omnichannel interactions, compared with 86% of millennials. In some markets—notably Japan and Russia—BCG found that older generations are the heaviest online shoppers for luxury goods and services. In fact, digitization now affects all consumer segments. Overall, more than 40% of consumers expect to be able to have two-way interactions with brands—at the very least, sharing feedback and opinions and, when necessary, speaking with online service reps and getting instant replies to their questions. The consequence for brands: they can no longer rely on “push” marketing alone.

Our study also showed big geographic variations in the digital “maturity” of luxury consumers. The US and UK are the furthest along: at least two-thirds of luxury shoppers in these two countries bought their last product online, researched it online and purchased it in a store, or viewed it in a store and then bought it (or a similar model) online. Interestingly, Italy and France, the two nations most closely associated with luxury fashion, still strongly emphasize the in-store experience. In France, for instance, only 31% of the shoppers surveyed said that they researched their last luxury purchase online and bought it in a store, compared with 47% who did so in the US and Brazil and 46% who did so in Japan.

At the same time, consumers are ready for omnichannel interactions with luxury brands; our research indicates that fully 80% of consumers actively expect this. (See Exhibit 3.) Omnichannel does not just mean the option of shopping online rather than in stores, even though e-commerce is indeed surging in most luxury sectors in many countries. Rather, it means a customer experience that is seamlessly integrated across all touch points. Shoppers want integrated delivery service (31% of those surveyed), the same promotions and rewards regardless of channel (24%), and a consistent brand image (22%), among other factors.

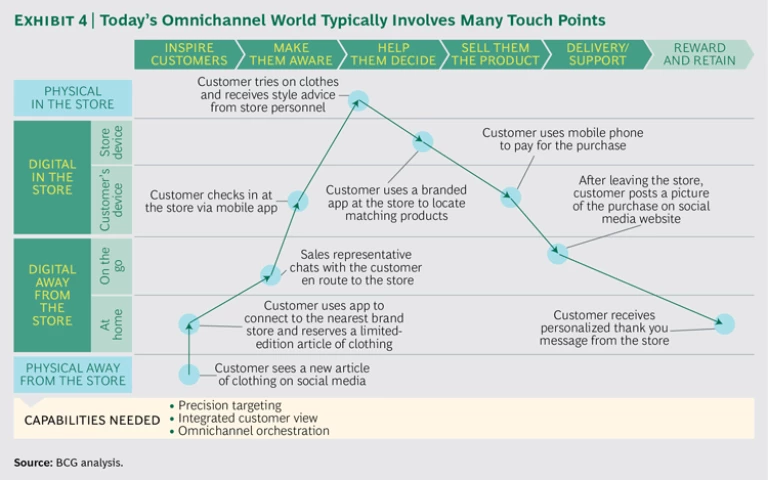

In most cases, the omnichannel world that luxury brands now confront means many more touch points between brand and customer, making the path to purchase more variable and individualized. (See Exhibit 4.) Channel switching is common among many segments of the luxury-buying population. Millennials are not the only ones comparison shopping in the store, capturing QR codes, and sending photos to friends to solicit their opinions.

Moreover, every touch point contributes to—or detracts from—the customer’s overall perception of the product or service being offered. If a luxury product shows up in oddly irrelevant digital channels, or if additional information about the product is difficult or awkward to obtain online, those experiences will diminish the desirability of the product itself.

Of course, putting the spotlight on omnichannel does not mean ignoring websites. As the importance of brands’ sites declines (only 29% of consumers surveyed in 2015 who shopped online purchased from a brand website, compared with 38% in 2014) and that of online marketplaces and department stores grows (up 5 and 3 percentage points respectively, over the same 12 months), it is imperative that brands find new ways to improve their websites, using them to make the brand more engaging (with continually updated content, for instance) and ensuring that their customers have equally good experiences on the websites of the brand’s partners.

