This is the third in a series of articles on technology economics.

To navigate the physical world, ship captains use longitude and latitude. To navigate the technology economy, business and technology leaders need other tools.

In the first two articles in this series, we explored the strong relationships among technology spending, corporate profits, GDP, and productivity. (See “ Why Technology Matters ,” BCG article, September 2016, and “ Why the Technology Economy Matters ,” BCG article, September 2016.) To track the impact of their spending, we’ve recommended that business leaders keep a close eye on technology intensity, a proprietary metric that analyzes technology spending relative to a company’s and an industry’s revenues and operating expenses simultaneously.

In this article, we argue that each industry has an optimal level of spending on technology and that it can be determined on the basis of technology intensity. The diagnostic we outline is superior to conventional approaches, such as simply assessing technology spending as a percentage of revenues or operating expenses without considering business performance. Consideration of technology intensity in the context of profitability links technology and business performance in a new way and provides a basis for maximizing and optimizing the return on technology investments. This structured way of investing in technology can differentiate companies from their competitors and deliver tangible results.

The Efficient Frontier of Technology Spending

In 1990, Harry Markowitz won a Nobel Prize in economics for his contribution to the development of modern portfolio theory. Central to the theory is the “efficient frontier,” a curved-line chart that reflects the optimal balance between risk and return in a portfolio of investments.

The close relationship between technology intensity and gross margins, highlighted in the first article in this series, makes it possible for companies to derive a technology economics frontier, which our research has validated across 3,000 companies in 21 sectors over the last decade. This diagnostic can indicate whether executives are generating higher- or lower-than-expected returns on their technology investments.

This frontier shows how reductions in technology investments can put a drag on company performance. Likewise, it can illustrate the performance penalty for over-investment. The diagnostic can identify a company that generates outsize returns by making highly surgical technology investments into infrastructure that supports big data and advanced analytics, and it can highlight another company that scatters its investments across so many subscale projects that few achieve critical mass and have a lasting impact.

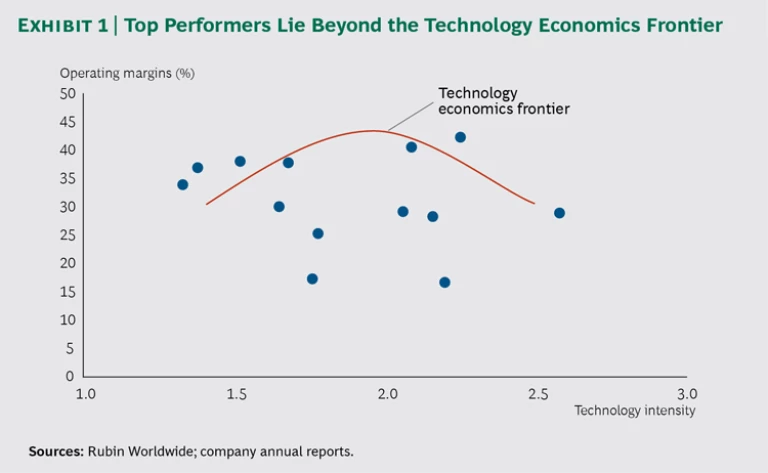

Exhibit 1, which shows the technology economics frontier for a set of companies in the banking industry, compares the performance of individual companies along the dimensions of technology intensity and operating margins. With sufficient data about the performance of many companies in an industry, we can draw a curve—the technology economics frontier—that best reflects all the individual data points. The apex of the curve represents the level of technology spending that maximizes profits: specifically, the point at which margins and technology intensity reach an optimal level.

The technology economics frontier reveals several insights:

- Companies that are to the left of the curve’s apex could be spending too little on technology: technology spending has the potential to improve their performance.

- Companies that are to the right of the apex could be spending too much on technology: technology spending is no longer improving their performance.

- Companies that are directly below the apex have found the right level of technology spending, but they might be investing in areas that don’t generate results.

- Companies that are directly above the apex are spending the right amount on technology, and they are also getting above-average returns from their investments.

Organizations can benchmark themselves at the company, business unit, and industry segment levels. A company that consists of business units with different characteristics can, for instance, benchmark itself unit by unit. Furthermore, the technology economics frontier is a valuable tool for industries that are facing disruption. Companies can chart themselves against disruptive new competitors. The exercise can reveal what companies aspire to and what they must change.

Executives can use their position relative to the technology economics frontier to target specific improvements in technology spending. One caveat: the technology economics frontier shows a point-in-time view of the historical link between technology intensity and profitability. It is an indicator that can fuel further analysis, not an absolute final judgment.

As they do with any other investments, executives must strive to achieve the right return on their technology investments. Masters of technology economics generate superior business performance while optimizing their spending. The following strategies can help executives manage their investment portfolios and reach the technology economics frontier.

Monitor the right metrics. To calculate the technology economics frontier, technology and business leaders must start by tracking a KPI, such as technology intensity, in management reports and dashboards. They should also look at other metrics that affect technology investments such as those we addressed in the first two articles in this series, including income per dollar of technology spending, the IT cost of goods, and output per dollar of wages.

Any metric that leaders choose to track should focus on both input measures of what the business aims to achieve with technology and outcome measures of true business impact. These metrics must be in alignment with the company’s business strategy and aspirations, connecting the dots between IT and the business. The right KPIs can include goals such as operational efficiency, customer intimacy, and product leadership. The ways leaders convey company performance to investors offer an excellent starting point.

Once they are monitoring the right metrics, those who influence technology investment—and those influencers include more functions and higher management levels than ever before—need to think about ways to embed the emerging KPIs into the business and use them to improve performance. Furthermore, executives need to periodically refresh the metrics. Today’s new digital metrics might be relevant now, but things can change. Management must review the metrics from time to time to ensure that they are still the ones that tell the most relevant story.

