International trade has tripled as a share of global GDP since 1945, and banks have done well from it. Revenues from trade finance now total approximately $50 billion a year. But signs suggest that the good times may be ending, not only because the growth of trade is now slowing but also because new entrants could capture attractive parts of the value chain.

Documentary trade, traditionally facilitated by letters of credit (LCs) issued by banks, is steadily being replaced by open-account trade. Increased legal certainty, the ease of international communication, and a new abundance of information on counterparties mean that importers and exporters are more confident about trading without the financial reassurance a bank provides. Competition for slices of a shrinking pie is pushing down prices. Simultaneously, regulation is making trade finance more costly to supply.

Adapting to shifts in demand is not straightforward, however. The global economy is precariously positioned, with causes for concern in China, the EU, and commodity- based economies. If confidence falls, demand for credit guarantees may take off again. Banks must be prepared to respond to rapid changes in the quantity and location of demand. The most lucrative transactions are those in which a bank serves both sides. But no cost-efficient bank can have a leading presence in every market.

To succeed in this challenging and uncertain environment, banks’ trade finance offerings must be agile, low cost, and valued by customers despite the growing availability and safety of alternatives to documentary trade.

Part of the answer lies in the digital revolution unfolding in trade finance. Digital innovations in the customer interface can create “stickier,” more valuable relationships. And by automating many laborious paper-based processes, digital technology can reduce costs and expand a bank’s operational footprint without requiring more people on the ground. The next generation of trade technologies—electronic bills of lading (eB/Ls), MT798, bank payment obligation (BPO), and blockchain—may push trade finance toward the paperless business long envisaged.

If banks do not embrace these digital advances, their challenges will only grow. They are likely to find that tech-savvy upstarts have shunted them out of the lucrative role they have played for centuries, costing them not only the revenue from trade finance but the customers that came with it.

Innovation on the Front End

Trade finance customers seek the same things that other corporate banking customers want: process transparency, risk reduction, credit when needed, and the rapid, low-cost facilitation of transactions.

In recent years, banks have used digital technology to make it easier and cheaper for customers to access such services. Deutsche Bank’s Autobahn platform offers clients an ever-growing variety of apps for cash flow management, supply chain management, trade finance, and more. But for trade finance, best-in-class innovation has come predominantly from fintechs. PrimeRevenue and MarketInvoice are winning business in supply chain and receivables financing by offering customer interfaces that simplify interactions and reduce time-to-cash. A large gap has opened up between the leaders and the rest.

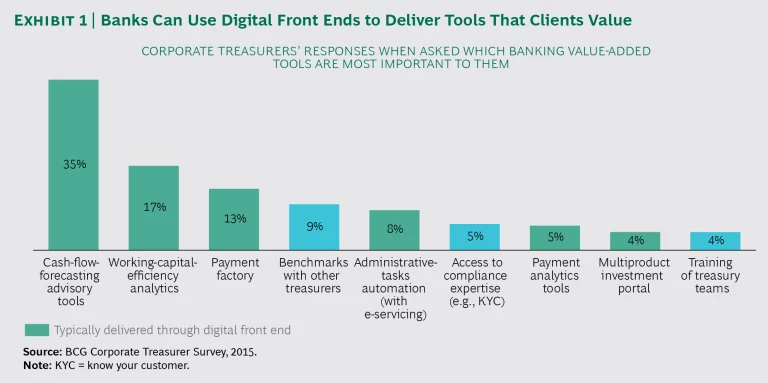

Banks should not underestimate the importance of high-quality digital front ends. (See Exhibit 1.) These interfaces do more than improve customer convenience. By acting as gateways for supplying customers with complementary services over and above mere transactions, they can strengthen relationships in a way that fintechs struggle to achieve. Getting the front end right allows banks to be seen as service partners rather than document processors, thus letting them sustain their fees in the increasingly competitive digital world.

More Efficient Operations

The legal and financial processes involved in trade are still predominantly paper based, requiring a large, inflexible, and expensive operational footprint. Digitally documented trade promises to increase agility and reduce costs.

