This is an excerpt from Global Payments 2016: Competing on Open Seas .

Currently, about one-third of payments-related fintech investment is going to B2B providers. Although B2B does not grab as many headlines as C2B, significant pain points still exist for banks’ corporate customers, and the opportunity to solve problems and deliver value is sizable. Indeed, banks that act decisively are in a prime position to be a core partner in corporate treasurers’ digital transformations.

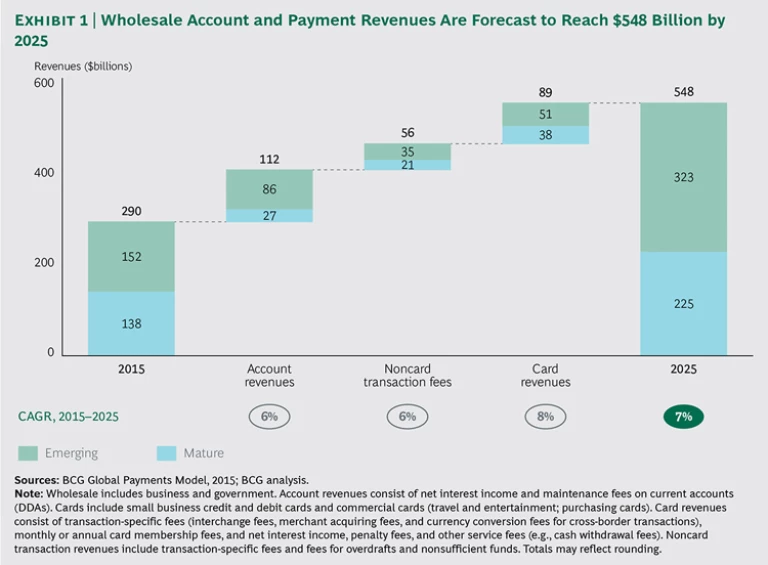

The stakes, of course, are high. Wholesale transaction banking—which includes payments, cash management, and trade finance—generated about $370 billion in revenues globally in 2015. Account and payment revenues (included in BCG’s Global Payments Model) represented $290 billion of that total and are expected to reach $548 billion by 2025, a CAGR of nearly 7%. (See Exhibit 1.) In general, growth will be driven by increasing volumes and deposit balances, as well as by improving spreads. The importance of these drivers, however, will vary by region. In RDEs, account revenues stand out as a dominant growth engine.

Overall, even though growth projections for revenue pools are solid, it is becoming increasingly challenging to excel in wholesale transaction banking. Regulation has intensified competition and also made it more difficult to do business, especially with regard to “know your customer” (KYC) regulations. Shortcomings in banking services, along with the wish of some corporations to be “bank agnostic,” have opened the revenue doors to fintechs and digital giants. Such players are not likely to displace transaction-banking business models outright, but some entrants are successfully making inroads with specialized services and customer-friendly interfaces. In addition, the increasing adoption of treasury management systems (TMS) and enterprise resource planning (ERP) platforms gives corporate treasurers a powerful alternative to bank portals.

Nonetheless, banks can combine their financial expertise with their tech acumen to fulfill the trusted advisor role, simplify treasurer’s lives, and fuel growth with what we call “smart selling.” In addressing these calls to action, we will incorporate relevant findings from a recent global survey of corporate treasurers conducted by BCG and BNP Paribas. (See Corporate Treasury Insights 2016: It’s All About Security and Client Experience , a Focus report by BCG and BNP Paribas, May 2016.)

Fulfilling the Trusted Advisor Role

In our view, wholesale transaction banking is far from becoming a commodity. Rather, it is ready for a renaissance driven by service innovation. The renaissance begins with the bank playing the role of key advisor: sitting down with corporate clients, learning what their priorities and pain points are, and figuring out the best solutions. Treasurers would clearly like banks to assume this role in many areas, including risk management and cybersecurity, as well as data and analytics.

Risk Management and Cybersecurity. Many treasurers are ill equipped to oversee the growing set of risks that they face—especially in the critical area of cybersecurity. Among treasurers in our survey who cited cyber attacks as a significant risk, more than half reported they had not deployed (or were unaware of) mitigation measures such as staff awareness training, authentication tokens, and fraud-detection tools. In addition, approximately three-quarters of respondents said they did not use cognitive systems, infrastructure defense barriers, or network traffic monitoring mechanisms. Banks can fill that void by providing advisory services and certification of their clients’ IT security. Some banks could go a step further by building in-house solutions or partnering with tech providers that specialize in cybersecurity.

