Over the last 13 years, the commercial aerospace industry has experienced sweeping changes, from new composite designs to a highly outsourced production model. In addition, the industry weathered a major economic downturn and carried out a massive expansion of production capacity. Through it all, aerospace companies have maintained robust profits, with the earnings of 32 major manufacturers averaging $44 billion a year from 2012 through 2014.

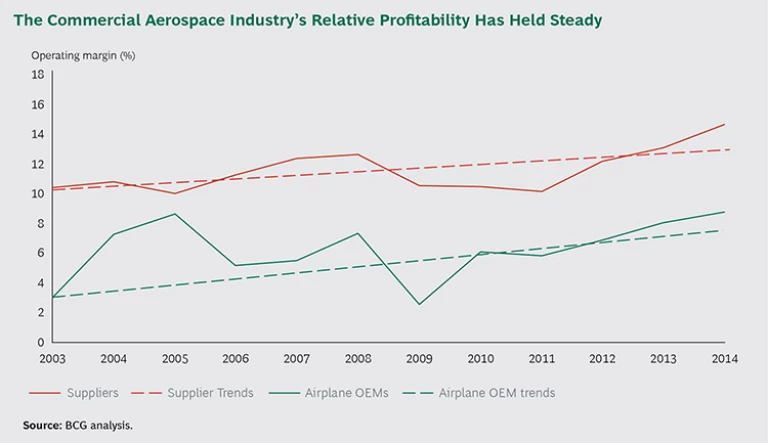

Airplane original equipment manufacturers (OEMs), among them Boeing and Airbus, are at the top of the industry value chain, yet they are consistently at the bottom of the pack when it comes to profitability. The relative profitability of OEMs and suppliers (excluding engine manufacturers) has changed little from 2003 through 2014. (See the exhibit.)

This persistently steady allocation of profits raises the question: is this the permanent state of the industry or can OEMs make changes that will shift this balance?

Factors Influencing Profit Allocation

For decades, suppliers have reaped strong profits from the aftermarket, selling spare parts at margins well in excess of those generated by parts sold to OEMs for new aircraft. Airplane OEMs, however, typically have not participated in the aftermarket to the same degree, in part because they rely on suppliers to build the majority of parts that require replacement.

Suppliers have enjoyed other advantages as well. Procurement dynamics, for example, favor suppliers because parts built to program specifications are expensive to develop and go through lengthy qualification processes, making it costly to switch parts or suppliers. Because of this concentrated supply base, airplane OEMs are less able to create competition among suppliers, especially in major subsystems. Once the specs are set and production rates are high, competition becomes even less likely. Furthermore, most contracts operate on long cycles, so even if airplane OEMs make changes to reduce costs, these changes take time to implement and even longer to affect suppliers’ bottom lines.

The airplane OEMs, not the suppliers, typically shoulder most of the multibillion-dollar costs for the development of new aircraft designs and their derivatives. For example, Boeing spent about $20 billion developing the 787; suppliers’ development costs were far lower. Over the last five years, Boeing and Airbus have each spent $3 billion to $4.5 billion annually on R&D. By comparison, the equivalent costs for Spirit AeroSystems, which builds fuselages, nacelles, and wing components, have been about $30 million to $40 million, based on BCG’s analysis of company financial filings.

Suppliers are also major drivers of performance and advancement in aircraft. Boeing’s 737 MAX provides an estimated 14% improvement in fuel efficiency compared with previous versions—and 12 of those 14 percentage points are expected to come from the LEAP-1B engines, which are built by CFM International. Advances in avionics, materials science, and electric propulsion are driving next-generation aircraft capability and performance, and they all have strong supplier-driven components.

Finally, changes in supplier ownership have created more profitable businesses. Beginning in the early 2000s, companies such as TransDigm and Precision Castparts (PCC) have developed a strategy of acquiring midsize suppliers and boosting profitability by aggressively raising prices, curbing development spending, and improving operating performance.

The Airplane OEMs Fight Back

Given this margin disparity, airplane OEMs in recent years have worked to capture a greater share of the industry’s profits. They have tried to drive down supplier pricing through programs such as Boeing’s Partnering for Success and Airbus’s single-aisle cost optimization program (SCOPE+), which use traditional procurement tactics such as creating incentives on future programs to encourage suppliers to lower prices on current ones. In some cases, they have reinforced these programs with get-tough moves such as Boeing’s decision to switch its supplier of 777X landing gear from United Technologies, which made the gear for previous 777 versions, to Héroux-Devtek. Boeing also recently canceled Spirit AeroSystems’ license to build spare parts for which Boeing owns the intellectual property.

Similarly, Airbus has recently reopened competition on major A350 work packages even though its current risk-sharing partners are entering production. The aircraft maker has also succeeded in double- and even triple-sourcing commodity parts, and it has gained leverage because of its large order book, particularly for narrow-body aircraft.

None of these tactics has significantly reduced the profit disparity between suppliers and airplane OEMs during the past decade, however, and they are unlikely to create a meaningful change in the future. Quite simply, more stringent OEM procurement processes have not addressed the fundamental economics underlying commercial aircraft manufacturing.

More recently, some airplane OEMs have turned to selective insourcing, which gives them more potential for aftermarket profits for spare parts. Boeing, for example, chose to bring in-house the manufacture of wings for the 777X and nacelles for the 737 MAX.

