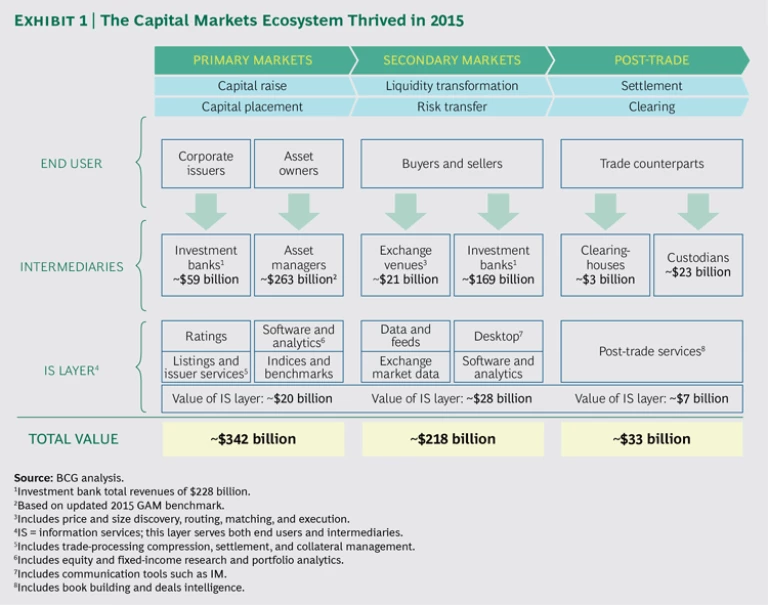

The capital markets ecosystem, as a whole, thrived in 2015. (See Exhibit 1.) New pools of value are emerging, and opportunities abound amid ever-intensifying competition. Yet the sharp focus on investment banking performance over the past five years has masked a broader truth: banks are not the only players competing for revenue. Asset managers, hedge funds, high-frequency traders, exchanges, information service providers, clearing-houses, infrastructure firms, and custodians, for example, all have critical roles.

Global Capital Markets 2016

- The Value Migration

- How Value Is Shifting in the Capital Markets Ecosystem

- How Investment Banks Can Transform Their Business Models

As banks retrench and relinquish control of the value chain, this broader set of industry participants is now being presented with an opportunity to compete for revenues that, traditionally, might not have been considered up for grabs. It is no coincidence that the past two years have been among the most active in the history of capital markets M&A. And firms today are moving strategically to capture as much as of the future revenue opportunities as possible.

Secular Trends

A distinct and unique set of secular trends is driving change in the capital markets industry and altering the competitive landscape. Revenues and costs may shift, and in some instances will erode or be destroyed. New pools of value will also emerge. Information service firms and exchanges may compete directly, and new market constituents may emerge. The secular trends in play today can be broadly described as follows:

-

Cost Mutualization. Exchanges, information service providers, and infrastructure firms derive their revenues from the cost base of the sell side and the buy side. While it would seem logical to assume that their fortunes would therefore run in parallel, the need to mutualize costs means that, in fact, third-party providers now have an opportunity to accelerate their growth. Utilities and industry consortia are offering outsourced solutions for duplicated middle- and back-office post-trade processes that add little value. They have expanded into trade identification, trade reporting, and client onboarding functions, such as Know Your Client and anti-money-laundering measures. Other market-related functions, such as trade surveillance and benchmark administration, are also being actively considered.

This trend is still in the initial stages; growing regulatory and compliance requirements will drive further demand for utilities. Regulatory audits will increase the need for standardized models and data as a service. Indeed, utilities deliver so-called regulatory cover, meaning that authorities are more likely to accept standards that have been adopted by the industry as a whole than those pursued by an individual firm on its own path toward compliance. We estimate that the cost mutualization revenue opportunity will exceed $6 billion over the next five years.

Growth of the Buy Side. Growth in AuM, combined with demand for investment management services, represents the single biggest revenue opportunity in the capital markets ecosystem. Investment management revenues are set to grow at a compound annual growth rate of 3%, to $300 billion, by 2020. While this trend is not new per se, growth in buy-side AuM will introduce new dynamics to price discovery, risk transfer, and liquidity realization. This in turn will drive increased demand for buy-side connectivity. Indeed, as a result of the increase in the flow of funds, there are more highly skilled buy-side players today than there were five years ago. Investment managers hold the majority of inventory and often have access to better pricing and general market information than their dealer market makers. As a result, the buy side is looking toward trade execution environments that enable them to trade with other buy-side firms, hedge fund replicators, and even online wealth-management services.

