For all the angst over the disruptive impact of financial technology providers, the smart money in corporate banking sees fintechs as strategic allies, not enemies. Over the past decade, the fintech market has become a hotbed of customer-centric banking innovation. Sleek and efficient offerings such as payments, foreign exchange, advanced analytics, and supply chain finance are redefining service, creating lucrative niches, and extending corporate banking activities from the small-business segment to the mid-cap and beyond.

Although their service models have attracted considerable attention, fintechs are unlikely to endanger established corporate banks in the near term. Existing players hold sizable structural, economic, and relationship advantages that new entrants will have trouble overcoming. Instead, far and away the greater threat comes from within corporate banking’s own ranks—from fast-moving incumbents that blend fintech innovations into their business and operating models. Some corporate banks have already begun to parlay their investment in fintech partnerships, acquisitions, and internal incubators into big gains by launching attractive new services, reaching underserved segments, and differentiating the client experience—at competitive price points and lower operating costs.

To avoid being left behind, corporate banks need to determine where fintech innovations can deliver the greatest top- and bottom-line impact and develop a cohesive strategy for befriending their fintech foes.

Weighing the Fintech Threat

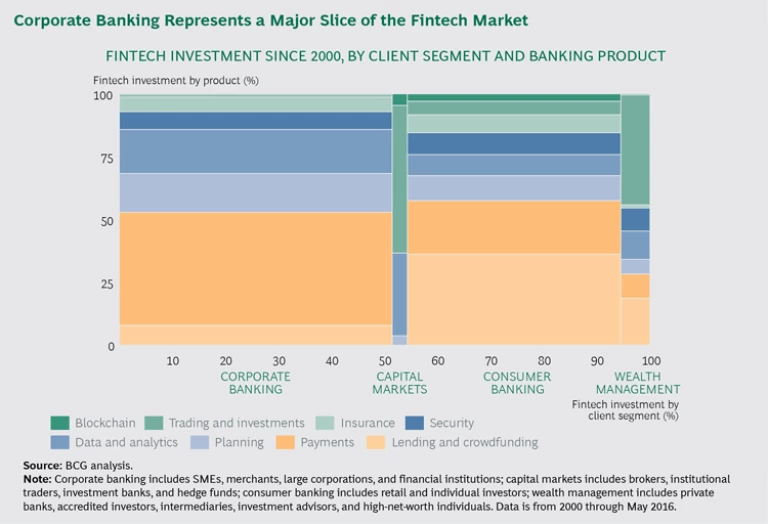

Of the approximately $78 billion invested in the fintech market since 2000, more than half has gone to fintechs in the corporate banking sector. (See the exhibit.) Despite their growth and innovation, however, the new entrants face several barriers that offer established players a number of advantages in the near term.

First, incumbent corporate banks enjoy an inexpensive and stable deposit base and greater institutional access to equity and debt markets. Fintech business models, by contrast, tend to depend on wholesale funding, such as institutional money (including hedge funds), brokered deposits, foreign deposits, and public debt. This type of funding costs more and can dry up during a downturn.

Second, incumbents also enjoy long-standing customer relationships, especially in the mid- and large-cap segments. BCG’s benchmark data confirms that corporate banking is very much a people business and will remain so even if clients come to rely more heavily on remote and digital service interactions. Their client relationships make it easier for banks to upsell and cross-sell, drawing on their professional sales forces and multiproduct offerings to serve the full suite of client needs. Fintechs lack that base: their offerings tend to be transactional and oriented toward single products. Moreover, banks court long-term relationships with higher-value clients, which deliver greater lifetime returns. To attract these clients and sell larger, more complex services, banks often spend $1,000 or more per prospect, a figure that can be prohibitively high for fintechs on a startup budget.

The nature of many corporate banking activities provides another layer of defense. Fintech solutions are better suited to offerings that can be easily engineered and standardized for digital channels, whereas banks tend to be stronger at managing the nuances of complex products, such as derivatives and structured credits. Banks also hold a full banking license and have the capacity to keep up with heavy regulatory demands. This can be a struggle for younger, smaller entrants.

A Major Indirect Threat

Although fintechs may not displace corporate banks directly, an indirect threat—posed by the banks themselves—is likely to be more sweeping and profound.

Corporate banks that move swiftly to combine their funding, relationship, and sales force strengths with fintechs’ customer service and efficiency edge will have an advantage over the rest of the field. Already, several corporate banks have signed up fintech partners to lock in proprietary technologies and gain access to specialized services and talent before the cost of acquiring those businesses climbs. Incumbents that do not move quickly will be hit twice—by fast-moving competitors and by fintechs that nibble away margins in attractive fee businesses, such as payments, supplier finance, and foreign exchange.

The fintech capabilities that corporate banking leaders are looking to capitalize on include the following:

- Specialized Service. Fintechs home in on specific parts of the value chain. In payment processing, for instance, MineralTree offers a cloud-based mobile and online platform for which it develops customized products and processes. Similarly, within supply chain financing, companies such as Taulia, Viewpost, and MarketInvoice provide automated electronic invoicing and payments. Beyond offering a superior customer experience, such services are less regulated, and thus easier to launch, and highly profitable, delivering revenue along with customer insights that can be used to market additional services. Some payment players, for example, have begun using the cash flow data gleaned from transaction processes to enter the funding market.

