Pricing goods and services is an important capability for companies in every industry worldwide. For today’s hard-pressed retail banks, it is a critical one. Yet few banks mine the full potential of pricing to generate significant revenue and profit.

Retail bank revenue is stagnating in developed markets, and growth has downshifted to slow in rapidly developing economies. Global revenue crept ahead at a compound annual growth rate of just 2% from 2011 through 2013, compared with a 7% CAGR from 2005 through 2008, when the financial crisis took hold.

The industry’s profitability also remains well below precrisis levels, and competition is intensifying. New players—from large international banks to small, low-cost nonbanks and fintech digital platforms—are entering markets with aggressive prices and specialized offerings designed to extract the most profitable slices of incumbents’ business. The cost of doing business, meanwhile, continues to rise, largely because of the growing array of local and global regulations and increased capital requirements.

At the same time, today’s digitally connected consumers, empowered by online price-comparison data, increasingly expect transparency and price matching for bank fees, products, and services. Persistent low interest rates have reduced margins on rate-related products, such as savings accounts, and also on payment products, such as checking accounts. This has forced banks to increase their emphasis on fees—such as for checking accounts, ATM transactions, and late payments—and has made pricing acumen crucial to revenue growth.

Superior pricing performance offers a potential revenue windfall for banks caught in this cross fire of slow growth, heightened competition, price-conscious customers, and intensifying regulatory change. Such prowess, however, requires a dedicated initiative to define an optimal pricing strategy; develop pricing structures, levels, and practices that fulfill the strategy; and build the skills, capabilities, and oversight to sustain those benefits over time. The payoff is substantial. Pricing programs can provide a sustained revenue lift of 5% to 15%, all of which goes directly to the bottom line.

But this premium for pricing excellence is a mostly missed opportunity. Pricing capabilities remain largely underdeveloped in retail banking compared with other B2C industries, such as telecommunications, consumer packaged goods, and airlines. Few banks have dedicated pricing departments or programs to establish a pricing strategy, assign price-setting responsibilities and standards, or fully cultivate advanced techniques and tools, as well as talent. Only a handful of front-runners scrutinize, measure, and optimize critical activities and capabilities such as data mining, customer segmentation, price differentiation, discounting structures, and sales incentives, to name a few.

The Three Layers of Pricing

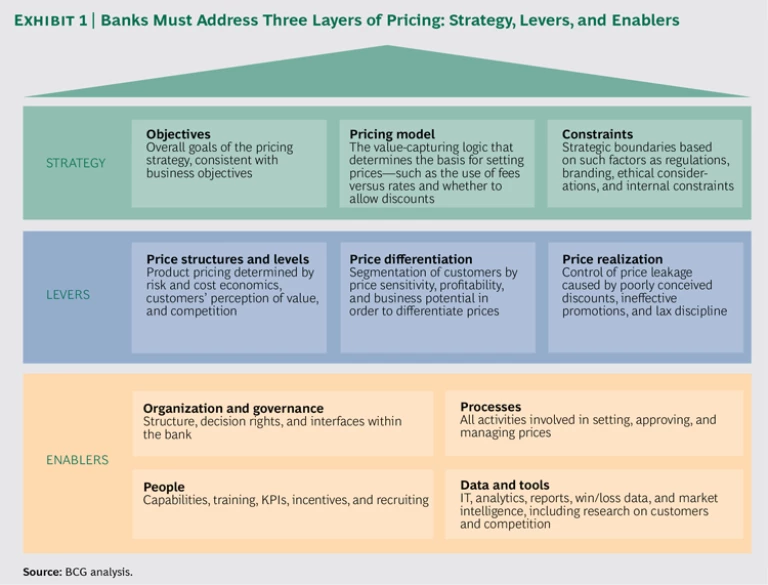

Enhancing a bank’s pricing performance is a low-risk, sustainable means of increasing top- and bottom-line growth and countering low return on equity. To unlock this potential, banks need to address three layers of pricing: strategy, levers, and enablers. (See Exhibit 1.) We find that few retail banks worldwide adequately address all three layers of pricing.