Previous attempts at moving to paperless trade—the EU’s Bolero project is the best known—have gained little traction. The main obstacle is the variety of participants in the process. Banks and large companies have the scale to benefit from investing in digital technology, but small traders and some freighting firms do not, especially those in emerging markets. And although government agencies have the required scale, they often lack incentives to improve efficiency.

Completely paperless trade is thus unlikely to happen anytime soon. Nevertheless, banks can gain most of the benefit by going paperless internally, creating a digital ring fence around their operations. In this way, banks incur the effort and cost of handling paper only at points of entry and exit. To achieve this, they need to make

advances in two areas.

Optical Character Recognition and Machine Learning. Most global banks already use standard optical character recognition (OCR), which recognizes text from trade documents, allowing data input employees to copy and paste content into back-end fields. Although valuable, this provides no step change in efficiency.

The untapped opportunity lies in intelligent OCR, which learns to recognize document templates and automatically transfers paper-based text and handwritten content into back-end fields. Some banks are already using this technology, but it needs fine-tuning. Citibank speculates that the technology could increase productivity in operationally intensive tasks by as much as 50%. It will also reduce the operational and compliance risks that arise from tracking activities on paper.

The next advance is OCR enhanced with machine learning, which would automatically transfer paper-based content into back-end fields, screen documents for consistency and compliance, and feed data into issuance systems. For a bank that serves both ends of a transaction, the marginal transaction cost could become negligible. While still in the concept stage, this technology is on the radar of advanced banks.

Digital Compliance. Trade finance is covered by a host of regulations, such as know-your-customer and anti-money-laundering policies, and trade embargoes. Such regulation is becoming not only more comprehensive and changeable but also more strictly policed, exposing banks to the risk of reputational damage and fines. From 2007 to 2014, fines imposed on US and European financial firms grew from $30 million to $58 billion. Moreover, BCG experience suggests that compliance accounts for up to 25% of servicing capacity, a figure that will only increase without digital intervention. Effective compliance is thus a key driver of performance and a significant operational burden.

The filtering technology that most banks rely on today produces a high rate of false positives, increasing the need for manual checking and overrides. Basic solutions, which scan documents for blacklisted keywords, fail to account for context. Artificial intelligence and big data can make filtering more effective. For example, Thomson Reuters World-Check uses both technologies to build profiles and identify high-risk entities before they are officially blacklisted. As a result, false positives have decreased by as much as 50%. BAE Systems’ NetReveal applies predictive big data analytics for a similar purpose.

The inflexibility of legacy IT architectures prevents banks from realizing the full value of such tools. Significant effort and expense are required when simply adapting solutions to minor policy adjustments, let alone adopting the latest machine intelligence technology. To keep up with policy and technological change, banks must invest in expandable platforms and establish teams dedicated to maintaining and fine-tuning the big data that feeds those platforms. They must also decide what they are going to do about emerging technologies that promise more profound transformations of the trade finance business.

Disruptive Technologies

Four potentially disruptive technologies have emerged in trade finance over recent years: MT798, BPO, eB/Ls, and blockchain. Despite the cost-cutting potential, uptake of the first three has been slow. Blockchain, however, may buck the trend.

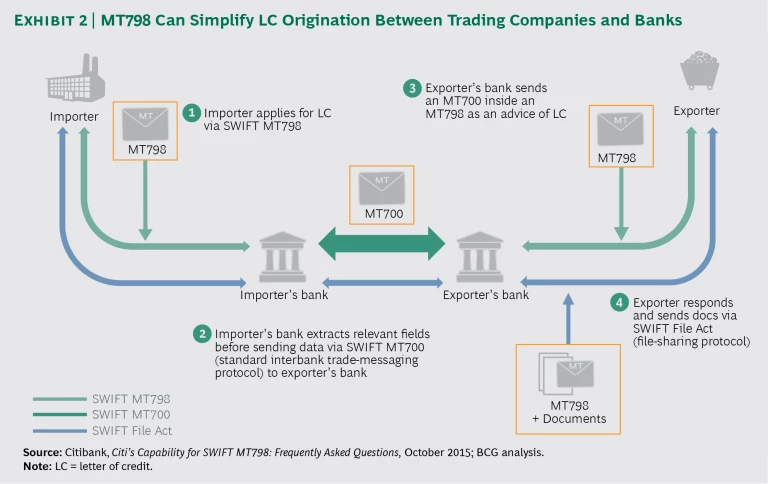

MT798. MT798, the so-called “trade envelope,” is a standardized SWIFT messaging protocol for direct-to-bank origination from within a client’s enterprise-resource-planning system. (See Exhibit 2.) It reduces process complexity and allows companies to buy from multiple banks with ease.

