The return of economic growth to many of the world's markets, albeit at different rates, should help to boost the overall outlook for retail banking. At the same time, however, banks face a number of diverse challenges and uncertainties, including macroeconomic fluctuations, tighter regulations, customers’ heightened digital expectations, a need for better brand advocacy, and new sources of competition.

Despite the tentative recovery, interest rates remain at historic, decade-long lows, with no consensus about when they might rebound.

Global Retail Banking 2016

- Banking on Digital Simplicity

- Customers Steer Digital Trends Driving Retail Bank Transformation

- Retail Bank Operational and Digital Leaders Reap the Rewards

Banks Face Macroeconomic and Regulatory Uncertainties

Any rise in interest rates will likely boost the economics of many banks—but not all banks and not equally. First, it is unclear how much banks can increase net-interest margins in an era of heightened regulatory scrutiny. Also, as rates rise, the increasing contingent of Internet-informed retail depositors, more aware than their predecessors of alternative opportunities for better returns, might abandon savings accounts—a potential “digital run on the bank.”

Competition and higher impairments could also erode the potential benefit of higher interest rates. Historically, in many markets, rising interest rates have moved income from assets to liabilities without materially changing the overall net-interest margin. Also, many banks would have to balance the political pressure to keep borrowing rates low, while increasing deposit rates for long-suffering savers.

In some regions and for some market activities, the introduction of new regulations has slowed—for example, in anti-money-laundering compliance. But that has done little to reduce the uncertainties that banks face, especially since many banks have yet to develop effective ways to both manage regulatory requirements and rein in compliance costs.

One notable uncertainty concerns future capital requirements under Basel IV, which will likely have a significant impact on banks’ economics and business models. Until banks are given more guidance, bank managers will remain strategically frozen. Banks should expect higher levels of risk-weighted assets to be the “new normal.” They should start scenario planning now on that basis to design their product mix and funding choices.

Consumer protection continues to be paramount for regulators in mature markets. That concern is evident from the relatively intrusive levels of intervention on matters related to retail customers, such as payment protection insurance and packaged accounts in the UK. Regulatory efforts to ensure that customers are treated fairly will persist. Pressure by regulators to implement ring-fencing arrangements—to insulate and protect depositors’ assets, for example—is likewise increasing. This poses particular challenges for European banks. In less mature markets such as those in Southeast Asia, however, regulators are currently much more concerned about system stability than about conduct and protection.

Until now, banks have generally bolted compliance activities onto existing processes, increasing organizational layers to address new regulations as they arise. This has led to oversize compliance functions—which are now a target that banks can take aim at. Banks have the opportunity to fully redesign and optimize their bloated compliance processes, embedding “smart compliance” in digitized customer journeys. (See “ Enabling Sustainable Compliance at Banks ,” BCG article, September 2015.)

Digital Pioneers in Retail Set the Bar Higher

Consumer expectations are increasingly influenced by the advances of digital pioneers in the retail sector, such as Amazon, Netflix, and Uber, whose users access services 24-7. Bank customers now expect quick and convenient service from their banks as well—through simple, intuitive interfaces. But they also expect human interaction when they need it. In other words, they want a “bionic” banking experience: one that combines digital and human elements. (See The Bionic Bank , BCG Focus, March 2015.)

The emergence of innovators like Apple Pay and Google Wallet is also changing the competitive landscape for banks. New products and payment methods are challenging the relevance of traditional banks’ offerings and threatening their customer relationships. Unless they act, banks face an increasing risk of commoditization: customers will begin to regard banks as public utility companies, a trend that will put downward pressure on margins and undermine pricing power.

One way for a bank to avoid that fate—to differentiate its offerings and value—is to provide a superior customer journey. But doing so is also a challenge. Increasingly, customer transactions are not only multichannel but also multistep. Users are often distracted, their attention fragmented. Often, they use product applications and complete other banking tasks over several sessions, perhaps using more than one device. Mobile-device screens are small, and bank advisors aren’t present to guide the way. Any provider able to surmount these impediments and give the customer a smooth, painless, digitally simple experience will be ahead of the pack in winning the customer’s loyalty.

