A little over three years ago, our first report on corporate venture capital (CVC) investing stated that “CVC appears to be here to stay.” (See Corporate Venture Capital: Avoid the Risk, Miss the Rewards , BCG Focus, October 2012.) Although time has validated that insight, we did not foresee how quickly and deeply CVC investing would take root and evolve. From 2010 through 2015, the overall amount of venture capital investments nearly doubled, but the amount of CVC investments grew even faster. Thus, as a share of overall venture-capital investments, CVC investments increased from 7% to 9%. In addition, the number of corporate venturing tools expanded rapidly—CVC is now only one on a long list that includes accelerators or incubators and innovation labs.

CVC investing has also spread to new industries and new regions worldwide, but the US remains the most popular target for CVC investing. From 2010 through 2015, CVC investing in the US had a compound annual growth rate of 32%. China has attracted strong interest in recent years as well, with CVC investments in the country reaching 5% of all venture investments in 2015.

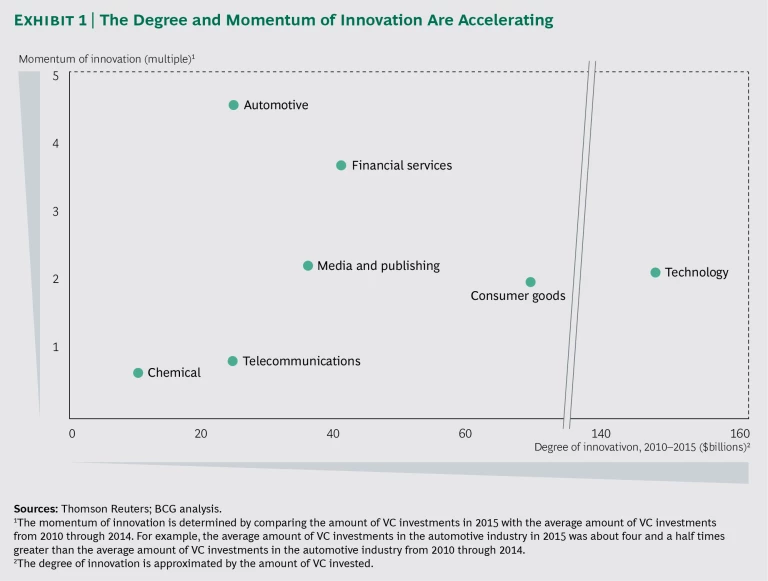

Investing in innovation is critical to remaining competitive today. To assess and measure innovation, we analyzed venture capital investments in seven industries: automotive, chemical, consumer goods, financial services, media and publishing, technology, and telecommunications. We found the overall degree of innovation—approximated by the amount of VC invested from 2010 through 2015—to be high, with technology companies posting the highest result. In the past year, the momentum of innovation—a comparison of the amount of VC investments in 2015 with the average amount of VC investments from 2010 through 2014—rose sharply, with automotive and financial services companies having the greatest momentum.

We also analyzed the innovation strategies and venturing tools used by the top 30 companies (by market capitalization) in each of the seven industries, as these companies are particularly active corporate venturers. This report discusses the increasing diversification of tools these companies are using to pursue innovation.

Corporate Venturing Tools Now Include More Than CVC

CVC has been the mainstay of corporate venturing. Companies have used CVC to take minority equity stakes in start-ups to reap financial returns, gain an early understanding of new markets or technologies, or expand strategic options over the medium term. Today, CVC continues to be an important tool for corporate venturing. However, companies are also expanding their venturing repertoire. (See Incubators, Accelerators, Venturing, and More: How Leading Companies Search for Their Next Big Thing , BCG Focus, June 2014.) The purpose of this expansion is to enable more active searching for innovation that complements an internal R&D effort and ultimately increases the speed, agility, and scope of innovation.

An accelerator or incubator is the most common alternative to CVC, providing short- or medium-term support and resources to start-ups. The sponsors of such an entity gain the opportunity to quickly become acquainted with a broad variety of new business ideas in their search fields. Accelerators offer highly structured programs that typically last no more than three months. These programs provide start-ups that do not yet have proven products or services with the facilities, resources, and expertise needed to speed their product development and time to market. By contrast, incubators offer longer-term programs—typically lasting a year—that include mentoring and access to corporate resources, both of which enable start-ups with proven products or services to develop business models in order to go to market. The functions performed by an accelerator are closely related to those of an incubator, so the terms are often used interchangeably. For the purposes of this report, therefore, accelerators and incubators are considered one type of corporate venturing tool.