MT798 could reduce banks’ costs and increase their access to new customers. By eliminating the need for local banks, it could also allow big players to sweep market share with little investment on the ground. However, some banks fear that MT798 will undermine the stickiness of trade finance business. Because it can work on multiple platforms, MT798 reduces dependence on bank channels and might thereby reduce customers’ willingness to pay for them. Rather than promoting MT798, some banks are waiting to assess corporate demand. As long as banks do not offer MT798, however, companies will have little use for it—hence its current slow rate of adoption.

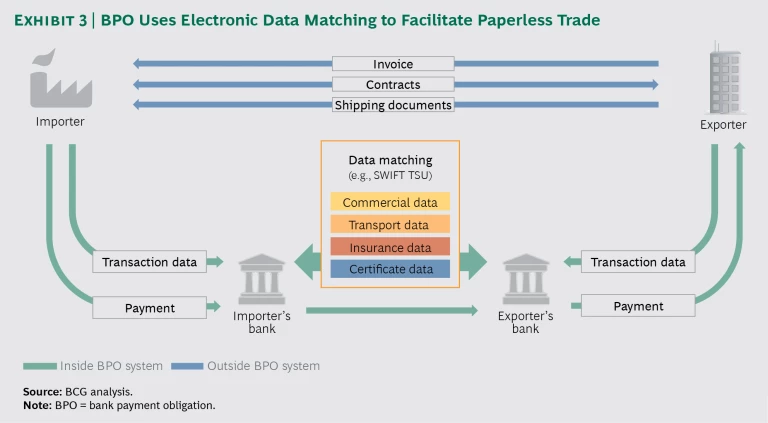

Bank Payment Obligation. BPO uses electronic data matching to facilitate payments between the importer’s bank and the exporter’s bank. It is quicker and usually cheaper for companies than LCs (partly because of a shorter credit utilization period), while still avoiding the settlement risk of open-account trading. (See Exhibit 3.)

Nevertheless, there are obstacles to its adoption. The parties on either end of the transaction must be BPO enabled, but installing this capability is costly, requiring an overhaul of well-integrated and long-standing processes. And the tradeoff between cost and security presented by BPO will not suit all trading partners; some will prefer the greater security of LCs, and others will favor the lower cost of open-account trading.

Banks also face the adoption costs of developing new governance, marketing, risk management, and operational expertise. And even though BPO could reduce banks’ transactional complexity and costs, many fear that it could cannibalize their fee-rich LC business. As with MT798, then, these obstacles limit the possibility of a network effect. Why incur the expense of adopting BPO when, as things stand, only about 55 companies and 20 banks can use it? As long as uptake is low, firms and banks have little incentive to adopt BPO, creating a vicious cycle.

Despite these obstacles, BPO has some strong advocates. BPO-secured transactions open doors to exporter receivables financing and foreign exchange transactions, both of which are impossible with open-account trading. By taking the leap and adopting BPO, banks will make it worthwhile for other market participants to follow suit. If banks can devise effective cross-selling and pricing strategies, BPO could significantly boost revenue instead of cannibalizing it.

Electronic Bills of Lading. The idea of eB/Ls has been around since the 1980s. But only in recent years have functional solutions, from Bolero and essDOCS, become available. These digital document platforms aim to lead the journey toward paperless trade by transferring shipping documents instantly between parties. The technology can be extended to the many other documents supporting trade transactions.