Strategy is missing in action. Pricing strategy is usually not a priority on the management agenda of retail banks. Most banks have not clearly defined how pricing will support their overall strategy or what goals it should achieve. In the absence of strategic bearings and guidance, banks have no solid foundation for price setting and enforcement, and they fail to execute pricing coherently.

The use of available levers is limited. Pricing execution typically takes advantage of just a limited subset of the levers available to retail banks. Many banks use cost-based pricing but often fail to fully account for all risk and capital costs. Few base pricing on the value of their offerings to the customer. Pricing still often follows a one-price-fits-all approach, with limited differentiation by customer segment or region. Price “leakage,” or failure to achieve agreed-upon price levels, is common because of irrational discounting, ineffective promotions, or failure to update prices when warranted—for example, when a client’s business status changes or during periods of inflation.

Enablers are weak or absent. Enablers form the platform of pricing competence that must be built and sustained across the organization. They include processes, tracking tools, and employee capabilities. Many banks have deep gaps to overcome in this area—including a shortage of individuals with pricing expertise, inadequately structured processes, incentives based mostly on revenues rather than on price performance, and a lack of tools such as data dashboards and scenario planning for sales teams. Many banks have limited reporting on price metrics and no tracking of win/loss data. As a result, they make decisions with insufficient facts and insights.

Capturing the Opportunity

Assessing a bank’s activities, capabilities, and goals in these three overarching layers provides structure and clarity to the otherwise complex task of capturing the pricing opportunity.

Begin with a Strategy

Pricing should be a means to realizing the bank’s strategic objectives. This requires creating a pricing strategy on the basis of explicit discussion and agreement among senior managers. The strategy should comprise three elements: overall objectives, a pricing model, and a set of constraints.

In establishing the overall objectives, senior managers should ask the following questions: What are our business goals? For example, do we want to increase profit, volume, or market share? To achieve these goals, which products, channels, and customer segments should we prioritize, and how can pricing help? How can we translate our strategic goals into concrete pricing objectives? For example, should we use discounts for promotions or to increase loyalty and engagement?

The pricing model—the second strategic element—establishes the value-capturing logic by which tactical pricing decisions are made. The following are among the principal questions to ask:

- Should we charge customers on the basis of interest rates or fees? And by what measure—by volume or usage? Or should we charge a flat rate? How do we capture value over the customer’s life cycle—up front or over time?

- Should we allow discounting and, if so, to what levels, for which customers, and why? Should we differentiate the sales reps’ mandates on the basis of their specific capabilities and performance?

- Should the pricing of each line of products be kept independent across products, or should we price per customer—through cross-product pricing and discounts? Should we allow for cross-subsidies and to what extent? Or should all products and clients have a minimum threshold of profitability?

The third strategic element of pricing—establishing constraints—requires defining boundaries for price setting from several perspectives. One involves banking rules and regulations: for example, is the bank permitted to charge different prices to new and existing customers? Ethical issues impose another set of questions, such as what personal information will the bank permit itself to use in pricing, to determine either a customer’s credit risk or willingness to pay? Branding considerations are also important, including the perception the bank wants to create regarding its pricing—premium, quality, or value—and the extent of its reputation for transparency. And finally, internal limitations and constraints must be understood and recognized—for instance, regarding IT systems and sales force capabilities.

Pull Three Levers to Optimize Pricing

There are three levers that banks must pull to capture the full value of pricing:

- Optimize price structures and levels on the basis of the value perceived by customers and on competitive dynamics, while taking into full account all product costs and risks.

- Differentiate pricing by segmenting customers, even to the individual level when warranted, according to such criteria as willingness to pay and value to the business.

- Improve price realization—that is, achieving the previously established price levels and goals—by, for example, increasing the effectiveness of discounts and promotions.

Optimize price structures and levels. Banks should start with price structures. These must take into account the costs and risks of products, such as payments, with many different price components—including credit interest, debit interest, monthly fees, transaction fees, penalties, overdraft charges, late-payment fees, and service fees. Likewise, loans, investments, and even deposits have many price components to consider—for example, a savings interest rate that varies with the deposit volume. Optimizing price structures requires a deep and quantitative understanding of the role that different price components play in the customer’s value perception. Some services and fees are crucial for acquiring or retaining customers and may be priced at lower margins. Other services and fees do not trigger much customer response and may be optimized to generate more value for the bank.

