An ambitious group of digital insurance startups is diving into the market, hoping to compete with incumbent providers, according to a new report by The Boston Consulting Group and Morgan Stanley Research. The report, North American Insight: Digital Disruption in Small Business Insurance , focuses on insurance buying at companies with up to 50 employees, a profitable market whose fragmentation and dearth of digital offerings makes it attractive to those with innovative solutions.

Insurance has lagged other industries in terms of digital services, but the changing demographics of small businesses in the US make this market ripe for disruption. By 2020, more than three in every five small businesses in the US will be owned by millennials or gen-Xers. These business owners will want more flexible forms of insurance—including insurance they can turn on and off according to their workload—and will naturally gravitate toward solutions that allow them to purchase and manage insurance products digitally.

The prize is substantial. The report describes three scenarios that show at least 15% and as much as 30% of small-business insurance premiums being digitally underwritten by 2020, versus 4% now. In the most probable scenario, $26 billion in small-business premiums will be digitally underwritten—meaning sold primarily through online, mobile, or call center channels. This represents an annual growth rate in excess of 40% through 2020 versus a decline in traditionally underwritten small-business premiums of 2.5% a year. The estimated growth in the market is based in part on a survey of small businesses and on roughly two dozen interviews that BCG and Morgan Stanley conducted with incumbent carriers and brokers as well as startups.

Theoretically, there’s no reason why incumbent insurance carriers can’t become more digital in how they go to market and service their small-business customers. Some will undoubtedly do so, and in the process may increase their overall market share and substantially boost their earnings. Other carriers will hold back, reluctant to make the necessary investments or risk channel conflicts with the brokers and agents who constitute their existing distribution networks.

Distributors, not carriers, face the most immediate threat from digitization. Small-business brokers and agents have historically provided most of their value in the acquisition and renewal stages. If small-business customers are able to do more buying and renewing of insurance through options including online self-service, brokers and agents will have to find new ways of creating value for customers. They may struggle to do so.

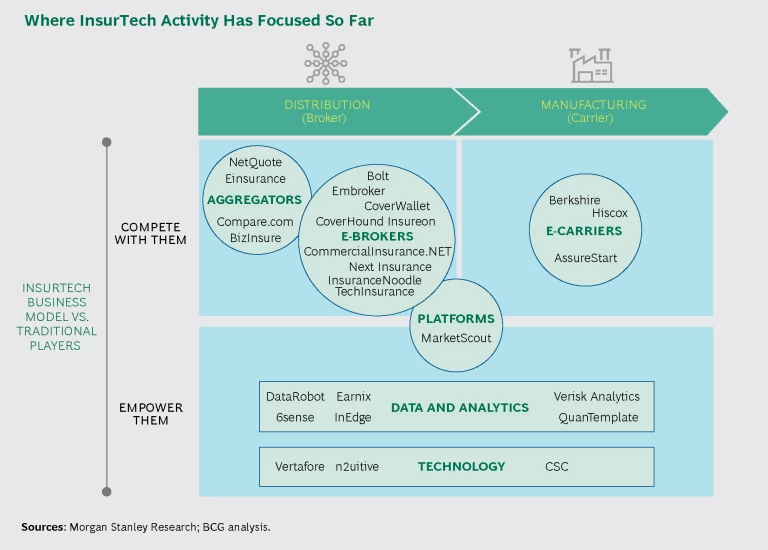

Today, the bulk of the activity among insurtechs (as these mostly new, venture-capital-backed companies are called) is in the e-broker space. E-brokers offer platforms that shed light on the insurance options available to small businesses. Some insurtechs are setting out to be aggregators (essentially, providers of comparison tools, a model that is not easy to pull off in commercial insurance), while others are positioning themselves as insurance carriers or managing general underwriters whose marketing and points of contact with small-business customers are overwhelmingly digital. A final category in the insurtech startup space: data analytics or technology companies that aim to empower existing players in their digital transformation rather than competing with them. (See the exhibit below.)

The disruptive forces at play also create an opening for nonincumbent players to enter the small-business market from other geographies or from adjacent insurance product segments. Finally, new competition may come from those that are not currently in the insurance business at all but have a solid base of customers in small business and can seamlessly integrate insurance into their other offerings.

In the carrier segment, the advantage will be with those that can reduce product complexity and improve customer service. In the distributor segment, it will be with those capable of redefining the role of the insurance middleman in a newly digital world.

Investment capital will certainly be necessary for success, but it will not be sufficient on its own. Those that have capital will also need the ability to reimagine the future.