Innovation labs, which have recently come into increasingly widespread use, function as start-ups within a corporate setting. Teams of in-house innovators convene for short, intensive projects, during which they rapidly prototype new products and services with the aim of developing and market testing a minimum viable product by the end of the project. Innovation labs typically are not in the R&D offices and the projects usually do not involve the in-house R&D department.

Corporations are employing many other venturing tools as well:

- “Hackathons,” which bring together software developers in collaborative, intensive workshops to create apps for particular platforms

- Employee jurors or mentors, who participate in start-up competitions to spot emerging technologies or business models early

- Scouting missions, which are meetings with start-ups, inventors, or university researchers to seek out innovations

- Corporate-university partnerships, which are collaborations between corporate R&D departments and university researchers to find promising ideas for further development and investigation

- Strategic partnerships, which are alliances between corporations and start-ups to bring the latter’s commercial-ready innovations to new or larger markets

- Start-up acquisitions, which are purchases of young companies and their commercial-ready products by corporations in order to access new technologies or markets

- Licensing, which enables corporations to apply innovations developed by start-ups to new markets, industry sectors, and customer segments

The Largest Companies Lead the Way in Corporaate Venturing

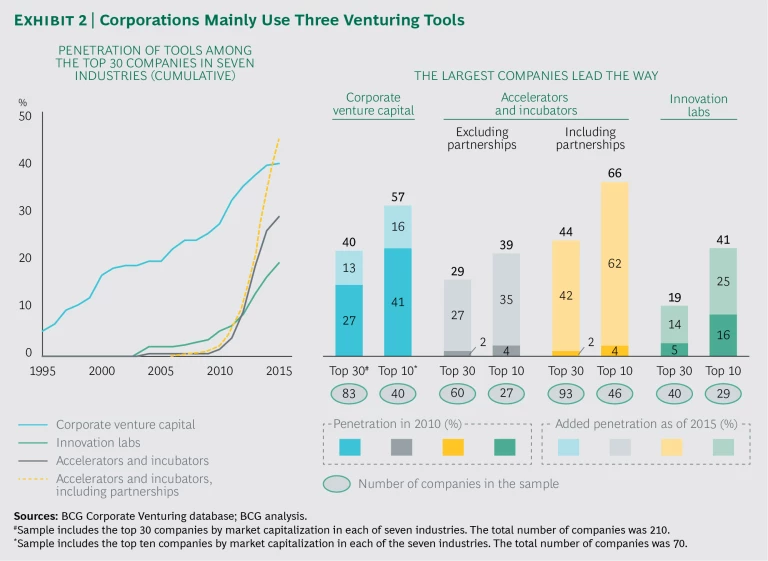

CVC, accelerators and incubators, and innovation labs are especially popular among the top 30 companies in each of the seven industries that we focused on for this report. The percentage of players employing CVC rose from 27% in 2010 to 40% in 2015.

During the same period, the percentage of companies using accelerators and incubators surged from 2% to 44%. This increase was propelled in part by a sharp increase in the number of accelerator partnerships, a practice that we first observed in our company sample in 2006. By 2015, accelerator partnerships accounted for 15 percentage points—more than one-third—of the 44% penetration of accelerators and incubators. The usage rate of innovation labs climbed from 5% to 19% among companies.

Zeroing in on the ten largest companies, we found that they have been the earliest adopters of these three tools. Moreover, the larger the company, the more intensive its use of these venturing tools. Of the top ten companies in the sample, 57% make CVC investments; 66% use incubators and accelerators (accelerator partnerships account for 27 percentage points); and 41% operate innovation labs.

The diverse array of tools illustrates how the motivations of corporate venturers have evolved since the pioneering days of CVC. Where once corporate investors sought financial returns, they now apply a customized repertoire of tools to gain access to innovation. This finding resulted from further analysis of the two industries that have most intensively pursued corporate venturing since 2007: technology and telecommunications. It is no coincidence that the two industries undergoing some of the greatest change also have the greatest share of companies with a dedicated corporate-venturing function.