By accelerating the transfer and presentation of documents, eB/Ls shorten the payment cycle and thereby improve the working capital position of exporters. Digitized documentation is cheaper to process, more traceable, and more secure. Banks also benefit from the integration of eB/Ls with SWIFT and proprietary bank platforms.

Yet the adoption of eB/Ls is constrained by the familiar obstacles. Many participants in the trade ecosystem are, for reasons of size or lack of sophistication, unlikely to invest in the technology. As long as adoption is far from universal, banks have little to gain by investing in it. They will need to maintain their old paper-based processes.

Blockchain. Although trading companies and banks are proving slow to adopt the latest technology, discussion is shifting to innovations that are even more disruptive. What one banker we surveyed called the “arrogant assumption with BPO that only we can do the document-checking process” may soon be undermined. Distributed ledgers built on blockchain technology can validate ownership, certify transactions, and make payments, reducing duplicate and fraudulent documentation. Everledger has proved the concept of using a distributed ledger for validation and authentication across the multiple entities in the diamond industry’s value chain—a development that, although not specific to trade, is encouraging.

Deutsche Bank has publicly expressed an intention to explore applications for blockchain in payments, transfers of ownership, and smart contracts. In Singapore, DBS and Standard Chartered have launched a joint pilot using a blockchain distributed ledger to confidentially host authenticated invoices and prevent duplicate invoicing fraud. They aim to extend this to other trade documentation, such as bills of lading. Bank of America has just announced a similar intention to experiment with blockchain in trade finance.

It is unlikely, however, that one or two banks can establish a blockchain platform. Recognizing this, more than 40 banks around the world, including Goldman Sachs, Credit Suisse, J.P. Morgan, HSBC, and UniCredit, have joined the consortium R3CEV to develop universal standards and a shared protocol or platform for blockchain in financial services. R3CEV’s efforts may fuel the rapid adoption of blockchain-based solutions.

Blockchain is an opportunity not only for banks. Within the past six months, two blockchain fintechs focused on trade finance have garnered attention. Wave BL, backed by Barclays Accelerator, focuses on enabling the exchange of bills of lading across a decentralized ledger in order to decrease cost and risk. SkuChain, a Silicon Valley startup, aims to digitize both LCs and supply chain finance using “brackets”—a term the company coined for blockchain-based self-executing contracts. Third-party infrastructure players, such as SWIFT and Bolero, may also be well positioned to advance blockchain.

The potential of blockchain has yet to be proved in financial services, let alone in trade finance. But it has attracted much more interest than MT798 or BPO. Within three years, we are likely to see blockchain applied to trade finance transactions. The technology has the potential not only to reduce cost through automation but also to increase speed and security. It could be the much-anticipated technology that finally causes a paradigm shift in trade finance.

Key Takeaways for Banks

Trade finance is becoming a tough business for banks. And it will only get tougher for those that do not embrace the digital revolution. They will find themselves offering services that are more expensive, slower, and less secure than those of their tech-savvy rivals. Banks seeking a long-term future in trade finance must go digital. Three principles can guide them:

- Deliver value-adding functions on the front end for documentary trade and financing; do not rely on playing the traditional role of document processor.

- Do not underestimate the growing importance of best-in-class operations. Increased efforts in OCR, machine intelligence, and digital compliance will be rewarded with lower costs and increased agility and speed of service.

- Experiment in order to stay ahead of the technology curve. Banks can choose whether to push MT798, BPO, eB/Ls, or blockchain, as the impacts of such technologies are yet to be proved. What is clear, however, is the significant opportunity to digitize trade finance and thus change how it works. Banks that explore this and collaborate with technology partners and key clients will come out ahead rather than risk being left behind when adoption increases.

Although fintechs are a major site of innovation in this area, banks should see them not as a threat but as potential partners. Banks have the experience and deeply embedded relationships; fintechs have the technological innovations. By working together, they can revolutionize trade finance, making it faster, safer, and cheaper for everyone involved.

We believe that banks have the opportunity to increase their revenues from trade finance by 10% and reduce operational and compliance costs by 15% to 25% if they embrace digital technology in trade finance. They cannot afford to take a back seat in this journey.