To optimize price structures and levels, banks should quantify the value that customers place on specific product features, including services that are free. For example, in daily banking products, customers may attach significant value to free ATM withdrawals or a free credit card, which can compensate for higher monthly fees. One retail bank measured in detail the perceived value of all its product features and prices, then adjusted its offerings to different customer segments accordingly. That allowed it to increase monthly fees or raise fees for specific features that were less important to customers, such as lost-card replacements. As a result, the bank increased revenues in its daily banking products by almost 15%.

Setting price levels should be based on a quantitative understanding of price elasticity. How do volumes change with price levels—overall, by customer segments, and by channel? On the basis of this knowledge, banks can set prices in line with their goals, understanding that price levels established to maximize revenue are different from those aimed at maximizing profits.

Particularly for products with thin margins and a large back book, such as savings, pricing decisions on the front book will have a big impact on the entire portfolio’s profitability. For example, increasing interest rates to gain revenues from new deposits will simultaneously lower revenues on existing deposits. In contrast, when pricing for maximum margin, banks should determine the lowest interest rate that doesn’t motivate customers to withdraw savings. The price elasticity curve for products such as savings and mortgages is often complex and nonlinear. But when well understood and used, it can easily lift back-book revenue by 5 to 10 basis points for the portfolio.

Finally, optimizing price structures and levels should also be based on competitive dynamics. Banks often price their products on the basis of competitors’ prices, but they seldom track competitors’ responses to their own pricing moves. Monitoring those responses can help decode a competitor’s strategy, allowing the bank to continuously improve its own decisions.

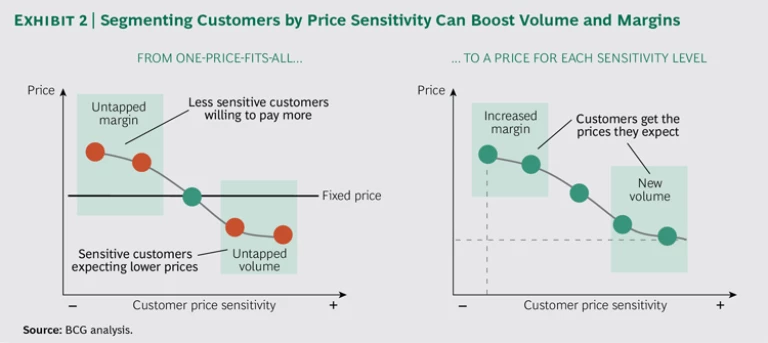

Differentiate pricing by segmenting customers on the basis of price sensitivity. Price differentiation is a means of capturing untapped margin or volume opportunities. Banks often segment customers by their value to the business—using income or wealth levels, for example—but rarely by their willingness to pay. However, a one-price-fits-all approach fails to attract price-sensitive customers, ignoring a potential opportunity to build volume. Conversely, less price-sensitive customers, once identified, can be tapped as a margin opportunity. (See Exhibit 2.)

Banks can deploy a wealth of data to segment their customers by their willingness to pay. By data mining historical customer data—such as previously accepted prices and promotion responses—or by conducting targeted client research, banks can statistically determine the factors that predict price sensitivity and use them to set individual prices.

At a number of European banks, individualized pricing achieved through microsegmentation has increased revenue 10% to 30% in deposits, consumer loans, and credit cards.

Improve price realization. Better price realization can be achieved through more effective discounts and promotions, and through billing discipline. While discounting is a useful tool for attracting or retaining customers, lack of monitoring and insufficient sales-force discipline often lead to excessive price leakage. As a result, these discounts often yield no benefit to the bank.

Leakage also occurs when pricing isn’t updated to reflect changing circumstances—such as a client’s increased risk profile or a student discount retained by a customer who has graduated—or when services rendered aren’t billed, fees are waived, and penalties aren’t charged.