These venturing tools do not supplant internal R&D but complement and encourage it. This can be seen in the media and publishing industry. As a percentage of sales, the R&D spending of companies that use a combination of CVC, accelerators or incubators, and innovation labs is 2.4 percentage points higher, on average, than the R&D spending of the top 30 companies. Similar results can be seen in the technology and automotive industries. As a percentage of sales, the R&D spending of companies that employ all three tools is, on average, 1.6 percentage points and 1.3 percentage points higher, respectively, than the R&D spending at the top 30 companies.

How Corporate Venturers Choose Their Tools

We have extensively researched the innovation strategies and venturing tools of the top 30 companies as well as their search fields. We’ve found that the most successful corporate venturers can state clearly why they are engaging in a search for external innovation, the search fields they are considering, and how they intend to create value, because they have a clear innovation strategy.

To formulate this strategy, these companies conduct assessments to determine the strengths and weaknesses of their internal and external innovation efforts, pinpoint the areas of the company’s businesses that are most vulnerable to disruption, and ascertain the areas that offer attractive growth opportunities. This research helps these companies create their venturing strategy, including the search fields to pursue for external innovation, the type of venturing tool that is best suited to each search field, and when to begin. The venturing strategy determines how a venturing tool or unit will operate, including where it fits in the company’s organization structure as well as how the unit will be funded, the degree of interaction it will have with the business units, and the metrics by which its success will be measured.