Digital technologies and data analytics represent a significant opportunity for banks not only to better meet the needs of their customers but also to lower their costs and increase their efficiency. The best banks are now fully seizing these opportunities and capitalizing on them. Those that fail to act will be left behind.

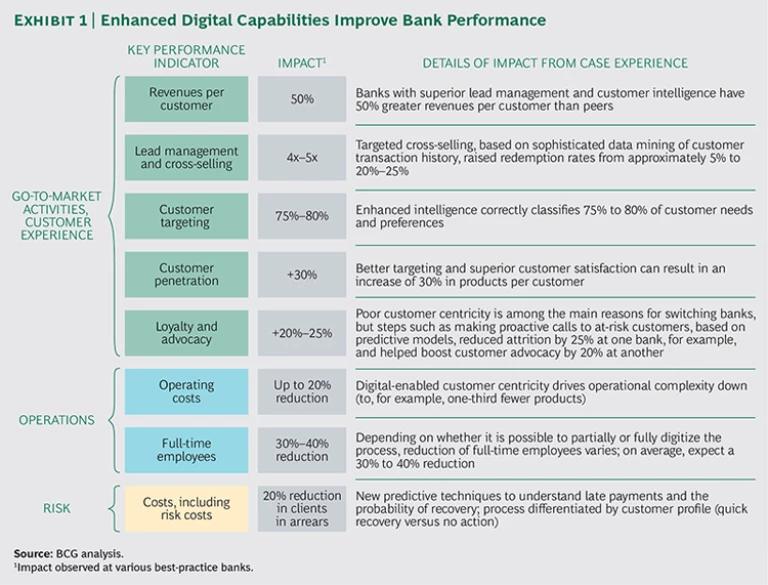

In our experience, enhanced digital capabilities drive substantial and measurable improvements in banks’ financial and operational performance. These benefits can include boosting revenues per customer by 50%, increasing customer penetration by 30%, and reducing operating costs by as much as 20%. (See Exhibit 1.)

Digital channels, especially mobile, are growing rapidly worldwide. Customers increasingly prioritize digital functionality when choosing a bank, our Consumer Digital Banking Surveys found. But

Our findings also showed conclusively that multichannel customers have higher expectations than single-channel customers and therefore are more challenging to serve. (See Exhibit 2.) They demand that their banks be simpler, quicker, more integrated, and more personal. Banks that get their offering right for this demanding group are more likely to get it right for the rest of their customer base.

Cybersecurity is also of increasing concern to customers amid a rising number of high-profile data thefts and account breaches. Customers require account security that offers gold-standard data protection but does not compromise the quality, speed, and ease of their banking experience. Questions remain regarding the extent of bank liability when a third-party provider, such as a retailer or a dating website, loses credit card data or fails to prevent the hacking of customer accounts.