The Urgency of Reaching New Consumers

More and more leading luxury brands are recognizing the urgency of the digital push. They are beginning to see that digital activism is essential if they are to appeal to tomorrow’s luxury consumers. While it is true that, overall, the industry’s embrace of digital lags that of other consumer sectors, some brands are mastering mobile and social media, continually experimenting, learning from those experiments, and putting the best lessons into practice.

Few brands have pushed as far and as fast as Burberry, which a decade ago shifted its entire business strategy to digital. Burberry makes full use of technology to ensure a rich experience both online and at the store. It is a master of social media marketing and storytelling, as proven by more than 42 million followers across 20 global platforms. Recent partnerships with Snapchat, Google, DreamWorks Animation, Instagram, and Apple TV have allowed the company to interact with its audience globally.

Burberry was one of the first players to turn runway shows into digital happenings. The company uses the buzz around the events to animate its customer base, interact with and strengthen relationships with customers, and woo new ones.

Burberry is not alone in its digital drive. Saks Fifth Avenue has its successful #SaksAtTheShows campaign, which streams live videos on the retailer’s site and uses artful watercolor illustrations to convey its signature style. And Louis Vuitton has been winning plaudits for its digital customer experience and for engaging with consumers through its City Guides travel app.

The Need for a Digital Mindset

So what must the leaders of luxury brands do differently now? First, they have to accept that managing the customer’s total experience of the brand is what counts today. They must then understand the impact that digital already has, and will have increasingly, on their businesses. There are eight areas in which they need to act on that understanding, shifting from a mindset that sees digital as threat to one that sees it as an opportunity.

Strategy. The leadership team must gain a thorough understanding of how digital technologies affect and drive the company’s business model. Designing a digital strategy—or, more accurately, redesigning the business strategy with digital in mind—means moving from a mindset of control to one of agility. Leaders must take a flexible approach to strategy that allows the company to react nimbly to customers’ fast-changing needs. As noted earlier, Burberry has done this and excelled.

Consumer Insight. Executives must understand how their companies can leverage big data to better know their customers, apply the insights gained across the entire value chain, and create personalized customer experiences. They can build the necessary capabilities using big data analytics tools such as Infegy Atlas and Brandwatch—software designed to reveal how people truly feel about topics being discussed on social media.

This approach shifts the emphasis to discovering patterns and deriving insights from numerous potentially unrelated data sets. For example, social media listening makes it possible to understand, on a worldwide scale, consumers’ attitudes toward a brand and its products and to identify, within seconds and in real time, key purchasing factors or customer pain points. A company that masters social media listening can then initiate countermeasures, in the case of service failures, and identify opportunities to delight customers—for example, by accommodating a valued customer who has a sudden service request.

Products and Services. Brands’ management teams must understand how digital products and services could enhance the company’s value proposition and the customer’s experience.

Disney has mastered digital to enhance its offerings in real time. The company equips visitors to its theme parks and hotels, and travelers on its cruises, with the MagicBand, a wristband that enables a range of personalized experiences: for example, greeting the wearer by name, opening the guest’s hotel room door, and having the visitor’s lunch order waiting at the table. The MagicBand shows how Disney has thought through the multiple interactions that make up the entire customer experience at its attractions.

In the luxury world, the partnership between Hermès and Apple is a nice example of a luxury brand thinking beyond its industry and harnessing the power of a broader business ecosystem to create additional value. This requires brands to retain traditional “high touch” customer interactions while enhancing and scaling them with technology. Partnering with a technology player could be an interesting way for traditional luxury brands to add a digital element to their product and service offerings without building deep technology expertise in-house. For technology companies, such partnerships can be a great opportunity to enhance their products with the aura of a luxury brand.