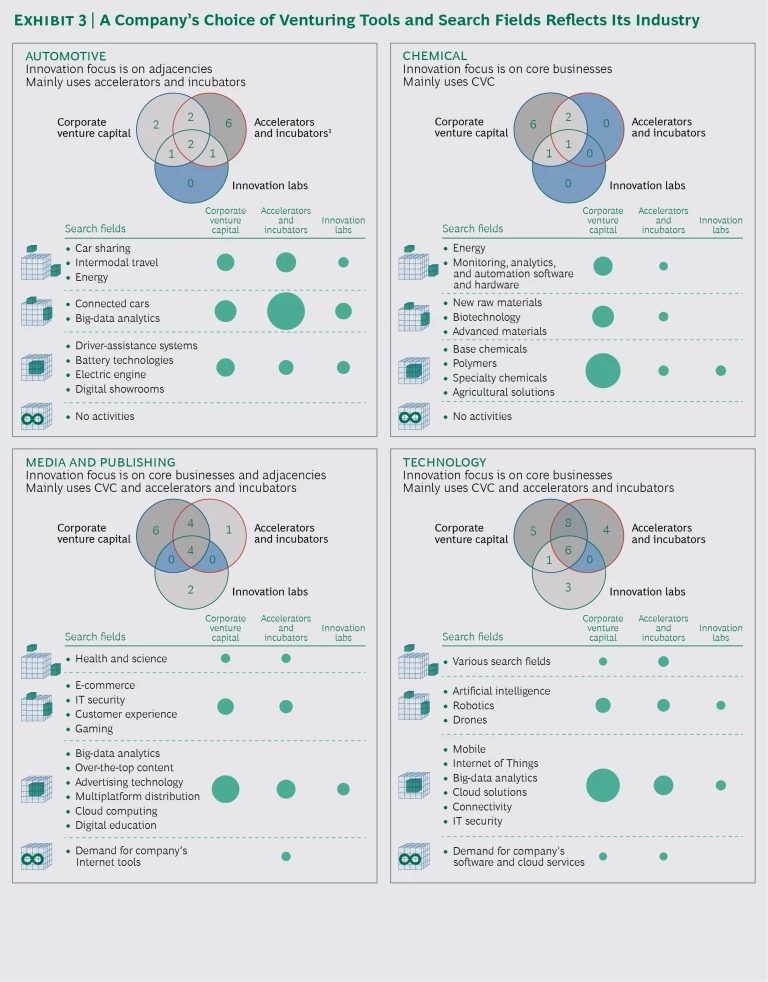

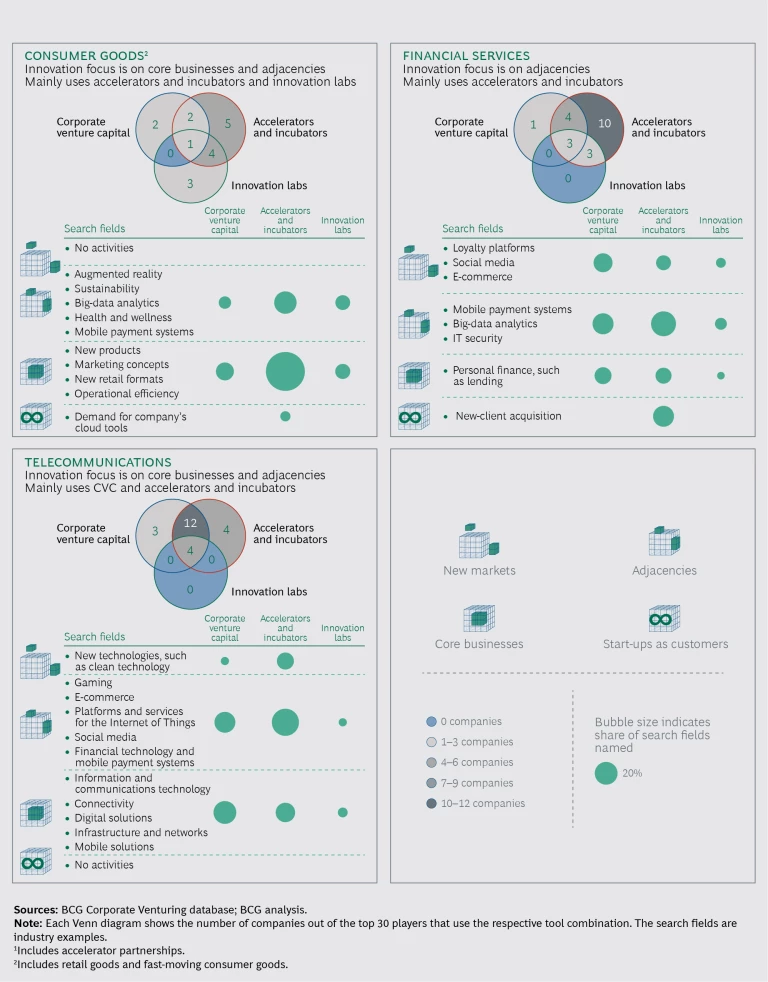

Our research on the top 30 companies found that corporate venturers’ choice of tools is influenced significantly by the industry the company is in. (See Exhibit 3.) Speed of innovation, for example, differs from one industry to the next. In industries where innovation momentum is high and the need for innovation is great, such as the automotive and financial services industries, companies predominantly use accelerators and incubators, in contrast to industries such as chemicals, where the pace of innovation is somewhat slower and companies mainly use CVC.

Entrenched practices also affect how corporate venturers choose their tools. For example, players in industries that were among the earliest practitioners of corporate venturing (such as the chemical and technology industries) predominantly apply CVC, although technology companies often employ accelerators and incubators in parallel.

Further still, companies in certain industries choose particular venturing tools when their aim is to attract start-ups as clients and help them grow so as to develop customers whose needs for services continually expand. This goal, in addition to achieving financial and strategic returns, is important to financial institutions, for instance, which cultivate long-term customers.

When we assessed the focus of innovation, the tools, and the search fields for the companies in our sample, we identified various industry patterns:

- Automotive companies seek innovation in adjacencies, such as connected cars and big-data analytics, by using accelerators and incubators.

- Chemical companies focus on core-business innovation using mainly CVC, with their largest investments fostering innovation in areas such as base chemicals, polymers, and specialty chemicals.

- Consumer goods companies look for core-business innovation, seeking advances in areas such as new products, marketing concepts, and new retail formats. Further, they seek innovation in adjacencies, such as big-data analytics. Consumer goods companies mostly employ accelerators or incubators, or a combination of them, and innovation labs.

- Financial services institutions focus on adjacencies in areas such as mobile payment systems, big-data analytics, and IT security using accelerators and incubators. They also use accelerators and incubators to develop long-term customers: start-ups that receive short-term support and resources that enable them to grow and succeed are likely to be loyal to the institutions that provided assistance.

- Media and publishing companies mainly use CVC, or a mix of CVC and accelerators or incubators, to find core-business innovations, such as big-data analytics, advertising technology, and multiplatform distribution. In addition, these companies use CVC to gain an early understanding of disruptive business models, which are managed in parallel to the core business.