Retail Banks Need to Improve Their Brand Advocacy

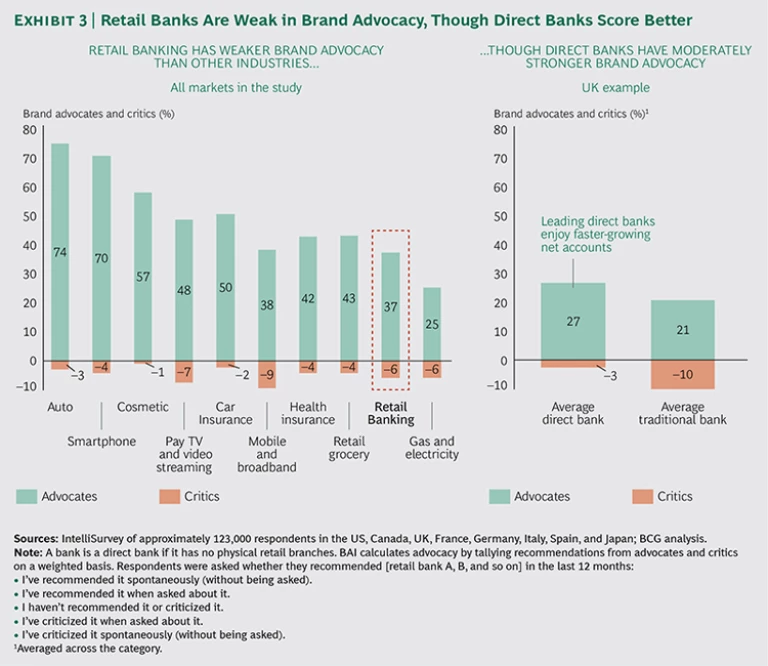

Banks looking to assess and improve their customers’ experience can do so through a simple yet powerful indicator that is also one of the best predictors of business performance: word-of-mouth recommendation, or brand advocacy. That’s the good news. The bad news is that most retail banks—and the industry as a whole—register weak brand advocacy compared with other industries.

BCG’s Brand Advocacy Index (BAI) measures word-of-mouth influence, including both recommendations and criticism, for 650 brands in more than 35 industries based on 120,000 surveys completed in eight countries worldwide. Responses are weighted to give an overall brand advocacy score by brand per country. The 2015 BAI study showed that retail banks rank significantly behind businesses in most other industries in brand advocacy, though direct banks fare slightly better. (See Exhibit 3.)

Globally, just 37% of customers positively recommended their retail banks. Direct banks—mostly small, upstart players that forgo branches and tellers to offer fluid, no-waiting services often online or mobile only—fared better than traditional brick-and-mortar banks in all markets. They were recommended on average by 44% of customers and sometimes by more than 60%—a high level of advocacy that helped them to achieve stronger net account growth in 2015.

In Germany, the three most-recommended banks were direct. In fact, the three top banks in most markets were fairly small, focused players. Almost universally, customers of these winning banks told BCG that they preferred these banks for their better service, greater trustworthiness, and enhanced product range. It’s likely that an ongoing backlash against large established banks has heightened customers’ expectations for performance on these dimensions. There were a couple of exceptions: branch and ATM locations were important in Japan, and fees were an important consideration in Spain.

Indeed, surveyed customers in 75% of countries cited “customer service” as the primary basis for word-of-mouth advocacy, and “trust in the institution” consistently ranked second. Offering an excellent customer experience can support sustainable growth, because it breeds brand advocates, who are less likely than customers in general to leave their bank and more likely to buy a greater number of products and to provide positive recommendations to friends and family. It is important to note that social media makes it easier than ever for customers to make their views known.

New Challengers Disrupt the Competitive Environment

Around the world, a host of small challengers—which have been, in many cases, encouraged and supported by regulators—are taking on established retail banks and presenting competition to the industry’s traditional, core offerings. While some of these upstarts operate little differently from established banks, they often claim to differentiate themselves through better service, lower or “fairer” fees, or offerings that purport to better resolve customers’ problems. These claims remain to be proven in the long term, but they are creating plenty of disruption now—in both developing and developed markets. In India, for example, more than 20 licenses for new and specialized banks were issued in 2015, after several years when few or no licenses were granted.

Many of the niche players among these challengers are financially adept technology companies that specialize in market subsections that traditional banks have struggled to make profitable—such as near-prime lending. They thrive by offering targeted and innovative products and touting speedy, hassle-free service.

For example, Avant, a US-based consumer loan provider, has developed an automated credit-screening process—using machine learning to predict the likelihood of customer credit defaults—that allows it to provide loan approval within 15 minutes of a customer’s application submission.