Engine makers, which consistently capture a greater share of aftermarket profits than other suppliers, are also reintegrating parts of their supply chains, as evidenced by GE’s purchase of Avio Aero, which makes turbines and other engine components, and its recently announced $200 million investment in ceramic matrix composite capacity. These are more profound moves than tactical procurement actions and could change the fundamental structure of the industry. However, most airplane OEMs are limited in their ability to insource, and these programs will take years or even decades to generate an effect on profitability.

One way to lower costs is to create more competition among suppliers. Airplane OEMs can develop existing niche companies in the aerospace industry and encourage them to expand their product offerings, or they can bring in suppliers from other industries. Supplier Héroux-Devtek, for example, was able to move beyond its historical market segments thanks to the 777X landing-gear contract.

Both Boeing and Airbus have structured risk-sharing partnerships with suppliers on the development of new projects such as the 787 and A350 XWB. These partnerships represent several billion dollars in at-risk funds for the suppliers, which have a greater stake in the successful rollout of the program. By embedding the supplier in the development process, however, OEMs limit their ability to lower costs through the procurement process later on.

Along with their focus on costs, Airbus and Boeing are increasing their involvement in the aftermarket. Airbus’s Flight Hour Services offers customers tailored support packages and guarantees on parts availability, and Boeing’s GoldCare is an integrated service that manages maintenance, materials, and engineering for customers’ fleets.

Two Possible Outcomes

Is the industry headed for a fundamental shift in the allocation of profits during the next decade? In analyzing the profit landscape, we have identified two possible outcomes—one in which the pattern of the last decade and a half continues, and another in which OEMs reclaim a greater portion of profits from their supply base.

Suppliers maintain their superior profitability. In this scenario, the industry status quo holds and suppliers innovate both their products and their business models to maintain their advantage in the market. Airplane OEMs are able to make changes to the margin by insourcing and increasing leverage on key suppliers, but those changes result in only modest profit gains for OEMs, and supplier profitability is unaffected. The entry of new OEMs and aircraft classes—Mitsubishi’s MRJ regional jet, Bombardier’s CSeries, and Comac’s C919 narrow body—only strengthens suppliers’ relative power.

OEMs have limited—and expensive—options for vertically integrating through mergers and acquisitions because most suppliers serve both Boeing and Airbus, making large-scale integration more difficult. In addition, insourcing moves will be limited to airframe-related elements because the capabilities for building subsystems are outside OEMs’ expertise.

Meanwhile, more suppliers mimic the success of companies such as TransDigm and PCC by innovating their business models, and performance-enhancing advances for aircraft continue to be driven by systems and their suppliers rather than airframe design.

As a result, suppliers will be able to fend off airplane OEMs chasing a larger share of the aftermarket as well as niche competitors trying to expand their business.

OEMs change the industry structure and reverse supplier trends. In this scenario, actions taken by OEMs during the past five years—insourcing, increased procurement leverage, dual-sourcing some parts, and cultivating niche suppliers—result in sustained increases in profitability for the decade ahead.

To capture a larger share of aftermarket profits, airplane OEMs rely on digital analytics, which create opportunities for airplane OEMs to launch new services that encroach on suppliers’ profits. At the same time, renewed fleets of next-generation aircraft, such as the Airbus A320neo and A350 and Boeing’s 737 MAX, 787, and 777X, depress overall aftermarket demand as new lower-maintenance aircraft replace older higher-maintenance models.

Airplane OEMs insource high-margin components such as cabin interiors and engines, undermining the model of companies such as TransDigm, which were designed for a time when airplane OEMs (especially Boeing) outsourced major portions of their aircraft. This model continues to erode as OEMs bring work in-house.

In addition, airplane OEMs are better able to leverage their intellectual property. In many cases, airplane OEMs have licensed production and distribution of spare parts to suppliers. As those licenses expire, OEMs can raise prices for parts that are specified on existing aircraft, shifting aftermarket volumes and contract patterns and reducing supplier profits.

As airplane OEMs make more supplier changes, demonstrating that no supplier is safe, their procurement practices have a significant effect on profitability over time. This shifts a larger segment of the aftermarket profit pool to them.

Implications for Suppliers, OEMs, and Investors

Based on our analysis of all the moves to date, we believe it is unlikely that the industry’s historical pattern will be broken in the foreseeable future.

Suppliers will endure periodic procurement pressures from OEMs and will have to work closely with them to protect contract positions. However, the heavy reliance on suppliers for new aircraft entering production—the A320neo, 737 MAX, B787, and A350XWB—will protect suppliers’ market share in the medium term because OEMs will be reluctant to upset the delicate balances within those programs. At the same time, suppliers will have to make investments in their positions to protect against aftermarket encroachment by OEMs.

Airplane OEMs, meanwhile, must continue their procurement efforts as a normal course of business. High-profile, hardball moves, such as switching suppliers on a major project, will be important and should be pursued wherever possible. Boeing’s cancellation of the Spirit license is the sort of tactic we should see more often as competition increases.

Airplane OEMs also have opportunities to increase profitability by continuing to bring more work in-house and push into the aftermarket. However, making these moves at prices that create value will be difficult, and they should be prioritized.

Surprisingly, investment markets appreciate that aerospace is a long-cycle business and see companies’ earnings and valuations as stable. Even shocks like the canceled Spirit licenses,

This means that investors are still likely to get the highest returns from companies that are focused on the aftermarket, although they should continue to analyze insourcing and vertical integration trends among the airplane OEMs for potential shifts in the industry’s profit allocation.