Maximizing price realization requires banks to employ both discipline and guidance in managing the sales force. Discipline can be achieved partly through time-tested and self-evident practices such as setting, monitoring, and enforcing discount rules and partly through incentives. But less obvious measures must also be employed. They include sophisticated but simple tools that instantly equip sales representatives with an integrated view of each client—such as next negotiating steps, target prices and profitability by product, and cross-sales needed to balance a discount.

Close guidance is crucial—though the need is often underestimated—when a bank commits itself to full price realization. That goal imposes a change in culture, not just metrics, as the sales team shifts focus from sales volumes to profitability targets. The team and the individual reps must learn that every discount is counterbalanced by an additional cross-sale or by a larger or longer customer commitment. A successful transition requires constant reinforcement through training, coaching, oversight, and team discussions.

Optimizing price realization is an opportunity at every bank, and with every product, that provides the sales force discretion to discount. Revenue increases of 5% to 10% are typical for price realization efforts. One Benelux bank increased revenue by nearly 25% in its consumer lending portfolio through a combination of sales force guidance, tools, and steering.

Sustain Value with Enablers

Banks often approach pricing improvement as a one-off exercise, after which the impact dilutes over time. To sustain the value created, banks should address their people capabilities and their processes, governance, and tools—including their IT resources.

A governance structure that allows for fact-based cross-functional decision making is a crucial element of any pricing capability in retail banking today. Traditionally, pricing was cost-plus, with decisions made in asset-and-liability-management, finance, and risk departments. Now banks must also factor in the value perspective—that is, the customer’s perception of value and willingness to pay; this change has given marketing, customer intelligence, and sales a seat at the pricing table. There is therefore no single “right” home for pricing responsibilities and decisions. Today, responsibility should usually reside in a pricing council—often comprising senior management—supported by a pricing team that provides dashboards, what-if scenarios, and other information for decision making.

To make the step from cost-plus to value pricing, banks need to train their people. Teams must be educated in quantitative and qualitative customer-research techniques, as well as data analytics, to unveil customers’ perception of value. Banks should also invest in frontline-staff awareness and sales capabilities to extract the full value from each transaction and interaction—as well as to deepen the customer relationship.

Data and tools also require attention. Banks have a wealth of untapped customer information that can be exploited for value-based pricing. They should unlock and mine this data for insights on critical factors like price elasticity, business potential, and buying propensity. In addition, banks should access and use information they often do not capture, such as win/loss and competitor-pricing data. To bring this enhanced intelligence and these better pricing models into the field, they should design simple and flexible tools.

Banks must improve their pricing performance management and processes through better tracking and enhanced mechanisms for coordinating and steering all personnel involved in pricing. This requires clear and frequent dashboards on metrics and incentives that are directly linked to performance.

Finally, banks must establish clear mandates within predefined boundaries so that decisions can be made quickly and at the right level. Achieving this requires getting information on competitive pricing, price sensitivity, and what-if scenarios to decision makers in a timely manner. Then, decision implementation processes must be fast and accurate to avoid leakage.

How to Get Started

Pricing is a fundamental go-to-market commercial capability, along with sales, marketing, and branding. Properly executed, it can generate a significant windfall. Pricing is increasingly on the radar of senior management as banks revisit their business models and strategies to address regulatory change, rising competition, and disruptive new business models. They should start today, before their competitors and the industry as a whole have made advances in pricing sophistication.

However, banks should not treat pricing improvement as an isolated, do-it-all-at-once exercise—achieved, for example, by simply buying a pricing tool. To advance in pricing is a longer-term commitment requiring senior management commitment and a multiyear plan. It mandates a bankwide approach that addresses all three pricing layers—setting strategic objectives, applying levers to realize impact, and building enablers.

As a first step, we often recommend that banks address the lever of price realization by improving adherence to agreed-upon price structures. It is also wise to focus on one product first. In our experience, both checking-account fees and consumer loans are good choices, providing a solid learning opportunity while delivering impact at the same time. Quick and visible gains build confidence in the broader pricing effort and provide funding to cover the full pricing journey.