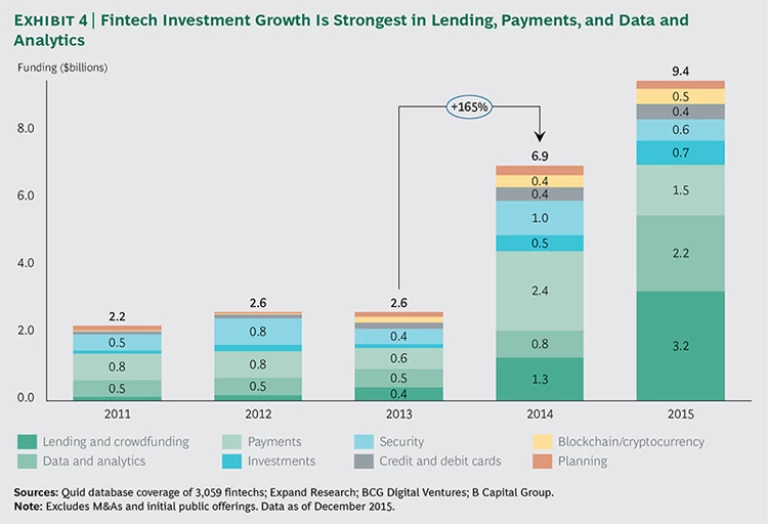

In recent years, fintech start-ups have increased dramatically in number and have harnessed new technologies to provide financial services while sidestepping the legacy cost structures and regulatory constraints of traditional banks. Collectively, fintechs now offer services covering many of the traditional business lines of retail and other banks, from credit cards and loans to payments, cross-border transfers, and digital currencies. Tradle, an early-stage, UK-based start-up, allows banks to perform know-your-customer assessments with a mobile app that also eases the path for customers applying for new accounts. Applicants complete all verification procedures and upload images of required documents on the app.

Several nonpublic firms have garnered more than $500 million of cumulative investment: Social Finance (or SoFi), Alipay, Avant, One97 Communications, and Square. More than 15 unicorns—start-ups with valuations of $1 billion or more—have emerged; their aggregate valuation is $49 billion. North America accounts for almost 1,700 of the roughly 3,100 fintech firms worldwide.

Often, fintechs provide superior customer service as a means of taking market share, rebasing prices, and stealing margin from banks. For example, peer-to-peer lending has grown by more than 150% since 2010, typically filling a gap for consumers or small businesses seeking small finance when traditional options are either not suitable or not available.

Markets differ significantly, however: in China, estimates show, fintechs may have accounted for

Some skeptics believe that the share of revenues and margin captured by fintechs will remain small in the long term. They may have to revise this prediction, however, if fintechs manage to increase their market share in more profitable niches than they currently occupy. For example, in UK peer-to-peer lending, vehicle purchases and debt consolidation already account for 46% and debt consolidation 25%, respectively. Both of these areas are more profitable than many other traditional banking activities, such as

For leading retail banks, however, fintechs offer an opportunity to achieve a step change in performance: they can learn from and adapt fintechs’ innovative methodologies, tools, and capabilities. In fact, many banks are investing heavily in fintechs through accelerator programs and competitions. Barclays’ global accelerator program is one example; it is supported by Techstars, which offers office space, expertise, mentoring, and seed funding to start-ups in return for a 6% equity stake. Other banks, such as Santander, sponsor competitions to encourage fintech talent.

Meanwhile, some banks, including HSBC and Capital One, are setting up innovation labs that operate as independent entities with their own distinct cultures. The labs recruit start-up talent and collaborate with the wider tech industry.

In some instances, banks are buying or partnering with successful fintechs and then integrating them into their operations. One of them is the Spanish multinational Banco Bilbao Vizcaya Argentaria, which has won multiple awards for its digital applications. BBVA made at least two significant digital purchases in 2014: Simple, a US digital-only bank, and Madiva, a company specializing in aggregation of publicly available big data. Also, BBVA is partnering with payment service provider Dwolla to offer customers rapid online and mobile payment and recently purchased a share of mobile-only Atom Bank, based in the UK.