Marketing and Branding. The marketing chief must have the job of leveraging new technologies to build the brand online and enhance traditional campaigns with more precise targeting. This entails a shift from simply targeting consumer segments to creating offers for individual customers—on the basis of data from the CRM system, for example. A detailed understanding of customer values, preferences, and behaviors, drawn from purchasing patterns and other interactions with the brand, makes it possible to better anticipate customer needs and initiate personalized conversations. This means more than the straightforward selling of products; it involves building emotional connections with customers based on shared interests and broader opportunities for interaction. It could mean, for example, an exclusive invitation to a “money can’t buy” event or a personal note from the brand’s relationship manager offering helpful advice on how to service the product or enjoy it in new ways while on vacation.

Distribution Channels. Can the management team orchestrate seamless customer experiences across channels? Does every employee know what it takes to deliver those experiences consistently and repeatedly? What will it take for customers to experience comparably high levels of service at every touch point? A basic proof point is whether customers can easily exchange at a physical store a product bought online. If that simple benchmark cannot be met reliably, the management team must find ways to ensure tight collaboration across disparate business functions, from product development to customer service.

Sephora has mastered omnichannel with an array of online and mobile products that create a rich, engaging customer experience. For example, there is My Beauty Bag, a digital shopping list that augments the shopper’s online and in-store purchase history with a product wish list. And the Sephora app enables augmented reality via in-store displays and with Pocket Contour and Sephora Virtual Artist.

Ecosystems and Partnerships. The leaders of luxury brands must think in terms of ecosystems and ask which companies would make the best partners. It is crucial to have a clear partnering strategy and to actively manage relationships with a broad set of online players, such as Google, Facebook, and Instagram. One example that luxury brands can learn from is the digital ecosystem created by Nike—personalized products and mailings and

Organization and Capabilities. The wrong way to go digital is to set up separate digital units that work in isolation. The right way is to weave digital thinking and actions into the structure and processes of the whole company. The key is to support digitization and experimentation by shifting the organization’s mindset from knowing to learning—for example, by combining a top-down design approach with a customer-centric test-and-learn delivery model; by aligning staff incentives with, say, online purchases; or by ensuring the right mix of creative top-down decision making and customer-focused execution.

Digital capabilities represent the “how” part of the equation: building the skills base, institutional knowledge, and business processes so that digital becomes part of “the way we do things.” That, in turn, means determining which capabilities must be acquired externally and how digital talent can be continuously identified, trained, managed, and retained.

Operations and Infrastructure. The CEO must ensure that the company has the capabilities to scale up quickly when a digital experiment strikes oil. It’s the CEO’s job to push for constructive answers to questions like these: Do we collect and use accurate and actionable data that can deliver consumer insights in real time? Do we have all the necessary data and IT infrastructure to manage our supply chain and inventory in real time? Are we using predictive modeling to guide our business decisions in real time? What level of automation is right for us today—and five years from now? Do we have data security standards that consumers can trust?

Nordstrom was a pioneer in rethinking its operations and infrastructure, systematically transforming its back-end activities to enable digital ways of doing business. At the same time,

Luxury brands will be successful only by keeping the customer front and center. With that as a prerequisite, brands must press forward, urgently, with digital initiatives. They can no longer look to emerging markets for dependable growth. Digital tools, skills, and mindset are the oxygen that will enable them to anticipate and respond rapidly to the expectations of tomorrow’s consumers.

There are many digital moves that brands can make quickly and at low cost. But they must realize that a complete embrace of digital requires nothing less than a companywide transformation effort encompassing all business areas and all employees. That level of commitment calls for careful, top-down orchestration across the entire business to ensure one brand voice no matter how, when, and where the customer interacts with the brand.

The choice is clear. To embrace digital fully and strategically is to set a course for renewed growth and more predictable prosperity. To ignore it is to signal to stakeholders that they should put their faith—and funding—elsewhere.

Acknowledgments

The authors thank Nicolas de Bellefonds, Peter Burggraaf, Joël Hazan, Youllee Kim, Vincent Lui, Amitabh Mall, Pierre Mercier, Gillian Moore, Sophie Salaire, Sergey Sushentsev, and Alessandro Zanotti for their contributions to this report. They also thank John Kerr for writing assistance.