To be sure, survey respondents signaled that they would look favorably on banks that take proactive measures to share their expertise and help strengthen internal control procedures and IT infrastructure. One treasurer noted, “I would pay for advisory services from my bank to diagnose such things as the security level of my systems and to help me understand what I should improve.”

Data and Analytics. Corporate treasurers are increasingly in need of advanced data analysis but often find current tools inadequate—because the tools either do not deliver as promised or are not sufficiently customized. While cash-flow forecasting tools are always in demand, treasurers are also seeking advanced FX exposure analysis and metrics in areas such as peer-group performance, working capital, and payment efficiency. Banks that can offer flexible tools and provide analytics advisory services that meet the individualized needs of treasurers will be very well positioned. As one treasurer stated, “There are great opportunities for concrete consulting assignments for banks.” Another noted that “these are things where banks are in the pole position.”

Simplifying Treasurers’ Lives

“We want simplicity” is a recurring plea of corporate treasurers, many of whom remain focused on traditional products. A sizable number of treasurers still feel that most banking products are commodities, and they value fair pricing and quality of execution more than pure product innovation. But simplifying treasurers’ lives is no simple endeavor. It involves easing the complexity and friction that is inherent in many customer journeys, as well as truly becoming part of the treasurer’s tech ecosystem.

Easing Customer Journeys. Treasurers are engulfed in a morass of banking paperwork. They have valid complaints regarding inefficient processes that result in difficult customer transactions, such as those involving the opening of new accounts. While some banks have helped battle the paper overload by offering electronic-bank-account and signatory management, few have made further inroads. As a result, there is a significant opportunity for banks to differentiate themselves on this front. Banks that take a client-centric perspective in overhauling processes will benefit from a virtuous circle: faster customer onboarding, higher satisfaction, earlier revenue streams, stronger cross-selling, and greater loyalty.

Indeed, banks can stand out by focusing on several specific areas. First, they should simplify, standardize, and automate forms, maintaining a central depository of data that is accessible bankwide. Second, they should explore the potential of proprietary or shared blockchain-based solutions to allow them to function as a decentralized, fully secure repository of data. (See “A Reality Check on Blockchain.”) Third, many treasurers would like banks to go one step further and share relevant KYC data with third parties such as external FX trading-platform providers.

A Reality Check on Blockchain

Blockchain is one of the most-hyped technologies to come along in a great while. It is also one whose label is being applied loosely and, according to some, falsely. Yet beyond the hype and the debate, it’s clear that the concept of blockchain is spurring both innovative thinking and targeted investment aimed at solving pain points in payments. Banks should thus evaluate blockchain’s potential as a technological improvement to their current operations and as a means of launching new business models.

Blockchain technology is showing promise in critical areas such as trade finance and cross-border transactions for commercial customers, consumers, and even banks (internal cross-border transactions). Such innovations may have profound implications for correspondent banking and remittances. Indeed, global banks need to explore how blockchain technologies can simplify and streamline their correspondent bank networks, while domestic banks with international aspirations should determine if there is a platform that could facilitate their ability to provide cross-border services.

Beyond cross-border payments, blockchain may help overcome m-wallet interoperability challenges. For example, Stellar is applying its blockchain platform to enable the interoperability of m-wallets in Nigeria. For corporate treasurers, the leap to blockchain is a long one, although many report that they find the technology conceptually appealing. For blockchain to gain traction, banks will need to provide a controlled, regulated ecosystem and battle-tested use cases. Demand from multinational corporations should be robust given that, for some, the majority of their transactions are intracompany and often cross-border.

Banks can also leverage their unique competitive advantage over fintechs and digital giants to assist companies in meeting their compliance and regulatory requirements. Several treasurers in our survey expressed interest in bank support, with responses such as “I expect my banks to provide me with regular updates on regulatory changes that could affect my company” and “I would love to have my banks helping me handle China’s compliance requirements.” Beyond KYC and compliance, banks can further add insight by helping corporations evaluate vendor risk.

Another area ripe for simplification is cross-border transactions, which have vast room for improvement not only from a client perspective but also from an operational-efficiency standpoint. Most cross-border transactions run through a correspondent-banking network, which can be slow, opaque, and expensive. Recognizing that they must develop a better model, more than 75 leading global banks, along with SWIFT, launched the global payments innovation initiative (GPII) with a goal of providing same-day use of funds, fee transparency, end-to-end payments tracking, and rich payment information. The GPII comprises a service-level agreement rule book, a platform for smart collaboration (such as enhanced compliance practices and optimized intraday liquidity flows), and SWIFT platform enhancements (such as centralized payments tracking). Set to go live in early 2017, the GPII is a prime example of how banks and third parties can collaborate to deliver simplicity and remain competitive in the face of fintech incursions.