The buy side is also seeking new ways to realize independent revenues. The trend toward passive investing over the past five years has resulted in enormous growth in index-based trackers, exchange-traded funds, and other “smart” beta instruments. Issuing such products has opened up an additional means of growth for some asset management firms. The shift to low-cost passive investing has also created heightened demand for benchmarks, indices, and reference information. While sell-side firms were previously able to capture liquidity and new customers through their unique ability to deploy capital, new sources of liquidity that gravitate toward intellectual property are emerging. Exchanges owning benchmarks that are protected by intellectual-property law will be able to both command market liquidity and benefit from additional trading activity.-

Digital and the Importance of Data. Electronification continues to compress prices and erode sell-side margins, a trend that not only destroys revenue but also allows other players—such as high-frequency-trading firms—to compete. This development can create an environment in which only the largest players will have the scale to succeed. What’s more, investment banks that retrench will, in turn, accelerate the move to agency business models and the migration of over-the-counter products onto exchanges. We estimate that more than $5 billion in market-making revenue has migrated to alternative firms, such as high-frequency-trading players. This amount will grow over the next five years as more asset classes are traded electronically.

Electronic markets also reduce the need for human labor, undermining the requirements for individual desktop software, terminals, and other graphical-user-interface products. This development increases the relevance of other layers in the technology stack, such as security, data centers, communication protocols, and physical networks. Electronic markets require both straight-through processing (STP) and the streamlining of the trade life cycle to reduce operational risks—in turn creating new opportunities for other technology-related services, particularly for post-trade products.

Electronic markets lead to higher volumes and a proliferation of market data as well, presenting new opportunities in mining, packaging, and redistributing actionable information as quickly as possible. Exchanges and information service providers, which enjoy extensive control of market data, will be able to increase prices in order to generate additional revenues. The proliferation of big data will shift emphasis away from the traditional sell-side research model. Buy-side players—armed with large volumes of reported trade data, inventory information, economic indicators, market news, and other forms of data—will increasingly adopt an independent approach to the investment-decision-making process.

Furthermore, greater access to historical data and statistical analysis will enable investment managers to increase their effectiveness and efficiency as well as use machine-learning algorithms to discover clearer market entry and exit signals. They will be able to answer natural-language questions about the impact of events on asset prices, as well as derive structured data from unstructured sources, such as the Internet, social media, and text published by newswires. Technologies such as cloud, distributed computing, and mobile will also increase operating leverage, while improving both the customer experience and the overall technology revenue footprint in the capital markets ecosystem.

Finally, for investment banks, financial technology (fintech) can be a useful, low-cost alternative to expensive bolt-on legacy IT architectures, which are difficult to manage and to maintain, inflicting high costs. By commingling electronic market data with diverse sources to analyze real-time and historical data, banks can also develop an internal view on client profitability. Startups can both threaten bank revenues as well as enable banks wishing to move into new areas of financial services to gain a foothold.

Industry Convergence

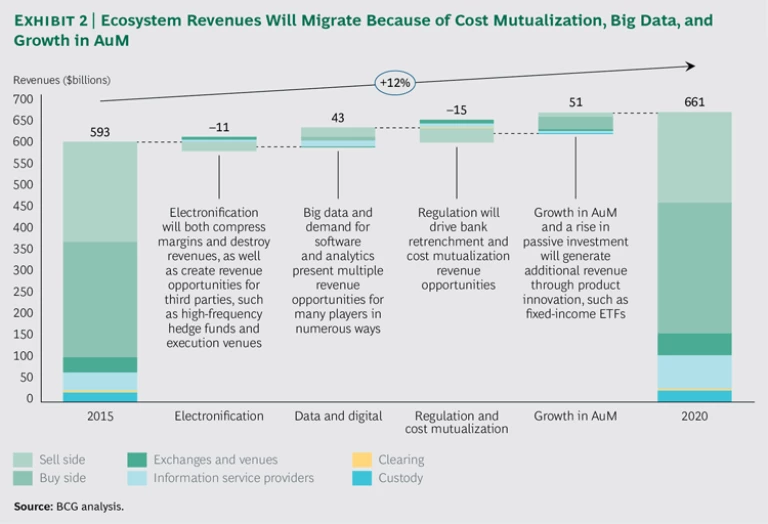

Regulation and technological innovation are fundamentally changing the capital markets industry. By 2020, these forces will cause the broader capital markets ecosystem to produce revenue growth of about 12%—increasing from $593 billion to an estimated $661 billion—with revenue migration driven largely by ongoing electronification, big data, cost mutualization, and growth in AuM. (See Exhibit 2.)