- Technology companies focus on core-business innovation using CVC or a combination of CVC and accelerators or incubators. Technology companies use these tools to locate innovations in such fields as the Internet of Things, big-data analytics, cloud solutions, and IT security. These companies are increasingly turning to innovation labs, using them in concert with their other venturing tools.

- Telecommunications companies seek innovation in their core businesses and adjacencies, mostly using a combination of CVC and accelerators or incubators. For core innovation, the search fields include connectivity, infrastructure and networks, and mobile solutions; for adjacent innovation, the search fields include e-commerce, platforms and services for the Internet of Things, financial technology, and mobile payment systems.

Three Factors Are Critical to an Effective Innovation Strategy

Although the top corporate-venturers have established best practices, mere imitation of these practices does not ensure success. Through our extensive research of the top 30 corporations, including how they set up and fine-tune their venturing tools, we have identified three factors that are critical to creating an effective innovation strategy. These factors apply regardless of industry or region. They also underscore that it’s not enough for a company to plunge into corporate venturing; what matters most is to engage in corporate venturing in the right way.

Choosing an Appropriate CVC Model. CVC in its nascent years was mainly invested to produce financial returns. After 2000, the focus shifted to predominantly accomplishing strategic objectives. In the past few years, CVC investing has further evolved into four distinct models:

- The strategically oriented corporate-led model

- The strategically oriented business-unit-led model

- The financially oriented corporate-led model

- The financially oriented independent model

The first two models have primarily strategic objectives, but they differ fundamentally in three important respects: the unit responsible for defining the search fields, the objectives for the CVC, and the preferred approach to value creation.

In the strategically oriented corporate-led model, the corporate center defines the search fields, which mostly have one of two foci. The first is innovations that will help the company or its business units move into adjacencies and disruptive technologies. The second focus is business models that could change existing core businesses. Our research shows that disruptive forces are more effectively managed by the center. The center also chooses the innovations on which to focus its investments and the maturity stages of the start-ups in which it invests, often very narrowly defining both. The value of this model is mainly derived from the opportunities to identify and understand market trends early and to evaluate and sometimes build businesses in parallel to the existing core businesses.

By contrast, in the strategically oriented business-unit-led model, the business unit defines the search fields according to the innovations that it needs to achieve its strategic growth plans. Therefore, the search fields are mainly focused on the unit’s core business and adjacencies. A business unit typically can invest in start-ups at various maturity stages, such as early or growth. In this CVC model, the CVC investment is commonly complemented by operational cooperation between the start-up and the business unit. Such cooperation is supported by a dedicated team that is responsible for scaling the start-up. This cooperation leads to a close relationship among the start-up, the CVC team, and selected experts from the business unit. The value of this model is mainly derived from the operational cooperation and from leveraging both the start-up’s competencies and the resources of the corporation.

In contrast to the strategically oriented CVC models, the other two models focus on financially oriented objectives.

In the financially oriented corporate-led model, the financial goals of the CVC team outweigh any strategic mandates. To achieve its goals, the CVC team defines search fields that reflect the business units’ growth plans and that focus on the corporate ecosystem, including suppliers and customers. The CVC team typically uses the expertise and know-how of the business units for investment evaluations, but the team does not need the consent of the corporate center or business units to invest. The value of this model is derived from the financial gains that a company can garner from the CVC investment and from the growth of the corporate ecosystem.

In the financially oriented independent model, the CVC team, operating as an independent venture-capital fund, focuses exclusively on earning financial returns for the corporation. The CVC team defines the search fields, which may or may not be part of the corporate core and adjacencies. This type of CVC investing may use experts from the corporate center for investment evaluation, but the CVC team has few, if any, close ties to the business units. The strong focus on financial returns often leads to investments in later-stage start-ups, especially those with proven products or scalable businesses. This means that the CVC team can exit the investment sooner. The value of this model is derived purely from the financial returns of the CVC investments.

Of the 83 CVC units in our sample, financially oriented independent CVC units accounted for 12%, up from 8% in the first decade of this century, while the financially oriented corporate-led units accounted for 22% and all of the strategically focused units accounted for 66%. Looking at the amount invested in 2015, however, financially oriented independent units accounted for 43%, with financially oriented corporate-led CVC teams accounting for 39% and all strategically focused units accounting for only 18% of the amount invested.