- Low Cost. The ability to digitize and standardize offerings lets fintechs sell products, platforms, and services at substantially lower prices than corporate banks do. Businesses such as TransferWise and freemarketFX offer international transactions that cost 75% to 80% less than traditional offerings. Others, such as Ripple, are using blockchain technologies, similar to the algorithms that run services such as bitcoin, to accelerate processing times for payment settlement and to lower transaction costs. Such technologies combine robust computing power with decentralized payment networks to generate back-office efficiencies, saving banks billions of dollars a year, by some estimates.

- Digitally Enhanced Features. By partnering with fintechs, corporate banks can take advantage of modern, flexible, and integrated IT architectures to provide real-time interaction, speedy processing, continuous availability, and other attractive customer features. Kabbage, for example, can approve loans of up to $100,000 for small businesses in as little as seven minutes. Earthport’s platform and network capability allows the company to settle international transactions in near real time, thereby removing the need for correspondence banks to serve as intermediaries. And BioTrust’s multimodal voice, facial, and biometrical recognition features make access more secure and convenient.

- Ability to Reach Underserved Segments. Offerings from Lending Club, Kabbage, OnDeck, and Amazon Lending have grown exponentially by servicing segments that are often shut out of traditional corporate banking channels—such as the small-business subprime category. These fintechs are able to apply digital lending models to assess the creditworthiness of clients whose financial profiles don’t conform to traditional lending processes—something corporate banks have long aspired to do but have yet to master. The flexibility of many fintech business models allows companies such as Receivables Exchange to support data-enabled services at a granular level, such as the trading of single receivables, which can help small businesses that manage large volumes of highly volatile accounts receivable.

- Strong Data Analytics. Corporate banks are sitting on what is arguably the best source of customer data: clients’ core investment or transaction accounts. By combining the predictive risk modeling techniques that fintechs have refined with their own data and balance sheets, corporate banks can offer far better pricing and selection. Similarly powerful data-crunching capabilities can help corporate banks enhance their underwriting practices. OnDeck, for instance, uses 2,000-plus data points from more than 100 sources, while PrimeRevenue’s SCiMap tool sifts through thousands of variables to optimize payment terms for clients.

Corporate banks that don’t act swiftly to adopt these fintech capabilities will see profit margins come under increasing pressure—especially in areas such as foreign exchange, international transactions, and trade finance (and in segments such as small-business lending), in which fintech offerings not only cost much less but also provide better value and experience. Back-office gains may be even more pronounced. Fintech technologies can help corporate banks accelerate their own digitization efforts, achieving greater process automation and improved risk management outcomes faster and often less expensively than they could on their own. Those savings can be channeled into better pricing and client service to keep slower-moving banks at a disadvantage.

Engaging with Fintechs for Competitive Advantage

To avoid seeing profitability erode, corporate banking leaders should move swiftly to do the following.

Prioritize innovations with the greatest impact. When developing their engagement strategies, corporate banks should focus on the handful of areas where fintech capabilities will offer the biggest lift in customer retention and satisfaction, new-product offerings, risk assessment, or cost efficiency. Management needs to look across activities as varied as sales, risk, onboarding, servicing, and product lines to understand where and how digitization is likely to reshape value creation and to spot critical gaps. It’s also important to consider where the business is most vulnerable in order to ensure that the strategy can help defend as well as attack. Scenario modeling and diagnostics that assess the bank’s digital maturity in a range of practices can provide some of this guidance.

Build, partner, or acquire. If a bank has the culture and track record to create disruptive capabilities, building offerings can be less expensive than developing them through partnerships or acquisition. However, that approach requires significant management time and technical talent, both of which may be hard to secure. As an alternative, some banks are establishing internal incubators. One US corporate bank, for instance, relies on a fintech accelerator program to get a jump on promising innovations and gain access to the digital talent needed to turn ideas into customer solutions.

Others are establishing partnerships, such as JPMorgan Chase’s recent deal with OnDeck, a leading small-business lending platform. The deal will allow Chase to take advantage of OnDeck’s sophisticated credit modeling and could give the bank an underwriting advantage over competitors.

Acquisition is another option. Some corporate banks are creating venture capital funds of more than $100 million to invest in or acquire promising fintechs. Benefits include access to attractive, market-tested technologies and the ability to prevent competitors from using them. That can be especially powerful if a fintech has distinctive capabilities and offerings that are hard to replicate. Dips in fintech valuations may provide buying opportunities, but as with any acquisition, cultural, technological, and other forms of integration can be difficult.

Fast-moving players that develop a thoughtful fintech engagement strategy will be able to lock in strong partnerships, talent, and proprietary technologies and deliver superior financial performance. Winning corporate banks will make fintechs their allies, not their enemies.