Calibrate performance. Once executives have a solid understanding of the business’s individual performance, they should put that information into perspective by benchmarking it against other companies in their industry, sector, or both. In particular, they should focus on those companies they aspire to beat, not those that have already lost the game. They can also look at companies in adjacent industries outside their peer group. For instance, a telecom company might want to benchmark itself against an online retailer, a chain of retail stores, and a media company, if it plans to compete with such businesses. The future business might not look like the current business.

Next, executives should chart the technology economics frontier for their competitive context. No company can compare itself with others on every metric. One or two key metrics—such as technology intensity and operating margins—per industry, sector, or business unit could be enough. And leaders need to make sure that they’re comparing apples with apples. The ways companies define revenues and IT expenses must line up across business units. The benchmark must have meaning to be meaningful.

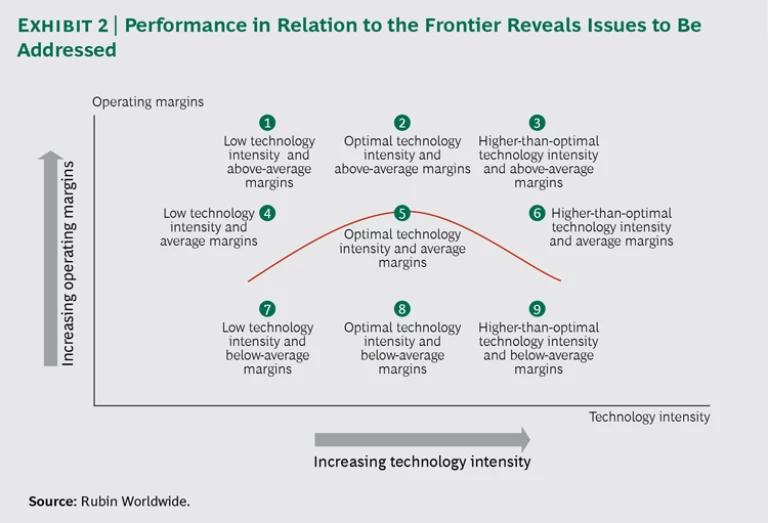

Optimize performance. A company should use its position along the technology economics frontier to help identify specific strategies for improvement. (See Exhibit 2.) Where your company falls in relation to the apex of the frontier will be within one of nine zones, each of which implies a strategic response.

- Zone 1: Low Technology Intensity and Above-Average Margins. Adjust your technology investments to target higher-impact business processes. You are “beating the curve,” but competitors with a higher level of technology investment and a keener focus on business process improvement are achieving superior operating efficiency from technology.

- Zone 2: Optimal Technology Intensity and Above-Average Margins. Consider ways to further optimize costs and drive the return on technology investment to new levels. Think about alternatives such as cloud computing and big data tools while focusing on innovations in business products, operational processes, and the customer experience.

- Zone 3: Higher-Than-Optimal Technology Intensity and Above-Average Margins. Recalibrate your technology investments so as to shift your profile to the left and achieve the same—or perhaps more—with less. Your margins are better than those of many of your competitors, but your costs are not. Generating the same results with less spending will set a new best-in-class performance bar for your competitors.

- Zone 4: Low Technology Intensity and Average Margins. Increase your technology spending while shifting the balance to investments that improve operational efficiency. Such investments typically involve business process automation to reduce costs.

- Zone 5: Optimal Technology Intensity and Average Margins. Focus on staying ahead of the pack. As you regularly benchmark your performance, look for opportunities to invest in ways that do more than create operational efficiencies through cost reductions. Focus on technology’s impact to beat the curve through revenue growth.

- Zone 6: Higher-Than-Optimal Technology Intensity and Average Margins. You are not getting enough “bang for your buck.” Your technology intensity is above the optimal level, but you have nothing but average returns to show for it. Extraordinary intensity should support extraordinary results.

- Zone 7: Low Technology Intensity and Below-Average Margins. Rethink where and how much you invest in technology. Also, assess your balance of run-the-business versus change-the-business spending. Perhaps aging or inefficient infrastructure is inhibiting your ability to invest; perhaps your core costs for people, hardware, and software are too high. Benchmark to gain insights into what could be causing underinvestment and underperformance.

- Zone 8: Optimal Technology Intensity and Below-Average Margins. Restructure your technology investment port-folio. Perhaps the total amount of spending is right, but it is going to too many or too few places. Benchmark to find out where the “smart money” is going. Shift your margins upward by increasing the yield of your investments.

- Zone 9: Higher-Than-Optimal Technology Intensity and Below-Average Margins. You’re spending too much and generating too little. Transform what you do with technology to shift your profile to the left—to optimal technology intensity levels as well as on-the-curve returns. Your technology is too expensive, and it’s ineffective at fueling operational efficiency and increasing revenues.

While taking these steps, you can focus technology investments on innovation and on changing ways of working. You can also focus on reducing costs, delivering growth (for companies and GDP overall), and improving wealth and the quality of life on our planet. (See “ Saving Globalization and Technology from Themselves ,” BCG article, July 2016.)

At most companies, technology investment is growing faster than revenues—and faster than the GDP of any country. Clearly, technology is essential to the success of companies and the global economy. But managing technology spending well in the future will require an increasingly sophisticated way of looking at the world and at a company’s performance.

Companies must monitor, calibrate, and optimize investments in real time according to market conditions and on the basis of new forms of market data. They must consider both inputs and outcomes. They must look at technology economically to gain competitive advantage—before others beat them to the punch. Ultimately, when executives view investments in this way, technology will not only matter, it will make all the difference.