Information service providers and execution venues will compete for a growing portion of the revenue pool, increasing their market share to 19% from 14% in 2015. In addition, the buy side will generate and retain more of the available share of wallet than the sell side and increase its market share by 6%, to 45%. By contrast, we expect that sell-side revenues will constitute just 31% of the overall revenue pool in 2020, down from 54% in 2006.

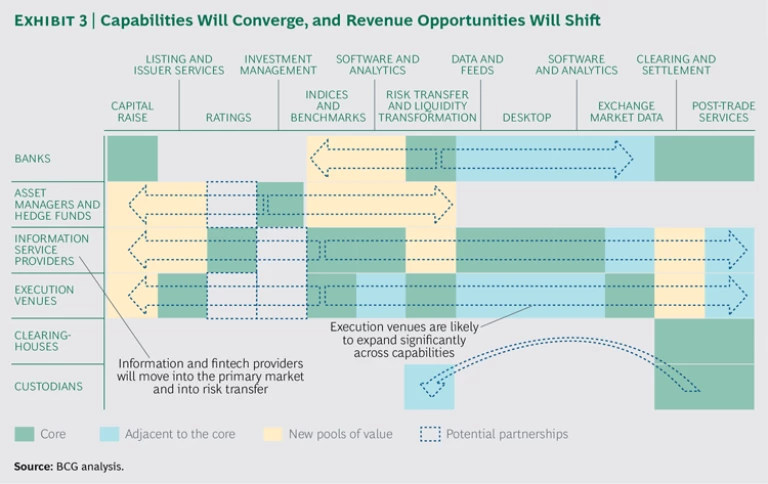

As the competitive landscape shifts, key players will reinvent themselves, creating new capabilities and converged roles. New business models may also emerge, as players today are more likely to move across the value chain in pursuit of nontraditional revenues.

Investment banks, of course, operate along multiple aspects of the value chain. They dominate the capital-raising function and act as market makers, supplying capital to facilitate both risk transfer and liquidity transformation. Banks also often provide post-trade services, such as trade settlement and clearing, to their clients. What’s more, some operate asset management companies, while others act as custodians. With such a broad footprint, banks will have to consider total cost of ownership along the value chain, from the pretrade decision-making process (research), to trade execution (next-generation algorithms and market access), to post-trade efficiency (STP, settlement, and collateral management). They may even start charging customers appropriately for the full gamut of offerings, instead of giving away services in the hope of generating revenue in alternative channels.

Indeed, investment banks today have less incentive to give away valuable information assets, such as research and benchmarks, in the hope of generating revenues via spread-based products. They will increasingly embrace explicit charging models as the industry continues to move away from soft-dollar services. Some will seek to monetize their rich information sets and will explicitly charge for data, applications, and intellectual property. They may seek research utilities for financial-data models, as well as sell data from their systematic internalizers and dark pools (private markets). We can also expect banks to behave like service providers, as in electronic execution and prime brokerage, advising buy-side firms on algorithms and effective leverage, and on how best to engage with and manage their own client bases.

Meanwhile, the buy side will continue to diversify into software and analytics. Sophisticated buy-side firms are most likely to lead in terms of innovation. We already see some firms offering advisory services in securities origination as well as in risk management. New business models will emerge to allow investment managers to bypass banks when it comes to helping companies raise capital in the public markets. We expect additional strategic announcements that will enable buy-side-to-buy-side networks to facilitate risk transfer and liquidity transformation, again without depending on investment banks. Overall, capabilities will converge and revenue opportunities will shift for all market participants. (See Exhibit 3.)

Moreover, very few elements of the value chain will be off-limits to information service providers and to exchanges. There will be a greater push for liquidity to form on trading venues such as swap execution facilities. Exchanges will focus more on bolstering intellectual-property assets and on expanding their post-trade capabilities. As the role of the human trader declines, information service providers will cease to give away desktop applications and software in the hope of generating demand for chargeable data. As machine-to-machine trading proliferates, these providers will seek out new opportunities across the technology stack. There will be a greater focus on diversifying and developing dormant intellectual property. For example, interdealer brokers are already expanding into post-trade and risk analytics as they revamp their own intermediation models.