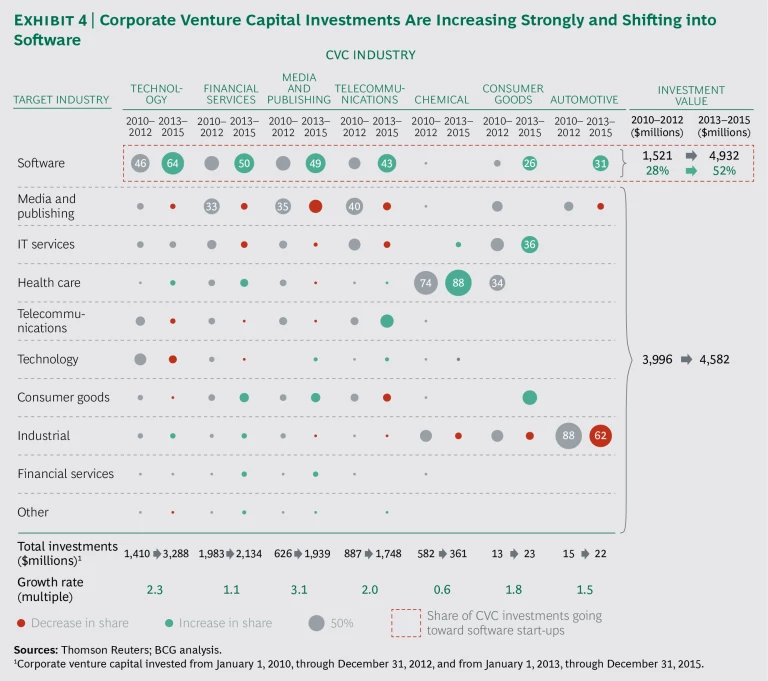

Further, we observed a strong shift in investment focus among the top 30 companies we analyzed. (See Exhibit 4.) In the past three years, both strategically and financially oriented CVC units have focused much of their investment capital on the software industry, reflecting the increasing value of data as well as the megatrends toward digitization and virtualization—that is, the transformation of hardware to software. The value of CVC investments in software by the top 30 companies now surpasses the value of their investments in all other target industries combined. The value of investments in software start-ups has risen 24 percentage points, from 28% between 2010 and 2012 to 52% between 2013 and 2015.

We also analyzed the profiles of leaders of the CVC units in our sample and found distinct patterns. (See “Who Runs CVC Units?”)

WHO RUNS CVC UNITS?

Leaders of CVC units are overwhelmingly male, making up 86% of the population. Those with either economics or business degrees account for 44%, while 28% have an engineering background. And 44% of the heads of CVC units have 11 to 15 years of professional experience.

Many of these leaders gained their professional experience by spending their early careers in the same industry as the CVC unit’s corporate parent. Another 12% worked in technology, and 12% were employed in investment banking.

The percentage of leaders who hold MBA degrees varies by industry, region, and investment objective. In the technology industry, for example, MBAs predominate, with 88% of CVC unit heads possessing this degree, compared with 47% of those in the telecommunications industry. Three out of four heads of US CVC units (76%) have an MBA degree, while only 33% of leaders of non-US units have one. Of the heads of financially oriented independent CVC units, 75% have MBA degrees, compared with 33% at financially oriented corporate-led CVC units and 53% at both types of strategically oriented CVC units.

Some 60% of CVC unit heads are recruited from within the corporate parent. Most internally recruited leaders are promoted either from within the CVC unit (29%) or from the corporate development functions (26%), including strategy and mergers and acquisitions. Among externally recruited CVC unit heads, 39% come from other corporations and 26% from venture capital firms. Among non-US CVC units, 53% of leaders are internally recruited.

Forming Accelerator and Incubator Partnerships. The current environment is marked by a sharp increase in the use of accelerators and incubators. Although some companies abandoned their accelerator or incubator activities shortly after launching them, most companies are sticking with this tool, viewing it as the preferred means of engaging with a greater number and wider array of start-ups.

Successful accelerators and incubators typically do not venture alone; they form partnerships with venturing operations from other corporations or team up with an independent accelerator or incubator. The partners have a common interest in specific search fields.

There are several advantages to such partnerships. Companies can reach critical mass in their venturing activities more rapidly and gain access to a greater number of high-quality start-ups than they could on their own. Companies are able to tap into the networks of professional facilitators that organize and direct acceleration and incubation activities and connect companies with communities of entrepreneurs and researchers. And accelerator and incubator partnerships enable corporate venturers to participate in programs that are tightly focused on specific promising fields.