Becoming Part of the Treasurer’s Tech Ecosystem. Our survey revealed that many treasurers still consider banks to be the gold standard when it comes to IT system quality. And although many treasurers claim to be bank-platform agnostic, they still expect banks to position themselves at the center of their tech ecosystems in order to help them not only carry out but also simplify their jobs. Treasurers are increasingly called upon to understand how technology can make their operations more efficient and effective. Most, however, have not been trained in cutting-edge technology. Given that banks are at the nexus of systems, connectivity, and massive amounts of data, they are in a prime position to support treasurers in optimizing their tech infrastructure. As one treasurer described it, “Banks are now IT companies selling financial solutions.” Indeed, many treasurers now expect banks to behave like tech companies. They also question the traditionally segregated front, middle, and back office structure that can impede access to banks’ IT teams.

Banks can respond to these needs by bringing the tech side to the client earlier in the process and by encouraging ongoing engagement. A myriad of benefits can result. First, the tech side hears the customer’s voice directly. Second, closer tech-client ties foster codevelopment opportunities and facilitate beta-testing of new products and services. Ultimately, reducing friction should result in cost savings.

Banks’ evolution toward providing more technology assistance should also involve exploring new solutions such as application programming interfaces (APIs), through which banks can facilitate access to their services and data, and provide (as one survey respondent put it) “plug-and-play solutions.” The few pioneering banks that offer APIs view them as an additional channel, not as a substitute for pushing services and data through their portal or ERP integration. For commercial customers undertaking large numbers of transactions or massive information processing (such as accounts receivables reconciliation), APIs enable seamless integration of data access into their platforms.

Another area in which banks can provide vital support is in digitizing the financial supply chain (from order to reconciliation), which remains fraught with paper and manual processes and has accordingly attracted fintechs as well as digital giants. While treasurers report that they like the specialized value propositions of fintechs, 90% indicate that fintechs are not yet capable of meeting the full array of corporate treasury needs. Moreover, treasurers are wary of fintechs’ long-term sustainability. As a result, banks have an opportunity to team with fintechs to integrate solutions into their global offerings. In particular, e-invoicing and integration into accounting systems have been successful initiatives. These integrated services are particularly valued by middle-market companies, which typically do not have the in-house IT capabilities to digitize their financial supply chain. Another area ripe for digitization is merchant acquiring. (See “Winning in the Merchant Acquiring Game.”)

Winning in the Digital Merchant Acquiring Game

Merchant acquiring is experiencing a renaissance, highlighted by the current unprecedented rate of industry consolidation and digital transformation. This renaissance is being fueled by the rise of digital commerce and by technological advancements that are spawning inexpensive hardware and software-as-a-service (SaaS), enabling easy integration. Digital disruption is allowing both incumbents and new entrants to offer new value propositions, redefining the power of scale and generating both new business models and an extended value chain. Not all stakeholders, however, will be able to reap the rewards.

The renaissance in merchant acquiring is concentrated in the small and medium-size enterprise (SME) segment and is being driven by advances in integrated POS (IPOS) systems. IPOS systems combine a cash register system, a POS terminal, and value-added software. For merchant acquirers, selling IPOS systems is a powerful business model that combines an attractive business segment with an attractive value-added service. In most markets, the SME segment is the dominant revenue generator—typically accounting for about 65 percent of revenues and less than 30 percent of purchase value—and it has also experienced less margin compression than the large-merchant segment. The benefits of offering IPOS systems to SMEs are many: margin preservation, a compelling sales pitch that competes more on value than on cost, and access to SKU (stock-keeping unit) data. Our experience suggests that the margin decline for a merchant using an IPOS system is three percentage points less, on average, than the margin decline for a merchant not using an IPOS system.

In order to excel in the IPOS game, acquirers must strive for three key success factors:

- Deliver differentiated value-added services, which is of paramount importance in increasing retention, minimizing the impact of margin compression, and generating additional revenues. Acquirers need to prioritize the right value-added services at the industry vertical level.

- Achieve distribution scale at the industry vertical level, which is required to realize the potential of an integration-driven strategy. To excel in delivering IPOS systems—one of the most attractive value-added services—an industry-specific approach is critical.

- Execute an effective acquisition and partnering strategy, which is critical to achieving the first two success factors. Merchant acquirers, depending on their individual market share and product scope, can potentially pursue three acquisition plays: gain distribution scale; extend and differentiate capabilities in the core business; and expand into adjacent merchant services. Partnering is another option that can build distribution scale and extend capabilities, in addition to providing experience in new markets or products.