Accelerator and incubator partnerships have become increasingly popular in the past three years. In 2010, only two of the existing accelerators and incubators were partnerships; today, 33 of the 93 accelerators and incubators are partnerships.

Designing Customer-Centric Innovation Labs That Speed Time to Market. Corporations increasingly use innovation labs to accelerate the time to market of internal innovations. These labs are in-house units designed to complement—not supplant—conventional R&D and often interact closely with the outside entrepreneurial world. They take a customer-centric approach to innovation. In effect, such labs present an attempt to operate as in-house start-ups with all the speed and agility that characterizes the breed. (See “Innovation Labs: The Latest Addition to the Innovator’s Toolkit.”)

INNOVATION LABS: THE LATEST ADDITION TO THE INNOVATOR'S TOOLKIT

Companies have increasingly launched innovation labs in recent years. From 2013 through 2015, the number of innovation labs surged, especially in industries such as consumer goods, financial services, media and publishing, and technology.

The main focus of innovation labs tends to be on advancing products or services that are close to the core business or in adjacencies. For example, financial institutions often invest in mobile payment systems, consumer goods companies tend to explore augmented reality, and media and publishing companies may research gaming. Innovation labs also often focus on developing small new products and services or add-ons to existing products and services. For example, financial institutions may create new banking products and automotive companies may develop new business models, such as car sharing.

Innovation labs consist of small internal innovation teams that operate separately from the internal R&D unit. The teams have a mandate for rapid delivery of prototypes and fast testing of minimum viable products (MVP) in the market. The teams’ structures and mind-sets are more similar to those of a start-up than to those of the corporate parent. The teams often work with external partners, such as programmers, for prototyping and MVP development.

The teams take their ideas from business units, customers, the marketplace, and their own observations. They are customer-oriented and focus on relieving customer pain points and addressing unmet needs. The teams are also fast and agile, needing only a few weeks to progress from an idea to testing a first prototype in the market. The process includes identifying a customer pain point or unmet need, ideating solutions, prioritizing the solutions to be explored, developing proofs of concept, prototyping the solutions, testing the solutions, and finally creating an MVP. Physically, the teams often work in lab-type facilities with areas for demonstrations, desk work, and open meeting and discussion spaces.

The most successful innovation labs open their doors to employees and customers alike—it’s no accident that such labs are located near the main entrance to their company’s headquarters—and create a safe space to “fail quickly” by testing and refining the solutions they devise. Innovation areas are predominantly centered on improving corporate products by reimagining the customer experience or adding new services to core products.

Keeping the innovation lab physically separate from headquarters, so that it has a culture of its own and limited interaction with the corporate center, has also proven effective. This setup is often used when the innovation lab is tasked with exploring adjacencies and new fields (both of which demand less interaction with the operating businesses) or when the corporation is looking to build a greenfield digital disruptor of itself.

Proactively Shape the Corporate Venturing Approach

As companies deliberate (or consider refining) their approach to corporate venturing, they should ask themselves the following four questions. The answers will help shape the corporate venturing unit’s approach:

- Which search fields can we address internally, and for which search fields should we engage with the entrepreneurs and companies that constitute the start-up ecosystem?

- Have we determined which venturing tools best support our innovation strategy and spur fast and agile innovation?

- Does the proposed mix of venturing tools and how they operate fit our search fields?

- Should we create our own venturing tools or work with partners?

These are vital questions for players in any innovation-driven industry—which is to say, nearly every industry. The total amount of venture capital investments has mushroomed in recent years, growing from $76 billion in 2010 to $142 billion in 2015. The practical effect of that surge is that more start-ups are now arriving in the marketplace with more financial firepower than ever before—and hence more ability to innovate rapidly. Established companies must determine the answers to the four questions posed above and then use those answers to shape—or reshape—their external innovation strategies and participate actively in start-up ecosystems. Companies that do so with speed and agility will spur innovation and remain competitive.

Acknowledgments

The authors wish to acknowledge the valuable contributions of Markus Brummer, Philipp Englisch, Martin Gräbeldinger, Kathrin Herrmann, Stefan Schmidt, and Kaili Shen, who greatly supported the research for this report.