Fueling Growth with “Smart Selling”

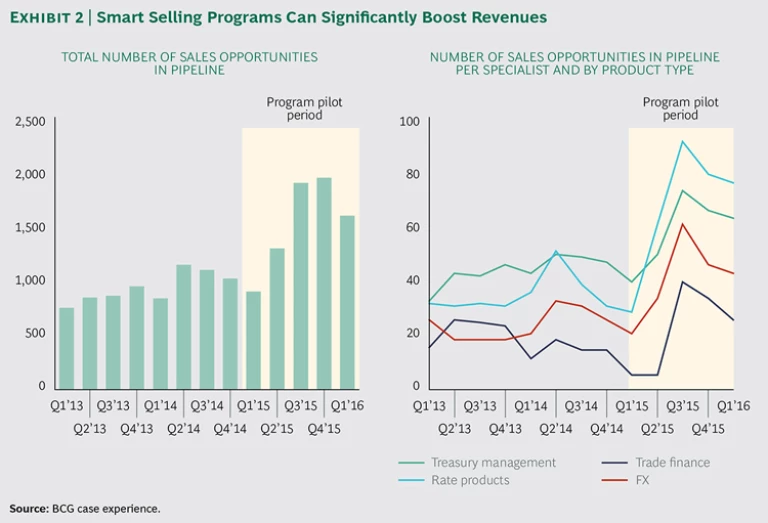

Beyond responding to the voice of the treasurer, one of the greatest opportunities for boosting wholesale transaction-banking revenues is in enhanced cross- and upselling, or what we call smart selling. BCG’s experience with smart selling has shown that a significant portion of revenue-growth opportunity is concentrated in a bank’s existing clients, whereas business from new clients tends to be relatively minimal and can take years to develop. Many banks have an incomplete understanding of the client wallet—especially by industry, size, and region—and have fairly rudimentary selling approaches, typically leading to poor conversion. BCG has found that within an individual bank, there can be large disparities in sales force performance across comparable clients. With a smart selling approach, banks can turbocharge growth by 10% to 15% within 12 to 18 months and achieve a far higher conversion rate. (See Exhibit 2.)

Smart selling essentially comprises four components: sizing the wallet and identifying opportunities; validating with relationship managers (RMs) and sales teams; developing a sales plan and tracking results; and creating and embedding a toolkit.

Sizing the Wallet and Identifying Opportunities. BCG has developed a proprietary “market cube” model segmented by revenue, industry, and product type, which can be combined with client data to generate a share-of-wallet opportunity map at both the client and product level, identifying cross- and upsell opportunities.

Validating with RMs and Sales Teams. Critical to the success of a smart selling initiative is buy-in from the RMs and product sales teams. The process must result in not only validating the opportunities but also identifying and overcoming historical challenges to seizing these opportunities. Ultimately, the RMs and product sales teams must jointly commit to pursuing the opportunities with an agreed-upon time frame and conversion goal.

Developing a Sales Plan and Tracking Results. BCG has found that “closed loop” account planning and sales execution processes can drive transparency and positive operating momentum. Account planning starts with the prioritization of opportunities on the basis of a portfolio heat map, and is completed at the start of each sales cycle. RMs and product specialists meet with clients and track their results using a sales funnel approach.

Creating and Embedding a Toolkit. Execution and tracking excellence requires arming RMs and product sales teams with key tools such as a share-of-wallet calculator and an account-planning and tracking tool. In addition, effective incentive systems and coaching must be put in place.

Another initiative that has proven to be highly successful is so-called smart pricing. This involves stronger governance and discipline in enforcing pricing protocols, the implementation of effective sales incentives (such as a focus on margins instead of on revenues), the repricing of existing business (for example, eliminating unjustified discounts and reinstating omitted charges), and improved price realization on new business. BCG has found that fee revenues can be increased by 12% to 17% through smart pricing.

Ultimately, the payments industry is being transformed in ways that can play to the strengths of not only fintechs and digital giants but also bank incumbents themselves. It is clear, moreover, that although ongoing change and disruption in the industry are here to stay, the exact types of players that will emerge as true long-term winners is not. Finally, amid a great deal of industry uncertainty, there is one fact that remains absolutely certain: Inaction is not an option for players that wish to achieve or maintain market-leading positions. In order to win, institutions must capitalize on the disruption—and find a smart way to compete in today’s wide-open payments seas.